|

市場調查報告書

商品編碼

1930543

全球機載衛星通訊市場(2026-2036)Global Airborne SATCOM Market 2026-2036 |

||||||

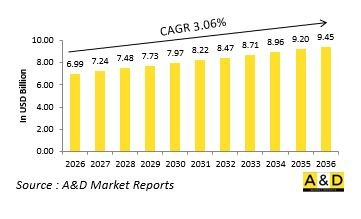

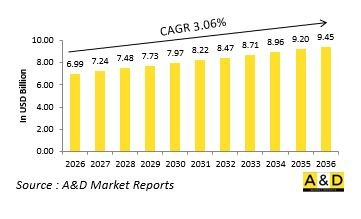

據估計,2026年全球機載衛星通訊市場規模為69.9億美元,預計到2036年將達到94.5億美元,2026年至2036年的複合年增長率為3.06%。

引言

機載衛星通訊能力是一項對現代軍事行動至關重要的基礎技術,它能夠為在地面網路覆蓋範圍之外運行的空中平台提供安全可靠的通訊連接。這些系統支援在廣闊偏遠的作戰區域內,透過飛機、無人機系統和空中指揮所傳輸語音、資料和視訊。機載衛星通訊確保高強度作戰行動期間指揮控制、資訊共享和作戰協調的連續性。隨著空中平台日益發揮情報樞紐而非孤立資產的作用,其作用也不斷擴大。現代軍事行動依賴不間斷的通訊來協調空中、陸地和海上領域的行動。機載衛星通訊能夠支援長時間作戰、即時資訊傳輸和協同攻擊行動。它也支持人道援助、災害應變和戰略運輸等非戰鬥行動。隨著作戰行動越來越依賴數據連接,機載衛星通訊已成為作戰成功和韌性的關鍵保障。

科技對機載衛星通訊的影響

技術進步顯著提高了機載衛星通訊的性能和可靠性。天線設計的進步提高了高速機動過程中的訊號穩定性。先進的調變和編碼技術提高了資料吞吐量,同時保持了鏈路的穩健性。數位波束成形技術實現了衛星資源的動態分配。增強的加密技術防止了敏感通訊被截獲。平台整合降低了尺寸、重量和功耗。多頻段支援提高了跨不同衛星網路的運作靈活性。軟體定義架構實現了快速更新和適應性。這些技術發展增強了機載衛星通訊作為彈性且適應性強的通訊骨幹網路的能力。

機載衛星通訊的關鍵驅動因素

對先進機載衛星通訊能力的需求主要受以下幾個因素驅動。超視距通訊在現代空中作戰中至關重要。以網路為中心的戰術概念依賴於持續的資料交換。無人機作戰的擴展增加了對衛星鏈路的依賴。聯合作戰需要可互通的通訊系統。在衝突環境中對安全可靠的連接的需求推動了進一步的投資。此外,情報、監視和偵察 (ISR) 以及作戰系統日益增長的資料需求也持續推動需求。這些驅動因素確保機載衛星通訊將繼續保持戰略優先地位。

機載衛星通訊的區域趨勢

各區域對機載衛星通訊的策略反映了不同的作戰優先事項。北美軍方強調與全球衛星網路的整合以及先進的加密技術。歐洲國防機構則著重於互通性和自主通訊能力。亞太地區優先考慮覆蓋廣闊的海洋區域和偏遠地區。中東軍方優先考慮為快速反應行動提供安全連接。非洲國防機構正擴大採用機載衛星通訊來擴展通訊範圍。在各個區域,對國內製造能力和合作夥伴關係的投資都在擴大。這些趨勢凸顯了機載衛星通訊在全球現代國防行動中的重要性。

本報告對全球航空衛星通訊市場進行了考察和分析,提供了影響該市場的技術資訊、未來十年的預測以及區域趨勢。

目錄

航空衛星通訊市場報告定義

航空衛星通訊市場區隔

按地區

按最終使用者

按應用

未來十年航空衛星通訊市場分析

航空衛星通訊市場技術

全球航空衛星通訊市場預測

區域航空衛星通訊市場趨勢及預測

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測及情境分析

主要公司

供應商層級概覽

公司基準分析

歐洲

中東

亞太地區

南美洲

航空衛星通訊市場國家分析

美國

國防項目

最新資訊

專利

當前市場技術成熟度

市場預測及情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

航空衛星通訊市場機會矩陣

航空衛星通訊市場專家意見報告

結論

關於航空和國防市場報告

The Global Airborne SATCOM market is estimated at USD 6.99 billion in 2026, projected to grow to USD 9.45 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.06% over the forecast period 2026-2036.

