|

市場調查報告書

商品編碼

1231835

東南亞的保險產業(2023年~2032年)Research Report on Southeast Asia Insurance Industry 2023-2032 |

||||||

由於經濟發展的大幅可能性,可支配所得的緩慢增加,中產階級的擴大,保險意識的提高等,東南亞的保險市場前景廣闊。

本報告提供東南亞的保險產業調查分析,主要的促進因素,課題與機會,COVID-19影響等資訊。

樣本圖

目錄

第1章 新加坡的保險產業的分析

- 新加坡的保險產業的開發環境

- 地區

- 人口

- 經濟

- 新加坡的最低工資

- 新加坡的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 新加坡的主要的保險企業的分析

第2章 泰國的保險產業的分析

- 泰國的保險產業的開發環境

- 地區

- 人口

- 經濟

- 泰國的最低工資

- 泰國的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 泰國的主要的保險企業的分析

第3章 菲律賓的保險產業的分析

- 菲律賓的保險產業的開發環境

- 地區

- 人口

- 經濟

- 菲律賓的最低工資

- 菲律賓的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 菲律賓的主要的保險企業的分析

第4章 馬來西亞的保險產業的分析

- 馬來西亞的保險產業的開發環境

- 地區

- 人口

- 經濟

- 馬來西亞的最低工資

- 馬來西亞的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 馬來西亞的主要的保險企業的分析

第5章 印尼的保險產業的分析

- 印尼的保險產業的開發環境

- 地區

- 人口

- 經濟

- 印尼的最低工資

- 印尼的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 印尼的主要的保險企業的分析

第6章 越南的保險產業的分析

- 越南的保險產業的開發環境

- 地區

- 人口

- 經濟

- 越南的最低工資

- 越南的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 越南的主要的保險企業的分析

第7章 緬甸的保險產業的分析

- 緬甸的保險產業的開發環境

- 地區

- 人口

- 經濟

- 緬甸的最低工資

- 緬甸的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 緬甸的主要的保險企業的分析

第8章 汶萊的保險產業的分析

- 汶萊的保險產業的開發環境

- 地區

- 人口

- 經濟

- 汶萊的最低工資

- 汶萊的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 汶萊的主要的保險企業的分析

第9章 寮國的保險產業的分析

- 寮國的保險產業的開發環境

- 地區

- 人口

- 經濟

- 寮國的最低工資

- 寮國的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 寮國的主要的保險企業的分析

第10章 柬埔寨的保險產業的分析

- 柬埔寨的保險產業的開發環境

- 地區

- 人口

- 經濟

- 柬埔寨的最低工資

- 柬埔寨的保險產業的經營(2023年~2032年)

- 個人保險

- 產物保險

- 柬埔寨的主要的保險企業的分析

第11章 東南亞的保險產業預測(2023年~2032年)

- 東南亞的保險產業發展的影響因素分析

- 有利的要素

- 不利的要素

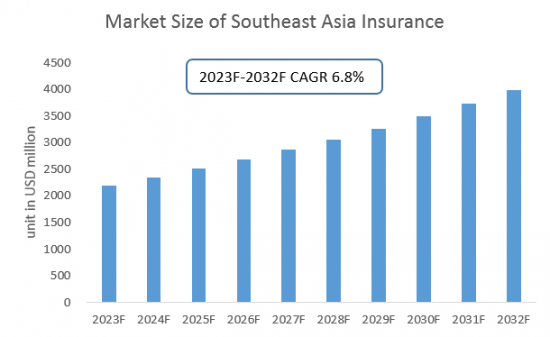

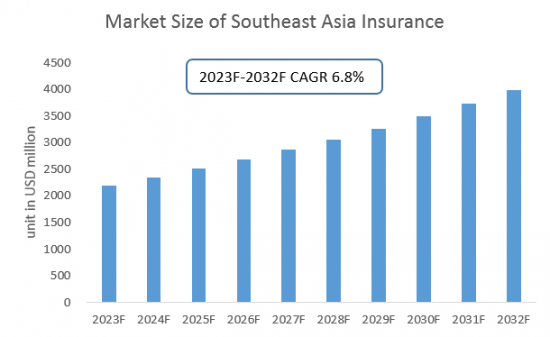

- 東南亞的保險產業的規模的預測(2023年~2032年)

- COVID-19流行對保險產業的影響

Insurance is a major form of risk management and can be divided into two categories, property insurance and personal insurance, depending on the object of the insurance. The booming economy of Southeast Asia has driven the expansion of its insurance industry. Although the overall development of insurance in Southeast Asia has also been rapid in recent years, there are great differences in the speed and stage of development among countries. Singapore has a developed economy, a mature and large insurance market, and a regulatory system that is well aligned with international standards. While Myanmar, Cambodia and Laos, which are economically backward countries, have very low insurance coverage, and the depth and density of insurance are at a low level. The insurance industry in the rest of the countries is at a certain stage of development.

SAMPLE VIEW

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI's analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

With the huge potential for economic growth, gradual increase in disposable income, expansion of the middle class and rising insurance awareness, the Southeast Asian insurance market faces a promising future. CRI expects the insurance industry in Southeast Asia to maintain growth from 2023-2032.

Topics covered:

- Southeast Asia Insurance Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Insurance Industry?

