|

市場調查報告書

商品編碼

1259910

益生菌產業的東南亞市場(2023年~2032年)Research Report on Southeast Asia Probiotics Industry 2023-2032 |

||||||

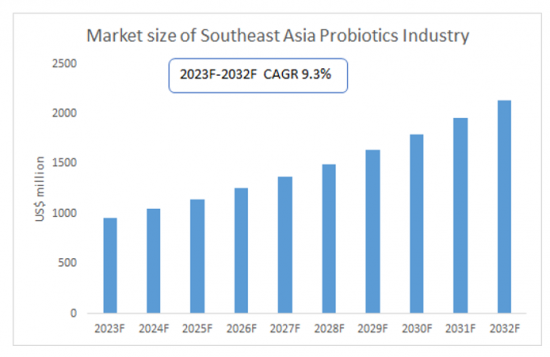

東南亞的益生菌產業的市場規模,從2023年到2032年預計繼續成長。隨著東南亞的經濟開發與中產階級的擴大,消費者,尤其是年輕的世代的健康意識高漲,促進市場成長。

本報告提供東南亞的益生菌產業市場的相關調查,產業分析,產業的展望等全面性資訊。

目錄

第1章 新加坡的益生菌產業分析

- 新加坡的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 新加坡的最低工資

- 新加坡的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 新加坡的主要的益生菌品牌的分析

第2章 泰國的益生菌產業分析

- 泰國的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 泰國的最低工資

- 泰國的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 泰國的主要的益生菌品牌的分析

第3章 菲律賓的益生菌產業分析

- 菲律賓的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 菲律賓的最低工資

- 菲律賓的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 菲律賓的主要的益生菌品牌的分析

第4章 馬來西亞的益生菌產業分析

- 馬來西亞的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 馬來西亞的最低工資

- 馬來西亞的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 馬來西亞的主要的益生菌品牌的分析

第5章 印尼的益生菌產業分析

- 印尼的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 印尼的最低工資

- 印尼的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 印尼的主要的益生菌品牌的分析

第6章 越南的益生菌產業分析

- 越南的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 越南的最低工資

- 越南的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 越南的主要的益生菌品牌的分析

第7章 緬甸的益生菌產業分析

- 緬甸的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 緬甸的最低工資

- 緬甸的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 緬甸的主要的益生菌品牌的分析

第8章 汶萊的益生菌產業分析

- 汶萊的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 汶萊的最低工資

- 汶萊的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 汶萊的主要的益生菌品牌的分析

第9章 寮國的益生菌產業分析

- 寮國的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 寮國的最低工資

- 寮國的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 寮國的主要益生菌品牌的分析

第10章 柬埔寨的益生菌產業分析

- 柬埔寨的益生菌產業的開發環境

- 地區

- 人口

- 經濟

- 柬埔寨的最低工資

- 柬埔寨的益生菌產業的營運(2023年~2032年)

- 供給

- 需求

- 柬埔寨的主要的益生菌品牌的分析

第11章 東南亞的益生菌產業的展望(2023年~2032年)

- 東南亞的益生菌產業的開發的影響因素的分析

- 有利的要素

- 不利的要素

- 東南亞的益生菌產業的供給分析(2023年~2032年)

- 東南亞的益生菌產業的需求分析(2023年~2032年)

- COVID-19流行對益生菌產業的影響

Probiotics are a group of ingested microorganisms that colonize the human body after ingestion and change the composition of the host flora in a certain area with positive benefits for the host. Probiotics can promote nutrient absorption and maintain intestinal health by regulating the immune function of the host mucosa and system or by regulating the balance of flora in the intestinal tract.

SAMPLE VIEW

According to CRI's analysis, with the economic development and expansion of the middle class in Southeast Asia, consumers, especially the younger generation, have become more health conscious, and the demand for health products has gradually increased, driving the rapid development of the probiotic industry in Southeast Asia. For example, Life-Space, a probiotic brand, entered Lazada, a Southeast Asian e-commerce platform, in 2020. Life-Space became the top-selling product in the digestive health category on the Singapore site within four months, and also entered the Top 10 in the digestive health category on the Malaysia site, gradually becoming the head probiotic brand on the Lazada platform.

