|

市場調查報告書

商品編碼

1665404

汽車攝影機監控系統 (CMS) 市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Automotive Camera Monitoring System (CMS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

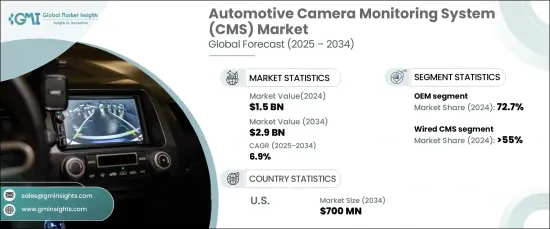

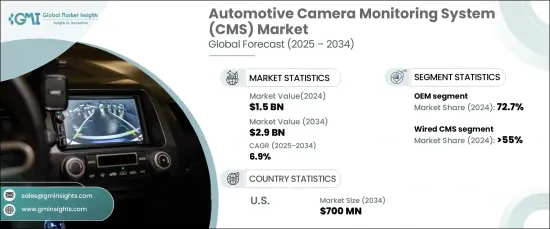

2024 年全球汽車攝影機監控系統市場價值為 15 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.9%。這些系統包括自動煞車、自適應巡航控制和車道維持輔助等功能,其中攝影機監控系統在盲點偵測和防撞等功能中發揮至關重要的作用。政府致力於加強道路安全的規定進一步增強了對這些技術的需求。全球機構推出的更嚴格政策迫使汽車製造商將基於攝影機的系統納入新車型和現有車型中。從傳統鏡子到基於攝影機的系統的轉變符合這些法規,為市場創造了巨大的成長機會。

根據技術,市場分為有線系統和無線系統。有線系統憑藉其在安全關鍵型應用中的可靠性和穩定性能,在 2024 年佔據了 55% 以上的市場佔有率。這些系統廣泛應用於商用車輛,即時視訊傳輸至關重要。它們能夠提供不受干擾的一致資料傳輸,這使得它們在涉及重型車輛的應用中不可或缺。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 29億美元 |

| 複合年成長率 | 6.9% |

另一方面,無線系統由於其易於安裝和美觀的優勢,正顯著普及。這些系統在乘用車和售後市場解決方案中特別受歡迎,因為它們消除了大量佈線的需要並有助於實現更簡潔的設計。人們對連網汽車技術(包括自動駕駛和車對車通訊)的日益重視預計將推動無線系統的進一步應用。這一趨勢在消費車輛和改裝市場尤為明顯,這些市場優先考慮靈活性和先進的功能。

攝影機監控系統的分佈分為原始設備製造商(OEM)和售後市場。截至 2024 年,原始設備製造商佔據 72.7% 的市場佔有率,這主要歸功於新製造的車輛中整合了先進的安全系統。汽車製造商正在積極採用攝影機監控系統,以滿足嚴格的安全標準並提高車輛性能,尤其是在電動和自動駕駛車型中。受消費者升級需求和遵守不斷發展的安全法規的推動,售後市場也正在獲得發展動力。在尋求提高安全性和功能性的車主中,改裝解決方案越來越受歡迎。

在美國,隨著安全標準的嚴格化和對先進汽車技術的日益關注,預計到 2034 年市場規模將達到約 7 億美元。消費者對安全增強型汽車的興趣日益濃厚以及監管要求是支持這一成長軌蹟的關鍵因素。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- OEM供應商

- 售後市場供應商

- 系統整合商

- 最終用戶

- 利潤率分析

- 價格分析

- 成本明細分析

- 專利分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 高級駕駛輔助系統 (ADAS) 的採用日益廣泛

- 科技進步加快

- 消費者對先進安全性的期望不斷提高

- 監管壓力不斷加大

- 產業陷阱與挑戰

- 初始成本高

- 消費者對新科技的抵制

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 無線的

- 無線上網

- 藍牙

- 蜂窩網路

- 有線

- 同軸

- 乙太網路

- 光纖

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 7 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第 8 章:市場估計與預測:按相機分類,2021 - 2034 年

- 主要趨勢

- 數位的

- 模擬

- 紅外線 (IR)

