|

市場調查報告書

商品編碼

1750606

金屬玻璃市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Metallic Glasses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

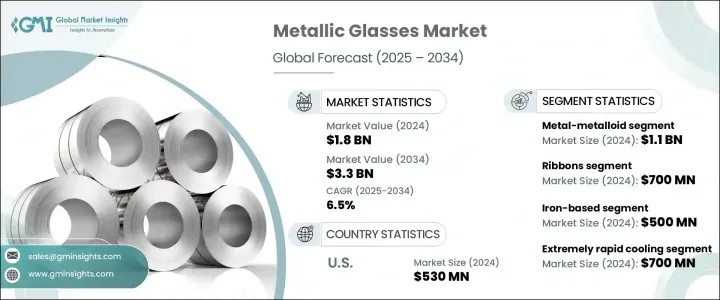

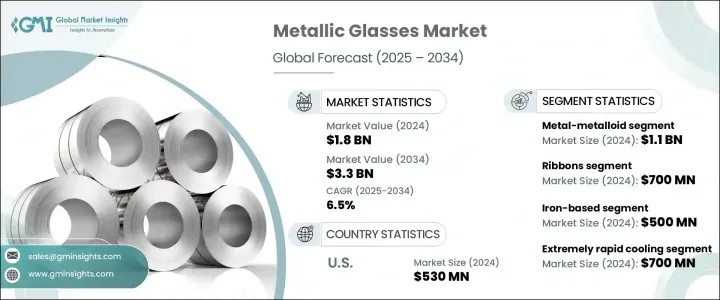

2024年,全球金屬玻璃市場規模達18億美元,預計年複合成長率將達6.5%,2034年將達33億美元。這得益於金屬玻璃的獨特性能,即兼具高抗張強度、優異的耐腐蝕性和延展性。金屬玻璃的非晶態原子結構使其在嚴苛條件下也能表現出色,是結構強度和精度的理想選擇。它們在對耐用性和耐磨性有嚴格要求的行業中大有可為,例如電氣和磁性元件。隨著各行各業對更先進、更有效率材料的需求不斷成長,金屬玻璃的廣泛應用也日益受到青睞。

市場受益於電磁和電子領域需求的成長。金屬玻璃的低功耗和高效率使其適用於磁芯、感測器和變壓器。此外,快速凝固和物理氣相沉積等製造技術的進步正在降低生產成本並實現規模化營運。生物醫學領域是金屬玻璃的另一個關鍵成長領域,因為其生物相容性和機械強度使其成為醫療植入物和手術工具的理想選擇。金屬玻璃的抗菌和耐磨性也增加了其在醫療保健應用領域的吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 33億美元 |

| 複合年成長率 | 6.5% |

2024年,金屬玻璃市場中的金屬-準金屬部分價值11億美元,預計到2034年將以5.7%的複合年成長率成長,這得益於對輕量化和具成本效益材料日益成長的需求,尤其是在消費電子、擴增實境/虛擬實境 (AR/VR) 和醫療設備等行業。這些材料在強度和柔韌性之間實現了完美平衡,使其成為這些快速發展行業中微型組件的理想選擇。隨著技術進步推動產品尺寸更小、效率更高,金屬-準金屬玻璃預計將在各種應用中加速普及。

金屬帶市場規模在2024年將達到7億美元,預計到2034年也將實現5.1%的成長率,這得益於其卓越的磁性能,使其特別適用於變壓器和磁性感測器。隨著對先進電子系統、節能設備和更精密感測器技術的需求不斷成長,金屬玻璃製成的金屬帶將繼續在這些應用中發揮關鍵作用。它們能夠在嚴苛條件下保持高性能,這對於專注於發電、能源分配和高科技感測技術的行業而言,無疑是一項寶貴的資產。

2024年,美國金屬玻璃市場價值達5.3億美元,預估2025年至2034年的複合年成長率為6%,主要得益於航太、國防系統和電子產品領域對金屬玻璃日益成長的需求。製造商和國防承包商之間的密切合作正在加速新型金屬玻璃解決方案的開發和推廣。此外,美國的研究機構在推動新型合金和最佳化生產流程方面發揮著至關重要的作用,這進一步支持了市場的擴張。