There is a certain gap in the development level of probiotics industry in Southeast Asia in different countries. According to CRI analysis, Indonesia, Thailand, Malaysia, Vietnam and Singapore occupy the major market share of Southeast Asia probiotics industry, among which Indonesia probiotics market is larger. UOB data shows that the middle class in Indonesia is close to 90 million people. With the improvement of living standards, the dietary habits of the middle class in Indonesia have developed towards more balanced nutrition and there is a strong demand for probiotics and other health products.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

CRI expects the Southeast Asian probiotics industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Probiotics Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Probiotics Industry?

- Which Companies are the Major Players in Southeast Asia Probiotics Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Probiotics Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Probiotics Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Probiotics Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Probiotics Industry Market?

- Which Segment of Southeast Asia Probiotics Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Probiotics Industry?

Table of Contents

1 Probiotics Industry Analysis in Singapore

- 1.1 Singapore Probiotics Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Probiotics Industry Operation in Singapore 2023-2032

- 1.2.1 Supply

- 1.2.2 Demand

- 1.3 Analysis of Major Probiotic Brands in Singapore

2 Analysis of Probiotics Industry in Thailand

- 2.1 Development Environment of Probiotics Industry in Thailand

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Probiotics Industry Operation in Thailand 2023-2032

- 2.2.1 Supply

- 2.2.2 Demand

- 2.3 Analysis of Major Probiotic Brands in Thailand

3 Analysis of Probiotics Industry in the Philippines

- 3.1 Development Environment of the Probiotics Industry in the Philippines

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Probiotics Industry Operation 2023-2032

- 3.2.1 Supply

- 3.2.2 Demand

- 3.3 Analysis of Major Probiotic Brands in the Philippines

4 Malaysia Probiotics Industry Analysis

- 4.1 Probiotics Industry Development Environment in Malaysia

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Probiotics Industry Operation in Malaysia 2023-2032

- 4.2.1 Supply

- 4.2.2 Demand

- 4.3 Analysis of Major Probiotic Brands in Malaysia

5 Indonesia Probiotics Industry Analysis

- 5.1 Probiotics Industry Development Environment in Indonesia

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Probiotics Industry Operation 2023-2032

- 5.2.1 Supply

- 5.2.2 Demand

- 5.3 Major Probiotics Brands Analysis in Indonesia

6 Vietnam Probiotics Industry Analysis

- 6.1 Vietnam Probiotics Industry Development Environment

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Probiotics Industry Operation 2023-2032

- 6.2.1 Supply

- 6.2.2 Demand

- 6.3 Vietnam Major Probiotics Brand Analysis

7 Myanmar Probiotics Industry Analysis

- 7.1 Development Environment of Probiotics Industry in Myanmar

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Probiotics Industry Operation 2023-2032

- 7.2.1 Supply

- 7.2.2 Demand

- 7.3 Major Probiotics Brands Analysis in Myanmar

8 Brunei Probiotics Industry Analysis

- 8.1 Brunei Probiotics Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Probiotics Industry Operation 2023-2032

- 8.2.1 Supply

- 8.2.2 Demand

- 8.3 Brunei Major Probiotics Brand Analysis

9 Laos Probiotics Industry Analysis

- 9.1 Probiotics Industry Development Environment in Laos

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Probiotics Industry Operation in Laos 2023-2032

- 9.2.1 Supply

- 9.2.2 Demand

- 9.3 Laos Major Probiotics Brand Analysis

10 Cambodia Probiotics Industry Analysis

- 10.1 Probiotics Industry Development Environment in Cambodia

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Probiotics Industry Operation in 2023-2032

- 10.2.1 Supply

- 10.2.2 Demand

- 10.3 Analysis of Major Probiotics Brands in Cambodia

11 Southeast Asia Probiotics Industry Outlook 2023-2032

- 11.1 Southeast Asia Probiotics Industry Development Impact Factors Analysis

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Supply Analysis of Probiotics Industry in Southeast Asia 2023-2032

- 11.3 Southeast Asia Probiotics Industry Demand Analysis 2023-2032

- 11.4 Impact of COVID -19 Epidemic on Probiotics Industry