|

市場調查報告書

商品編碼

1930541

全球反潛戰 (ASW) 市場 (2026-2036)Global Anti Submarine Warfare Market 2026-2036 |

||||||

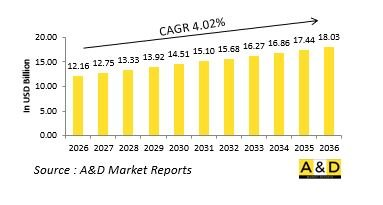

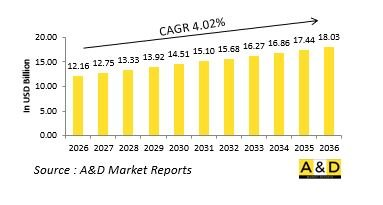

據估計,全球反潛戰 (ASW) 市場在 2026 年的價值為 121.6 億美元,預計到 2036 年將達到 180.3 億美元,2026 年至 2036 年的複合年增長率 (CAGR) 為 4.02%。

引言

反潛戰 (ASW) 是海軍作戰中一個高度專業化且具有戰略意義的關鍵領域,其重點在於探測、追蹤和摧毀那些本身俱有隱蔽性和挑戰性的水下威脅。潛水艇在威懾、情報收集和海上拒止方面發揮著至關重要的作用,因此是海軍部隊的首要關注點。反潛作戰(ASW)並非單一能力,而是涵蓋平台、感測器、人員和戰術的綜合系統,需要在廣闊的海洋空間內協同作戰。水面艦艇、潛水艇、海上巡邏機、直升機、無人系統和固定式水下感測器網路共同合作。現代潛艦的靜音性能不斷提升,續航力也隨之增強,這增加了水下作戰的複雜性,並使反潛作戰成為海軍的核心能力。除了衝突局勢之外,這些能力還有助於海上監視、水下基礎設施保護和戰略穩定。隨著海軍競爭的加劇和水下領域的日益擁擠,反潛作戰作為海上安全和海軍優勢的關鍵支柱,將繼續發展壯大。

科技對反潛作戰 (ASW) 的影響

技術進步從根本上重塑了反潛作戰,其探測範圍更廣、資料融合能力更強、反應速度更快。先進的聲吶系統,包括主動聲吶、被動聲吶和低頻聲吶,能夠在各種聲學環境中進行有效探測。改進的訊號處理技術使操作人員能夠更準確地從背景噪音中識別潛艇。感測器融合技術整合了聲學、磁學和環境數據,從而提供水下態勢的全面視圖。自主水下航行器 (AUV) 將監視範圍擴展到有人平台難以到達的區域。機載系統部署了先進的感測器,能夠快速覆蓋廣闊的海洋區域。安全的資料鏈路實現了海軍作戰單位之間的即時水下資訊共享。模擬和建模工具支援在高度複雜的水下環境中進行作戰規劃和操作人員訓練。這些技術進步正在將反潛作戰 (ASW) 從被動偵察行動轉變為主動和預測性的海上防禦能力。

反潛作戰 (ASW) 的關鍵驅動因素

對先進反潛作戰 (ASW) 能力的需求源自於潛艦的戰略價值及其所帶來的挑戰。潛艇的擴散和技術的日益複雜化增加了對有效反制措施的需求。保護海軍作戰部隊、商業航道和水下通訊基礎設施進一步凸顯了水下監視的重要性。海軍現代化計劃將水下優勢作為更廣泛海上主導權的先決條件。聯合行動需要在空中、水面和水下領域具備整合的反潛能力。無人和自主系統的擴展也推動了對探測、規避和追蹤技術的投資。訓練和戰備要求強調持續監視和快速反應。此外,從戰略威懾的角度來看,反潛作戰 (ASW) 對於維護海上力量平衡至關重要。這些驅動因素要求持續關注並加強水下防禦能力。