- Which Companies are the Major Players in Southeast Asia Insurance Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Insurance Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Insurance Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Insurance Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Insurance Industry Market?

- Which Segment of Southeast Asia Insurance Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Insurance Industry?

Table of Contents

1 Analysis of the Insurance Industry in Singapore

- 1.1 Singapore Insurance Industry Development Environment

- 1.1.1 Geography

- 1.1.2 Population

- 1.1.3 Economy

- 1.1.4 Minimum Wage in Singapore

- 1.2 Insurance Industry Operation in Singapore 2023-2032

- 1.2.1 Personal Insurance

- 1.2.2 Property Insurance

- 1.3 Analysis of Major Insurance Companies in Singapore

2 Analysis of Thailand's Insurance Industry

- 2.1 Development Environment of Thailand Insurance Industry

- 2.1.1 Geography

- 2.1.2 Population

- 2.1.3 Economy

- 2.1.4 Thailand Minimum Wage

- 2.2 Thailand Insurance Industry Operation 2023-2032

- 2.2.1 Personal Insurance

- 2.2.2 Property Insurance

- 2.3 Analysis of Major Insurance Companies in Thailand

3 Analysis of the Insurance Industry in the Philippines

- 3.1 Development Environment of the Insurance Industry in the Philippines

- 3.1.1 Geography

- 3.1.2 Population

- 3.1.3 Economy

- 3.1.4 Minimum Wage in the Philippines

- 3.2 Philippine Insurance Industry Operation 2023-2032

- 3.2.1 Personal Insurance

- 3.2.2 Property Insurance

- 3.3 Analysis of Major Insurance Companies in the Philippines

4 Analysis of the Malaysian Insurance Industry

- 4.1 Malaysia Insurance Industry Development Environment

- 4.1.1 Geography

- 4.1.2 Population

- 4.1.3 Economy

- 4.1.4 Minimum Wage in Malaysia

- 4.2 Malaysian Insurance Industry Operation 2023-2032

- 4.2.1 Personal Insurance

- 4.2.2 Property Insurance

- 4.3 Analysis of Major Insurance Companies in Malaysia

5 Indonesia Insurance Industry Analysis

- 5.1 Indonesia Insurance Industry Development Environment

- 5.1.1 Geography

- 5.1.2 Population

- 5.1.3 Economy

- 5.1.4 Minimum Wage in Indonesia

- 5.2 Indonesia Insurance Industry Operation 2023-2032

- 5.2.1 Personal Insurance

- 5.2.2 Property Insurance

- 5.3 Analysis of Major Insurance Companies in Indonesia

6 Vietnam Insurance Industry Analysis

- 6.1 Development Environment of Vietnam Insurance Industry

- 6.1.1 Geography

- 6.1.2 Population

- 6.1.3 Economy

- 6.1.4 Minimum Wage in Vietnam

- 6.2 Vietnam Insurance Industry Operation 2023-2032

- 6.2.1 Personal Insurance

- 6.2.2 Property Insurance

- 6.3 Analysis of Major Insurance Companies in Vietnam

7 Analysis of Myanmar Insurance Industry

- 7.1 Development Environment of Myanmar Insurance Industry

- 7.1.1 Geography

- 7.1.2 Population

- 7.1.3 Economy

- 7.1.4 Myanmar Minimum Wage

- 7.2 Myanmar Insurance Industry Operation 2023-2032

- 7.2.1 Personal Insurance

- 7.2.2 Property Insurance

- 7.3 Analysis of Major Insurance Companies in Myanmar

8 Analysis of Brunei's Insurance Industry

- 8.1 Brunei Insurance Industry Development Environment

- 8.1.1 Geography

- 8.1.2 Population

- 8.1.3 Economy

- 8.1.4 Brunei Minimum Wage

- 8.2 Brunei Insurance Industry Operation 2023-2032

- 8.2.1 Personal Insurance

- 8.2.2 Property Insurance

- 8.3 Analysis of Major Insurance Companies in Brunei

9 Analysis of the Insurance Industry in Laos

- 9.1 Development Environment of the Insurance Industry in Laos

- 9.1.1 Geography

- 9.1.2 Population

- 9.1.3 Economy

- 9.1.4 Minimum Wage in Laos

- 9.2 Laos Insurance Industry Operation 2023-2032

- 9.2.1 Personal Insurance

- 9.2.2 Property Insurance

- 9.3 Analysis of Major Insurance Companies in Laos

10 Analysis of Cambodia's Insurance Industry

- 10.1 Development Environment of Cambodia's Insurance Industry

- 10.1.1 Geography

- 10.1.2 Population

- 10.1.3 Economy

- 10.1.4 Minimum Wage in Cambodia

- 10.2 Cambodia Insurance Industry Operation 2023-2032

- 10.2.1 Personal Insurance

- 10.2.2 Property Insurance

- 10.3 Analysis of Major Insurance Companies in Cambodia

11 Southeast Asia Insurance Industry Outlook 2023-2032

- 11.1 Analysis of Factors Affecting the Development of Insurance Industry in Southeast Asia

- 11.1.1 Favorable Factors

- 11.1.2 Unfavorable Factors

- 11.2 Southeast Asia Insurance Industry Size Forecast 2023-2032

- 11.3 Impact of COVID -19 Epidemic on Insurance Industry