|

市場調查報告書

商品編碼

1156137

家具行業電子商務E-Commerce for the Furniture Industry |

||||||

電子商務家具市場將在 2019-2022 年期間以每年 18% 的速度增長,近年來發展迅速,增長速度快於整體家具市場。在全球電子商務市場中,美國的滲透率最高,其次是中國。

瞬息萬變的全球形勢正在強烈影響著電子商務渠道的發展。市場受到烏克蘭戰爭、能源和食品短缺以及大流行期間強大的通脹壓力的影響。電子商務競爭領域也出現了混亂。在線家具銷售正在下滑,對市場低迷具有彈性的全渠道零售商(實體店)正在佔據上風。

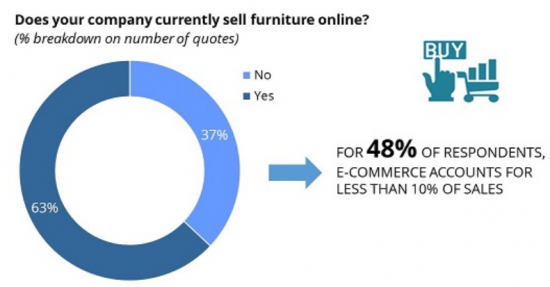

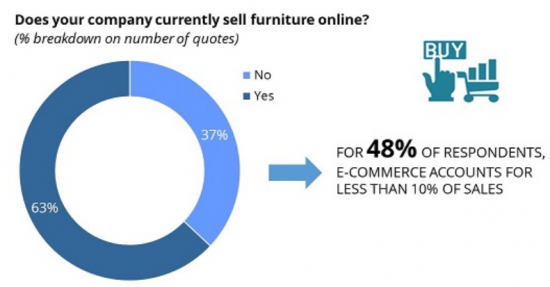

電子商務在整體家具銷售中的使用和發生率(2022 年)

CSIL 調查受訪者佔總樣本的比例 /p>

本報告探討了全球家具行業的電子商務,概述了全球家具行業、當前大型市場的家具消費情況,以及主要地區和國家家具行業電子商務領先企業的表現. 它提供分析、收益和趨勢等信息。

本報告中的主要公司

亞馬遜、Ambientedirect、Anthropologie、Bygghemma Group、C Discount、Coupang、Crate and Barrel、Dunhelm、Hayneedle、Harvey Norman、Home Depot、Home 24、宜家、京東、John Lewis、Lowe's、Otto、Overstock、Pepperfry、Restoration硬件、蘇寧、天貓、沃爾瑪、Wayfair、Westwing、Williams-Sonoma.com等

內容

簡介:研究工具、公司樣本、術語和方法說明

執行摘要:家具行業電子商務概覽

第一章:家具行業的電子商務

- 家具市場概覽:消費和進口

- 電子商務行業的 EC:基本數據

- 電子商務佔家具總消費的比例

- 按地理區域劃分的家具消費和電子商務銷售額

- 按產品細分分類的家具消費和電子商務銷售額(軟墊家具、戶外家具、廚房家具、辦公家具、其他家具)

- 按渠道劃分的電子商務家具銷售額(網上商店的電子零售商、家具專業人士、非專業人士/生活方式/DIY 和家具製造商)

- 示例公司的電子商務銷售業績

- 電子商務商業模式:家具製造商、批發商和 B2B 企業、電子零售商、實體企業、非家具專業連鎖店、開放平台

第 2 章活動趨勢

- 家具銷售額和電子商務家具銷售額的增長

- 前 10 個國家/地區的電子商務家具銷售額(按地區和電子商務家具消費量)

- 按產品細分劃分的電子商務家具銷售額

- 按類別劃分的在線家具賣家:規模、市場份額和平均增長率

- 業務發展和組織:全渠道方法、動態購物、可持續性

區域分析:歐洲、北美、亞太

第三章:歐洲的家具電子商務

- 歐洲的零售和電子商務銷售:概述和需求驅動因素

- 歐洲家具市場:行業概覽

- 按國家/地區(奧地利、比利時、丹麥、芬蘭、法國、德國、意大利、荷蘭、挪威、西班牙、瑞典、瑞士、英國)按歐洲最終用戶價格計算的家具消費和電子商務家具銷售額

- 在歐洲銷售家具的領先電子商務網站:估計的電子商務家具銷售額和電子商務總收入

第 4 章:北美家具電子商務

- 北美零售和電子商務銷售:概覽和需求驅動因素

- 北美家具市場:行業概覽

- 按國家/地區(美國、加拿大、墨西哥)劃分的北美最終用戶價格家具消費和電子商務家具銷售額

- 在線銷售的家具製造商

- 在北美銷售家具的領先電子商務網站:估算的電子商務銷售額和電子商務總收入

第五章亞太地區的家具電子商務

- 亞太地區零售和電子商務銷售:概覽和需求驅動因素

- 亞太家具市場:行業概覽

- 按國家/地區(澳大利亞、中國、印度、日本、韓國)劃分的亞太地區按最終用戶價格計算的家具消費和電子商務家具銷售額

- 亞太地區銷售家具的領先電子商務網站:電子商務總收入

第 6 章家具行業的電子商務:調查結果

- 公司樣本

- 收益結果

- 使用電子商務

- 電子商務渠道

- 產品和促銷工具

This report analyses e-commerce for the furniture industry on a global level and it is mainly divided into two parts:

PART I. E-COMMERCE FOR THE FURNITURE INDUSTRY deals with the features and the incidence of the online channel in the furniture market with a focus on key geographical areas (Europe, North America, Asia Pacific) and key countries, and analyses the different e-commerce business models and the performance of the leading players.

