|

市場調查報告書

商品編碼

1666546

海上平台電氣化市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Offshore Platform Electrification Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

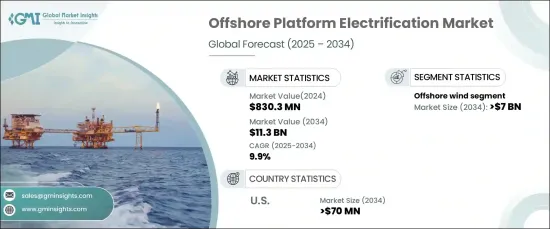

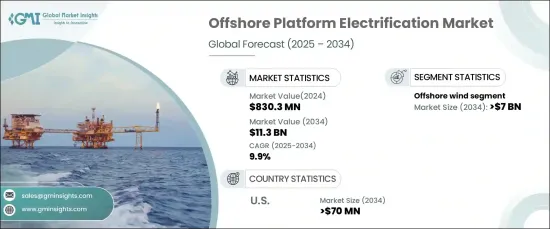

2024 年全球海上平台電氣化市場價值為 8.303 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 9.9%。對可靠且經濟高效的電氣化網路的需求不斷成長,在促進市場發展方面發揮著至關重要的作用,從而確保了海上平台穩定的電源解決方案。隨著世界轉向更清潔、永續的能源,海上平台對創新電氣化組件的需求預計將進一步加速市場成長。

離岸風電產業尤其有望大幅成長,預計到 2034 年該產業將創造 70 億美元的產值。先進的離岸風電技術的應用進一步推動了這一成長,例如具有卓越發電能力和更高營運效率的大型渦輪機。政府為減少碳排放而推出的優惠政策正在創造支持市場積極勢頭的環境。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.303 億美元 |

| 預測值 | 113億美元 |

| 複合年成長率 | 9.9% |

在美國,到 2034 年,離岸平台電氣化市場預計將產生 7,000 萬美元的收入。海底電力傳輸的技術進步,特別是高壓直流 (HVDC) 電纜技術和尖端電纜設計,大大增強了海上平台的能力。這些創新確保了更有效率的電力分配並提高了海上設施之間的連通性,從而推動了市場擴張。

隨著世界各國政府繼續對再生能源項目實施有利的監管框架,國家再生能源目標正在推動基礎設施發展的財政誘因。這些措施為海上平台電氣化的發展創造了有利環境,刺激了對促進向更永續能源解決方案轉變的技術的進一步投資。隨著對清潔能源的需求不斷增加,預計海上電氣化市場在預測期內將保持強勁的成長軌跡。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:依技術,2021 – 2034 年

- 主要趨勢

- 離岸風電

- 地下電纜

- 渦輪

第6章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 挪威

- 英國

- 荷蘭

- 丹麥

- 亞太地區

- 中國

- 印度

- 韓國

- 越南

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 阿曼

- 拉丁美洲

- 巴西

- 墨西哥

第7章:公司簡介

- ABB

- ADNOC

- Aker Solutions

- BP

- Cerulean Winds

- Equinor

- GE Vernova

- Havfram

- LS Cable

- Nexans

- NKT

- Norddeutsche Seekabelwerke

- Prysmian

- SLB

- Siemens Energy

- Southwire

- ZTT

The Global Offshore Platform Electrification Market, valued at USD 830.3 million in 2024, is set to expand at a CAGR of 9.9% from 2025 to 2034. This expansion is driven by ongoing breakthroughs in renewable energy technologies, including floating solar arrays, offshore wind turbines, and energy storage systems. The rise in the demand for reliable and cost-effective electrification networks is playing a crucial role in boosting the market, thus ensuring stable power supply solutions for offshore platforms. As the world shifts toward cleaner, sustainable energy sources, the need for innovative electrification components in offshore platforms is expected to further accelerate market growth.

The offshore wind sector is particularly poised for major growth, with projections indicating it could generate USD 7 billion by 2034. The consistent expansion of offshore wind power installations, fueled by ambitious renewable energy goals and growing energy needs, directly benefits the offshore electrification market. This growth is further driven by the adoption of advanced offshore wind technologies, such as larger turbines that offer superior power generation capabilities and enhanced operational efficiency. Favorable government policies aimed at reducing carbon emissions are creating an environment that supports the market's positive momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $830.3 Million |

| Forecast Value | $11.3 Billion |

| CAGR | 9.9% |

In the United States, the offshore platform electrification market is predicted to generate USD 70 million by 2034. This growth is fueled by the ongoing development of offshore wind farms, which have garnered substantial investment from both the government and private sectors. Technological advancements in subsea power transmission, particularly high-voltage direct current (HVDC) cable technology and cutting-edge cable designs, are significantly enhancing the capabilities of offshore platforms. These innovations ensure more efficient power distribution and improve connectivity across offshore installations, thus fueling market expansion.

As governments around the world continue to implement favorable regulatory frameworks for renewable energy projects, national renewable energy targets are driving financial incentives for infrastructure development. These measures create a supportive environment for the growth of offshore platform electrification, spurring further investments in technologies that promote the shift toward more sustainable energy solutions. With increasing demand for clean energy, the offshore electrification market is expected to maintain a strong growth trajectory through the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Offshore wind

- 5.3 Underground cable

- 5.4 Turbine

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 UK

- 6.3.3 Netherlands

- 6.3.4 Denmark

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 South Korea

- 6.4.4 Vietnam

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Qatar

- 6.5.4 Oman

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Mexico

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 ADNOC

- 7.3 Aker Solutions

- 7.4 BP

- 7.5 Cerulean Winds

- 7.6 Equinor

- 7.7 GE Vernova

- 7.8 Havfram

- 7.9 LS Cable

- 7.10 Nexans

- 7.11 NKT

- 7.12 Norddeutsche Seekabelwerke

- 7.13 Prysmian

- 7.14 SLB

- 7.15 Siemens Energy

- 7.16 Southwire

- 7.17 ZTT