|

市場調查報告書

商品編碼

1775077

美國的照明設備市場The Lighting Fixtures Market in the United States |

||||||

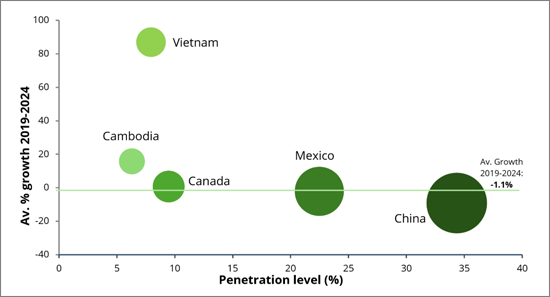

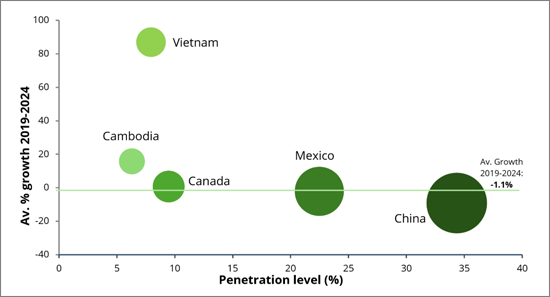

美國照明設備市場規模約200億美元,市場相對開放。該市場也高度依賴進口。中國和墨西哥仍然是主要供應國,但越南和柬埔寨等快速成長的國家正逐漸取代中國。

CSIL表示,美國照明設備市場前景表明,到2025年,市場仍將面臨課題。然而,儘管市場存在許多不確定性,但互聯互通和智慧技術的興起仍在持續顯著改變美國照明產業。

本報告對美國照明設備市場進行了研究,並提供了全面的信息,包括製造、消費和國際貿易方面的關鍵統計數據,以及基本面數據、預測、細分市場細分、新技術趨勢、競爭格局、市場佔有率以及主要製造商的分析。

主要企業

本報告刊載的照明設備製造商:

|

|

|

亮點

美國:照明設備的進口:各原產國

) ·年平均變化率市場規模 (一百萬美元

2019-2024年·2024年佔有率 (%)

CSIL加工出處:正式資料

目錄 (摘要)

調查手法

- 調查工具和用語,目錄

摘要整理:美國的照明產業概要

第1章 情境:美國的照明產業,市場趨勢和市場區隔

- 照明市場發展及區隔市場

- 美國主要集團及其市場佔有率

- 公司資訊:相關合併、收購及協議

第2章 美國的照明設備市場業績與預測

- 照明設備的製造,消費,國際貿易的目前趨勢與預測

- 價格趨勢

第3章 照明設備的國際貿易

- 照明燈具進出口(依國家、目的地和原產地劃分)

- 美國照明公司的國際影響力

- 向美國出口照明燈具的中國公司

第4章 市場結構:照明產業的用途,產品,技術

- 產品與應用

- 住宅(室內)照明:按風格和產品劃分的銷售額

- 商業(室內)照明:按產品劃分的銷售額

- 商業照明:按目的地劃分的銷售額

- 工業照明:依目的地劃分的銷售額

- 戶外照明:按產品和目的地劃分的銷售額

- 按目的地劃分的預測

- LED 照明的演變

- 智慧互聯照明

- 互聯應用

第5章 美國的流通管道

- 概述:普通照明、住宅和商業照明市場

- 合約、專案和建築承包商

- 照明專業人士

- 家具連鎖店、家具店和百貨公司

- 經銷商和代理商

- DIY 與居家裝修

- 電子商務

- 各地區照明燈具銷售趨勢

- 雜誌與線上媒體

- 照明展會

- 照明產業協會

第6章 競爭系統:各用途企業佔有率

- 照明燈具整體情況:美國主要公司及其市場佔有率(消費和製造)

- 美國競爭性系統:按市場(住宅/消費室內、酒店、辦公、零售、藝術場所、娛樂、學校和基礎設施、工廠、危險環境、海洋、醫療、緊急、園藝、住宅室外、城市環境、街道、隧道、聖誕節、區域照明)

