|

市場調查報告書

商品編碼

1402568

氣候金融和碳金融市場,按市場類型、計劃類型、買方類型、碳市場機制、重點領域、交易類型、市場參與企業、地區Climate and Carbon Finance Market, By Market Type, By Project Type, By Buyer Type, By Carbon Market Mechanism, By Sector Focus, By Transaction Type, By Market Participants, By Geography |

||||||

預計2023年全球氣候和碳金融市場將達3,670億美元,2023年至2030年年複合成長率為33.7%。

| 報告範圍 | 報告詳情 | ||

|---|---|---|---|

| 基準年 | 2022年 | 2023年市場規模 | 3670億美元 |

| 實際資料 | 2018-2021 | 預測期 | 2023-2030 |

| 預測期年複合成長率 | 33.70% | 2030年市場規模預測 | 28,082 億美元 |

氣候變遷和不斷增加的碳排放對環境和生活方式構成了重大威脅。全球對於向低碳經濟轉型並在本世紀中葉實現碳中和的必要性日益達成共識。因此,碳金融和碳排放交易已成為有效的市場機制,以獎勵排放和消除大氣中多餘的碳。碳市場允許政府和私人組織購買相當於一噸二氧化碳當量的排放信用。這有助於各國和組織以具成本效益的方式實現國際氣候變遷協議規定的排放目標。然而,圍繞經濟成長軌跡的不確定性,未來氣候政策的嚴重性,技術顛覆等因素繼續影響著這個不斷變化的市場的供需動態。全球氣候和碳金融市場是一個目的是鼓勵企業和國家減少溫室氣體排放的金融體系。該市場按照「限額與交易」原則運作,即對允許的排放設定上限,並允許公司購買和出售「碳權」以滿足此上限。碳權額度是一種可交易的證書,使信用擁有者有權排放一噸二氧化碳或等量的另一種溫室氣體。

市場動態:

全球氣候和碳金融市場主要是由國際社會對實現淨零排放目標的承諾不斷增加所推動的。透過嚴格監管的碳定價機制和碳排放交易體系鼓勵各地區的產業遏制溫室氣體排放。政府對低碳計劃的有利承諾和獎勵,特別是在再生能源和能源效率領域,創造新的機會。然而,缺乏全球統一的定價機制以及碳政策的地區差異阻礙了市場充分發揮其潛力。宏觀經濟不確定性所造成的價格波動也是一個問題。儘管如此,由於對 ESG(環境、社會和管治)投資的日益關注以及碳關稅調整的進展,市場預計將獲得進一步的動力。市場受到國內外監管政策和框架的顯著影響。 《巴黎協定》等目的是減少溫室氣體排放的政策推動對排碳權的需求。

本研究的主要特點

- 本報告對全球氣候金融和碳金融市場進行了詳細分析,並列出了以2022年為基準年的預測期(2023-2030年)的市場規模和年複合成長率。

- 揭示了各個細分市場的潛在商機,並為該市場說明了一系列有吸引力的投資提案。

- 提供了有關市場促進因素、抑制因素、機會、新產品發布和核准、市場趨勢、區域前景、主要企業採取的競爭策略等的主要考察。

- 根據公司亮點、產品系列、主要亮點、財務業績和策略等參數,對全球氣候融資和碳融資市場的主要企業進行了介紹。

- 本報告的見解使行銷人員和公司負責人能夠就未來的產品發布、產品升級、市場擴張和行銷策略做出明智的決策。

- 本報告針對該產業的各個相關人員,包括投資者、供應商、產品製造商、經銷商、新進業者和財務分析師。

- 相關人員可以透過用於分析全球氣候融資和碳融資市場的各種策略矩陣來促進決策。

目錄

第1章 研究目的與前提

- 研究目標

- 先決條件

- 簡稱

第2章 市場展望

- 報告說明

- 市場定義和範圍

- 執行摘要

- Coherent Opportunity Map(COM)

