|

市場調查報告書

商品編碼

1927662

全球航空航太與國防工業銅需求(2026-2036 年)Global Copper demand in Aerospace & Defense Industry 2026-2036 |

||||||

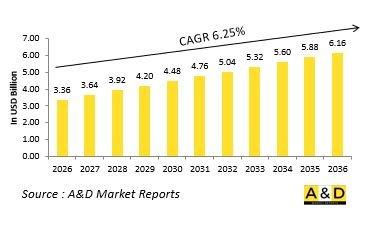

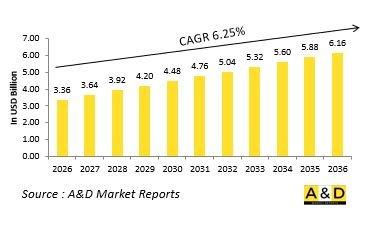

2026 年全球航空航太和國防工業銅需求預計為 33.6 億美元,預計從 2026 年到 2036 年將以 6.25% 的複合年增長率增長,到 2036 年將達到 61.6 億美元。

全球航空航太與國防工業銅需求概述

銅是航空航太和國防應用中的關鍵材料,因其優異的導電性和導熱性、耐腐蝕性和機械強度而備受重視。 銅的應用範圍十分廣泛,涵蓋飛機佈線、配電系統、航空電子設備、雷達系統和通訊網路。在國防系統中,銅對於可靠的電子設備、感測器和飛彈系統至關重要,這些系統容不得任何故障。現代軍事平台日益複雜的,包括無人機、電子戰系統和衛星技術,正在推動對銅的需求。此外,在航空航太領域,銅對於商用和軍用飛機的推進系統、能源管理和熱控系統都至關重要。業界朝著更輕量化、更耐用和更高性能的方向發展,確保銅在提升運作效率和系統可靠性方面繼續發揮核心作用。由於地緣政治因素會影響採購和提煉,供應鏈的穩定性是關鍵考慮因素。為了在控製成本和實現永續性的同時滿足不斷增長的需求,回收和替代採購策略變得越來越重要。總而言之,銅獨特的性能、多功能性以及在關鍵任務系統中發揮的關鍵作用,使其成為現代航空航天和國防工業不可或缺的一部分,直接影響創新、系統性能和戰略規劃。

航空航太和國防工業中影響全球銅需求的技術因素

航空航太和國防系統的技術進步顯著影響銅的需求,因為現代平台需要高性能的電氣、熱學和通訊組件。諸如電力推進、混合動力飛機系統、大容量儲能和先進航空電子設備等新興技術,正在提高對銅的數量和品質要求。電子戰和雷達系統依靠銅來實現高效的信號傳輸和散熱,而衛星通訊和天基感測器則依靠可靠的銅導體來不間斷運作。積層製造和精密加工技術使得銅能夠被加工成複雜的組件,從而在保持導電性和熱性能的同時,提高了設計的靈活性。將銅整合到緊湊型電子設備和小型化系統中,符合飛機和國防平台朝向更輕、更有效率方向發展的趨勢。材料科學的創新,包括銅合金和塗層,正在提高銅的耐腐蝕性、耐久性和在惡劣環境下的性能。國防電子設備的網路安全和可靠性也推動了對高品質銅組件的需求,以防止故障發生。隨著新型推進、能源和感測器技術的不斷發展,它們越來越依賴銅作為基礎材料,而這些技術趨勢正是航空航太和國防領域銅需求的關鍵驅動因素。

航空航太和國防工業銅需求的關鍵驅動因素

全球航空航太和國防領域的銅需求受多種因素驅動。隨著包括無人機平台、雷達網路和通訊系統在內的飛機和國防系統日益複雜,高品質銅對於確保其可靠性能至關重要。電動和混合動力推進技術的日益普及,以及先進儲能和電源管理解決方案的應用,進一步增加了對銅的需求。多個地區的國防現代化計劃和採購項目,重點在於機隊升級、整合先進電子設備和增強系統韌性,這些都進一步推動了銅的消耗。感測器系統、航空電子設備和衛星通訊技術的進步需要高精度銅組件。在關鍵系統中,可靠性、耐久性和熱管理使得銅在風險較高的運作環境中至關重要。 供應鏈的考量,包括原物料採購和品質保證,都會影響採購和策略庫存規劃。此外,環境法規和永續發展措施推動了銅的回收和再利用,間接影響市場動態。營運需求、技術進步和戰略國防優先事項的交匯,正在支撐銅需求的持續成長,鞏固其作為航空航太和國防領域關鍵全球材料的地位。

