|

市場調查報告書

商品編碼

1666917

皮膚病學設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Dermatology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

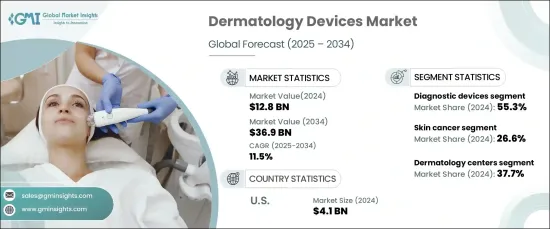

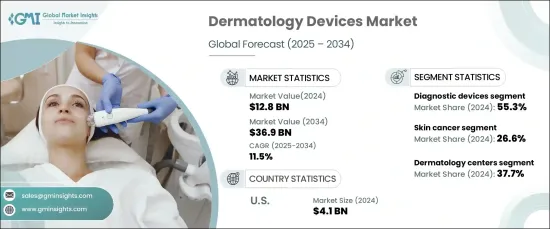

2024 年全球皮膚病設備市場價值為 128 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 11.5%。此外,皮膚病學設備的技術進步在該市場的擴張中發揮關鍵作用,而已開發地區對美容手術的需求日益增加。隨著消費者繼續重視皮膚健康和美容治療,市場將持續成長。

市場分為診斷和治療設備,它們在解決全球日益增多的皮膚相關健康問題方面發揮關鍵作用。診斷設備對於早期和準確的檢測至關重要,包括影像系統、皮膚鏡和活體組織切片工具。同時,治療設備包括光療系統、雷射、微晶換膚儀、冷凍療法工具、電外科設備和抽脂設備。 2024年,診斷設備佔據市場主導地位,佔總佔有率的55.3%。這是因為人們越來越需要及時識別濕疹和皮膚癌等疾病,因為早期發現是成功治療的關鍵。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 128億美元 |

| 預測值 | 369億美元 |

| 複合年成長率 | 11.5% |

在應用方面,皮膚科設備廣泛應用於治療皮膚癌、皮膚嫩膚、除毛、身體塑形、牛皮癬和其他各種皮膚病。 2024 年,皮膚癌領域佔據市場主導地位,佔 26.6% 的顯著佔有率。這是由於全球皮膚癌病例的增加,推動了對可靠的診斷和治療工具的需求。先進的皮膚病學設備對於識別癌症和癌前病變至關重要,有助於早期介入並改善患者的治療效果。

美國皮膚科設備市場規模到 2024 年將達到 41 億美元,仍是全球最大的皮膚科設備市場。這種主導地位是由於美國黑色素瘤和非黑色素瘤皮膚癌的高發生率,加上廣泛的宣傳計劃和皮膚癌預防措施。此外,美國FDA批准先進的皮膚病學設備,增強了尖端診斷和治療解決方案的可用性,促進了市場的持續成長和創新。隨著皮膚病護理需求的日益加劇,美國仍將在這個快速擴張的市場中發揮關鍵作用。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球皮膚相關疾病和皮膚癌發生率不斷上升

- 發展中國家皮膚護理支出增加

- 護膚設備的技術進步

- 已開發國家對整容手術的需求不斷成長

- 產業陷阱與挑戰

- 設備成本過高

- 嚴格的監管環境

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 專利分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略展望

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 診斷設備

- 影像設備

- 皮膚鏡

- 切片設備

- 治療設備

- 光療設備(LED 療法)

- 雷射器

- 微晶煥膚設備

- 冷凍治療設備

- 電外科設備

- 抽脂設備

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 皮膚癌

- 皮膚年輕化

- 除毛

- 塑身和緊緻肌膚

- 牛皮癬

- 其他應用

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 皮膚科中心

- 醫院

- 診所

- 其他最終用途

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Alma Lasers (Fosun Pharma)

- Ambicare Health

- Bausch Health Companies

- Biolitec

- Bruker Corporation

- Candela Corporation

- Canfield Scientific

- Carl Zeiss

- Cutera

- Cynosure Lutronic

- Genesis Biosystems

- Heine Optotechnik

- Hologic

- Image Derm

- Leica Microsystems

- Lumenis

- Michelson Diagnostics (VivoSight)

