|

市場調查報告書

商品編碼

1665298

美塑療法市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Mesotherapy Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

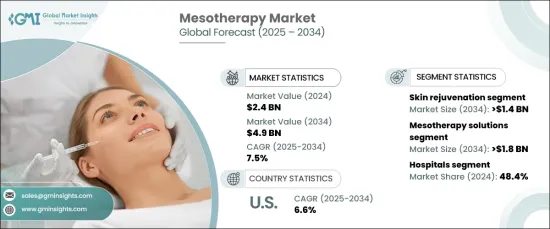

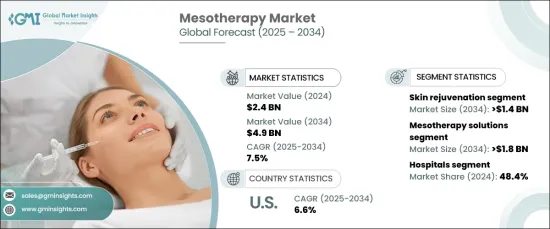

2024 年全球美塑療法市場價值為 24 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.5%。隨著消費者越來越注重自己的外表,對中胚層療法等非手術美容療法的需求持續上升。這些治療方法以其舒適性和極短的恢復時間而聞名,提供了一種比傳統手術更安全、更有效的替代方法。

美容醫學領域取得了重大進步,非侵入性手術的普及度激增,這些手術不僅有效,而且耗時少、風險低。中胚層療法完全符合這一趨勢,它提供多種治療方式,針對皮膚恢復活力、頭髮修復和減少脂肪。它的非手術性質使其能夠滿足那些尋求有效美容解決方案而無需擔心侵入性手術的個人的需求。因此,中胚層療法已成為尋求安全、可靠和微創手術的患者的首選治療方法。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 7.5% |

就產品類型而言,美塑療法市場分為美塑療法解決方案、面膜、乳霜、設備和其他產品。中胚層療法解決方案領域在 2024 年佔據了市場主導地位,預計複合年成長率為 7.2%,到 2034 年將達到 18 億美元。無論是皮膚保濕、抗老化、皮膚活化、減少脂肪或刺激毛髮生長,中胚層療法解決方案都能滿足患者的特定需求。他們能夠將針對不同問題的有效成分結合起來,從而保持對這些產品的強勁需求。

當考慮最終用途時,中胚層療法市場分為醫院、皮膚病診所和其他設施。到 2024 年,醫院將佔據 48.4% 的顯著佔有率,這得益於其擁有先進的技術和提供全面治療方案的能力。這些醫療機構因其處理複雜病例的能力和維持無菌環境的能力而受到患者的信賴,成為中胚層療法手術的理想選擇。憑藉最先進的設備和訓練有素的醫務人員,醫院比小型診所和家庭診所更具優勢,確保了市場持續成長。

在美國,中胚層療法市場的價值在 2024 年將達到 7.45 億美元,預計到 2034 年的複合年成長率為 6.6%。廣泛的熟練從業人員網路、尖端技術的獲取以及消費者在抗衰老治療上的高支出都是促成因素。此外,隨著國際患者尋求先進的中胚層療法治療,美國蓬勃發展的醫療旅遊業極大地促進了市場擴張。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創美容手術需求不斷成長

- 人們對皮膚和頭髮健康的認知不斷提高

- 技術進步

- 產業陷阱與挑戰

- 替代療法的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 美塑療法解決方案

- 美塑療法面膜

- 美塑療法霜

- 中胚層治療設備

- 其他產品類型

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 皮膚年輕化

- 減少疤痕和妊娠紋

- 疼痛管理

- 脂肪流失

- 掉髮

- 其他應用

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 皮膚科診所

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- abbvie

- CACI

- DERMAQUAL

- FILLMED LABORATOIRES

- HYALUAL

- LOBORATOIRE REVITACARE

- mesoskinline

- OstarBeuty

- Pluryal

- sesderma

- SpectruMed

- TOSKANI

The Global Mesotherapy Market is valued at USD 2.4 billion in 2024 and is anticipated to expand at a CAGR of 7.5% from 2025 to 2034. This growth is fueled by the increasing demand for minimally invasive aesthetic treatments and heightened awareness about skincare and haircare. As consumers become more conscious of their appearance, the demand for non-surgical cosmetic procedures, such as mesotherapy, continues to rise. These treatments, known for their comfort and minimal recovery time, offer a safe and effective alternative to traditional surgery.

The field of aesthetic medicine has experienced significant advancements, leading to a surge in the popularity of non-invasive procedures that are not only effective but also less time-consuming and risky. Mesotherapy fits perfectly into this trend by providing versatile treatments that target skin rejuvenation, hair restoration, and fat reduction. Its non-surgical nature allows it to meet the needs of individuals looking for efficient cosmetic solutions without the concerns associated with invasive surgeries. As a result, mesotherapy has become a go-to treatment for those seeking safe, reliable, and minimally invasive procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 7.5% |

In terms of product types, the mesotherapy market is divided into mesotherapy solutions, masks, creams, devices, and other offerings. The mesotherapy solutions segment dominated the market in 2024 and is projected to grow at a CAGR of 7.2%, reaching USD 1.8 billion by 2034. These solutions are highly favored due to their flexibility in addressing a range of aesthetic and therapeutic concerns. Whether for skin hydration, anti-aging, skin revitalization, fat reduction, or hair growth stimulation, mesotherapy solutions are tailored to meet the specific needs of patients. Their ability to combine active ingredients that target distinct issues has helped maintain a strong demand for these products.

When considering end use, the mesotherapy market is segmented into hospitals, dermatology clinics, and other facilities. Hospitals held a significant share of 48.4% in 2024, supported by their access to advanced technologies and the ability to offer comprehensive treatment options. These healthcare institutions are trusted by patients due to their capacity to handle complex cases and maintain sterile environments, making them ideal for mesotherapy procedures. With state-of-the-art equipment and highly trained medical staff, hospitals offer an edge over smaller clinics and at-home alternatives, ensuring consistent growth in the market.

In the U.S., the mesotherapy market was valued at USD 745 million in 2024, with an expected CAGR of 6.6% through 2034. The country's well-established aesthetic medicine industry, coupled with a growing preference for non-invasive cosmetic procedures, has helped position the U.S. as a leader in the global mesotherapy market. The extensive network of skilled practitioners, access to cutting-edge technologies, and high consumer spending on anti-aging treatments are all contributing factors. Furthermore, the booming medical tourism sector in the U.S. has significantly bolstered market expansion, as international patients seek advanced mesotherapy treatments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for minimally invasive aesthetic procedures

- 3.2.1.2 Growing awareness about skin and hair health

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Mesotherapy solutions

- 5.3 Mesotherapy masks

- 5.4 Mesotherapy creams

- 5.5 Mesotherapy devices

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Skin rejuvenation

- 6.3 Scar and stretch mark reduction

- 6.4 Pain management

- 6.5 Fat loss

- 6.6 Hair loss

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Dermatology clinics

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 abbvie

- 9.2 CACI

- 9.3 DERMAQUAL

- 9.4 FILLMED LABORATOIRES

- 9.5 HYALUAL

- 9.6 LOBORATOIRE REVITACARE

- 9.7 mesoskinline

- 9.8 OstarBeuty

- 9.9 Pluryal

- 9.10 sesderma

- 9.11 SpectruMed

- 9.12 TOSKANI