全球金屬玻璃市場的主要公司包括賀利氏控股有限公司 (Heraeus Holding GmbH)、Liquidmetal Technologies Inc.、Materion Corporation、Usha Amorphous Metals Limited 和日立金屬有限公司 (Hitachi Metals Ltd.)。為了鞏固市場地位,金屬玻璃市場中的公司專注於擴大產能並改善製造流程以降低成本。與研究機構和其他行業參與者的策略合作夥伴關係和合作正在加速創新和新材料的引入。製造商投資於積層製造和先進合金開發等技術進步,以滿足各行各業對高性能材料日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 市場定義與演變

- 金屬玻璃的定義與分類

- 金屬玻璃的歷史發展

- 材料成分和性能

- 原子結構和特性

- 機械性質

- 磁性

- 耐腐蝕

- 熱性能

- 製造流程

- 快速凝固技術

- 熔融紡絲

- 氣體霧化

- 吸鑄

- 積層製造

- 比較分析:金屬玻璃與傳統材料

- 金屬玻璃與晶體金屬

- 金屬玻璃與陶瓷

- 金屬玻璃與聚合物

- 金屬玻璃的技術進步

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

- 利潤率分析

- 監管環境和標準

- 全球監理框架

- 區域監理框架

- 北美洲

- FDA 法規(針對醫療應用)

- Astm 標準

- 其他相關規定

- 歐洲

- 歐盟醫療器材法規(mdr)

- CE標誌要求

- 達到法規

- 亞太

- 中國法規

- 日本的規定

- 其他地區法規

- 世界其他地區

- 北美洲

- 產品認證和標準

- 品質標準

- 安全標準

- 績效標準

- 合規挑戰與策略

- 未來監管趨勢及其影響

- 市場動態

- 市場促進因素

- 優異的材料性能

- 電子和能源領域的需求不斷成長

- 製造技術的進步

- 生物醫學領域的應用日益增多

- 市場限制

- 生產成本高

- 尺寸和形狀能力有限

- 脆性和有限的延展性

- 來自傳統材料的競爭

- 市場機會

- 航太和國防領域的新興應用

- 積層製造的進步

- 對永續材料的需求不斷成長

- 發展中經濟體的擴張

- 市場挑戰

- 擴大生產

- 實現始終如一的質量

- 監理合規性

- 市場認知度與接受度

- 市場促進因素

- 波特五力分析

- 杵分析

- 價值鏈分析

- 原物料供應商

- 製造商

- 經銷商

- 最終用戶

- 環境、社會與治理 (esg) 分析

- 環境影響評估

- 碳足跡分析

- 生命週期評估(LCA)

