|

市場調查報告書

商品編碼

1729700

按類型和地區分類的企業重組服務市場Corporate Recovery Service Market, By Type (Administrative Takeover, Compulsory Liquidation & Creditor Voluntary Liquidation, Voluntary Management, and Others), By Geography (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) |

||||||

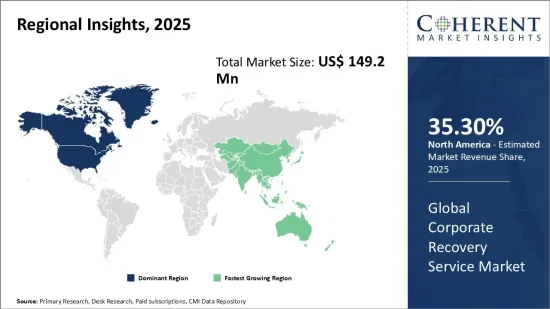

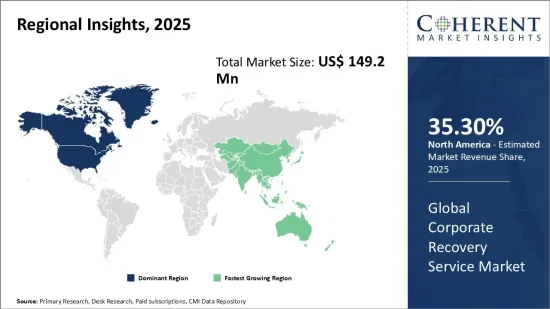

預計 2025 年全球企業重振服務市場規模將達到 1.492 億美元,到 2032 年將達到 2.288 億美元,2025 年至 2032 年的複合年成長率為 6.3%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025年的市場規模 | 1.492億美元 |

| 效能數據 | 從2020年到2024年 | 預測期 | 2025年至2032年 |

| 預測期:2025-2032年複合年成長率: | 6.30% | 2032年價值預測 | 2.288億美元 |

近年來,全球企業重組服務市場穩定成長。我們的扭虧為盈服務透過提供諮詢、扭虧為盈策略和危機管理幫助陷入困境的公司恢復收益。此外,新冠疫情使許多企業陷入財務困境。這導致對專業扭虧為盈服務的需求不斷成長,這些服務可以找出業績不佳的根本原因並分析和最佳化公司的財務和業務。

市場動態:

全球企業重組服務市場受到多種因素的推動,例如越來越多的公司因宏觀經濟逆風而面臨財務困境、全球營運日益複雜以及跨行業監管變化。然而,扭虧為盈計畫的高成本以及採用扭虧為盈策略的文化障礙對市場成長構成了挑戰。主要業務機會包括透過夥伴關係擴展到新興市場、提供客製化的數位解決方案和綜合併購諮詢服務。

本研究的主要特點

本報告對全球企業重組服務市場進行了詳細分析,並以 2024 年為基準年,展示了預測期(2025-2032 年)的市場規模和復合年成長率。

它還強調了各個領域的潛在商機,並說明了該市場的有吸引力的投資提案矩陣。

它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景和主要企業採用的競爭策略的重要見解。

全球企業轉型服務市場的主要企業是根據公司亮點、產品系列、關鍵亮點、財務績效和策略等參數進行的分析。

本報告的見解將使負責人和公司經營團隊能夠就未來的產品發布、類型升級、市場擴張和行銷策略做出明智的決策。

本研究報告針對該產業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

第3章市場動態、法規與趨勢分析

- 市場動態

- 影響分析

- 主要亮點

- 監管情景

- 產品發布/核准

- PEST分析

- 波特分析

- 市場機會

- 監管情景

- 主要進展

- 產業趨勢

第4章 2020 年至 2032 年全球企業轉型服務市場(按類型)

- 獲得

- 強制清算與債權人自願清算

- 自我管理

- 其他

第5章 2020 年至 2032 年全球企業重振服務市場(按地區)

- 北美洲

- 美國

- 加拿大

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 歐洲

- 德國

- 英國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- ASEAN

- 其他亞太地區

- 中東

- 海灣合作理事會國家

- 以色列

- 其他中東地區

- 非洲

- 南非

- 北非

- 中部非洲

第6章 競爭態勢

- Deloitte

- PricewaterhouseCoopers(PwC)

- Ernst & Young(EY)

- KPMG

- Grant Thornton

- Alvarez & Marsal

- Baker Tilly

- BDO

- CBIZ, Inc.

