|

市場調查報告書

商品編碼

1665183

抗高血壓藥物市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Antihypertensive Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

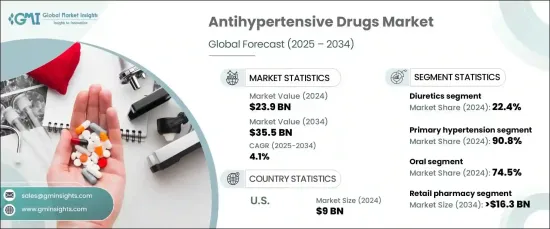

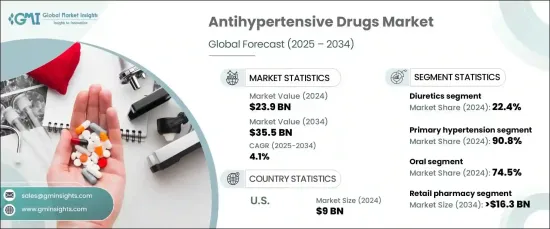

2024 年全球抗高血壓藥物市場價值為 239 億美元,預計 2025 年至 2034 年的年複合成長率(CAGR) 為 4.1%。

隨著人口老化以及不良飲食、壓力、缺乏運動等生活方式因素的持續存在,高血壓發病率持續上升,推動了對有效治療的需求。藥物配方的不斷進步,加上遠端監控和個人化用藥計畫等數位健康技術的整合,正在重塑治療格局。此外,人們對高血壓不控制可引發的併發症(如心臟病和中風)的認知不斷提高,這鼓勵人們進行早期診斷和積極治療,從而確保了對抗高血壓藥物的持續需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 239億美元 |

| 預測值 | 355億美元 |

| 複合年成長率 | 4.1% |

根據治療類型,市場分為利尿劑、血管緊張素轉換酶 (ACE) 抑制劑、血管緊張素受體阻斷劑、BETA 受體阻斷劑、鈣通道阻斷劑、腎素抑制劑、α 受體阻斷劑、血管擴張劑和其他治療。 2024 年,利尿劑領域佔最大佔有率,為 22.4%,這得益於噻嗪類利尿劑的廣泛使用,該類藥物因其降低血壓的功效而受到認可。該部門還包括袢利尿劑和保鉀利尿劑,以滿足不同的治療需求。另一個主要類別是BETA受體阻斷劑,它進一步細分為BETA-1選擇性和內在擬交感神經藥物變異體,可根據患者的個別需求提供個人化的解決方案。

根據藥物類型,市場分為原發性高血壓治療藥物和繼發性高血壓治療藥物。 2024 年原發性高血壓治療佔據主導地位,佔有 90.8% 的市場佔有率,反映了該疾病在全球範圍內的高盛行率。原發性高血壓通常與生活方式和遺傳因素有關,凸顯了對有效的長期治療方案的需求日益成長。

美國仍然是抗高血壓藥物市場的主導者,2024 年的收入為 90 億美元。創新療法的監管批准使患者能夠獲得尖端藥物,從而進一步推動市場成長。對早期診斷活動和先進治療方案的關注也正在加速全國的採用率。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 高血壓盛行率不斷上升