- 廢棄物管理和回收利用

- 生產中的能源消耗

- 社會影響

- 勞動實務和工作條件

- 社區影響力和參與

- 健康和安全考慮

- 治理和道德考慮

- 公司治理實踐

- 道德供應鏈管理

- 透明度和報告

- 關鍵參與者的 ESG 績效基準

- ESG風險評估及緩解策略

- 金屬玻璃產業的未來 ESG 趨勢

- 環境影響評估

- 製造和生產分析

- 製造流程概述

- 原料採購與準備

- 合金熔化和均質化

- 快速凝固技術

- 後處理和精加工

- 品質控制和測試

- 生產成本分析

- 原料成本

- 能源成本

- 勞動成本

- 製造費用

- 成本最佳化策略

- 製造設施分析

- 主要製造地點

- 生產能力評估

- 設施擴建計劃

- 供應鏈挑戰與解決方案

- 製造流程的永續性

- 能源效率措施

- 減少廢棄物的策略

- 環保材料和工藝

- 製造流程概述

- 消費者行為與市場趨勢分析

- 消費者偏好與購買模式

- 影響購買決策的因素

- 性能和品質

- 成本考慮

- 永續性因素

- 品牌聲譽

- 產業特定的採用趨勢

- 電子業採用

- 汽車業採用

- 醫療業採用

- 航太航太業採用

- 消費者行為的區域差異

- 數位轉型對消費者參與度的影響

- 未來消費趨勢及其影響

- 技術格局與創新分析

- 金屬玻璃的當前技術趨勢

- 新興技術及其潛在影響

- 先進的製造技術

- 新型合金成分

- 表面改質技術

- 複合金屬玻璃

- 研發活動與創新中心

- 跨應用程式的技術採用趨勢

- 技術準備評估

- 未來技術路線圖 2025-2034

- 定價分析與經濟因素

- 價格趨勢分析

- 歷史價格趨勢

- 目前定價情景

- 價格預測

- 影響定價的因素

- 原料成本

- 生產複雜性

- 生產規模

- 市場競爭

- 特定於應用程式的要求

- 區域價格差異

- 價格價值關係分析

- 影響市場的經濟指標

- GDP成長和工業生產

- 研發支出

- 金屬商品價格

- 能源成本

- 主要市場參與者的定價策略

- 價格趨勢分析

- 原料和供應鏈分析

- 主要原料概覽

- 金屬和準金屬

- 稀土元素

- 其他關鍵材料

- 原物料採購

- 全球供應來源

- 供應集中和風險

- 永續採購舉措

- 供應鏈結構與動態

- 上游供應鏈

- 中游加工

- 下游分銷

- 供應鏈挑戰

- 原料可用性和關鍵性

- 價格波動

- 地緣政治因素

- 物流和運輸

- 供應鏈風險緩解策略

- 原料和供應鏈的未來趨勢

- 主要原料概覽

第4章:競爭格局

- 主要參與者的市佔率分析

- 競爭定位矩陣

- 主要參與者所採用的競爭策略

- 產品創新與開發

- 併購

- 夥伴關係和合作

- 擴張策略

- 投資分析和市場吸引力

- 目前投資情境

- 按領域分類的投資機會

- 各地區的投資機會

- 投資報酬率分析

- 創投與私募股權格局

- 併購活動分析

- 未來投資展望

- 風險評估和緩解策略

- 市場風險

- 技術風險

- 監理風險

- 競爭風險

- 供應鏈風險

- 環境和永續性風險

- 風險緩解策略

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 金屬-金屬金屬玻璃

- 金屬-類金屬玻璃

第6章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 絲帶

- 電線

- 粉末

- 工作表

- 其他

第7章:市場估計與預測:依材料成分,2021 年至 2034 年

- 主要趨勢

- 鐵基

- 鋯基

- 鈦基

- 銅基

- 鈀基

- 鎂基

- 鋁基

- 其他作品

第8章:市場估計與預測:按製造程序,2021 年至 2034 年

- 主要趨勢

- 極快的冷卻速度

- 物理氣相沉積

- 固相反應

- 離子輻照

- 其他

第9章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 電子和電氣

- 汽車和運輸

- 航太和國防

- 醫療保健

- 體育和休閒

- 能源

- 工業設備

- 其他

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Amorphology Inc.

- Antai Technology Co., Ltd.

- EPSON ATMIX Corporation

- Exmet AB

- Glassimetal Technology

- Heraeus Holding

- Hitachi Metals Ltd.

- Liquidmetal Technologies Inc.

- Materion Corporation

- PrometalTech

- PX Group SA

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- RS Alloys

- Usha Amorphous Metals Limited

The Global Metallic Glasses Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 3.3 billion by 2034, driven by the unique properties of metallic glasses, which combine high tensile strength with excellent corrosion resistance and malleability. These materials' amorphous atomic structure allows them to perform exceptionally well under challenging conditions, making them ideal for structural strength and precision. They are useful in industries requiring durability and resistance to wear, such as electrical and magnetic components. As industries continue to demand more advanced and efficient materials, the versatile applications of metallic glasses are gaining traction.

The market benefits from increased demand in the electromagnetic and electronics sectors. Metallic glasses' low power dissipation and high efficiency make them suitable for magnetic cores, sensors, and transformers. Moreover, advancements in manufacturing technologies, such as rapid solidification and physical vapor deposition, are reducing production costs and enabling scalable operations. The biomedical sector is another key growth area for metallic glasses, as their biocompatibility and mechanical strength make them ideal for medical implants and surgical tools. Their resistance to bacteria and wear adds to their appeal for healthcare applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 6.5% |

In 2024, the metal-metalloid segment of the metallic glasses market was valued at USD 1.1 billion and is projected to grow at a CAGR of 5.7% through 2034 fueled by the rising demand for lightweight and cost-effective materials, particularly in industries such as consumer electronics, augmented reality/virtual reality (AR/VR), and medical devices. These materials offer the perfect balance of strength and flexibility, making them ideal for the miniaturized components in these fast-evolving sectors. As technological advancements push for smaller, more efficient products, the adoption of metal-metalloid glasses is expected to accelerate across various applications.