第3章 市場動態、法規及趨勢分析

- 市場動態

- 各國政府加強減少碳排放。

- 加大對再生能源來源的投資。

- 抑制因素

- 需要大量資金投入。

- 全球範圍內沒有統一的碳定價。

- 主要亮點

- 監管場景

- 產品發布/核准

- PEST分析

- 波特的分析

- 併購場景

第4章 全球氣候融資與碳融資市場 -冠狀病毒(COVID-19)大流行的影響

- 新型冠狀病毒感染疾病(COVID-19)的流行病學

- 供需面分析

- 經濟影響

第5章 全球氣候融資/碳金融市場,依市場類型分類,2017-2030年

- 任意市場

- 合規市場

第6章 2017-2030年全球氣候融資和碳融資市場,依計劃類型

- 再生能源計劃

- 能源效率計劃

- 森林碳匯計劃

- 沼氣回收利用計劃

- 廢棄物管理計劃

- 農業和土地利用計劃

- 其他

第7章 2017-2030年全球氣候融資/碳金融市場,依買家類型

- 公司

- 政府

- 金融機構

- 非政府組織(NGO)

- 個人

第8章 全球氣候融資/碳金融市場,按碳市場機制,2017-2030

- 總量控制與交易(排放交易體系)

- 碳補償(自願性碳權)

- 碳價(碳排放稅或碳費)

第9章 全球氣候與碳金融市場,依重點領域分類,2017-2030年

- 能源與公共事業

- 運輸

- 製造和工業流程

- 農林業

- 建築與建造

- 廢棄物管理

- 其他

第10章 2017-2030年全球氣候和碳金融市場,依交易類型

- 現貨交易市場

- 遠期市場

- 期貨市場

第11章 全球氣候融資/碳融資市場,依市場參與企業分類,2017-2030年

- 碳計劃開發商

- 碳市場仲介業者(經紀人、顧問)

- 碳權檢驗和檢驗

- 交流平台

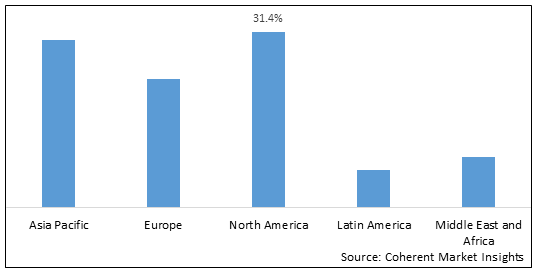

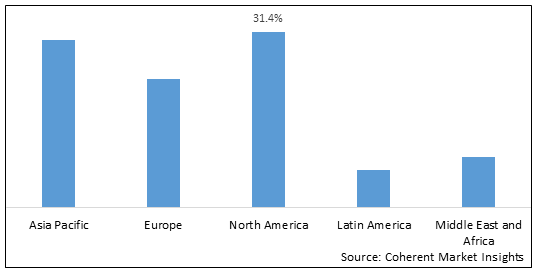

第12章 2017-2030年全球氣候與碳金融市場,依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 西班牙

- 法國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲 韓國

- ASEAN

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 海灣合作理事會國家

- 以色列

- 南非

- 北非

- 中部非洲

- 其他中東地區

第13章 競爭形勢

- ClimateCare(United Kingdom)

- South Pole Group(Switzerland)

- Climate Trust Capital(United States)

- Carbon Clear(United Kingdom)

- EcoAct(France)

- First Climate(Germany)

- ClimatePartner(Germany)

- Ecosphere+(United Kingdom)

- Verra(United States)

- Gold Standard(Switzerland)

- Climate Friendly(Australia)

- Forest Carbon(United Kingdom)

第14章 章節

- 調查方法

- 關於出版商

The global climate and carbon finance market is estimated to be valued at US$ 367.0 billion in 2023 and is anticipated to witness a compound annual growth rate (CAGR) of 33.7% from 2023 to 2030.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2022 | Market Size in 2023: | US$ 367 Bn |

| Historical Data for: | 2018 to 2021 | Forecast Period: | 2023 - 2030 |

| Forecast Period 2023 to 2030 CAGR: | 33.70% | 2030 Value Projection: | US$ 2,808.2 Bn |

