|

市場調查報告書

商品編碼

1665291

姿勢矯正市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Posture Correction Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

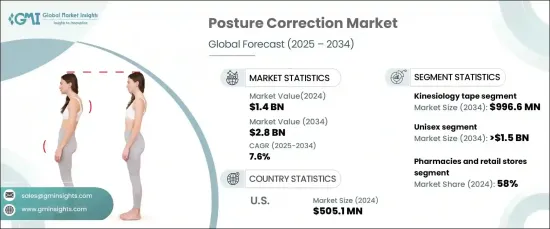

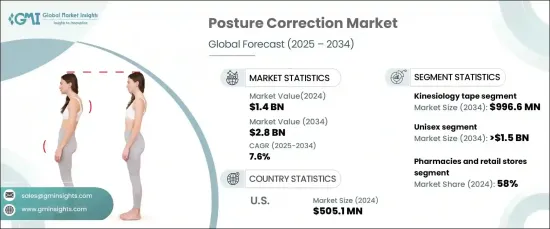

2024 年全球姿勢矯正市場價值為 14 億美元,預計 2025 年至 2034 年期間將以 7.6% 的複合年成長率強勁成長。這一令人印象深刻的擴張是由肌肉骨骼疾病患病率的不斷上升、姿勢矯正技術的創新以及消費者對康復工具的認知不斷提高所推動的。

突破性的技術進步正在改變市場。由人工智慧(AI)驅動的智慧穿戴裝置正在徹底改變姿勢矯正領域。這些設備提供即時姿勢追蹤和個人化回饋,增強用戶體驗。注重健康的消費者,尤其是那些尋求多功能設備的消費者,正在推動對這些現代解決方案的需求。此外,網上購物的激增提高了產品的可及性,進一步加速了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 7.6% |

就產品類型而言,市場包括運動機能貼、坐姿支撐裝置、姿勢矯正器、腰部支撐帶和各種相關產品。運動機能貼市場預計將以 7.7% 的複合年成長率成長,到 2034 年將達到 9.966 億美元。運動機能貼因在不限制運動的情況下提供肌肉和關節支撐而聞名,其在矯正姿勢和緩解疼痛方面的有效性而受到高度重視。

市場也按配銷通路細分,包括藥局和零售店以及電子商務平台。 2024年,藥局和零售店佔據了58%的市場佔有率,並維持了領先配銷通路的地位。這些實體店為消費者提供了在購買前親自檢查產品的機會,確保品質和可用性。零售連鎖店也利用店內促銷和折扣來促進銷售,透過在一個地方提供各種各樣的姿勢矯正產品來創造便利的購物體驗。

在美國,姿勢矯正市場的價值在 2024 年將達到 5.051 億美元,預計在整個預測期內將顯著成長。慢性背痛和與工作相關的肌肉骨骼疾病是該國對姿勢矯正產品需求的主要促進因素。人工智慧設備與健康計畫的整合凸顯了持續創新和採用技術來改善健康結果。

零售業透過為消費者提供多種姿勢矯正解決方案(例如支架、腰部支撐和智慧穿戴裝置)在支持美國市場成長方面發揮著至關重要的作用。這些產品的廣泛應用,加上人們健康意識的不斷增強,使得美國在未來幾年將成為姿勢矯正解決方案的主要市場。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 提高對肌肉骨骼健康的認知

- 與姿勢相關的健康問題日益普遍

- 工作場所擴大採用人體工學

- 智慧姿勢設備的技術進步

- 產業陷阱與挑戰

- 對產品耐用性和功效的擔憂

- 醫療級姿勢產品的監管障礙

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 各地區姿勢相關疾病流行趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 運動機能學膠帶

- 坐位支撐裝置

- 姿勢矯正器

- 腰部支撐帶

- 其他產品

第6章:市場估計與預測:依性別,2021 – 2034 年

- 主要趨勢

- 男女通用的

- 男性

- 女性

第 7 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 藥局和零售店

- 電子商務

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ALIGNMED

- Aspen

- BackJoy

- Berlin & Daughter

- ComfyBrace

- EVOKEPRO

- GAIAM

- Hempvana

- KT Tape

- Leonisa

- ottobock

- Swedish Posture

- THYSOL

- TOWATEK KOREA

- UPRIGHT

The Global Posture Correction Market, valued at USD 1.4 billion in 2024, is expected to experience strong growth at a CAGR of 7.6% from 2025 to 2034. This impressive expansion is fueled by the increasing prevalence of musculoskeletal disorders, innovations in posture correction technologies, and a rising awareness of rehabilitation tools among consumers.

The market is being transformed by groundbreaking technological advancements. Smart wearables powered by artificial intelligence (AI) are revolutionizing the posture correction landscape. These devices offer real-time posture tracking and personalized feedback, enhancing the user experience. Health-conscious consumers, particularly those looking for multifunctional devices, are driving the demand for these modern solutions. Additionally, the surge in online shopping has increased product accessibility, further accelerating market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 7.6% |

In terms of product types, the market includes kinesiology tape, sitting support devices, posture braces, lumbar support belts, and various related products. The kinesiology tape segment is projected to grow at a CAGR of 7.7%, reaching USD 996.6 million by 2034. This product's popularity among athletes, rehabilitation patients, and fitness enthusiasts has helped it dominate the market. Known for offering muscle and joint support without restricting movement, kinesiology tape is highly valued for its effectiveness in both posture correction and pain relief.

The market is also segmented by distribution channel, including pharmacies and retail stores, as well as e-commerce platforms. Pharmacies and retail stores accounted for 58% of the market share in 2024, maintaining their position as the leading distribution channel. These physical outlets offer consumers the opportunity to inspect products in person before making a purchase, ensuring quality and usability. Retail chains also utilize in-store promotions and discounts to boost sales, creating a convenient shopping experience by offering a wide range of posture correction products in one location.

In the U.S., the posture correction market was valued at USD 505.1 million in 2024, with significant growth expected throughout the forecast period. Chronic back pain and work-related musculoskeletal conditions are major drivers of demand for posture correction products in the country. The integration of AI-powered devices into wellness programs highlights ongoing innovation and the adoption of technology to improve health outcomes.

The retail sector plays a crucial role in supporting the market's growth in the U.S. by providing consumers with access to a diverse selection of posture correction solutions, such as braces, lumbar supports, and smart wearables. The broad availability of these products, combined with growing health awareness, positions the U.S. as a key market for posture correction solutions in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness of musculoskeletal health

- 3.2.1.2 Rising prevalence of posture-related health issues

- 3.2.1.3 Growing adoption of ergonomics in workplaces

- 3.2.1.4 Technological advancements in smart posture devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concerns about product durability and efficacy

- 3.2.2.2 Regulatory hurdles for medical-grade posture products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Prevalence trend of posture-related diseases, by region

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Kinesiology tape

- 5.3 Sitting support devices

- 5.4 Posture braces

- 5.5 Lumbar support belts

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Gender, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Unisex

- 6.3 Male

- 6.4 Female

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmacies and retail stores

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ALIGNMED

- 9.2 Aspen

- 9.3 BackJoy

- 9.4 Berlin & Daughter

- 9.5 ComfyBrace

- 9.6 EVOKEPRO

- 9.7 GAIAM

- 9.8 Hempvana

- 9.9 KT Tape

- 9.10 Leonisa

- 9.11 ottobock

- 9.12 Swedish Posture

- 9.13 THYSOL

- 9.14 TOWATEK KOREA

- 9.15 UPRIGHT