|

市場調查報告書

商品編碼

1666534

電動車充電管理軟體平台市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測EV Charging Management Software Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

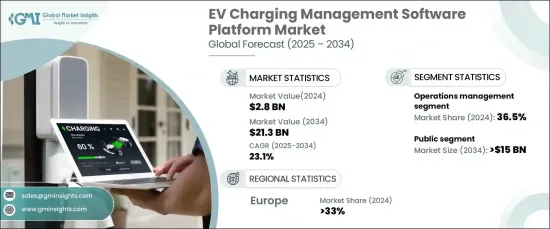

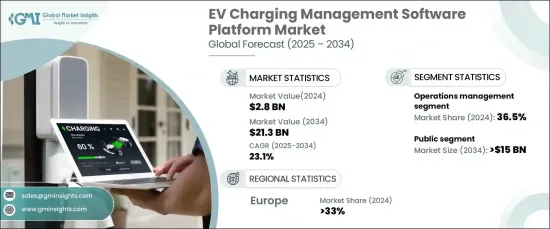

2024 年全球電動車充電管理軟體平台市場價值為 28 億美元,預計將經歷強勁成長,2025 年至 2034 年的複合年成長率為 23.1%。 這一顯著擴張主要得益於電動車 (EV) 的日益普及,這對更高效、更全面的電動汽車充電解決方案的需求也隨之增加。隨著電動車日益成為主流,對管理電動車充電基礎設施的先進軟體平台的需求正在迅速增加。

需求激增的關鍵因素是人們越來越關注能源效率和電網最佳化。這些軟體平台對於管理電動車與電網的無縫整合至關重要,可實現高效分配能源,同時保持較低的營運成本。此外,這些解決方案有助於最大限度地利用再生能源,為充電網路的整體永續性做出貢獻。隨著電動車的普及加速和能源系統的發展,電動車充電管理平台在最佳化電網性能和提高能源效率方面的作用將變得更加重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 213億美元 |

| 複合年成長率 | 23.1% |

市場根據充電站點分為公共和私人兩類。 2024 年,公共充電站市場佔有 65% 的主導佔有率,預計到 2034 年將達到 150 億美元。公共充電站在電動車的成功中發揮著至關重要的作用,為電動車車主(特別是那些沒有家庭充電選擇的車主)提供方便、可靠的充電基礎設施。公共充電網路的擴大是緩解里程焦慮的關鍵——里程焦慮是阻礙長途旅行和阻礙電動車廣泛普及的主要問題。

另一個關鍵的細分市場按模組分類,包括營運管理、能源管理、計費和支付等。 2024年,營運管理模組佔據36.5%的市場。營運管理對於確保電動車充電網路的平穩運作至關重要,可滿足對高效、可靠且易於管理的充電解決方案日益成長的需求。隨著道路上電動車數量的增加,對高性能充電基礎設施的需求變得更加迫切。

2024 年,歐洲電動車充電管理軟體平台市場佔全球佔有率的 33%。此外,歐洲對碳減排和永續發展的堅定承諾繼續推動整個地區採用電動車充電解決方案。

這個不斷成長的市場證明了對電動車的需求不斷成長,以及先進的充電管理平台在確保電動車無縫整合到電網、提高效率、永續性和整體電動車擁有體驗方面發揮的關鍵作用。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原料及零件供應商