The advent of climate change and rising carbon emissions have posed significant threats to our environment and way of living. There is a growing global consensus on the need to transition to a low carbon economy and achieve carbon neutrality by mid-century. This has led to the emergence of carbon finance and trading as effective market-based mechanisms to incentivize emission reductions and remove excess carbon from the atmosphere. The carbon market allows governments and private entities to buy carbon credits that represent one ton of carbon dioxide equivalent removed or avoided. This helps nations and organizations to comply with their emissions targets under international climate agreements in a cost-effective manner. However, uncertainties surrounding economic growth trajectories, stringency of future climate policies and technological disruptions continue to influence the demand and supply dynamics in this evolving marketplace. The global climate and carbon finance market is a financial system designed to encourage businesses and countries to reduce their greenhouse gas emissions. The market operates on the principle of 'cap and trade', where a limit is set on allowable emissions and entities are allowed to buy and sell 'carbon credits' to meet these limits.Carbon credits are a type of tradable certificate that provides the holder of the credit the right to emit one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas.

Market Dynamics:

The global climate and carbon finance market is primarily driven by the growing international commitments to achieve net-zero emission targets. Stringent regulations and carbon pricing mechanisms established via carbon trading schemes are compelling industries across regions to curb GHG ,Greenhouse Gas emissions. Favorable governmental initiatives and incentives for low-carbon projects especially in renewable energy and energy efficiency sectors are creating new opportunities. However, the lack of a unified global pricing mechanism and regional differences in carbon policies continue to hinder the market's full potential. Also, pricing volatility owing to macroeconomic uncertainties poses challenges. Nonetheless, the market is expected to gain further momentum with the rising focus on ESG, Enviornmental, Social and Governance investments and evolving carbon border tax adjustments. The market is heavily influenced by regulatory policies and frameworks at both national and international levels. Policies aimed at reducing greenhouse gas emissions, such as the Paris Agreement, drive the demand for carbon credits.

Key features of the study:

- This report provides an in-depth analysis of the global climate and carbon finance market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2023-2030), considering 2022 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global climate and carbon finance market based on the following parameters - company highlights, product portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include Climate Care (U.K), South Pole Group (Switzerland), Climate Trust Capital (U.S), Carbon Clear (U.K), EcoAct (France), First Climate (Germany), ClimatePartner (Germany), Ecosphere+ (U.K), Verra (U.S), Gold Standard (Switzerland), Climate Friendly (Australia), and Forest Carbon (U.K)

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, product up-gradation, market expansion, and marketing tactics

- The global climate and carbon finance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global climate and carbon finance market

Detailed Segmentation:

- By Market Type

- Voluntary Market

- Compliance Market

- By Project Type

- Renewable Energy Projects

- Energy Efficiency Projects

- Forest Carbon Projects

- Methane Capture and Utilization Projects

- Waste Management Projects

- Agriculture and Land Use Projects

- Others

- By Buyer Type

- Corporates

- Governments

- Financial Institutions

- Non-Governmental Organizations (NGOs)

- Individuals

- By Carbon Market Mechanism

- Cap and Trade (Emissions Trading System)

- Carbon Offsetting (Voluntary Carbon Credits)

- Carbon Pricing (Carbon Tax or Fee)

- By Sector Focus

- Energy and Utilities

- Transportation

- Manufacturing and Industrial Processes

- Agriculture and Forestry

- Buildings and Construction

- Waste Management

- Others

- By Transaction Type

- Spot Market

- Forward Market

- Futures Market

- By Market Participants

- Carbon Project Developers

- Carbon Market Intermediaries (Brokers, Consultants)

- Carbon Credit Verifiers and Validators

- Exchange Platforms

- By Geography

- North America (United States, Canada)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC countries, South Africa, Rest of Middle East & Africa)

- Company Profiles:

- ClimateCare (United Kingdom).