反潛戰 (ASW) 的區域趨勢

各區域的反潛戰 (ASW) 策略反映了各自獨特的海洋地理環境和威脅認知。北美軍隊強調深海監視和盟軍海軍網路的整合。歐洲軍隊則專注於狹窄水域監視和合作行動,以保護水下基礎設施。亞太地區各國由於海上交通繁忙和沿海環境複雜,將反潛能力列為優先事項。中東國家則致力於保障狹窄水道和近海資產的安全。非洲海上力量優先發展監視和能力建設,以監控不斷擴大的海洋區域。在整個區域內,對感測器網路、培訓和海上安全合作框架的投資都在增加。這些區域趨勢凸顯了地理環境、聯盟關係以及不斷演變的水下挑戰如何塑造反潛戰 (ASW) 戰略。 本報告分析了全球反潛戰 (ASW) 市場,深入探討了影響該市場的技術、未來十年的預測以及區域趨勢。

目錄

反潛戰 (ASW) 市場報告定義

反潛戰 (ASW) 市場區隔

按地區

按應用

按平台

未來十年反潛戰 (ASW) 市場分析

反潛戰 (ASW) 市場技術

全球反潛戰 (ASW) 市場預測

區域反潛戰 (ASW) 市場趨勢及預測

北美

驅動因素、限制因素及挑戰

PEST分析

市場預測與情境分析

主要公司

供應商層級狀況

公司標竿分析

歐洲

中東

亞太地區

南美洲

反潛戰(ASW)市場分析中的國家

美國

國防項目

最新資訊

專利

當前市場技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

反潛戰(ASW)市場機會矩陣

專家對反潛戰(ASW)市場的看法報告

結論

關於航空與國防市場報告

The Global Anti Submarine Warfare market is estimated at USD 12.16 billion in 2026, projected to grow to USD 18.03 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.02% over the forecast period 2026-2036.

Introduction

Anti submarine warfare represents a highly specialized and strategically vital discipline within naval operations, focused on detecting, tracking, and neutralizing underwater threats that are inherently stealthy and difficult to counter. Submarines play a decisive role in deterrence, intelligence gathering, and sea denial, making them a priority concern for maritime forces. Anti submarine warfare is not a single capability but a coordinated system of platforms, sensors, personnel, and tactics operating across vast ocean spaces. It involves surface vessels, submarines, maritime patrol aircraft, helicopters, unmanned systems, and fixed underwater sensor networks working in coordination. The growing quietness and endurance of modern submarines have increased the complexity of underwater operations, elevating anti submarine warfare as a core naval competency. Beyond conflict scenarios, these capabilities also support maritime surveillance, protection of undersea infrastructure, and strategic stability. As naval competition intensifies and underwater domains become more congested, anti submarine warfare continues to evolve as a critical pillar of maritime security and naval superiority.

Technology Impact in Anti Submarine Warfare

Technological progress has fundamentally reshaped anti submarine warfare by expanding detection ranges, improving data fusion, and accelerating response timelines. Advanced sonar systems, including active, passive, and low-frequency variants, enable more effective detection across varied acoustic environments. Improvements in signal processing allow operators to distinguish submarines from background noise with greater confidence. Sensor fusion technologies integrate acoustic, magnetic, and environmental data to create a comprehensive underwater picture. Autonomous underwater vehicles extend surveillance coverage into areas difficult for crewed platforms to access. Airborne systems deploy advanced sensors that rapidly cover large maritime zones. Secure data links enable real-time sharing of underwater intelligence across naval task groups. Simulation and modeling tools support mission planning and operator training in highly complex underwater conditions. These technological advancements transform anti submarine warfare from reactive search operations into proactive and predictive maritime defense capabilities.

Key Drivers in Anti Submarine Warfare

The demand for advanced anti submarine warfare capabilities is driven by the strategic value of submarines and the challenges they pose. Submarine proliferation and technological sophistication increase the need for effective countermeasures. Protection of naval task forces, commercial shipping routes, and undersea communication infrastructure reinforces the importance of underwater surveillance. Naval modernization programs prioritize undersea dominance as a prerequisite for broader maritime control. Joint operations require integrated anti submarine capabilities across air, surface, and subsurface domains. The expansion of unmanned and autonomous systems also drives investment in counter-detection and tracking technologies. Training and readiness requirements emphasize continuous monitoring and rapid response. Additionally, strategic deterrence considerations make anti submarine warfare essential for maintaining balance in maritime power. These drivers ensure sustained focus on enhancing underwater defense capabilities.

