|

市場調查報告書

商品編碼

1665383

氣彈簧市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Gas Springs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

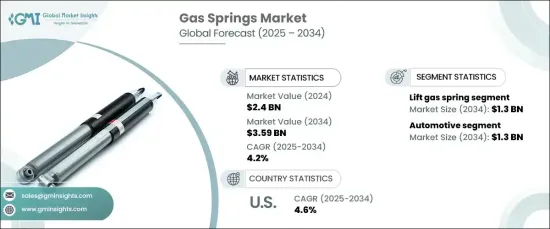

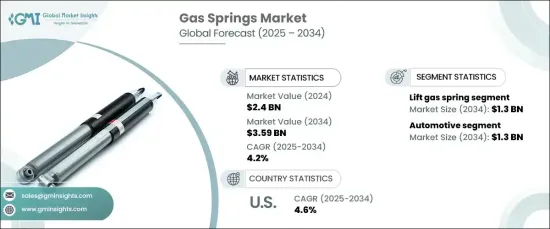

2024 年全球氣彈簧市場價值為 24 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.2%。這些組件提供平穩且可控的運動,使其成為需要精確度的自動化系統必不可少的組件。隨著企業採用先進製造和智慧技術,氣彈簧對於提升、傾斜和平衡任務變得至關重要。與液壓或電動致動器相比,它們的經濟性進一步增強了它們的吸引力,尤其是對於中小型企業而言。

對於注重安全性、人體工學和節能解決方案的產業來說,氣彈簧是不可或缺的一部分。智慧製造和工業 4.0 的興起加速了它們在互聯系統中的使用,它們以最少的外部能量提供精確可靠的運動控制。隨著汽車和工業機械等關鍵領域的自動化程度不斷提高,對氣彈簧的需求預計將大幅增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 35.9 億美元 |

| 複合年成長率 | 4.2% |

按類型分類,升降氣彈簧部分在 2024 年佔據了相當大的市場佔有率,收入達到 8.3 億美元。預計該領域將進一步成長,到 2034 年將達到 13 億美元。它們的客製化潛力使其成為需要精確運動控制的應用的理想選擇。各行各業都越來越青睞升降氣彈簧,因為它們節能、維護要求低,鞏固了其在各個領域的熱門選擇地位。

根據應用,汽車產業在 2024 年佔據 32.4% 的佔有率,佔據市場主導地位,到 2034 年估值達到 13 億美元。它們能夠提供受控的提升和定位,這使得它們在需要精確度和安全性的應用中不可或缺。各行各業都開始採用氣彈簧,因為它們價格便宜、節能,並且能夠支援自動化驅動的操作。

2024 年,美國將主導北美氣彈簧市場,佔據 53.5% 的區域佔有率,預計在預測期內以 4.6% 的複合年成長率成長。強大的工業化和先進的製造流程是美國的關鍵驅動力,對可靠的運動控制解決方案的需求很高。氣彈簧廣泛應用於製造業、汽車業、航太和其他領域,體現了其在支持現代生產需求方面的重要性。技術進步和研發投入進一步促進了市場成長,推動了提高氣彈簧在不同應用中的性能和功能的創新。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 各行各業擴大採用自動化