- South Pole Group (Switzerland)

- Climate Trust Capital (United States)

- Carbon Clear (United Kingdom)

- EcoAct (France)

- First Climate (Germany)

- ClimatePartner (Germany)

- Ecosphere+ (United Kingdom)

- Verra (United States)

- Gold Standard (Switzerland)

- Climate Friendly (Australia)

- Forest Carbon (United Kingdom)

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Climate and Carbon Finance Market, By Market Type

- Global Climate and Carbon Finance Market, By Project Type

- Global Climate and Carbon Finance Market, By Buyer Type

- Global Climate and Carbon Finance Market, By Carbon Market Mechanism

- Global Climate and Carbon Finance Market, By Sector Focus

- Global Climate and Carbon Finance Market, By Transaction Type

- Global Climate and Carbon Finance Market, By Market Participants

- Global Climate and Carbon Finance Market, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Increasing efforts by governments to reduce carbon emissions.

- Growing investments in renewable energy sources.

- Restraints

- High capital investment requirements.

- Lack of uniform carbon pricing globally.

- Key Highlights

- Regulatory Scenario

- Product launch/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

4. Global Climate and Carbon Finance Market - Impact of Coronavirus (COVID-19) Pandemic

- COVID-19 Epidemiology

- Supply Side and Demand Side Analysis

- Economic Impact

5. Global Climate and Carbon Finance Market, By Market Type, 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Voluntary Market

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Compliance Market

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

6. Global Climate and Carbon Finance Market, By Project Type, 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Renewable Energy Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Energy Efficiency Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Forest Carbon Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Methane Capture and Utilization Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Waste Management Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Agriculture and Land Use Projects

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

7. Global Climate and Carbon Finance Market, By Buyer Type, 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Corporates

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Governments

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Financial Institutions

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Non-Governmental Organizations (NGOs)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Individuals

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

8. Global Climate and Carbon Finance Market, By Carbon Market Mechanism, 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Cap and Trade (Emissions Trading System)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Carbon Offsetting (Voluntary Carbon Credits)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Carbon Pricing (Carbon Tax or Fee)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

9. Global Climate and Carbon Finance Market, By Sector Focus , 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Energy and Utilities

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Transportation

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Manufacturing and Industrial Processes

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Agriculture and Forestry

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Buildings and Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Waste Management

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

10. Global Climate and Carbon Finance Market, By Transaction Type , 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Spot Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Forward Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

- Futures Market

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2017-2030,(US$ Bn)

- Segment Trends

11. Global Climate and Carbon Finance Market, By Market Participants , 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, 2017 - 2030

- Segment Trends

- Carbon Project Developers

- Carbon Market Intermediaries (Brokers, Consultants)

- Carbon Credit Verifiers and Validators

- Exchange Platforms

12. Global Climate and Carbon Finance Market, By Region, 2017-2030, (US$ Bn)

- Introduction

- Market Share Analysis, By Country, 2023 and 2030 (%)

- Y-o-Y Growth Analysis, For Country 2017-2030

- Country Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Market Type, 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, Project Type, 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Buyer Type, 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Carbon Market Mechanism, 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Sector Focus , 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Transaction Type , 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Market Participants, 2017-2030,(US$ Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2017-2030,(US$ Bn)

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- APAC

- China

- India

- Japan

- Australia South Korea

- ASEAN

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- Israel

- South Africa

- North Africa

- Central Africa

- Rest of Middle East.

13. Competitive Landscape

- ClimateCare (United Kingdom)

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Strategies

- South Pole Group (Switzerland)

- Climate Trust Capital (United States)

- Carbon Clear (United Kingdom)

- EcoAct (France)

- First Climate (Germany)

- ClimatePartner (Germany)

- Ecosphere+ (United Kingdom)

- Verra (United States)

- Gold Standard (Switzerland)

- Climate Friendly (Australia)

- Forest Carbon (United Kingdom)

- Analyst Views

14. Section

- Research Methodology

- About us