- Buchler Phillips

- Hall Chadwick Melbourne Pty Ltd

- Moore Kingston Smith

- PKF International

- MENZIES LLP

- Business Victoria

第7章分析師建議

- 命運之輪

- 分析師觀點

- 一致的機會圖

第8章參考文獻與調查方法

- 參考

- 調查方法

- 關於出版商

Global Corporate Recovery Service Market is estimated to be valued at USD 149.2 Mn in 2025 and is expected to reach USD 228.8 Mn by 2032, growing at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 149.2 Mn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 6.30% | 2032 Value Projection: | USD 228.8 Mn |

The global corporate recovery service market has been growing steadily over the past few years. Corporate recovery services help struggling businesses return to profitability by providing consultation, turnaround strategies, and crisis management. To add to this, many businesses have been left in difficult financial situations by the COVID-19 pandemic. This has increased the demand for professional corporate recovery services that can analyze and optimize a company's financials and operations, identifying the root causes of underperformance.

Market Dynamics:

The global corporate recovery service market is driven by factors such as the rising number of businesses facing financial distress due to macroeconomic headwinds, increasing complexity of global operations, and regulatory changes across industries. However, high costs of recovery programs and cultural barriers in adopting turnaround strategies pose challenges to the market's growth. Key opportunities include expanding into developing markets through partnerships, offering customized digital solutions, and integrated M&A advisory services.

Key Features of the Study:

This report provides in-depth analysis of the global corporate recovery service market, and provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global corporate recovery service market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG, Grant Thornton, Alvarez & Marsal, Baker Tilly, BDO, CBIZ, Inc., Buchler Phillips, Hall Chadwick Melbourne Pty Ltd, Moore Kingston Smith, PKF International, MENZIES LLP, and Business Victoria

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global corporate recovery service market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Type Insights (Revenue, US$ Mn, 2020 - 2032)

- Administrative Takeover

- Compulsory Liquidation & Creditor Voluntary Liquidation

- Voluntary Management

- Others

- Regional Insights (Revenue, US$ Mn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Company Profiles:

- Deloitte

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

- Grant Thornton

- Alvarez & Marsal

- Baker Tilly

- BDO

- CBIZ, Inc.

- Buchler Phillips

- Hall Chadwick Melbourne Pty Ltd

- Moore Kingston Smith

- PKF International

- MENZIES LLP

- Business Victoria

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Corporate Recovery Service Market, By Type

- Global Corporate Recovery Service Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Corporate Recovery Service Market, By Type, 2020-2032, (US$ Mn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Administrative Takeover

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Compulsory Liquidation & Creditor Voluntary Liquidation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Voluntary Management

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (US$ Mn)

5. Global Corporate Recovery Service Market, By Region, 2020 - 2032, Value (US$ Mn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (US$ Mn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (US$ Mn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (US$ Mn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (US$ Mn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (US$ Mn)

- South Africa

- North Africa

- Central Africa

6. Competitive Landscape

- Deloitte

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PricewaterhouseCoopers (PwC)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Ernst & Young (EY)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- KPMG

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Grant Thornton

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Alvarez & Marsal

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Baker Tilly

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- BDO

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- CBIZ, Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Buchler Phillips

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Hall Chadwick Melbourne Pty Ltd

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Moore Kingston Smith

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PKF International

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- MENZIES LLP

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Business Victoria

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

7. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

8. References and Research Methodology

- References

- Research Methodology

- About us