- Olympus Corporation

The Global Dermatology Devices Market was valued at USD 12.8 billion in 2024 and is expected to grow at an impressive CAGR of 11.5% from 2025 to 2034. This growth is primarily driven by the increasing prevalence of skin diseases, including skin cancer, as well as the rising focus on skincare in emerging economies. Additionally, technological advancements in dermatology devices are playing a key role in the expansion of this market, while developed regions are seeing heightened demand for cosmetic procedures. As consumers continue to prioritize skin health and aesthetic treatments, the market is set for sustained growth.

The market is categorized into diagnostic and treatment devices, both of which serve critical roles in addressing the increasing incidence of skin-related health concerns globally. Diagnostic devices are essential for early and accurate detection and include imaging systems, dermatoscopes, and biopsy tools. Meanwhile, treatment devices encompass light therapy systems, lasers, microdermabrasion units, cryotherapy tools, electrosurgical equipment, and liposuction devices. In 2024, diagnostic devices dominated the market, accounting for 55.3% of the total share. This is attributed to the growing need for timely identification of conditions such as eczema and skin cancer, as early detection is key to successful treatment outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.8 Billion |

| Forecast Value | $36.9 Billion |

| CAGR | 11.5% |

In terms of application, dermatology devices are widely used in the treatment of skin cancer, skin rejuvenation, hair removal, body contouring, psoriasis, and various other dermatological conditions. The skin cancer segment led the market in 2024, commanding a significant 26.6% share. This is due to the global rise in skin cancer cases, driving the demand for reliable diagnostic and treatment tools. Advanced dermatology devices are indispensable in identifying both cancerous and precancerous lesions, allowing for early intervention and improved patient outcomes.

The U.S. dermatology devices market, with a valuation of USD 4.1 billion in 2024, remains the largest in the world. This dominance is driven by the high rates of melanoma and non-melanoma skin cancers in the U.S., combined with extensive awareness programs and skin cancer prevention initiatives. Furthermore, the approval of advanced dermatology devices by the U.S. FDA has bolstered the availability of cutting-edge diagnostic and treatment solutions, contributing to the market's continued growth and innovation. As the demand for dermatological care intensifies, the U.S. will remain a key player in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of skin associated diseases and skin cancer worldwide

- 3.2.1.2 Increasing expenditure on skin care in developing countries

- 3.2.1.3 Technological advancements in skincare devices

- 3.2.1.4 Growing demand for cosmetic procedures in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Excessive equipment cost

- 3.2.2.2 Stringent regulatory landscape

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.2.1 Imaging devices

- 5.2.2 Dermatoscopes

- 5.2.3 Biopsy devices

- 5.3 Treatment devices

- 5.3.1 Light therapy devices (LED therapy)

- 5.3.2 Lasers

- 5.3.3 Microdermabrasion devices

- 5.3.4 Cryotherapy devices

- 5.3.5 Electrosurgical equipment

- 5.3.6 Liposuction devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Skin cancer

- 6.3 Skin rejuvenation

- 6.4 Hair removal

- 6.5 Body contouring and skin tightening

- 6.6 Psoriasis

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dermatology centers

- 7.3 Hospitals

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alma Lasers (Fosun Pharma)

- 9.2 Ambicare Health

- 9.3 Bausch Health Companies

- 9.4 Biolitec

- 9.5 Bruker Corporation

- 9.6 Candela Corporation

- 9.7 Canfield Scientific

- 9.8 Carl Zeiss

- 9.9 Cutera

- 9.10 Cynosure Lutronic

- 9.11 Genesis Biosystems

- 9.12 Heine Optotechnik

- 9.13 Hologic

- 9.14 Image Derm

- 9.15 Leica Microsystems

- 9.16 Lumenis

- 9.17 Michelson Diagnostics (VivoSight)

- 9.18 Olympus Corporation