|

市場調查報告書

商品編碼

1665059

人類免疫缺乏病毒治療市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Human Immunodeficiency Virus Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

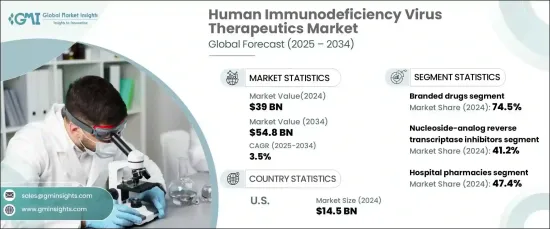

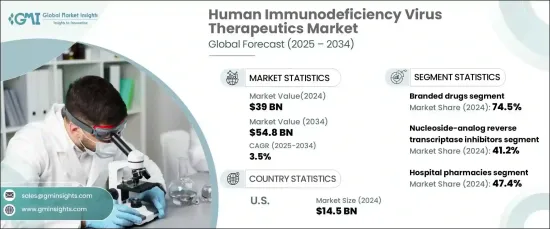

2024 年全球人類免疫缺乏病毒治療市場估值達到 390 億美元,預計 2025 年至 2034 年期間將以 3.5% 的複合年成長率穩步成長。 市場擴張主要得益於愛滋病毒感染率的上升、治療方案的重大進步、政府的支持舉措以及有利的監管批准。這些因素結合起來在促進市場持續成長方面發揮著至關重要的作用。

市場主要依藥品類型分為品牌藥和學名藥。 2024 年,品牌藥物憑藉其經過驗證的療效、長期的臨床可靠性以及在愛滋病毒治療中值得信賴的表現,佔據了 74.5% 的大幅佔有率,佔據市場主導地位。固定劑量組合越來越受歡迎,因為它們提供了簡化的給藥方案,從而提高了患者對治療計劃的依從性。它們在聯合療法中發揮的關鍵作用,特別是有效抑制病毒量,並繼續推動市場需求,確保未來幾年市場持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 390億美元 |

| 預測值 | 548億美元 |

| 複合年成長率 | 3.5% |

市場的分銷管道進一步凸顯了愛滋病毒治療的覆蓋範圍和可及性。主要分銷管道包括藥局和零售藥局、網路藥局和醫院藥局。 2024 年,醫院藥局佔最大的市場佔有率,達到 47.4%。醫院藥房設備齊全,可提供更廣泛的專門愛滋病毒藥物,包括先進的抗逆轉錄病毒療法和需要精心管理的注射療法。他們能夠在醫療專業人員的監督下提供包括聯合療法在內的尖端治療,這使得他們成為需要專門護理和關注的患者的首選。

在美國,愛滋病毒治療市場在 2024 年創造了 145 億美元的收入。醫療補助(Medicaid)和醫療保險(Medicare)等健康保險計劃的廣泛普及進一步保證了患者能夠負擔得起所需的救命治療。此外,廣泛的零售藥局、醫院設施和線上平台網路有助於促進愛滋病毒治療藥物的無縫分發和可用性,確保患者能夠輕鬆獲得所需的治療。

2024 年全球人類免疫缺乏病毒(HIV) 治療市場估值達到 390 億美元,預計 2025 年至 2034 年期間將以 3.5% 的複合年成長率穩步成長。這些因素結合起來在促進市場持續成長方面發揮著至關重要的作用。

市場主要依藥品類型分為品牌藥和學名藥。 2024 年,品牌藥物憑藉其經過驗證的療效、長期的臨床可靠性以及在愛滋病毒治療中值得信賴的表現,佔據了 74.5% 的大幅佔有率,佔據市場主導地位。固定劑量組合越來越受歡迎,因為它們提供了簡化的給藥方案,從而提高了患者對治療計劃的依從性。它們在聯合療法中發揮的關鍵作用,特別是有效抑制病毒量,並繼續推動市場需求,確保未來幾年市場持續成長。

市場的分銷管道進一步凸顯了愛滋病毒治療的覆蓋範圍和可及性。主要分銷管道包括藥局和零售藥局、網路藥局和醫院藥局。 2024 年,醫院藥局佔最大的市場佔有率,達到 47.4%。醫院藥房設備齊全,可提供更廣泛的專門愛滋病毒藥物,包括先進的抗逆轉錄病毒療法和需要精心管理的注射療法。他們能夠在醫療專業人員的監督下提供包括聯合療法在內的尖端治療,這使得他們成為需要專門護理和關注的患者的首選。

在美國,愛滋病毒治療市場在 2024 年創造了 145 億美元的收入。醫療補助(Medicaid)和醫療保險(Medicare)等健康保險計劃的廣泛普及進一步保證了患者能夠負擔得起所需的救命治療。此外,零售藥局、醫院設施和

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 愛滋病毒感染率高

- 治療方案的進展

- 透過政府措施和健康計劃增加支持

- 有利的監管批准

- 產業陷阱與挑戰

- 治療費用高昂

- 與患者依從性和治療連續性相關的擔憂

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 專利分析

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略展望

第 5 章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- 品牌藥物

- 學名藥

第 6 章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 核苷類似物逆轉錄酶抑制劑

- 整合酶抑制劑

- 非核苷逆轉錄酶抑制劑

- 蛋白酶抑制劑

- 進入和融合抑制劑

- 輔助受體拮抗劑

第 7 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 藥局和零售藥局

- 網路藥局

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AbbVie

- Aurobindo Pharma

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Cipla

- Dr. Reddy's Laboratories

- F. Hoffmann-La Roche

- Gilead Sciences

- Hetero Drugs

- Johnson & Johnson

- Merck & Co

- Mylan NV (Viatris)

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

- ViiV Healthcare

The Global Human Immunodeficiency Virus Therapeutics Market reached a valuation of USD 39 billion in 2024 and is projected to experience steady growth at a CAGR of 3.5% from 2025 to 2034. The market expansion is largely driven by the rising rates of HIV infections, significant advancements in treatment options, supportive government initiatives, and favorable regulatory approvals. These factors combined are playing a crucial role in fostering the market's ongoing growth trajectory.

