|

市場調查報告書

商品編碼

1666665

新生兒護理市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Neonatal Infant Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

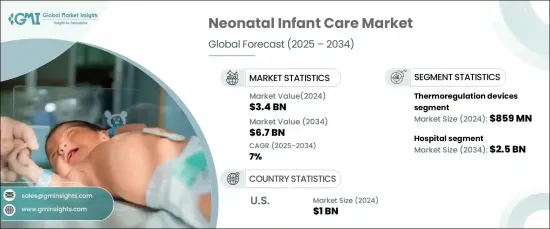

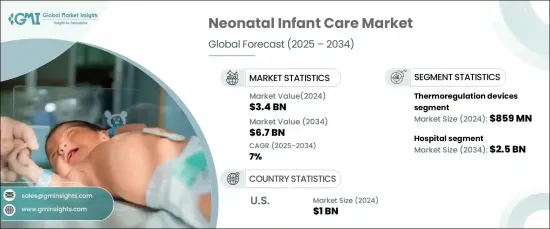

2024 年全球新生兒護理市場價值為 34 億美元,預計 2025 年至 2034 年期間將實現顯著成長,複合年成長率為 7%。旨在提高早產兒存活率、滿足這一弱勢群體特殊需求的創新推動著新生兒護理的不斷發展。隨著全球醫療保健格局的不斷發展,人們也越來越關注提高新生兒健康的意識和可近性,從而更廣泛地採用專業護理解決方案。這反過來又刺激了對能夠滿足早產兒獨特健康需求的新生兒必需設備的需求。

促成市場擴張的一個主要因素是早產的發生率不斷上升,早產約佔全球分娩總數的 10%。早產兒經常面臨器官發育不全等問題,需要專門的照護才能確保他們的生存。他們需要先進的支援系統,包括用於體溫調節的孵化器和用於呼吸護理的呼吸機。這些設備的需求激增在新生兒加護病房(NICU)中尤為明顯,這些技術對於早產兒的生存和長期健康發揮關鍵作用。透過提供更好的監測和更精確的治療選擇,這些設備正在徹底改變新生兒護理的模式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 67億美元 |

| 複合年成長率 | 7% |

新生兒護理市場根據最終用途分為醫院、兒科和新生兒診所以及療養院。其中,醫院佔據市場主導地位,到 2024 年將佔據相當大的佔有率。醫院,尤其是新生兒加護病房,配備了最先進的設備,例如孵化器、體溫調節設備和呼吸支援系統。這些設施對於提供對患有健康併發症或早產的新生兒所需的重症監護至關重要,進一步推動了對先進的新生兒護理技術的需求。

美國新生兒護理市場價值在 2024 年達到 10 億美元,憑藉其先進的醫療保健基礎設施和較高的早產發生率引領全球市場。美國醫院對新生兒護理產品(包括體溫調節系統、呼吸器和孵化器)的需求尤其強勁。該國專注於改善新生兒護理結果,並結合公共和私營部門的舉措,支持採用這些救生技術。隨著新生兒護理設備的不斷進步,美國仍然是全球新生兒護理市場的關鍵參與者,確保早產嬰兒獲得最佳結果。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球擴大兒科診所和新生兒加護病房