Introduction

Airborne satellite communication capabilities are fundamental to modern military operations, enabling secure and reliable connectivity for airborne platforms operating beyond the reach of terrestrial networks. These systems support voice, data, and video transmission for aircraft, unmanned aerial systems, and airborne command posts across vast and often remote operational theaters. Airborne SATCOM ensures continuity of command and control, intelligence sharing, and mission coordination during high-tempo operations. Its role has expanded as air platforms increasingly serve as information hubs rather than isolated assets. Modern military operations depend on uninterrupted communication to synchronize actions across air, land, and sea domains. Airborne SATCOM enables long-endurance missions, real-time intelligence dissemination, and coordinated strike operations. It also supports non-combat missions such as humanitarian assistance, disaster response, and strategic transport. As operational reliance on data connectivity grows, airborne SATCOM has become an indispensable enabler of mission success and operational resilience.

Technology Impact in Airborne SATCOM

Technological progress is driving significant enhancements in airborne SATCOM performance and reliability. Advances in antenna design improve signal stability during high-speed maneuvers. Enhanced modulation and coding techniques increase data throughput while maintaining link robustness. Digital beamforming enables dynamic allocation of satellite resources. Improved encryption safeguards sensitive communications against interception. Platform integration technologies reduce size, weight, and power requirements. Multi-band compatibility enhances operational flexibility across different satellite networks. Software-defined architectures allow rapid updates and adaptability. These technological developments strengthen airborne SATCOM as a resilient and adaptable communication backbone.

Key Drivers in Airborne SATCOM

Several factors are driving demand for advanced airborne SATCOM capabilities. The need for beyond-line-of-sight communication is critical for modern air operations. Network-centric warfare concepts rely on persistent data exchange. Expansion of unmanned aerial operations increases reliance on satellite links. Joint and coalition operations require interoperable communication systems. The need for secure and resilient connectivity in contested environments further supports investment. Additionally, increased data requirements for ISR and mission systems sustain demand. These drivers ensure airborne SATCOM remains a strategic priority.

Regional Trends in Airborne SATCOM

Regional approaches to airborne SATCOM reflect different operational priorities. North American forces emphasize integration with global satellite networks and advanced encryption. European defense organizations focus on interoperability and sovereign communication capabilities. Asia-Pacific regions prioritize coverage across vast maritime and remote areas. Middle Eastern forces emphasize secure connectivity for rapid response missions. African defense organizations increasingly adopt airborne SATCOM to extend communication reach. Across regions, investments in domestic capabilities and partnerships are expanding. These trends highlight the global importance of airborne SATCOM in modern defense operations.

Key Airborne SATCOM Program:

Boeing received a $2.8 billion U.S. Space Force contract in July 2025 for the Evolved Strategic Satellite Communications program, covering development and production of two nuclear command-and-control satellites with enhanced jam resistance. Separately, Gogo's SD Government division won a five-year federal contract in October 2025 to deliver multi-band, multi-orbit airborne satellite communications systems to a U.S. government agency, enabling global connectivity for executive transport and special mission aircraft fleets.

Table of Contents

Airborne SATCOM Market - Table of Contents

Airborne SATCOM Market Report Definition

Airborne SATCOM Market Segmentation

By Region

By End - User

By Application

Airborne SATCOM Market Analysis for next 10 Years

The 10-year Airborne SATCOM Market analysis would give a detailed overview of Airborne SATCOM Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Airborne SATCOM Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Airborne SATCOM Market Forecast

The 10-year Airborne SATCOM Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Airborne SATCOM Market Trends & Forecast

The regional Airborne SATCOM Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Airborne SATCOM Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Airborne SATCOM Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Airborne SATCOM Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By End - User, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By End - User, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Application, 2026-2036

List of Figures

- Figure 1: Global Airborne SATCOM Market Forecast, 2026-2036

- Figure 2: Global Airborne SATCOM Market Forecast, By Region, 2026-2036

- Figure 3: Global Airborne SATCOM Market Forecast, By End - User, 2026-2036

- Figure 4: Global Airborne SATCOM Market Forecast, By Application, 2026-2036

- Figure 5: North America, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 6: Europe, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 8: APAC, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 9: South America, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 10: United States, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 11: United States, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 12: Canada, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 14: Italy, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 16: France, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 17: France, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 18: Germany, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 24: Spain, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 30: Australia, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 32: India, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 33: India, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 34: China, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 35: China, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 40: Japan, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Airborne SATCOM Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Airborne SATCOM Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Airborne SATCOM Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Airborne SATCOM Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Airborne SATCOM Market, By End - User (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Airborne SATCOM Market, By End - User (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Airborne SATCOM Market, By Application (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Airborne SATCOM Market, By Application (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Airborne SATCOM Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Airborne SATCOM Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Airborne SATCOM Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Airborne SATCOM Market, By Region, 2026-2036

- Figure 58: Scenario 1, Airborne SATCOM Market, By End - User, 2026-2036

- Figure 59: Scenario 1, Airborne SATCOM Market, By Application, 2026-2036

- Figure 60: Scenario 2, Airborne SATCOM Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Airborne SATCOM Market, By Region, 2026-2036

- Figure 62: Scenario 2, Airborne SATCOM Market, By End - User, 2026-2036

- Figure 63: Scenario 2, Airborne SATCOM Market, By Application, 2026-2036

- Figure 64: Company Benchmark, Airborne SATCOM Market, 2026-2036