The market is primarily segmented by drug type into branded and generic drugs. In 2024, branded drugs led the market with a substantial share of 74.5%, attributed to their proven efficacy, long-standing clinical reliability, and trusted performance in HIV treatment. Fixed-dose combinations have been gaining widespread popularity, as they offer simplified dosing regimens that enhance patient adherence to treatment plans. Their key role in combination therapies, particularly for effectively suppressing viral loads, continues to drive demand in the market, ensuring consistent market growth in the years to come.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39 Billion |

| Forecast Value | $54.8 Billion |

| CAGR | 3.5% |

The market's distribution channels further highlight the reach and accessibility of HIV therapeutics. The primary distribution segments include drug stores and retail pharmacies, online pharmacies, and hospital pharmacies. In 2024, hospital pharmacies held the largest share of the market, with a notable 47.4%. Hospital pharmacies are well-equipped to offer a broader selection of specialized HIV medications, including advanced antiretroviral therapies and injectable treatments that require careful administration. Their ability to provide cutting-edge treatments, including combination regimens, under the supervision of healthcare professionals makes them the preferred choice for patients who require specialized care and attention.

In the United States, the HIV therapeutics market generated USD 14.5 billion in 2024. The country benefits from a highly developed healthcare infrastructure that ensures widespread access to advanced HIV treatments, including clinical trials and long-acting injectable therapies. The widespread availability of health insurance programs, such as Medicaid and Medicare, further guarantees that patients can afford the life-saving therapies they need. Moreover, the extensive network of retail pharmacies, hospital facilities, and online platforms helps facilitate seamless distribution and availability of HIV therapeutics, ensuring that patients can easily access the treatments they require.

The global Human Immunodeficiency Virus (HIV) therapeutics market reached a valuation of USD 39 billion in 2024 and is projected to experience steady growth at a CAGR of 3.5% from 2025 to 2034. The market expansion is largely driven by the rising rates of HIV infections, significant advancements in treatment options, supportive government initiatives, and favorable regulatory approvals. These factors combined are playing a crucial role in fostering the market's ongoing growth trajectory.

The market is primarily segmented by drug type into branded and generic drugs. In 2024, branded drugs led the market with a substantial share of 74.5%, attributed to their proven efficacy, long-standing clinical reliability, and trusted performance in HIV treatment. Fixed-dose combinations have been gaining widespread popularity, as they offer simplified dosing regimens that enhance patient adherence to treatment plans. Their key role in combination therapies, particularly for effectively suppressing viral loads, continues to drive demand in the market, ensuring consistent market growth in the years to come.

The market's distribution channels further highlight the reach and accessibility of HIV therapeutics. The primary distribution segments include drug stores and retail pharmacies, online pharmacies, and hospital pharmacies. In 2024, hospital pharmacies held the largest share of the market, with a notable 47.4%. Hospital pharmacies are well-equipped to offer a broader selection of specialized HIV medications, including advanced antiretroviral therapies and injectable treatments that require careful administration. Their ability to provide cutting-edge treatments, including combination regimens, under the supervision of healthcare professionals makes them the preferred choice for patients who require specialized care and attention.

In the United States, the HIV therapeutics market generated USD 14.5 billion in 2024. The country benefits from a highly developed healthcare infrastructure that ensures widespread access to advanced HIV treatments, including clinical trials and long-acting injectable therapies. The widespread availability of health insurance programs, such as Medicaid and Medicare, further guarantees that patients can afford the life-saving therapies they need. Moreover, the extensive network of retail pharmacies, hospital facilities, and on

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High incidence of HIV infections

- 3.2.1.2 Advances in therapeutic treatment options

- 3.2.1.3 Growing support through government initiatives and health programs

- 3.2.1.4 Favorable regulatory approvals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Concerns related to patient adherence and treatment continuity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Branded drugs

- 5.3 Generic drugs

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Nucleoside-analog reverse transcriptase inhibitors

- 6.3 Integrase inhibitors

- 6.4 Non-nucleoside reverse transcriptase inhibitors

- 6.5 Protease inhibitors

- 6.6 Entry and fusion inhibitors

- 6.7 Coreceptor antagonists

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Drugs stores and retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Aurobindo Pharma

- 9.3 Boehringer Ingelheim International GmbH

- 9.4 Bristol-Myers Squibb Company

- 9.5 Cipla

- 9.6 Dr. Reddy's Laboratories

- 9.7 F. Hoffmann-La Roche

- 9.8 Gilead Sciences

- 9.9 Hetero Drugs

- 9.10 Johnson & Johnson

- 9.11 Merck & Co

- 9.12 Mylan N.V. (Viatris)

- 9.13 Sun Pharmaceutical Industries

- 9.14 Teva Pharmaceutical Industries

- 9.15 ViiV Healthcare