The ribbons segment, valued at USD 700 million in 2024, is also projected to experience a growth rate of 5.1% through 2034, attributed to their exceptional magnetic properties, which make them particularly suitable for use in transformers and magnetic sensors. As the demand for advanced electronic systems, energy-efficient equipment, and more precise sensor technologies increases, ribbons made from metallic glasses will continue to play a crucial role in these applications. Their ability to perform under demanding conditions while maintaining high performance makes them an asset for industries focusing on power generation, energy distribution, and high-tech sensing technologies.

U.S. Metallic Glasses Market was valued at USD 530 million in 2024, with a projected growth rate of 6% CAGR from 2025 to 2034, driven by the growing demand for metallic glasses in aerospace, defense systems, and electronics. Close collaboration between manufacturers and defense contractors is expediting the development and distribution of new metallic glass solutions. Additionally, research institutions in the U.S. are playing a vital role in advancing new alloys and optimizing production processes, which further supports the market's expansion.

Key companies in the Global Metallic Glasses Market include Heraeus Holding GmbH, Liquidmetal Technologies Inc., Materion Corporation, Usha Amorphous Metals Limited, and Hitachi Metals Ltd. To strengthen their presence, companies in the metallic glasses market focus on expanding production capabilities and refining manufacturing processes to reduce costs. Strategic partnerships and collaborations with research institutions and other industry players are helping accelerate innovation and the introduction of new materials. Manufacturers invest in technological advancements, such as additive manufacturing and advanced alloy development, to meet the growing demand for high-performance materials across various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market definition and evolution

- 3.1.1 Definition and classification of metallic glasses

- 3.1.2 Historical development of metallic glasses

- 3.1.3 Material composition and properties

- 3.1.3.1 Atomic structure and characteristics

- 3.1.3.2 Mechanical properties

- 3.1.3.3 Magnetic properties

- 3.1.3.4 Corrosion resistance

- 3.1.3.5 Thermal properties

- 3.1.4 Manufacturing processes

- 3.1.4.1 Rapid solidification techniques

- 3.1.4.2 Melt spinning

- 3.1.4.3 Gas atomization

- 3.1.4.4 Suction casting

- 3.1.4.5 Additive manufacturing

- 3.1.5 Comparative analysis: metallic glasses vs. Conventional materials

- 3.1.5.1 Metallic glasses vs. Crystalline metals

- 3.1.5.2 Metallic glasses vs. Ceramics

- 3.1.5.3 Metallic glasses vs. Polymers

- 3.1.6 Technological advancements in metallic glasses

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Regulatory landscape and standards

- 3.5.1 Global regulatory framework

- 3.5.2 Regional regulatory frameworks

- 3.5.2.1 North America

- 3.5.2.1.1 Fda regulations (for medical applications)

- 3.5.2.1.2 Astm standards

- 3.5.2.1.3 Other relevant regulations

- 3.5.2.2 Europe

- 3.5.2.2.1 Eu medical device regulation (mdr)

- 3.5.2.2.2 Ce marking requirements

- 3.5.2.2.3 Reach regulations

- 3.5.2.3 Asia-pacific

- 3.5.2.3.1 China's regulations

- 3.5.2.3.2 Japan's regulations

- 3.5.2.3.3 Other regional regulations

- 3.5.2.4 Rest of the world

- 3.5.2.1 North America

- 3.5.3 Product certification and standards

- 3.5.3.1 Quality standards

- 3.5.3.2 Safety standards

- 3.5.3.3 Performance standards

- 3.5.4 Compliance challenges and strategies

- 3.5.5 Future regulatory trends and their implications

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.1.1 Superior material properties

