|

市場調查報告書

商品編碼

1665344

麵包機市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Bread Maker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

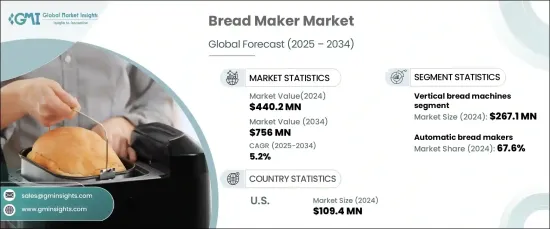

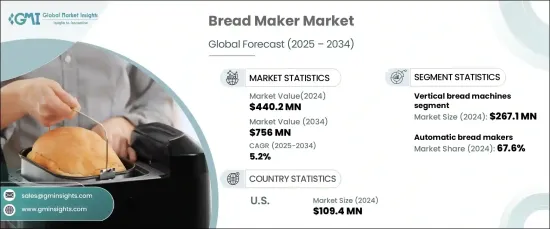

2024 年全球麵包機市場價值為 4.402 億美元,預計將呈現穩定成長的軌跡,2025 年至 2034 年的複合年成長率為 5.2%。這一成長是由消費者對自製麵包的偏好日益增加所推動的,尤其是那些尋求更健康、更新鮮和無防腐劑的麵包的人。隨著越來越多的人尋求控制食物成分的方法,對麵包機的需求激增。這些設備為製作新鮮的自製麵包提供了便捷的解決方案,滿足了日益成長的 DIY 烘焙趨勢。注重健康的消費者越來越意識到家庭烘焙的好處,而麵包機正成為任何熱衷於健康和天然成分的人的必備工具。

市場依產品種類分為立式麵包機和臥式麵包機。 2024 年垂直麵包機引領市場,貢獻 2.671 億美元的銷售額。預計在預測期內,它們將繼續以 5.4% 的複合年成長率擴張。立式麵包機設計緊湊,非常適合小廚房,而且能夠烘烤更高的麵包,因此受到櫃檯空間有限的消費者的青睞。這些機器也因其能源效率、成本效益和易用性而受到認可。對於注重成本的買家和重視快速儲存和輕鬆清潔的便利性的城市居民來說,它們是理想的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.402億美元 |

| 預測值 | 7.56億美元 |

| 複合年成長率 | 5.2% |

在操作模式方面,自動麵包機在 2024 年佔據市場主導地位,佔有 67.6% 的佔有率。這些設備預計將保持強勁成長,2025 年至 2034 年的複合年成長率為 5.5%。這種便利性對忙碌的家庭和專業人士特別有吸引力,他們可以享受新鮮的自製麵包的好處,而不需要花費通常與烘焙相關的時間。自動模型的方便用戶使用功能和節省時間的特點繼續使其成為受歡迎的選擇,進一步推動了它們的需求。

在美國,2024 年麵包機市場價值為 1.094 億美元,預計未來幾年將穩定成長。家庭烘焙越來越受歡迎,特別是在注重健康的消費者中,這增加了該地區對麵包機的需求。美國擁有先進的線上線下零售網路,確保廣大消費者能夠輕鬆獲得這些家電。此外,人們對更健康飲食習慣的認知不斷提高,加上對新鮮自製麵包的需求日益增加,預計將支持北美市場持續擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 人們對家庭烘焙的興趣日益濃厚

- 方便省時

- 健康與保健趨勢

- 可支配所得增加

- 產業陷阱與挑戰

- 初始成本和維護成本高

- 來自其他烘焙方法的競爭

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 直立式麵包機

- 臥式麵包機

第6章:市場估計與預測:依營運模式,2021 – 2034 年

- 主要趨勢

- 自動麵包機

- 手動麵包機

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 家庭

- 商業的

- 麵包店

- 咖啡廳

- 餐廳

- 其他

第 8 章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 小(500克以下)

- 中號(500克至1公斤)

- 大號(1公斤以上)