An overview of the world furniture industry, with current furniture consumption in large markets, introduces this part.

Trends in furniture e-commerce sales, 2022 (preliminary estimates) compared to 2019, are provided by segment (upholstered furniture, outdoor furniture, office furniture, kitchen furniture, other furniture), by geographical area and by kind of distributor (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers selling online)

The different E-commerce business models (Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms) and their evolution and organization (the omnichannel approach, the 'dynamic shopping' through a mixture of live-streaming and online shopping, and strategies and investments toward sustainable and responsible growth) are discussed in light of companies' experience.

ANALYSIS BY GEOGRAPHICAL AREAS: The furniture e-commerce business in Europe, North America, and Asia Pacific: for each considered region, the report analyses demand drivers, the online furniture market performance and sales of the leading furniture e-commerce players. E-commerce furniture sales are also provided for the most relevant markets (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom - the United States, Canada, Mexico - Australia, China, India, Japan, South Korea).

Online sales are presented for around 190 leading players based in North America, Europe, and Asia Pacific, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided. E-commerce furniture sales are provided both for European and North American companies.

PART II. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS provides results of a CSIL survey conducted in the period October-November 2022 to a sample of around 150 furniture manufacturers from all over the world, aiming at understanding their approach to the web channel, their strategies, their future expectations, and the most-demanded products in the web channel.

This survey mainly focus on:

- Companies revenues and performance

- The use of e-commerce/ Intentions to invest in e-commerce

- Features of the companies' e-commerce channels

- Products sold online, strategies and promotion tools

Highlights:

The use of e-commerce and incidence of total furniture sales, 2022.

Percentage shares on the total sample of respondents to the CSIL survey

With a +18% yearly growth in the period 2019-2022, the e-commerce furniture market has evolved rapidly in recent years, growing faster than the whole furniture market. The United States is the largest world e-commerce marketplace, with the highest penetration rate, followed by China.

The swiftly changing worldwide scenario strongly influences the e-commerce channel evolution. Following the booming performance during the pandemic, the market has been impacted by the consequences of the war in Ukraine, energy and food shortages, and strong inflationary pressures.

Also, the e-commerce competitive arena is showing some turbulence. Online sales of furniture are downgrading giving an advantage to the omnichannel retailers (brick&click) which are showing resilience to the weak market conditions, maximising physical stores' potential in combination with the virtual experience.

Selected companies mentioned:

Amazon, Ambientedirect, Anthropologie, Bygghemma Group, C Discount, Coupang, Crate and Barrel, Dunhelm, Hayneedle, Harvey Norman, Home Depot, Home 24, Ikea, Jingdong, John Lewis, Lowe's, Otto, Overstock, Pepperfry, Restoration Hardware,Suning, Tmall, Wal-Mart, Wayfair, Westwing, Williams-Sonoma.

TABLE OF CONTENTS

INTRODUCTION: Research Tools, Sample of companies, Terminology and methodological notes

EXECUTIVE SUMMARY: E-commerce for the furniture sector at a glance

1. E-COMMERCE FOR THE FURNITURE INDUSTRY

- 1.1. An overview of the furniture market: Consumption and Imports

- 1.2. E-commerce for the furniture industry: basic data

- incidence of e-commerce on total furniture consumption

- furniture consumption and e-commerce sales by geographical region

- furniture consumption and e-commerce sales by product segment (Upholstered furniture, Outdoor furniture, Kitchen furniture, Office furniture, Other furniture)

- e-commerce furniture sales by channel (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers through webstores)

- 1.3. E-commerce sales performance in a sample of companies

- 1.4. Models of e-commerce business: Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms

2. ACTIVITY TRENDS

- 2.1. Furniture sales and e-commerce furniture sales growth

- E-commerce furniture sales by geographical region and E-commerce furniture consumption in the top 10 countries

- E-commerce furniture sales by product segment

- Online furniture distributors by category: dimension, market share and average growth

- 2.2. The business evolution and organisation: the Omnichannel approach, Dynamic shopping and Sustainability

ANALYSIS BY GEOGRAPHICAL AREA: Europe, North America, Asia Pacific

3. FURNITURE E-COMMERCE IN EUROPE

- 3.1. Retail and e-commerce sales in Europe: overview and demand drivers

- 3.2. The furniture market in Europe: Sector overview

- Furniture consumption at end-user prices in Europe and e-commerce furniture sales by country (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom)

- 3.3. The leading e-commerce websites selling furniture in Europe: Estimated e-commerce furniture sales and Total e-commerce revenues

4. FURNITURE E-COMMERCE IN NORTH AMERICA

- 4.1. Retail and e-commerce sales in North America: overview and demand drivers

- 4.2. The furniture market in North America: Sector overview

- Furniture consumption at end-user prices in North America and e-commerce furniture sales by country (United States, Canada and Mexico)

- 4.3. Furniture manufacturers selling on-line

- 4.4. The leading e-commerce websites selling furniture in North America: Estimated e-commerce furniture sales and Total e-commerce revenues

5. FURNITURE E-COMMERCE IN ASIA PACIFIC

- 5.1. Retail and e-commerce sales in Asia Pacific: overview and demand drivers

- 5.2. The furniture market in Asia Pacific: Sector overview

- Furniture consumption at end-user prices in Asia Pacific and e-commerce furniture sales by country (Australia, China, India, Japan, South Korea)

- 5.3. The leading e-commerce websites selling furniture in Asia Pacific: Total e-commerce revenues

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

- 6.1. The sample of companies

- 6.2. Revenue performance

- 6.3. The use of e-commerce

- 6.4. E-commerce channels

- 6.5. Products and promotion tools