- 高血壓藥物研發及製劑進展

- 對高血壓風險的認知不斷提高

- 數位健康解決方案與治療策略的整合

- 產業陷阱與挑戰

- 抗高血壓治療期間服藥順從性差

- 存在嚴格的規定

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 專利分析

- 差距分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略展望

第 5 章:市場估計與預測:按療法,2021 – 2034 年

- 主要趨勢

- 利尿劑

- 噻嗪類利尿劑

- 袢利尿劑

- 保鉀利尿劑

- 血管緊張素轉換酶 (ACE) 抑制劑

- 血管張力素受體阻斷劑

- BETA受體阻斷劑

- Beta-1選擇性

- 內在擬交感神經藥

- 鈣通道阻斷劑

- 腎素抑制劑

- 阿爾法受體阻斷劑

- 血管擴張劑

- 其他療法

第 6 章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- 原發性高血壓

- 繼發性高血壓

第 7 章:市場估計與預測:按管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

- 其他給藥途徑

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 零售藥局

- 醫院藥房

- 網路藥局

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- AstraZeneca

- Bayer AG

- Boehringer Ingelheim International GmbH

- Daiichi Sankyo Company

- Johnson & Johnson Services

- Lupin

- Merck & Co

- Noden Pharma DAC

- Novartis AG

- Pfizer

- Sanofi

- Sun Pharmaceutical Industries

- Takeda Pharmaceutical

- Torrent Pharmaceuticals

The Global Antihypertensive Drugs Market, valued at USD 23.9 billion in 2024, is set to expand at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034. This growth is largely driven by the increasing prevalence of hypertension worldwide, a condition often referred to as the "silent killer" due to its asymptomatic nature and severe health risks.

As populations age and lifestyle factors such as poor diet, stress, and lack of exercise persist, hypertension rates continue to rise, fueling the demand for effective treatments. Continuous advancements in drug formulations, coupled with the integration of digital health technologies like remote monitoring and personalized medication plans, are reshaping treatment landscapes. Furthermore, heightened awareness of the complications associated with unmanaged hypertension, such as heart disease and stroke, is encouraging early diagnosis and proactive treatment adoption, ensuring a sustained demand for antihypertensive drugs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $35.5 Billion |

| CAGR | 4.1% |

The market is categorized by therapy type into diuretics, ACE inhibitors, angiotensin receptor blockers, beta blockers, calcium channel blockers, renin inhibitors, alpha-blockers, vasodilators, and other treatments. In 2024, the diuretics segment commanded the largest share at 22.4%, thanks to the widespread use of thiazide diuretics, which are recognized for their effectiveness in reducing blood pressure. This segment also includes loop and potassium-sparing diuretics, catering to diverse treatment requirements. Beta blockers, another key category, are further segmented into beta-1 selective and intrinsic sympathomimetic variants, offering personalized solutions based on individual patient needs.

By drug type, the market divides into treatments for primary and secondary hypertension. Primary hypertension treatments dominated with a commanding 90.8% market share in 2024, reflecting the high global prevalence of this condition. Primary hypertension, often linked to lifestyle and genetic factors, underscores the growing need for effective, long-term treatment options.

The United States remains a dominant player in the antihypertensive drugs market, generating USD 9 billion in revenue in 2024. This leadership is attributed to the high incidence of hypertension, coupled with robust healthcare infrastructure and significant investment in research and development. Regulatory approvals for innovative therapies are enabling patients to access cutting-edge medications, further driving market growth. The focus on early diagnosis campaigns and advanced treatment protocols is also accelerating adoption rates across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of hypertension

- 3.2.1.2 Advances in hypertensive drug development and formulations

- 3.2.1.3 Growing awareness about the risks of hypertension

- 3.2.1.4 Integration of digital health solutions in treatment strategies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Poor medication adherence during antihypertensive treatments

- 3.2.2.2 Presence of stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Patent analysis

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Therapy, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diuretics

- 5.2.1 Thiazide diuretics

- 5.2.2 Loop diuretics

- 5.2.3 Potassium-sparing diuretics

- 5.3 ACE inhibitors

- 5.4 Angiotensin receptor blockers

- 5.5 Beta blockers

- 5.5.1 Beta-1 selective

- 5.5.2 Intrinsic sympathomimetic

- 5.6 Calcium channel blockers

- 5.7 Renin inhibitors

- 5.8 Alpha-blockers

- 5.9 Vasodilators

- 5.10 Other therapies

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Primary hypertension

- 6.3 Secondary hypertension

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Bayer AG

- 10.4 Boehringer Ingelheim International GmbH

- 10.5 Daiichi Sankyo Company

- 10.6 Johnson & Johnson Services

- 10.7 Lupin

- 10.8 Merck & Co

- 10.9 Noden Pharma DAC

- 10.10 Novartis AG

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sun Pharmaceutical Industries

- 10.14 Takeda Pharmaceutical

- 10.15 Torrent Pharmaceuticals