航空航太與國防工業銅需求的區域趨勢

航空航太和國防工業對銅的區域需求因工業基礎、國防優先事項和技術應用而異。北美擁有強大的研發基礎設施,強調高性能銅在先進飛機、無人系統和太空防禦技術的應用。歐洲通常專注於將銅整合到多用途飛機、雷達網路和聯合防禦項目中,力求在性能和永續性之間取得平衡。亞太地區由於軍事現代化項目的擴展、民用航空活動的增加以及本土航空航天技術的開發,正經歷著快速增長。 中東國家優先將銅用於高科技國防系統,例如飛彈、監視平台和戰略飛機,通常透過國際合作採購零件。非洲和南美市場呈現選擇性成長,專注於在航空、海軍和通訊系統中實現成本效益高的部署,同時逐步引入先進材料。電氣化、小型化和網路化國防系統的趨勢正在推動所有地區銅用量的成長。回收利用計畫和安全的採購實踐影響著區域策略,確保銅供應與長期營運和工業目標保持一致。工業能力、技術應用和戰略重點的區域差異塑造了銅需求,同時也反映了全球航空航太和國防能力的進步。

航空航太和國防工業的主要銅需求項目:

美國國防後勤局 (DLA) 撥款 100 萬美元用於銅業先進鑄造技術開發。國防後勤局 (DLA) 為美國國防部的全球後勤需求提供支持,並為各軍事司令部和聯合作戰司令部提供支援。 其使命是為全球美軍提供經濟高效、可靠的後勤保障,確保其在和平時期和戰時都能保持戰備狀態。

目錄

航空航太與國防市場銅零件 - 目錄

航空航太與國防市場報告中銅部件的定義

航空航太與國防市場細分

按部件

按工藝

按地區

按合金

航空航太與國防市場銅零件未來十年分析

本章詳細概述了航空航太與國防市場銅零件的市場成長、趨勢變化、技術應用概況以及整體市場吸引力,並進行了未來十年的市場分析。

門禁控制市場技術概況

本部分討論了預計將影響該市場的十大技術,以及這些技術可能對整體市場產生的影響。

全球門禁管制市場預測

以上各部分詳細闡述了該市場未來十年的預測。

區域門禁管制市場趨勢及預測

本部分涵蓋區域門禁管制市場的趨勢、驅動因素、限制因素、挑戰以及政治、經濟、社會和技術因素。此外,還提供了詳細的區域市場預測和情境分析。最終的區域分析包括主要公司概況、供應商格局和公司基準分析。目前市場規模是基於 "一切照舊" 情境估算的。

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測與情境分析

主要公司

供應商層級結構

公司標竿分析

歐洲

中東

亞太地區

南美洲

門禁控制市場國家分析

本章涵蓋該市場的主要國防項目以及最新的市場新聞和專利申請。此外,本章也提供未來十年各國的市場預測和情境分析。

美國

國防項目

最新消息

專利

當前市場技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

德國

澳洲

南非

印度

中國

俄羅斯

南非

韓國

日本

馬來西亞

新加坡

巴西

門禁市場機會矩陣

機會矩陣幫助讀者了解該市場中高機會細分領域。

專家對門禁市場報告的意見

本報告總結了我們專家對此市場分析潛力的意見。

結論

關於航空與國防市場報告

The Global Copper demand in Aerospace & Defense Industry market is estimated at USD 3.36 billion in 2026, projected to grow to USD 6.16 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 6.25% over the forecast period 2026-2036.

Introduction to Global Copper Demand in Aerospace & Defense Industry

Copper is a critical material in aerospace and defense applications, valued for its excellent electrical and thermal conductivity, corrosion resistance, and mechanical strength. Its widespread use spans aircraft wiring, power distribution systems, avionics, radar systems, and communication networks. In defense systems, copper is essential for high-reliability electronics, sensors, and missile systems where operational failure is not an option. The increasing complexity of modern military platforms, including unmanned aerial vehicles, electronic warfare systems, and satellite technologies, has intensified copper requirements. Additionally, the aerospace sector relies on copper for propulsion systems, energy management, and thermal control in both commercial and military aircraft. Industrial focus on lightweight, durable, and high-performance materials ensures that copper remains central to achieving operational efficiency and system reliability. Supply chain stability is a major consideration due to geopolitical factors affecting sourcing and refining. Recycling and alternative sourcing strategies are gaining importance to meet rising demand while managing cost and sustainability. Overall, copper's unique properties, versatility, and critical role in mission-critical systems make it indispensable for modern aerospace and defense industries, directly influencing technological innovation, system performance, and strategic planning.