第 9 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司所有者網站

- 離線

- 電子產品零售商

- 家電賣場

- 超市

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 12 章:公司簡介

- BLACK+DECKER

- Breville Group

- Cuisinart

- DELONGHI

- Elite Gourmet

- Hamilton Beach

- Kenwood

- Morphy Richards

- Oster

- Panasonic Corporation

- Sharp Corporation

- Smeg

- Sunbeam

- Tefal

- Zojirushi Corporation

The Global Bread Maker Market was valued at USD 440.2 million in 2024 and is projected to experience a steady growth trajectory, expanding at a CAGR of 5.2% from 2025 to 2034. This growth is being driven by an increasing consumer preference for homemade bread, particularly among those seeking healthier, fresher, and preservative-free options. As more individuals look for ways to control the ingredients in their food, the demand for bread makers has surged. These devices provide a convenient solution for preparing fresh, homemade bread, catering to the growing DIY baking trend. Health-conscious consumers are becoming more aware of the benefits of home baking, and bread makers are emerging as an essential tool for anyone passionate about wellness and natural ingredients.

The market is segmented by product type into vertical and horizontal bread makers. Vertical bread machines led the market in 2024, contributing USD 267.1 million in sales. They are expected to continue expanding at a CAGR of 5.4% during the forecast period. Their compact design, which makes them perfect for small kitchens, and their ability to bake taller loaves have made vertical bread makers a favorite among consumers with limited counter space. These machines are also recognized for their energy efficiency, cost-effectiveness, and ease of use. They are an ideal choice for cost-conscious buyers and urban dwellers who appreciate the convenience of quick storage and easy cleaning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $440.2 Million |

| Forecast Value | $756 Million |

| CAGR | 5.2% |

When it comes to operational mode, automatic bread makers dominated the market in 2024, holding a 67.6% share. These devices are expected to maintain strong growth, with a projected CAGR of 5.5% from 2025 to 2034. Automatic bread makers simplify the baking process by managing essential tasks such as kneading, rising, and baking with minimal effort from the user. This convenience makes them particularly appealing to busy households and working professionals, who can enjoy the benefits of fresh, homemade bread without the time commitment typically associated with baking. The user-friendly functionality and time-saving features of automatic models continue to make them a popular choice, further boosting their demand.

In the United States, the bread maker market was valued at USD 109.4 million in 2024 and is expected to experience steady growth in the coming years. The rising popularity of home baking, especially among health-conscious consumers, is contributing to the demand for bread makers in the region. With an advanced retail network, both online and offline, the U.S. ensures easy access to these appliances for a broad consumer base. Additionally, growing awareness about healthier eating habits, combined with the increasing desire for fresh, homemade bread, is expected to support the continued expansion of the market in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing interest in home baking

- 3.2.1.2 Convenience and time saving

- 3.2.1.3 Health and wellness trends

- 3.2.1.4 Rising disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost and maintenance

- 3.2.2.2 Competition from other baking methods

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Million)

- 5.1 Key trends

- 5.2 Vertical bread machines

- 5.3 Horizontal bread machines

Chapter 6 Market Estimates & Forecast, By Operational Mode, 2021 – 2034, (USD Million)

- 6.1 Key trends

- 6.2 Automatic bread makers

- 6.3 Manual bread makers

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Million)

- 7.1 Key trends

- 7.2 Household

- 7.3 Commercial

- 7.3.1 Bakeries

- 7.3.2 Cafes

- 7.3.3 Restaurants

- 7.3.4 Other

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Million)

- 8.1 Key trends

- 8.2 Small (up to 500g)

- 8.3 Medium (500g to 1kg)

- 8.4 Large (1kg and above)

Chapter 9 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Million)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce website

- 10.2.2 Company owner website

- 10.3 Offline

- 10.3.1 Electronics retailers

- 10.3.2 Home appliance stores

- 10.3.3 Supermarkets

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Malaysia

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 BLACK+DECKER

- 12.2 Breville Group

- 12.3 Cuisinart

- 12.4 DELONGHI

- 12.5 Elite Gourmet

- 12.6 Hamilton Beach

- 12.7 Kenwood

- 12.8 Morphy Richards

- 12.9 Oster

- 12.10 Panasonic Corporation

- 12.11 Sharp Corporation

- 12.12 Smeg

- 12.13 Sunbeam

- 12.14 Tefal

- 12.15 Zojirushi Corporation