- 3.6.1.2 Increasing demand in electronics and energy sectors

- 3.6.1.3 Advancements in manufacturing technologies

- 3.6.1.4 Growing applications in biomedical field

- 3.6.2 Market restraints

- 3.6.2.1 High production costs

- 3.6.2.2 Limited size and shape capabilities

- 3.6.2.3 Brittleness and limited ductility

- 3.6.2.4 Competition from conventional materials

- 3.6.3 Market opportunities

- 3.6.3.1 Emerging applications in aerospace and defense

- 3.6.3.2 Advancements in additive manufacturing

- 3.6.3.3 Growing demand for sustainable materials

- 3.6.3.4 Expansion in developing economies

- 3.6.4 Market challenges

- 3.6.4.1 Scaling up production

- 3.6.4.2 Achieving consistent quality

- 3.6.4.3 Regulatory compliance

- 3.6.4.4 Market awareness and acceptance

- 3.6.1 Market drivers

- 3.7 Porter's five forces analysis

- 3.8 Pestle analysis

- 3.9 Value chain analysis

- 3.9.1 Raw material suppliers

- 3.9.2 Manufacturers

- 3.9.3 Distributors

- 3.9.4 End users

- 3.10 Environmental, social, and governance (esg) analysis

- 3.10.1 Environmental impact assessment

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Life cycle assessment (lca)