- 軟體平台供應商

- 充電站營運商/基礎設施供應商

- 最終用戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車的普及率不斷提高

- 政府支持和法規

- 充電技術的技術進步

- 更重視能源效率和電網最佳化

- 與再生能源整合

- 產業陷阱與挑戰

- 充電基礎設施缺乏標準化

- 安全和隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按模組,2021 - 2034 年

- 主要趨勢

- 營運管理

- 能源管理

- 帳單與付款

- 其他

第 6 章:市場估計與預測:按充電類型,2021 - 2034 年

- 主要趨勢

- 1級

- 2 級

- 3 級

第 7 章:市場估計與預測:按充電站點,2021 - 2034 年

- 主要趨勢

- 民眾

- 私人的

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- ABB

- Ampeco

- Bosch

- ChargeLab

- ChargePoint

- Current

- Driivz

- Enel X

- EV Connect

- EVBox

- Flo

- Greenflux

- LANDIS+GYR

- Powerflex

- Shell Recharge Solutions

- Siemens

- Touch GmbH

- Tridens

- Virta

- YoCharge

The Global EV Charging Management Software Platforms Market was valued at USD 2.8 billion in 2024 and is projected to experience robust growth, with a CAGR of 23.1% from 2025 to 2034. This significant expansion is primarily driven by the growing adoption of electric vehicles (EVs), which is creating a heightened demand for more efficient and comprehensive EV charging solutions. As electric mobility becomes increasingly mainstream, the need for advanced software platforms to manage EV charging infrastructure is rapidly increasing.

A key factor behind this surge in demand is the growing focus on energy efficiency and grid optimization. These software platforms are essential for managing the seamless integration of EVs into the power grid, enabling the efficient distribution of energy while keeping operational costs low. Moreover, these solutions help maximize the use of renewable energy sources, contributing to the overall sustainability of charging networks. As the adoption of electric vehicles accelerates and energy systems evolve, the role of EV charging management platforms in optimizing grid performance and improving energy efficiency will become even more vital.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $21.3 Billion |

| CAGR | 23.1% |

The market is segmented by charging sites into public and private categories. In 2024, the public charging site segment held a dominant market share of 65% and is expected to reach USD 15 billion by 2034. Public charging stations play a crucial role in the success of electric mobility, providing accessible and reliable charging infrastructure for EV owners, particularly those without home charging options. The expansion of public charging networks is key to easing range anxiety-a major concern that can deter long-distance travel and hinder the widespread adoption of EVs.

Another key market segment is categorized by module, including operation management, energy management, billing and payment, and others. In 2024, the operations management module held a 36.5% share of the market. Operations management is vital for ensuring the smooth operation of EV charging networks, supporting the increasing demand for efficient, reliable, and easily manageable charging solutions. As the number of electric vehicles on the road rises, the need for high-performance charging infrastructure becomes more urgent.

Europe EV charging management software platform market represented 33% of the global share in 2024. The region's leadership in the transition to electric mobility, fueled by favorable regulations and a robust EV infrastructure, positions it as a key player in the market. Additionally, Europe's strong commitment to carbon reduction and sustainability continues to drive the adoption of EV charging solutions across the region.

This growing market is a testament to the rising demand for electric vehicles and the critical role that sophisticated charging management platforms play in ensuring the seamless integration of EVs into the energy grid, enhancing efficiency, sustainability, and the overall EV ownership experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material and component suppliers

- 3.1.2 Software platform providers

- 3.1.3 Charging station operators / infrastructure providers

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing adoption of electric vehicles

- 3.8.1.2 Government support and regulations

- 3.8.1.3 Technological advancements in charging technology

- 3.8.1.4 Increased focus on energy efficiency and grid optimization

- 3.8.1.5 Integration with renewable energy sources

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of standardization across charging infrastructure

- 3.8.2.2 Security and privacy concerns

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Module, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Operation management

- 5.3 Energy management

- 5.4 Billing & payment

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Charging Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Level 1

- 6.3 Level 2

- 6.4 Level 3

Chapter 7 Market Estimates & Forecast, By Charging Site, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Public

- 7.3 Private

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Ampeco

- 9.3 Bosch

- 9.4 ChargeLab

- 9.5 ChargePoint

- 9.6 Current

- 9.7 Driivz

- 9.8 Enel X

- 9.9 EV Connect

- 9.10 EVBox

- 9.11 Flo

- 9.12 Greenflux

- 9.13 LANDIS+GYR

- 9.14 Powerflex

- 9.15 Shell Recharge Solutions

- 9.16 Siemens

- 9.17 Touch GmbH

- 9.18 Tridens

- 9.19 Virta

- 9.20 YoCharge