第7章 需求決定要素

- 主要宏觀經濟指標、社會趨勢和建築活動的關鍵數據

附錄

- 主要城市的零售設計公司,照明設備店,家居裝修及園藝中心範例

- 主要的照明企業的清單

The CSIL Market Research Report "The Lighting Fixtures Market in the United States" offers comprehensive analysis of the lighting fixtures market in the United States, with:

- Historical basic data (2019-2024) for production, consumption, and international trade

- Market forecasts 2025-2027

- Market structure, highlighting residential and professional segments and applications, indoor and outdoor

- Outline of the new smart and connected lighting technologies

- Performance of the leading companies, with sales figures and market shares

- Distribution channels

The report is structured as follows:

SCENARIO: THE LIGHTING INDUSTRY IN THE US, MARKET TRENDS AND SEGMENTS

An overview of the US lighting market, showing:

- The incidence of LED on total US lighting market, highlighting LED's evolution over the years

- Incidence and evolution of Connected lighting

- An overview of the main market segments for lighting fixtures: residential/consumer, commercial, industrial, and outdoor lighting.

- The leading North American groups with their market shares

- A selection of significant M&A and agreements that occurred in the industry over the last three years.

BUSINESS PERFORMANCE AND FORECASTS IN THE US LIGHTING FIXTURES MARKET

The US lighting fixtures sector is analysed through tables and graphs showing:

- Trends in the US lighting fixtures production, consumption, and international trade, for the time series 2019-2024

- A highlight on Residential/Consumer lighting and Professional lighting (commercial, industrial, outdoor lighting).

- The US lighting fixtures consumption forecasts 2025-2027

INTERNATIONAL TRADE OF LIGHTING FIXTURES

This section offers a comprehensive overview of international trade in lighting fixtures, offering:

- A focus on the US exports and imports of lighting fixtures over the past six years (2019-2024), by country and by geographical area of destination/origin.

- A selection of the main US lighting companies that export abroad

- A sample of Chinese lighting manufacturers exporting to the United States

MARKET STRUCTURE: APPLICATIONS, PRODUCTS, AND TECHNOLOGIES IN THE LIGHTING INDUSTRY

Analysis of the structure of the US lighting fixtures market, by segment:

- Residential indoor lighting: breakdown of lighting fixtures market by style and by products.

- Professional indoor lighting: breakdown of lighting fixtures market by products and by destination for Commercial and Industrial segments.

- Outdoor lighting: breakdown of lighting fixtures market by products and by destinations.

A selection of the main companies operating in each segment and forecasts by market destination are also provided.

SPECIAL FOCUS: the main sector trends, including the growth of LED and smart connected lighting technologies by application.

LIGHTING FIXTURES DISTRIBUTION IN THE UNITED STATES

An overview of the US lighting fixtures distribution, providing:

- Tables showing the breakdown of lighting fixtures sales by distribution channel (Direct sales / Contract / Projects; Lighting specialised retailers; Furniture chains / Furniture stores / Department stores; Wholesalers; DIY retailers / Home Improvement; E-commerce) for residential and professional lighting, and for a selection of leading companies.

- An estimate of the lighting fixtures sales by US Region and State

- An overview of the main Lighting Magazines & Online Media Outlets covering the North American market, together with the most important US fairs and Trade Associations for lighting fixtures.

THE COMPETITIVE SYSTEM: LEADING PLAYERS IN THE US LIGHTING MARKET AND COMPANY MARKET SHARES BY APPLICATION

Insights into the leading local and international players in each application segment, providing:

- Sales data and market shares of top lighting fixtures companies.

- Company profiles of selected leading market players providing sales performance and strategies.

DEMAND DRIVERS OF THE US LIGHTING FIXTURES

The main macroeconomic indicators, social trends, building activities (Residential and Non-Residential), to analyse the performance of the sector.

ANNEXES

- List of top Retail Design Firms and selected lighting stores in a sample of US cities

- Directory of lighting companies mentioned in this report: around 300 companies included.

The CSIL research report "The lighting fixtures market in the United States" answers the following questions:

- What is the size of the lighting fixtures market in the United States?

- What is the incidence of imports on the US consumption of lighting fixtures? What are the main countries supplying lighting fixtures to the United States?

- How is the US lighting fixtures market structured and segmented?

- Who are the main groups and leading companies in the US lighting fixtures industry?

- How is the distribution of lighting fixtures structured in the United States? What are the main channels?

- What are the forecasts for the lighting market in the United States?

