|

市場調查報告書

商品編碼

1664896

收縮包裝機市場機會、成長動力、產業趨勢分析與 2024 - 2032 年預測Shrink Wrapping Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

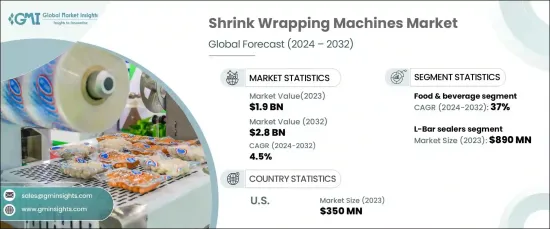

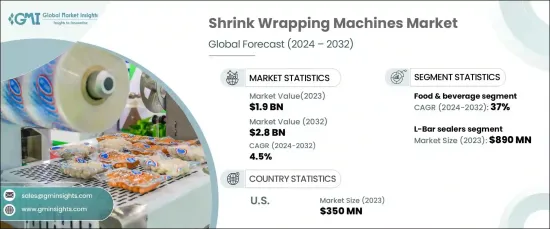

2023 年全球收縮包裝機市場價值 19 億美元,將呈現強勁的成長軌跡,預計 2024 年至 2032 年的複合年成長率為 4.5%。收縮包裝技術提供了一種輕巧、經濟高效的方法來保護運輸過程中的產品,同時增強其貨架吸引力。假期和促銷活動等季節性銷售熱潮進一步擴大了對靈活和可擴展包裝系統的需求,推動了各行業採用收縮包裝機。

依產品類型,市場分為 L 型桿封口機、I 型桿封口機和側封口機。其中,L-Bar 封口機在 2023 年佔據主導地位,創造了 8.9 億美元的收入,預計到 2032 年將以 5.2% 的複合年成長率成長。它們的使用者友善設計和易於操作的特點對於技術資源有限的中小型企業尤其具有吸引力。此外,其緊湊的尺寸使其成為空間有限且營運成本高昂的城市地區設施的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2023 |

| 預測年份 | 2024-2032 |

| 起始值 | 19億美元 |

| 預測值 | 28億美元 |

| 複合年成長率 | 4.5% |

根據最終用途,收縮包裝機市場分為食品和飲料、醫藥、工業品、化學品和其他。食品和飲料產業成為 2023 年最大的貢獻者,佔 37% 的市場。推動這一成長的因素包括消費者對包裝食品和簡便食品的需求不斷成長、網上購物的擴張以及更嚴格的食品安全法規。收縮包裝提供了一種經濟高效且永續的解決方案,可確保產品的完整性並延長保存期限,這是食品行業必不可少的品質。其保持新鮮度和提供環保包裝替代品的能力進一步提高了它的採用率。隨著城市化進程的加速和繁忙的生活方式推動對即食食品和飲料的需求,收縮包裝機在該領域的作用不斷擴大。

2023 年,北美收縮包裝機市場創造了 3.5 億美元的收入,美國市場預計在 2024 年至 2032 年期間以 4.8% 的複合年成長率成長。 該地區對收縮包裝的需求受到快節奏生活方式的消費者中包裝食品、飲料和即食產品日益流行的飲料推動。收縮包裝技術不僅可以維持食品品質、延長保存期限,還可以增強產品的外觀。它的經濟性和耐用性使其成為捆綁飲料和其他商品的首選,確保了其在北美市場的持續發展勢頭。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 包裝商品的需求不斷增加

- 包裝產業自動化程度不斷提高

- 電子商務產業蓬勃發展

- 產業陷阱與挑戰

- 初期投資成本高

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2032 年

- 主要趨勢

- L 型封口機

- I-Bar 封口機

- 側封機

第6章:市場估計與預測:依營運模式,2021-2032 年

- 主要趨勢

- 手動的

- 自動的

第 7 章:市場估計與預測:按最終用途,2021-2032 年

- 主要趨勢

- 食品和飲料

- 製藥

- 工業品

- 化學品

- 其他(個人護理、消費品等)

第 8 章:市場估計與預測:按地區,2021-2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第9章:公司簡介

- Aetna Group

- Axon

- Clamco

- Conflex Incorporates

- Duravant

- Lantech

- Maillis

- Massman Automation Designs

- ProMach

- Standard-Knapp

- Texwrap Packaging Systems

- Tripack

The Global Shrink Wrapping Machines Market, valued at USD 1.9 billion in 2023, is set to witness a robust growth trajectory, projected to expand at a CAGR of 4.5% from 2024 to 2032. The surging demand for secure, durable, and visually appealing packaging solutions-particularly spurred by the rapid growth of e-commerce-is a key driver of this market expansion. Shrink wrapping technology offers a lightweight, cost-efficient method to protect products during transit while enhancing their shelf appeal. Seasonal sales surges, including holidays and promotional campaigns, further amplify the demand for flexible and scalable packaging systems, fueling the adoption of shrink wrapping machines across various industries.

The market is segmented by product type into L-Bar sealers, I-Bar sealers, and Side sealers. Among these, L-Bar sealers dominated in 2023, generating revenues of USD 890 million, and are projected to grow at a CAGR of 5.2% through 2032. Known for their versatility, these machines efficiently handle products of varying sizes and shapes, making them indispensable in industries such as food, electronics, and consumer goods. Their user-friendly design and ease of operation are particularly attractive to small and medium-sized businesses with limited technical resources. Additionally, their compact size makes them ideal for facilities in urban areas where space is at a premium and operating costs are high.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $1.9 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 4.5% |

By end-use, the shrink wrapping machines market is segmented into food and beverage, pharmaceuticals, industrial goods, chemicals, and others. The food and beverage segment emerged as the largest contributor in 2023, capturing a 37% market share. This growth is propelled by rising consumer demand for packaged and convenience foods, the expansion of online grocery shopping, and stricter food safety regulations. Shrink wrapping offers a cost-effective and sustainable solution, ensuring product integrity and extending shelf life-essential qualities in the food industry. Its ability to maintain freshness and provide eco-friendly packaging alternatives further boosts its adoption. As urbanization accelerates and busy lifestyles drive demand for ready-to-eat meals and beverages, the role of shrink wrapping machines in this sector continues to expand.

In 2023, the North American shrink wrapping machines market generated revenues of USD 350 million, with the U.S. market poised to grow at a CAGR of 4.8% from 2024 to 2032. The region's demand for shrink wrapping is fueled by the growing popularity of packaged foods, beverages, and ready-to-eat products among consumers with fast-paced lifestyles. Shrink wrapping technology not only preserves food quality and extends shelf life but also enhances product presentation. Its affordability and durability make it the preferred choice for bundling beverages and other goods, ensuring continued market momentum in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for packaged goods

- 3.6.1.2 Rising adoption of automation in packaging

- 3.6.1.3 Growing e-commerce sector

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment cost

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 L-Bar sealers

- 5.3 I-Bar sealers

- 5.4 Side sealers

Chapter 6 Market Estimates & Forecast, By Operation Mode, 2021-2032 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2032 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Pharmaceutical

- 7.4 Industrial goods

- 7.5 Chemicals

- 7.6 Others (personal care, consumer goods, etc.)

Chapter 8 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aetna Group

- 9.2 Axon

- 9.3 Clamco

- 9.4 Conflex Incorporates

- 9.5 Duravant

- 9.6 Lantech

- 9.7 Maillis

- 9.8 Massman Automation Designs

- 9.9 ProMach

- 9.10 Standard-Knapp

- 9.11 Texwrap Packaging Systems

- 9.12 Tripack