Technology Impact in Global Copper Demand in Aerospace & Defense Industry

Technological advancements in aerospace and defense systems have significantly influenced the demand for copper, as modern platforms require high-performance electrical, thermal, and communication components. Emerging technologies such as electric propulsion, hybrid aircraft systems, high-capacity energy storage, and advanced avionics increase the volume and quality requirements for copper. Electronic warfare and radar systems rely on copper for efficient signal transmission and heat dissipation, while satellite communications and space-based sensors depend on reliable copper conductors for uninterrupted operations. Additive manufacturing and precision machining allow copper to be formed into complex components, enhancing design flexibility while maintaining conductivity and thermal performance. Integration of copper in compact electronics and miniaturized systems supports the trend toward lighter, more efficient aircraft and defense platforms. Materials science innovations, including copper alloys and coatings, improve corrosion resistance, durability, and performance under extreme conditions. Cybersecurity and reliability considerations in defense electronics further necessitate high-quality copper components to prevent failures. As new propulsion, energy, and sensor technologies evolve, the reliance on copper as a foundational material grows, making technological trends a central driver of its demand across aerospace and defense sectors.

Key Drivers in Copper Demand in Aerospace & Defense Industry

Several factors drive global copper demand in aerospace and defense sectors. The growing sophistication of aircraft and defense systems, including unmanned aerial platforms, radar networks, and communication systems, necessitates high-quality copper for reliable performance. Increasing adoption of electric and hybrid propulsion technologies, along with advanced energy storage and power management solutions, amplifies material requirements. Defense modernization initiatives and procurement programs in multiple regions focus on upgrading fleets, integrating advanced electronics, and enhancing system resilience, further boosting copper consumption. Technological progress in sensor systems, avionics, and satellite communications requires high-precision copper components. Reliability, durability, and thermal management in critical systems make copper indispensable in high-stakes operational environments. Supply chain considerations, including raw material sourcing and quality assurance, influence procurement and strategic inventory planning. Additionally, environmental regulations and sustainability initiatives encourage recycling and reuse of copper, indirectly affecting market dynamics. The intersection of operational necessity, technological evolution, and strategic defense priorities collectively underpins sustained growth in copper demand, reinforcing its status as a core material in aerospace and defense applications globally.

Regional Trends in Copper Demand in Aerospace & Defense Industry

Regional demand for copper in aerospace and defense varies according to industrial capabilities, defense priorities, and technological adoption. North America emphasizes high-performance copper for advanced aircraft, unmanned systems, and space-based defense technologies, driven by robust research and development infrastructure. Europe focuses on integrating copper in multi-role aircraft, radar networks, and collaborative defense programs, often balancing performance with sustainability considerations. Asia-Pacific demonstrates rapid growth due to expanding military modernization programs, increasing commercial aviation activity, and development of indigenous aerospace technologies. Middle Eastern nations prioritize copper for high-tech defense systems, including missiles, surveillance platforms, and strategic aircraft, often sourcing components through international partnerships. African and South American markets show selective growth, focusing on cost-efficient deployment in air, naval, and communication systems while gradually adopting advanced materials. Across all regions, trends in electrification, miniaturization, and networked defense systems drive higher copper utilization. Recycling initiatives and secure sourcing practices influence regional strategies, ensuring that copper availability aligns with long-term operational and industrial goals. Variations in regional industrial capacity, technological adoption, and strategic priorities shape copper demand while reflecting global advancements in aerospace and defense capabilities.

Key Copper demand in Aerospace & Defense Industry Program:

U.S. Defense Logistics Agency Allocates $1 Million to Copper Industry for Advanced Casting Technology. The Defense Logistics Agency supports the global logistics requirements of the U.S. Department of Defense, serving the Military Departments and Unified Combatant Commands. Its mission is to deliver cost-effective, reliable logistics support to U.S. Armed Forces worldwide, ensuring continuous readiness during both peacetime and conflict.

