|

市場調查報告書

商品編碼

1666914

硫胺素市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Thiamine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

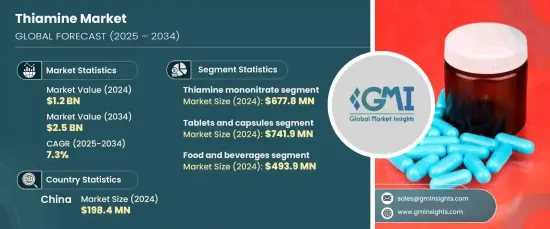

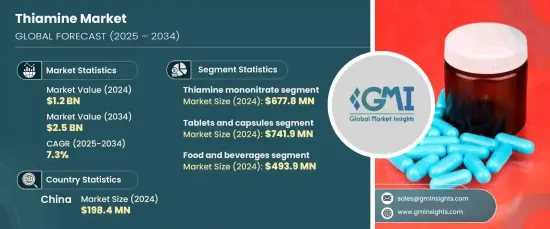

2024 年全球硫胺素市場價值為 12 億美元,預計 2025 年至 2034 年的複合年成長率為 7.3%。它在維持均衡飲食方面的重要性日益增加,導致對硫胺素補充劑和強化食品的需求增加。隨著消費者對健康和營養缺陷的認知不斷提高,這種激增趨勢進一步加劇。

硫胺素的多功能性體現在其在製藥、食品和飲料以及動物飼料等多個行業的應用。在醫藥領域,硫胺素被廣泛用於治療因缺乏硫胺素而引起的疾病,例如神經和心血管問題。它也是複合維生素中的關鍵成分,有助於解決廣泛的營養缺口。在食品領域,硫胺素經常被添加到穀物、麵包和補充劑等主食中,以提高其營養價值。人們對強化食品的日益成長的偏好推動了創新,使得製造商能夠將硫胺素加入到各種各樣的產品中,從而刺激了市場需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 7.3% |

在各種形式的硫胺素中,硝酸硫胺素因其穩定性和多功能性而佔有相當大的市場佔有率。作為一種更穩定的衍生物,它能夠承受熱和光等環境因素,非常適合用於食品強化和藥品。它常見於強化穀物、麵包和補充劑中,確保必需的營養輸送。在製藥業,硝酸硫胺素常用於複合維生素片劑和注射劑。它也是動物飼料中的重要成分,有助於維持牲畜的健康和生產力。

片劑和膠囊劑在硫胺素市場中佔據主導地位,由於其劑量精確、使用方便、廣泛可用而產生了可觀的收入。平板電腦因其成本效益和易於大規模生產而受到青睞,使其成為全球醫療保健和零售市場的主流產品。另一方面,膠囊適合那些尋求更快吸收和更少胃腸不適的人。這兩種格式都具有高度的便攜性和較長的保存期限,進一步提升了它們的受歡迎程度。

在食品和飲料領域,硫胺素對強化產品和營養補充劑的貢獻巨大,預計該領域將穩定成長。它經常被添加到穀物、麵包和能量飲料等食物中,以解決營養缺乏的問題。消費者對更健康食品和功能性飲料的需求日益成長,加上強化的監管要求,確保了這個細分市場的持續成長。

由於豐富的原料、高效的製造成本和堅實的生產基礎設施,中國預計將在硫胺素市場上保持強勢地位。中國高度重視擴大出口和加大研發投入,仍然是全球硫胺素市場的主要參與者,確保了穩定的供應並促進了硫胺素生產的創新。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高對均衡飲食重要性的認知