- 新興經濟體早產率上升

- NICU 裝置的安裝數量不斷增加

- 新生兒護理設備的技術進步

- 產業陷阱與挑戰

- 新生兒照護可及性差

- 成長動力

- 成長潛力分析

- 2024 年各國新生兒加護病房數量

- 監管格局

- 技術格局

- 價值鏈分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 體溫調節裝置

- 新生兒保溫箱

- 暖爐

- 新生兒冷卻系統

- 光療設備

- LED 光療系統

- CFL 光療系統

- 監控系統

- 新生兒通氣

- 血氣監測系統

- 腦部監測

- 其他監控系統

- 新生兒復甦器

- 新生兒聽力篩檢

- 視力篩檢

- 其他產品類型

第 6 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 兒科及新生兒診所

- 養老院

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Angelantoni Life Science

- ATOM MEDICAL

- Becton, Dickinson, and Company

- COBAMS

- DAVID

- Drager

- Fanem

- Fisher & Paykel Healthcare

- GE Healthcare

- INSPIRATION HEALTHCARE GROUP

- Masimo

- Medtronic

- natus

The Global Neonatal Infant Care Market is valued at USD 3.4 billion in 2024 and is expected to experience significant growth with a CAGR of 7% from 2025 to 2034. This expansion is driven by several key factors, including the rising rates of premature births, continuous advancements in neonatal care technologies, and the overall increase in healthcare spending. The ongoing evolution of neonatal care is being propelled by innovations designed to improve the survival rates of preterm infants, addressing the specialized needs of this vulnerable population. As the global healthcare landscape continues to advance, there is also a growing focus on enhancing the awareness and accessibility of neonatal health, leading to broader adoption of specialized care solutions. This, in turn, is fueling the demand for essential neonatal equipment that can support the unique health needs of premature infants.

A major factor contributing to the market expansion is the increasing prevalence of preterm births, which account for approximately 10% of all global deliveries. Premature infants often face challenges such as underdeveloped organs, which necessitate specialized care to ensure their survival. They require advanced support systems, including incubators for thermoregulation and ventilators for respiratory care. The surge in demand for these devices is particularly evident in neonatal intensive care units (NICUs), where these technologies play a critical role in the survival and long-term health of preterm infants. By offering better monitoring and more precise treatment options, these devices are revolutionizing the landscape of neonatal care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 7% |

The neonatal infant care market is segmented by end use into hospitals, pediatric and neonatal clinics, and nursing homes. Among these, hospitals dominate the market, accounting for a substantial share in 2024. This segment is expected to generate USD 2.5 billion by 2034, reflecting the widespread adoption of advanced neonatal technologies. Hospitals, particularly NICUs, are equipped with state-of-the-art equipment, such as incubators, thermoregulation devices, and respiratory support systems. These facilities are essential in delivering the intensive care needed to support newborns with health complications or prematurity, further driving the demand for advanced neonatal care technologies.

The U.S. neonatal infant care market, valued at USD 1 billion in 2024, leads the global market due to its advanced healthcare infrastructure and a high incidence of preterm births. The demand for neonatal care products, including thermoregulation systems, ventilators, and incubators, is particularly strong in U.S. hospitals. The country's focus on improving neonatal care outcomes, combined with public and private sector initiatives, supports the adoption of these life-saving technologies. With continuous advancements in neonatal care equipment, the U.S. remains a pivotal player in the global neonatal infant care market, ensuring optimal outcomes for infants born prematurely.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of pediatric clinics and neonatal intensive care units globally

- 3.2.1.2 Rising premature birth rate in emerging economies

- 3.2.1.3 Increasing number of installations for NICU units

- 3.2.1.4 Technological advancements in neonatal infant care devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Poor accessibility for neonatal care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Number of neonatal intensive care units, by country, 2024

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Value chain analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Thermoregulation devices

- 5.2.1 Neonatal incubators

- 5.2.2 Warmers

- 5.2.3 Neonatal cooling systems

- 5.3 Phototherapy devices

- 5.3.1 LED phototherapy system

- 5.3.2 CFL phototherapy system

- 5.4 Monitoring systems

- 5.4.1 Neonatal ventilation

- 5.4.2 Blood gas monitoring system

- 5.4.3 Brain monitoring

- 5.4.4 Other monitoring systems

- 5.5 Neonatal infant resuscitator devices

- 5.6 Neonatal hearing screening

- 5.7 Vision screening

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Pediatric & neonatal clinics

- 6.4 Nursing homes

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Angelantoni Life Science

- 8.2 ATOM MEDICAL

- 8.3 Becton, Dickinson, and Company

- 8.4 COBAMS

- 8.5 DAVID

- 8.6 Drager

- 8.7 Fanem

- 8.8 Fisher & Paykel Healthcare

- 8.9 GE Healthcare

- 8.10 INSPIRATION HEALTHCARE GROUP

- 8.11 Masimo

- 8.12 Medtronic

- 8.13 natus