|

市場調查報告書

商品編碼

1699566

按類型、通路和地區分類的匯款服務市場Money Transfer Services Market, By Type (Inward Money Transfer and Outward Money Transfer), By Channel (Money Transfer Operators, Banks, and Other Channels), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa) |

||||||

預計 2025 年全球匯款服務市場規模為 423.1 億美元,到 2032 年將達到 1,217.6 億美元,2025 年至 2032 年的複合年成長率為 16.3%。

| 報告範圍 | 報告詳細資訊 | ||

|---|---|---|---|

| 基準年 | 2024 | 2025年的市場規模 | 423.1億美元 |

| 效能數據 | 從2020年到2024年 | 預測期 | 2025年至2032年 |

| 預測期:2025-2032年複合年成長率: | 16.30% | 2032年價值預測 | 1217.6億美元 |

由於跨境貿易的成長、全球移民的增加以及數位付款管道的快速普及,市場正在經歷顯著成長。隨著行動錢包和金融科技解決方案的興起,消費者擴大轉向更快、更經濟、更安全的匯款服務。此外,區塊鏈和人工智慧在匯款服務中的整合正在透過提高透明度和效率進一步改變產業。然而,法規遵循、網路安全威脅和外匯波動等挑戰持續成為市場成長的障礙。

市場動態:

全球匯款服務市場的成長主要受到國際移民增加以及對無縫即時付款解決方案日益成長的需求的推動。數位銀行基礎設施的擴展和對行動交易的日益依賴對產業的發展做出了重大貢獻。此外,新興經濟體政府主導的金融包容性舉措正在培育更具競爭力和多樣化的市場格局。然而,該行業面臨的挑戰包括高昂的交易費用、不斷變化的監管要求以及持續存在的詐騙和網路威脅風險。同時,區塊鏈技術和人工智慧在金融服務中的融合,以及基於行動的匯款解決方案的擴展,為市場參與者提供創新、經濟、安全和高效的匯款服務創造了有利可圖的機會。

本研究的主要特點

本報告對全球匯款服務市場進行了詳細分析,並以 2024 年為基準年,展示了預測期(2025-2032 年)的市場規模和年複合成長率(CAGR%)。

它還強調了各個領域的潛在商機,並說明了該市場的有吸引力的投資提案矩陣。

它還提供了有關市場促進因素、限制因素、機會、新產品發布和核准、市場趨勢、區域前景和主要企業採用的競爭策略的重要見解。

全球匯款服務市場的主要企業已根據公司亮點、產品系列、主要亮點、業績和策略等參數進行了分析。

研究涉及的主要企業包括西聯匯款公司、Wise(TransferWise Ltd.)、Revolut Ltd.、Remitly Inc.、速匯金國際公司、PayPal Holdings Inc.、WorldRemit Ltd.、Intermex 電匯、Paytm(One97 Communications Limited)、OFX(OzForex)、摩根大通公司、美國銀行公司和花旗銀行公司。

從本報告中獲得的見解將使負責人和企業經營團隊能夠就未來的產品發布、新興趨勢、市場擴張和行銷策略做出明智的決策。

本研究報告針對該產業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

目錄

第1章 調查目的與前提條件

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告描述

- 市場定義和範圍

- 執行摘要

第3章市場動態、法規與趨勢分析

- 市場動態

- 影響分析

- 主要亮點

- 監管情景

- 產品發布/核准

- PEST分析

- 波特分析

- 市場機會

- 監管情景

- 主要進展

- 產業趨勢

4. 2020 年至 2032 年全球匯款服務市場(按類型)

- 存款及匯款

- 提款/匯款

5. 2020 年至 2032 年全球匯款服務市場(依通路分類)

- 匯款提供者

- 銀行

- 其他管道

6. 2020 年至 2032 年全球匯款服務市場(按地區)

- 北美洲

- 拉丁美洲

- 歐洲

- 亞太地區

- 中東

- 非洲

第7章 競爭態勢

- The Western Union Company

- Wise(TransferWise Ltd.)

- Revolut Ltd.

- Remitly Inc.

- MoneyGram International Inc.

- PayPal Holdings Inc.

- WorldRemit Ltd.

- Intermex Wire Transfer

- Paytm(One97 Communications Limited)

- OFX(OzForex)

- JPMorgan Chase & Co.