- 立體聲

- 360 度

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Ambarella

- Analog Devices

- Aptiv

- Bosch

- Continental

- Denso

- Ficosa

- Gentex

- Hella

- Hitachi Astemo

- Hyundai Mobis

- Kyocera

- Magna

- Mitsubishi Electric

- Omnivision

- Panasonic

- SMR

- Stoneridge

- Texas Instruments

- Valeo

The Global Automotive Camera Monitoring System Market was valued at USD 1.5 billion in 2024 and is projected to expand at a CAGR of 6.9% from 2025 to 2034. This growth is largely driven by the increasing adoption of advanced driver-assistance systems (ADAS) across the automotive sector. These systems include features like automatic braking, adaptive cruise control, and lane-keeping assist, where camera monitoring systems play a vital role in functions such as blind-spot detection and collision avoidance. Government regulations focused on enhancing road safety further bolster the demand for these technologies. Stricter policies from global bodies are compelling automakers to incorporate camera-based systems into both new and existing vehicle models. The shift from traditional mirrors to camera-based systems aligns with these regulations, creating substantial growth opportunities for the market.

The market is categorized by technology into wired and wireless systems. Wired systems held over 55% of the market share in 2024 due to their reliability and stable performance in safety-critical applications. These systems are widely used in commercial vehicles, where real-time video feeds are essential. Their ability to offer consistent data transmission without interference makes them indispensable in applications involving heavy-duty vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 6.9% |

Wireless systems, on the other hand, are witnessing a significant rise in popularity due to their ease of installation and aesthetic advantages. These systems are particularly favored in passenger vehicles and aftermarket solutions, as they eliminate the need for extensive wiring and contribute to a cleaner design. The increasing emphasis on connected vehicle technologies, including autonomous driving and vehicle-to-vehicle communication, is expected to drive further adoption of wireless systems. This trend is particularly notable in consumer vehicles and retrofit markets, where flexibility and advanced functionality are prioritized.

The distribution of camera monitoring systems is divided between original equipment manufacturers (OEMs) and the aftermarket. OEMs dominate the market with a 72.7% share as of 2024, primarily due to the integration of advanced safety systems in newly manufactured vehicles. Automakers are proactively incorporating camera monitoring systems to meet stringent safety standards and enhance vehicle performance, particularly in electric and autonomous models. The aftermarket is also gaining traction, driven by consumer demand for upgrades and compliance with evolving safety regulations. Retrofit solutions are becoming increasingly popular among vehicle owners seeking improved safety and functionality.

In the US, the market is expected to reach approximately USD 700 million by 2034, propelled by stringent safety standards and a growing focus on advanced vehicle technologies. Rising consumer interest in safety-enhanced vehicles and regulatory requirements are key factors supporting this growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 OEM Suppliers

- 3.2.2 Aftermarket suppliers

- 3.2.3 System integrators

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Price analysis

- 3.5 Cost breakdown analysis

- 3.6 Patent analysis

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing adoption of Advanced Driver-Assistance Systems (ADAS)

- 3.10.1.2 Increased technological advancements

- 3.10.1.3 Growing consumers' expectations for advanced safety

- 3.10.1.4 Increasing regulatory pressure

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs

- 3.10.2.2 Consumer resistance to new technology

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wireless

- 5.2.1 Wi-Fi

- 5.2.2 Bluetooth

- 5.2.3 Cellular

- 5.3 Wired

- 5.3.1 Coaxial

- 5.3.2 Ethernet

- 5.3.3 Fiber optic

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Camera, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Digital

- 8.3 Analog

- 8.4 Infrared (IR)

- 8.5 Stereo

- 8.6 360-Degree

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Ambarella

- 10.2 Analog Devices

- 10.3 Aptiv

- 10.4 Bosch

- 10.5 Continental

- 10.6 Denso

- 10.7 Ficosa

- 10.8 Gentex

- 10.9 Hella

- 10.10 Hitachi Astemo

- 10.11 Hyundai Mobis

- 10.12 Kyocera

- 10.13 Magna

- 10.14 Mitsubishi Electric

- 10.15 Omnivision

- 10.16 Panasonic

- 10.17 SMR

- 10.18 Stoneridge

- 10.19 Texas Instruments

- 10.20 Valeo