- 膳食補充劑和強化食品的需求不斷成長

- 在動物飼料中添加硫胺素對牲畜健康有益

- 產業陷阱與挑戰

- 價格波動和原物料成本波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 硝酸硫胺素

- 鹽酸硫胺素

- 硫胺素焦磷酸鹽

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 片劑和膠囊

- 液體

- 粉末

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 動物飼料

- 膳食補充劑

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- BASF

- DSM

- Chemizo Enterprise

- Lonza Group AG

- Jiangsu Jubang Pharmaceutical

- Huazhong Pharmaceutical

- HPC Standards

- McCartan's Pharmacy

- Nutricost

- PharmoVit

- Molekula Group

- Caisson Labs

- Brother Enterprises Holding

- Loba Chemie

- TCI Chemicals

The Global Thiamine Market, valued at USD 1.2 billion in 2024, is projected to grow at a CAGR of 7.3% from 2025 to 2034. Thiamine, also known as Vitamin B1, plays a vital role in supporting human health by assisting in energy metabolism, nerve function, and DNA and RNA synthesis. Its growing importance in maintaining a balanced diet has led to increased demand for thiamine supplements and fortified food products. This surge is further amplified by rising consumer awareness of health and nutritional deficiencies.

The versatility of thiamine is evident in its applications across multiple industries, such as pharmaceuticals, food and beverages, and animal feed. In pharmaceuticals, thiamine is widely used to treat conditions resulting from its deficiency, such as nerve and cardiovascular issues. It is also a key ingredient in multivitamins, helping to address a broad spectrum of nutritional gaps. In the food sector, thiamine is frequently added to staple items like cereals, bread, and supplements, enhancing their nutritional value. The growing preference for fortified foods is driving innovation, allowing manufacturers to incorporate thiamine into a wide variety of products, boosting market demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 7.3% |

Among the various forms of thiamine, thiamine mononitrate holds a significant market share due to its stability and versatility. As a more stable derivative, it withstands environmental factors like heat and light, making it ideal for use in food fortification and pharmaceuticals. It is commonly found in fortified cereals, bread, and supplements, ensuring essential nutrient delivery. In the pharmaceutical industry, thiamine mononitrate is commonly used in multivitamin tablets and injectable formulations. It is also an important ingredient in animal feed, supporting livestock health and productivity.

The tablets and capsules segment leads the thiamine market, generating significant revenue due to their precise dosing, convenience, and widespread availability. Tablets are favored for their cost-effectiveness and ease of mass production, making them a staple in healthcare and retail markets worldwide. On the other hand, capsules appeal to those looking for faster absorption and less gastrointestinal discomfort. Both formats are highly portable and have a long shelf life, further boosting their popularity.

In the food and beverage sector, thiamine's contribution to fortified products and nutritional supplements is substantial, and the segment is expected to grow steadily. It is frequently added to foods like cereals, bread, and energy drinks, addressing nutritional deficiencies. The increasing consumer demand for healthier food options and functional beverages, combined with regulatory requirements for fortification, ensures the continued growth of this market segment.

China is expected to maintain a strong position in the thiamine market, benefiting from abundant raw materials, cost-effective manufacturing, and a solid production infrastructure. With a strong focus on expanding exports and investing in research and development, China remains a major player in the global thiamine market, ensuring a steady supply and fostering innovations in thiamine production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of the importance of a balanced diet

- 3.6.1.2 Rising demand for dietary supplements and fortified foods

- 3.6.1.3 Adoption of thiamine in animal feed for livestock health

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility and fluctuations in raw material costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Thiamine mononitrate

- 5.3 Thiamine hydrochloride

- 5.4 Thiamine pyrophosphate

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Tablets & capsules

- 6.3 Liquid

- 6.4 Powder

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceutical

- 7.4 Animal feed

- 7.5 Dietary supplements

- 7.6 Other

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF

- 9.2 DSM

- 9.3 Chemizo Enterprise

- 9.4 Lonza Group AG

- 9.5 Jiangsu Jubang Pharmaceutical

- 9.6 Huazhong Pharmaceutical

- 9.7 HPC Standards

- 9.8 McCartan’s Pharmacy

- 9.9 Nutricost

- 9.10 PharmoVit

- 9.11 Molekula Group

- 9.12 Caisson Labs

- 9.13 Brother Enterprises Holding

- 9.14 Loba Chemie

- 9.15 TCI Chemicals