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company

- WorldFirst

第 8 章分析師建議

- 命運之輪

- 分析師觀點

- 一致的機會圖

第9章參考文獻與調查方法

- 參考

- 調查方法

- 關於出版商

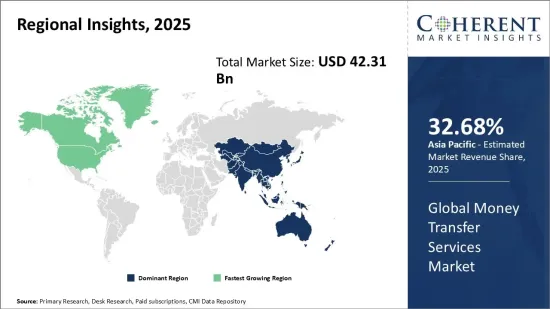

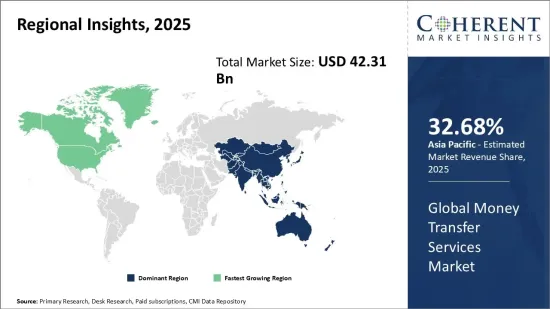

Global Money Transfer Services Market is estimated to be valued at US$ 42.31 Bn in 2025 and is expected to reach US$ 121.76 Bn by 2032, growing at a compound annual growth rate (CAGR) of 16.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 42.31 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 16.30% | 2032 Value Projection: | USD 121.76 Bn |

The market has experienced significant expansion driven by increasing cross-border transactions, rising global migration, and the rapid adoption of digital payment platforms. With the growing penetration of mobile wallets and fintech solutions, consumers are increasingly shifting towards faster, cost-effective, and secure money transfer services. Additionally, the integration of Blockchain and artificial intelligence in remittance services is further revolutionizing the industry by enhancing transparency and efficiency. However, challenges such as regulatory compliance, cybersecurity threats, and fluctuating foreign exchange rates continue to pose hurdles for market growth.

Market Dynamics:

The global money transfer services market growth is primarily driven by the rising number of international migrants and the increasing need for seamless, real-time payment solutions. The expansion of digital banking infrastructure, along with the growing reliance on mobile-based transactions, has significantly contributed to the industry's growth. Additionally, government-led financial inclusion initiatives in emerging economies are fostering a more competitive and diverse market landscape. However, the industry faces challenges such as high transaction fees, evolving regulatory requirements, and the persistent risk of fraud and cyber threats. Meanwhile, the integration of Blockchain technology and artificial intelligence in financial services, along with the expansion of mobile-based remittance solutions, presents lucrative opportunities for market players to innovate and offer cost-effective, secure, and efficient money transfer services.

Key Features of the Study:

This report provides in-depth analysis of the global money transfer services market, and provides market size (US$ Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global money transfer services market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include The Western Union Company, Wise (TransferWise Ltd.), Revolut Ltd., Remitly Inc., MoneyGram International Inc., PayPal Holdings Inc., WorldRemit Ltd., Intermex Wire Transfer, Paytm (One97 Communications Limited), OFX (OzForex), JPMorgan Chase & Co., Bank of America Corporation, Citigroup Inc., Wells Fargo & Company, and WorldFirst

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global money transfer services market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Market Segmentation

- Type Insights (Revenue, USD Bn, 2020 - 2032)

- Inward Money Transfer

- Outward Money Transfer

- Channel Insights (Revenue, USD Bn, 2020 - 2032)

- Money Transfer Operators

- Banks

- Other Channels

- Regional Insights (Revenue, USD Bn, 2020 - 2032)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- The Western Union Company

- Wise (TransferWise Ltd.)

- Revolut Ltd.

- Remitly Inc.

- MoneyGram International Inc.

- PayPal Holdings Inc.

- WorldRemit Ltd.

- Intermex Wire Transfer

- Paytm (One97 Communications Limited)

- OFX (OzForex)

- JPMorgan Chase & Co.

- Bank of America Corporation

- Citigroup Inc.

- Wells Fargo & Company

- WorldFirst

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Money Transfer Services Market, By Type

- Global Money Transfer Services Market, By Channel

- Global Money Transfer Services Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Impact Analysis

- Key Highlights

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Market Opportunities

- Regulatory Scenario

- Key Developments

- Industry Trends

4. Global Money Transfer Services Market, By Type, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Inward Money Transfer

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Outward Money Transfer

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

5. Global Money Transfer Services Market, By Channel, 2020-2032, (USD Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Money Transfer Operators

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Banks

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Other Channels

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Money Transfer Services Market, By Region, 2020 - 2032, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2025, 2028 & 2032, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2021 - 2032, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country, 2020 - 2032, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Type, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Channel, 2020 - 2032, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2020 - 2032, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

7. Competitive Landscape

- The Western Union Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Wise (TransferWise Ltd.)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Revolut Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Remitly Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- MoneyGram International Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- PayPal Holdings Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- WorldRemit Ltd.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Intermex Wire Transfer

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Paytm (One97 Communications Limited)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- OFX (OzForex)

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- JPMorgan Chase & Co.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Bank of America Corporation

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Citigroup Inc.

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Wells Fargo & Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- WorldFirst

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. References and Research Methodology

- References

- Research Methodology

- About us