- 氣彈簧的技術進步

- 對環保解決方案的關注度不斷上升

- 產業陷阱與挑戰

- 氣彈簧成本高

- 耐用性和維護有限

- 成長動力

- 成長潛力分析

- 消費者行為分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 升降氣彈簧

- 可鎖定氣壓彈簧

- 轉椅氣彈簧

- 氣牽引彈簧

- 氣彈簧減震器

- 其他

第 6 章:市場估計與預測:依安裝方向,2021 年至 2034 年

- 主要趨勢

- 臥式氣壓彈簧

- 垂直空氣彈簧

第 7 章:市場估計與預測:按最大力量 2021-2034

- 主要趨勢

- 250 N 以下氣彈簧

- 251 至 500 N 氣壓彈簧

第 8 章:市場估計與預測:按應用 2021-2034

- 主要趨勢

- 汽車

- 航太、海洋和鐵路

- 家庭和辦公設備

- 工業機械與自動化

- 衛生保健

- 其他

第 9 章:市場估計與預測:依最終用途 2021-2034

- 主要趨勢

- 工業的

- 住宅

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- OEM

- 售後市場

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- ACE Controls

- Ameritool Manufacturing

- AVM Industries

- Bansbach Easylift

- Barnes Group

- Dictator Technik

- Hahn Gas Springs

- IGS Italy

- Industrial Gas Springs

- Lantan Gas Spring

- Metrol Springs

- Showa

- Shunde Huayang Gas Spring

- Stabilus

- Suspa

The Global Gas Springs Market was valued at USD 2.4 billion in 2024 and is projected to grow at a CAGR of 4.2% between 2025 and 2034. Increasing reliance on automation across industries is driving the adoption of gas springs. These components offer smooth and controlled motion, making them essential for automated systems that require precision. As businesses embrace advanced manufacturing and smart technologies, gas springs are becoming crucial for lifting, tilting, and balancing tasks. Their affordability compared to hydraulic or electric actuators further enhances their appeal, especially for small and medium-sized enterprises.

Gas springs are integral to industries prioritizing safety, ergonomics, and energy-efficient solutions. The rise of smart manufacturing and Industry 4.0 is accelerating their usage in connected systems, where they deliver precise and reliable motion control with minimal external energy. As automation grows in key sectors like automotive and industrial machinery, demand for gas springs is anticipated to increase significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.59 Billion |

| CAGR | 4.2% |

By type, the lift gas spring segment captured a significant market share in 2024, with revenues reaching USD 0.83 billion. This segment is expected to grow further, hitting USD 1.30 billion by 2034. Lift gas springs are preferred for their versatility, cost-effectiveness, and ability to deliver consistent performance. Their customization potential makes them ideal for applications requiring precise motion control. Industries increasingly favor lift gas springs for their energy efficiency and low maintenance requirements, cementing their position as a popular choice across various sectors.

Based on application, the automotive sector led the market with a 32.4% share in 2024, reaching a valuation of USD 1.3 billion by 2034. Gas springs are essential for achieving smooth and accurate motion in automotive systems and components. Their ability to provide controlled lifting and positioning makes them indispensable in applications requiring precision and safety. Industries are turning to gas springs for their affordability, energy efficiency, and capability to support automation-driven operations.

The United States dominated the North America gas springs market in 2024, holding 53.5% of the regional share and projected to grow at a CAGR of 4.6% over the forecast period. Strong industrialization and advanced manufacturing processes are key drivers in the US, creating a high demand for reliable motion control solutions. Gas springs are widely used across manufacturing, automotive, aerospace, and other sectors, reflecting their importance in supporting modern production needs. Technological advancements and investments in research and development further contribute to market growth, enabling innovations that enhance the performance and functionality of gas springs in diverse applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier Landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of automation across industries

- 3.6.1.2 Technological advancements in gas spring

- 3.6.1.3 Rising concern regarding environmentally friendly solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Cost of Gas Springs

- 3.6.2.2 Limited Durability and Maintenance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million units)

- 5.1 Key trends

- 5.2 Lift gas spring

- 5.3 Lockable gas spring

- 5.4 Swivel chair gas spring

- 5.5 Gas traction spring

- 5.6 Gas spring damper

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Mounting Orientation, 2021-2034 (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Horizontal gas springs

- 6.3 Vertical gas springs

Chapter 7 Market Estimates & Forecast, By Maximum Force 2021-2034 (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Below 250 N gas spring

- 7.3 251 to 500 N gas spring

Chapter 8 Market Estimates & Forecast, By Application 2021-2034 (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace, Marine, & Rail

- 8.4 Home & Office Equipment

- 8.5 Industrial Machinery & Automation

- 8.6 Healthcare

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use 2021-2034 (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 Industrial

- 9.3 Residential

- 9.4 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 United States

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Unites kingdom

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 United Arab Emirates

Chapter 12 Company Profiles

- 12.1 ACE Controls

- 12.2 Ameritool Manufacturing

- 12.3 AVM Industries

- 12.4 Bansbach Easylift

- 12.5 Barnes Group

- 12.6 Dictator Technik

- 12.7 Hahn Gas Springs

- 12.8 IGS Italy

- 12.9 Industrial Gas Springs

- 12.10 Lantan Gas Spring

- 12.11 Metrol Springs

- 12.12 Showa

- 12.13 Shunde Huayang Gas Spring

- 12.14 Stabilus

- 12.15 Suspa