CONSIDERED PRODUCTS: Batten lights, Bollards, Ceiling luminaires, Chandeliers, Christmas lighting, Downlights, Embedded lighting, Emergency lighting, Floodlights, Floor light, High and Low Bay luminaires, LED panels, Light poles, Linear lighting, Modular lighting systems, Projectors, Spotlights, Step lighting, Strip lighting, Suspensions, Table lighting, Track lights, Wall luminaires.

DESTINATIONS: Residential; Commercial (Hospitality; Office; Retail; Museums and Art venues; Entertainment; Schools, Infrastructure, Airports); Industrial (Industrial plants; Hazardous environments; Marine; Horticulture; Healthcare; Emergency); Outdoor (Residential outdoor; Urban Landscape; Christmas and Events; Streets and major roads; Tunnels and Galleries; Sport facilities, parking, oil stations).

Selected companies

Among the considered lighting fixtures companies in the report:

|

|

|

Highlights:

United States. Imports of lighting fixtures by country of origin.

Market size (US$ million), average percentage change

per year 2019-2024 and % share 2024

Source: CSIL processing of official data.

The lighting fixtures market in the United States is worth around USD 20 billion and is still relatively open and largely dependent on imports. While China and Mexico continue to be the leading supplying countries to the US lighting fixtures imports, they are ceding ground to rapidly growing countries like Vietnam and Cambodia.

According to CSIL, the outlook for the US lighting fixtures market indicates a challenging 2025. Despite significant market uncertainties, however, connected, and smart technologies continue to gain ground and are profoundly transforming the country's lighting industry.

TABLE OF CONTENTS (SUMMARY)

METHODOLOGY

- Research Tools and Terminology, Contents

EXECUTIVE SUMMARY: THE US LIGHTING SECTOR AT A GLANCE

1. SCENARIO: THE LIGHTING INDUSTRY IN THE US, MARKET TRENDS AND SEGMENTS

- Lighting Market evolution and market segments

- Leading groups in the United States and their market shares

- Company facts: relevant mergers, acquisitions, and agreements

2. BUSINESS PERFORMANCE AND FORECASTS IN THE US LIGHTING FIXTURES MARKET

- Current trends of lighting fixtures production, consumption, international trade and forecasts 2025-2027

- Price trends

3. INTERNATIONAL TRADE OF LIGHTING FIXTURES

- Exports and imports of lighting fixtures by country and by geographical area of destination/origin

- International presence of US lighting companies

- Chinese companies exporting lighting fixtures to the United States

4. MARKET STRUCTURE: APPLICATIONS, PRODUCTS, AND TECHNOLOGIES IN THE LIGHTING INDUSTRY

- Products and applications

- Residential (indoor) lighting: sales breakdown by style and products

- Professional (indoor) lighting: sales breakdown by products

- Commercial lighting: sales breakdown by destinations

- Industrial lighting: sales breakdown by destinations

- Outdoor lighting: sales breakdown by products and destinations

- Forecasts by destination segment

- LED lighting evolution

- Smart connected lighting

- Connected applications

5. DISTRIBUTION CHANNELS IN THE US

- Overview: Total Lighting, Residential and Professional Lighting Market

- Contract, Projects and Builders

- Lighting specialists

- Furniture chains, furniture stores, department stores

- Distributors and Reps

- DIY and Home Improvement Centers

- E-commerce

- Sales of lighting fixtures by geographical area

- Magazines & Online Media Outlets

- Lighting Fairs

- Trade Lighting Associations

6. THE COMPETITIVE SYSTEM: COMPANY MARKET SHARES BY APPLICATION

- Total lighting fixtures: leading players in USA and market shares (consumption and production)

- The US competitive system by market destination (Residential/consumer indoor, Hospitality, Office, Retail, Art venues, Entertainment, Schools & Infrastructures, Industrial plants, Hazardous conditions, Marine, Healthcare, Emergency, Horticulture, Residential outdoor, Urban Landscape, Street, Tunnel, Christmas, and Area Lighting)

7. DEMAND DETERMINANTS

- Selected macroeconomic indicators, social trends and building activity key data.

ANNEXES

- Selected retail design firms, lighting fixtures stores and home improvement stores in a sample of US cities

- List of selected lighting companies mentioned in the Report