Table of Contents

Copper Component In The Aerospace And Defense Market - Table of Contents

Copper Component In The Aerospace And Defense Market Report Definition

Copper Component In The Aerospace And Defense Market Segmentation

By Component

By Process

By Region

By Alloy

Copper Component In The Aerospace And Defense Market Analysis for next 10 Years

The 10-year Copper Component In The Aerospace And Defense market analysis would give a detailed overview of Copper Component In The Aerospace And Defense market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Access Control Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Access Control Market Forecast

The 10-year access control market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Access Control Market Trends & Forecast

The regional access control market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Access Control Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Access Control Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2026-2036

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2026-2036

- Table 18: Scenario Analysis, Scenario 1, By Component, 2026-2036

- Table 19: Scenario Analysis, Scenario 1, By Alloy, 2026-2036

- Table 20: Scenario Analysis, Scenario 2, By Region, 2026-2036

- Table 21: Scenario Analysis, Scenario 2, By Component, 2026-2036

- Table 22: Scenario Analysis, Scenario 2, By Alloy, 2026-2036

List of Figures

- Figure 1: Global Copper Demand A&D Market Forecast, 2026-2036

- Figure 2: Global Copper Demand A&D Market Forecast, By Region, 2026-2036

- Figure 3: Global Copper Demand A&D Market Forecast, By Component, 2026-2036

- Figure 4: Global Copper Demand A&D Market Forecast, By Alloy, 2026-2036

- Figure 5: North America, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 6: Europe, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 7: Middle East, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 8: APAC, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 9: South America, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 10: United States, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 11: United States, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 12: Canada, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 13: Canada, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 14: Italy, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 15: Italy, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 16: France, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 17: France, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 18: Germany, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 19: Germany, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 20: Netherlands, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 21: Netherlands, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 22: Belgium, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 23: Belgium, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 24: Spain, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 25: Spain, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 26: Sweden, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 27: Sweden, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 28: Brazil, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 29: Brazil, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 30: Australia, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 31: Australia, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 32: India, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 33: India, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 34: China, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 35: China, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 36: Saudi Arabia, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 37: Saudi Arabia, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 38: South Korea, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 39: South Korea, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 40: Japan, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 41: Japan, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 42: Malaysia, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 43: Malaysia, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 44: Singapore, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 45: Singapore, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 46: United Kingdom, Copper Demand A&D Market, Technology Maturation, 2026-2036

- Figure 47: United Kingdom, Copper Demand A&D Market, Market Forecast, 2026-2036

- Figure 48: Opportunity Analysis, Copper Demand A&D Market, By Region (Cumulative Market), 2026-2036

- Figure 49: Opportunity Analysis, Copper Demand A&D Market, By Region (CAGR), 2026-2036

- Figure 50: Opportunity Analysis, Copper Demand A&D Market, By Component (Cumulative Market), 2026-2036

- Figure 51: Opportunity Analysis, Copper Demand A&D Market, By Component (CAGR), 2026-2036

- Figure 52: Opportunity Analysis, Copper Demand A&D Market, By Alloy (Cumulative Market), 2026-2036

- Figure 53: Opportunity Analysis, Copper Demand A&D Market, By Alloy (CAGR), 2026-2036

- Figure 54: Scenario Analysis, Copper Demand A&D Market, Cumulative Market, 2026-2036

- Figure 55: Scenario Analysis, Copper Demand A&D Market, Global Market, 2026-2036

- Figure 56: Scenario 1, Copper Demand A&D Market, Total Market, 2026-2036

- Figure 57: Scenario 1, Copper Demand A&D Market, By Region, 2026-2036

- Figure 58: Scenario 1, Copper Demand A&D Market, By Component, 2026-2036

- Figure 59: Scenario 1, Copper Demand A&D Market, By Alloy, 2026-2036

- Figure 60: Scenario 2, Copper Demand A&D Market, Total Market, 2026-2036

- Figure 61: Scenario 2, Copper Demand A&D Market, By Region, 2026-2036

- Figure 62: Scenario 2, Copper Demand A&D Market, By Component, 2026-2036

- Figure 63: Scenario 2, Copper Demand A&D Market, By Alloy, 2026-2036

- Figure 64: Company Benchmark, Copper Demand A&D Market, 2026-2036