Regional Trends in Anti Submarine Warfare

Regional approaches to anti submarine warfare reflect distinct maritime geographies and threat perceptions. North American forces emphasize deep-ocean surveillance and integration across allied naval networks. European navies focus on monitoring constrained seas and protecting undersea infrastructure through cooperative operations. Asia-Pacific countries prioritize anti submarine capabilities due to dense maritime traffic and complex littoral environments. Middle Eastern forces concentrate on securing narrow waterways and offshore assets. African maritime forces emphasize surveillance and capacity-building to monitor expanding maritime zones. Across regions, there is increasing investment in sensor networks, training, and cooperative maritime security frameworks. These regional trends highlight how anti submarine warfare strategies are shaped by geography, alliances, and evolving underwater challenges.

Key Anti Submarine Warfare Program:

The Royal Navy awarded a £40 million contract in 2025 to replenish sonobuoy inventories for maritime patrol aircraft conducting anti-submarine operations in the North Atlantic. Ultra Maritime secured a CAD $200 million contract to equip Netherlands and Belgian surface combatants with integrated ASW sensor suites combining hull-mounted sonar, towed arrays, and acoustic processing systems. These investments address growing undersea threats from advanced diesel-electric and nuclear-powered submarines operated by peer competitors.

Table of Contents

Anti Submarine Warfare Market - Table of Contents

Anti Submarine Warfare Market Report Definition

Anti Submarine Warfare Market Segmentation

By Region

By Application

By Platform

Anti Submarine Warfare Market Analysis for next 10 Years

The 10-year anti submarine warfare market analysis would give a detailed overview of Anti Submarine Warfare Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Anti Submarine Warfare Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Anti Submarine Warfare Market Forecast

The 10-year Anti Submarine Warfare Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Anti Submarine Warfare Market Trends & Forecast

The regional Anti Submarine Warfare Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Anti Submarine Warfare Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Anti Submarine Warfare Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Anti Submarine Warfare Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Application, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Application, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2026-2036

List of Figures

- Figure 1: Global Anti Submarine Warfare Market Forecast, 2026-2036

- Figure 2: Global Anti Submarine Warfare Market Forecast, By Region, 2026-2036

- Figure 3: Global Anti Submarine Warfare Market Forecast, By Application, 2026-2036

- Figure 4: Global Anti Submarine Warfare Market Forecast, By Platform, 2026-2036

- Figure 5: North America, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 6: Europe, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 8: APAC, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 9: South America, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 10: United States, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 11: United States, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 12: Canada, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 14: Italy, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 16: France, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 17: France, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 18: Germany, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 24: Spain, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 30: Australia, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 32: India, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 33: India, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 34: China, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 35: China, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 40: Japan, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Anti Submarine Warfare Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Anti Submarine Warfare Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Anti Submarine Warfare Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Anti Submarine Warfare Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Anti Submarine Warfare Market, By Application (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Anti Submarine Warfare Market, By Application (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Anti Submarine Warfare Market, By Platform (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Anti Submarine Warfare Market, By Platform (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Anti Submarine Warfare Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Anti Submarine Warfare Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Anti Submarine Warfare Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Anti Submarine Warfare Market, By Region, 2026-2036

- Figure 58: Scenario 1, Anti Submarine Warfare Market, By Application, 2026-2036

- Figure 59: Scenario 1, Anti Submarine Warfare Market, By Platform, 2026-2036

- Figure 60: Scenario 2, Anti Submarine Warfare Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Anti Submarine Warfare Market, By Region, 2026-2036

- Figure 62: Scenario 2, Anti Submarine Warfare Market, By Application, 2026-2036

- Figure 63: Scenario 2, Anti Submarine Warfare Market, By Platform, 2026-2036

- Figure 64: Company Benchmark, Anti Submarine Warfare Market, 2026-2036