- 3.10.1.3 Waste management and recycling

- 3.10.1.4 Energy consumption in production

- 3.10.2 Social implications

- 3.10.2.1 Labor practices and working conditions

- 3.10.2.2 Community impact and engagement

- 3.10.2.3 Health and safety considerations

- 3.10.3 Governance and ethical considerations

- 3.10.3.1 Corporate governance practices

- 3.10.3.2 Ethical supply chain management

- 3.10.3.3 Transparency and reporting

- 3.10.4 Esg performance benchmarking of key players

- 3.10.5 Esg risk assessment and mitigation strategies

- 3.10.6 Future esg trends in the metallic glasses industry

- 3.10.1 Environmental impact assessment

- 3.11 Manufacturing and production analysis

- 3.11.1 Manufacturing process overview

- 3.11.1.1 Raw material procurement and preparation

- 3.11.1.2 Alloy melting and homogenization

- 3.11.1.3 Rapid solidification techniques

- 3.11.1.4 Post-processing and finishing

- 3.11.1.5 Quality control and testing

- 3.11.2 Production cost analysis

- 3.11.2.1 Raw material costs

- 3.11.2.2 Energy costs

- 3.11.2.3 Labor costs

- 3.11.2.4 Manufacturing overheads

- 3.11.2.5 Cost optimization strategies

- 3.11.3 Manufacturing facilities analysis

- 3.11.3.1 Key manufacturing locations

- 3.11.3.2 Production capacity assessment

- 3.11.3.3 Facility expansion plans

- 3.11.4 Supply chain challenges and solutions

- 3.11.5 Sustainability in manufacturing processes

- 3.11.5.1 Energy efficiency measures

- 3.11.5.2 Waste reduction strategies

- 3.11.5.3 Eco-friendly materials and processes

- 3.11.1 Manufacturing process overview

- 3.12 Consumer behavior and market trends analysis

- 3.12.1 Consumer preferences and purchasing patterns

- 3.12.2 Factors influencing purchase decisions

- 3.12.2.1 Performance and quality

- 3.12.2.2 Cost considerations

- 3.12.2.3 Sustainability factors

- 3.12.2.4 Brand reputation

- 3.12.3 Industry-specific adoption trends

- 3.12.3.1 Electronics industry adoption

- 3.12.3.2 Automotive industry adoption

- 3.12.3.3 Medical industry adoption

- 3.12.3.4 Aerospace industry adoption

- 3.12.4 Regional variations in consumer behavior

- 3.12.5 Impact of digital transformation on consumer engagement

- 3.12.6 Future consumer trends and their implications

- 3.13 Technological landscape and innovation analysis

- 3.13.1 Current technological trends in metallic glasses

- 3.13.2 Emerging technologies and their potential impact

- 3.13.2.1 Advanced manufacturing techniques

- 3.13.2.2 Novel alloy compositions

- 3.13.2.3 Surface modification technologies

- 3.13.2.4 Composite metallic glasses

- 3.13.3 R&d activities and innovation hubs

- 3.13.4 Technology adoption trends across applications

- 3.13.5 Technology readiness assessment

- 3.13.6 Future technology roadmap 2025-2034

- 3.14 Pricing analysis and economic factors

- 3.14.1 Pricing trends analysis

- 3.14.1.1 Historical price trends

- 3.14.1.2 Current pricing scenario

- 3.14.1.3 Price forecast

- 3.14.2 Factors affecting pricing

- 3.14.2.1 Raw material costs

- 3.14.2.2 Production complexity

- 3.14.2.3 Scale of production

- 3.14.2.4 Market competition

- 3.14.2.5 Application-specific requirements

- 3.14.3 Regional price variations

- 3.14.4 Price-value relationship analysis

- 3.14.5 Economic indicators impacting the market

- 3.14.5.1 Gdp growth and industrial production

- 3.14.5.2 R&d spending

- 3.14.5.3 Metal commodity prices

- 3.14.5.4 Energy costs

- 3.14.6 Pricing strategies of key market players

- 3.14.1 Pricing trends analysis

- 3.15 Raw materials and supply chain analysis

- 3.15.1 Key raw materials overview

- 3.15.1.1 Metals and metalloids

- 3.15.1.2 Rare earth elements

- 3.15.1.3 Other critical materials

- 3.15.2 Raw material sourcing and procurement

- 3.15.2.1 Global supply sources

- 3.15.2.2 Supply concentration and risks

- 3.15.2.3 Sustainable sourcing initiatives

- 3.15.3 Supply chain structure and dynamics

- 3.15.3.1 Upstream supply chain

- 3.15.3.2 Midstream processing

- 3.15.3.3 Downstream distribution

- 3.15.4 Supply chain challenges

- 3.15.4.1 Raw material availability and criticality

- 3.15.4.2 Price volatility

- 3.15.4.3 Geopolitical factors

- 3.15.4.4 Logistics and transportation

- 3.15.5 Supply chain risk mitigation strategies

- 3.15.6 Future trends in raw materials and supply chain

- 3.15.1 Key raw materials overview

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis of key players

- 4.2 Competitive positioning matrix

- 4.3 Competitive strategies adopted by key players

- 4.3.1 Product innovation and development

- 4.3.2 Mergers and acquisitions

- 4.3.3 Partnerships and collaborations

- 4.3.4 Expansion strategies

- 4.4 Investment analysis and market attractiveness

- 4.4.1 Current investment scenario

- 4.4.2 Investment opportunities by segment

- 4.4.3 Investment opportunities by region

- 4.4.4 Roi analysis

- 4.4.5 Venture capital and private equity landscape

- 4.4.6 M&a activity analysis

- 4.4.7 Future investment outlook

- 4.5 Risk assessment and mitigation strategies

- 4.5.1 Market risks

- 4.5.2 Technological risk

- 4.5.3 Regulatory risks

- 4.5.4 Competitive risks

- 4.5.5 Supply chain risks

- 4.5.6 Environmental and sustainability risks

- 4.5.7 Risk mitigation strategies

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Metal-metal metallic glasses

- 5.3 Metal-metalloid metallic glasses

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Ribbons

- 6.3 Wires

- 6.4 Powders

- 6.5 Sheets

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Material Composition, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Iron-based

- 7.3 Zirconium-based

- 7.4 Titanium-based

- 7.5 Copper-based

- 7.6 Palladium-based

- 7.7 Magnesium-based

- 7.8 Aluminum-based

- 7.9 Other compositions

Chapter 8 Market Estimates and Forecast, By Manufacturing Process, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Extremely rapid cooling

- 8.3 Physical vapor deposition

- 8.4 Solid-state reaction

- 8.5 Ion irradiation

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Electronics and electrical

- 9.3 Automotive and transportation

- 9.4 Aerospace and defense

- 9.5 Medical and healthcare

- 9.6 Sports and leisure

- 9.7 Energy

- 9.8 Industrial equipment

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amorphology Inc.

- 11.2 Antai Technology Co., Ltd.

- 11.3 EPSON ATMIX Corporation

- 11.4 Exmet AB

- 11.5 Glassimetal Technology

- 11.6 Heraeus Holding

- 11.7 Hitachi Metals Ltd.

- 11.8 Liquidmetal Technologies Inc.

- 11.9 Materion Corporation

- 11.10 PrometalTech

- 11.11 PX Group SA

- 11.12 Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- 11.13 RS Alloys

- 11.14 Usha Amorphous Metals Limited