|

市場調查報告書

商品編碼

1665193

眼部植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ocular Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球眼部植入物市場價值為 171 億美元,預計在 2025 年至 2034 年期間實現 6.4% 的複合年成長率。此外,青光眼和白內障等慢性眼部疾病的激增,以及人們對視力矯正治療認知的提高,進一步推動了眼部植入物的採用。植入材料和設計的技術創新也促進了市場的成長,確保了更好的患者治療效果和更高的安全性。

市場分為青光眼植入物、人工水晶體、眼眶植入物、眼部假體和其他相關產品。其中,青光眼植入物領域脫穎而出,預計到 2034 年將實現 6.2% 的複合年成長率,達到 121 億美元。這一成長主要是由於青光眼患病率上升,尤其是在老年人群中,凸顯了對管理眼壓 (IOP) 的有效解決方案的需求日益增加。因此,青光眼植入物正在成為改善患者生活品質、提供更好的眼壓控制和減少併發症的關鍵組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 171億美元 |

| 預測值 | 311億美元 |

| 複合年成長率 | 6.4% |

從應用角度來看,眼部植入物市場細分為老年黃斑部病變、青光眼手術、藥物傳輸、眼整形和美容目的。 2024 年青光眼手術市場價值為 63 億美元,預計到 2034 年複合年成長率將達到 6.7%。這些創新提高了安全性、生物相容性和整體治療效果,使其在患者和醫療保健提供者中更受歡迎。

2024 年美國眼部植入物市場價值為 64 億美元,預計 2025-2034 年期間的複合年成長率為 6.1%。該國人口眾多且老化,患有各種與年齡相關的眼部疾病,包括白內障、青光眼、糖尿病視網膜病變和黃斑部病變。隨著老齡人口不斷成長和慢性眼疾發病率上升,用於矯正視力和管理高眼壓的先進眼部植入物的需求持續增加。需求的激增推動了美國市場的大幅成長,醫療保健的進步在滿足患者不斷變化的需求方面發揮著至關重要的作用。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 眼部疾病盛行率不斷上升

- 人工水晶體設計的創新

- 眼科手術激增

- 產業陷阱與挑戰

- 植入物和手術費用高昂

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 價值鏈分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 青光眼植入物

- 人工水晶體

- 眼眶植入物

- 義眼

- 其他產品

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 青光眼手術

- 眼整形手術

- 藥物輸送

- 老年性黃斑部病變

- 美學目的

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 眼科診所

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AbbVie

- Alcon

- Bausch Health

- Glaukos Corporation

- Gulden Ophthalmics

- HOYA Corporation

- HumanOptics Holding

- Johnson & Johnson

- Lenstec

- MORCHER

- NIDEK

- Orbtex

- Rayner Group

- STAAR Surgical

- ZEISS Group

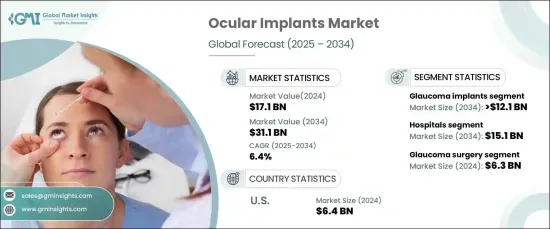

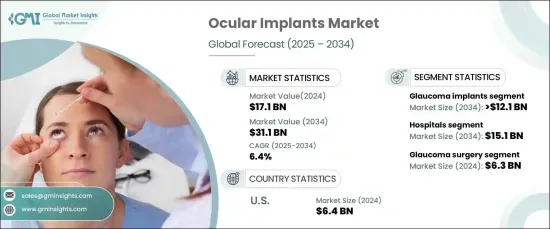

The Global Ocular Implants Market, valued at USD 17.1 billion in 2024, is set for robust growth at a CAGR of 6.4% from 2025 to 2034. This impressive expansion is fueled by multiple factors, including the increasing demand for aesthetic enhancements, the rising popularity of minimally invasive procedures, escalating healthcare spending, and a growing aging population in need of advanced eye care solutions. Additionally, the surge in chronic eye diseases, such as glaucoma and cataracts, along with rising awareness about vision correction treatments, is further driving the adoption of ocular implants. Technological innovations in implant materials and designs also contribute to the market's growth, ensuring better patient outcomes and increased safety.

The market is categorized into glaucoma implants, intraocular lenses, orbital implants, ocular prostheses, and other related products. Among these, the glaucoma implants segment stands out, expected to achieve a CAGR of 6.2% and reach USD 12.1 billion by 2034. This growth is primarily driven by the rising prevalence of glaucoma, especially among older populations, highlighting the increasing demand for effective solutions to manage intraocular pressure (IOP). As a result, glaucoma implants are becoming a critical component in improving the quality of life for patients, offering better IOP control and fewer complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.1 Billion |

| Forecast Value | $31.1 Billion |

| CAGR | 6.4% |

Focusing on applications, the ocular implants market is segmented into age-related macular degeneration, glaucoma surgery, drug delivery, oculoplasty, and aesthetic purposes. The glaucoma surgery segment, valued at USD 6.3 billion in 2024, is expected to grow at a CAGR of 6.7% by 2034. The demand for glaucoma implants is driven by advancements in implant design, which include smaller, more effective, and minimally invasive options. These innovations enhance safety, biocompatibility, and overall treatment effectiveness, making them more popular among both patients and healthcare providers.

The U.S. ocular implants market, valued at USD 6.4 billion in 2024, is projected to grow at a CAGR of 6.1% during 2025-2034. The country has a large and aging population dealing with various age-related eye conditions, including cataracts, glaucoma, diabetic retinopathy, and macular degeneration. As the elderly population continues to grow and the incidence of chronic eye diseases rises, the demand for advanced ocular implants to address vision correction and manage high intraocular pressure continues to increase. This surge in demand is driving significant growth in the U.S. market, with healthcare advancements playing a crucial role in meeting the evolving needs of patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Innovations in intraocular lens design

- 3.2.1.3 Surge in ophthalmic surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of implants and procedures

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Glaucoma implants

- 5.3 Intraocular lenses

- 5.4 Orbital implants

- 5.5 Ocular prosthesis

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Glaucoma surgery

- 6.3 Oculoplasty

- 6.4 Drug delivery

- 6.5 Age-related macular degeneration

- 6.6 Aesthetic purpose

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmic clinics

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Alcon

- 9.3 Bausch Health

- 9.4 Glaukos Corporation

- 9.5 Gulden Ophthalmics

- 9.6 HOYA Corporation

- 9.7 HumanOptics Holding

- 9.8 Johnson & Johnson

- 9.9 Lenstec

- 9.10 MORCHER

- 9.11 NIDEK

- 9.12 Orbtex

- 9.13 Rayner Group

- 9.14 STAAR Surgical

- 9.15 ZEISS Group