|

市場調查報告書

商品編碼

1905001

全球國防裝甲材料市場(2026-2036)Global Defense Armor Materials Market 2026-2036 |

||||||

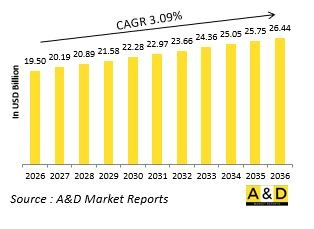

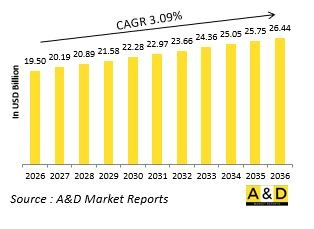

據估計,2026年全球國防裝甲材料市場規模為195億美元,預計到2036年將達到264.4億美元,2026年至2036年的複合年增長率(CAGR)為3.09%。

國防裝甲材料市場簡介

全球國防裝甲材料市場涵蓋用於保護人員、車輛、船艦和飛機免受彈道、爆炸、彈片和定向能威脅的專用材料。現代裝甲對材料科學提出了複雜的挑戰,需要在各種作戰場景下平衡防護等級、重量、厚度、成本和多威脅應對能力。所用材料包括高硬度鋼、鋁合金、陶瓷、複合材料、透明裝甲以及能夠主動防禦威脅的反應系統。應用範圍涵蓋個人防彈衣、車輛應用套件、主戰坦克的整合式車身結構以及艦船和飛機的防護系統。隨著威脅機制的演變,例如聚能裝藥、爆炸成形穿甲彈和動能穿甲彈,裝甲材料必須透過新的材料組合、幾何形狀以及主動防護系統的整合來應對挑戰。威脅與防護之間的持續衝突推動著這個至關重要的國防領域的持續創新。

科技對國防裝甲材料市場的影響

裝甲材料的技術進步主要集中在多功能性、輕量化和自適應防護方面。奈米工程材料,包括碳奈米管、石墨烯和金屬玻璃,為下一代裝甲系統提供了卓越的強度重量比。透明陶瓷和層壓聚合物複合材料在提升彈道防護性能的同時,也能減輕遮蔽視線和頂篷應用中的重量。積層製造技術能夠生產具有梯度材料特性的複雜裝甲零件,這些零件可針對特定威脅進行最佳化。主動防護系統能夠偵測並攔截來襲威脅,從而在被動裝甲材料受到攻擊之前就將其攔截,起到補充作用。多重打擊設計透過精心設計的失效模式,確保即使在首次受到攻擊後也能持續提供防護。整合式健康監測感測器無需目視檢查即可檢測裝甲損傷。這些進步解決了裝甲設計中的一個根本挑戰:在保證最大防護性能的同時,最大限度地減少重量和體積,並保持經濟性,以便廣泛部署。

國防裝甲材料市場的主要驅動因素

從先進的火箭推進榴彈到頂部攻擊飛彈系統,威力日益強大的反裝甲武器的擴散,不斷催生了對更先進防護解決方案的需求。非對稱作戰環境使平台和人員面臨各種威脅,包括簡易爆炸裝置,因此需要能夠有效應對多種威脅機制的裝甲解決方案。車輛重量受限於運輸性、機動性和燃油效率,因此需要輕質裝甲材料,以最大限度地提高單位品質的防護能力。增強人員防護的需求推動了舒適、靈活的防彈衣的研發,這種防彈衣能夠在提供廣泛防護的同時,又不限制行動能力。平台生存能力的要求促使人們採用整合裝甲結構,這種結構能夠在保護關鍵部件和乘員艙的同時,最大限度地減輕整體重量。此外,成本方面的考慮也推動了製造流程和替代材料的創新,以在可持續的採購和生命週期成本下,大規模地提供所需的防護水平。

國防裝甲材料市場區域趨勢

各地區的裝甲材料產能反映了威脅環境、車輛裝備狀況和工業技術水準的差異。北美地區的研發重點是為下一代作戰車輛整合被動、反應和主動元件的車輛防護系統。歐洲的創新則著重於輪式裝甲車輛和個人防護系統的輕質複合材料解決方案。亞太地區正快速推動陶瓷裝甲材料和現有平台車輛改裝方案的研發。以色列工業憑藉其持續的作戰經驗和快速原型製造能力,在創新裝甲解決方案方面表現卓越。中東國家正投資於全面的車輛防護升級,以應對特定的區域威脅和環境條件。發展中國家越來越多地尋求技術轉讓,以在車輛採購合約中實現本地裝甲生產。全球材料供應和出口管制影響著區域生產能力,而一些具有重要戰略意義的地區則受到某些戰略材料的限制,這促使人們進行本地替代和研發活動。

本報告檢視並分析了全球國防裝甲材料市場,提供了影響該市場的技術資訊、未來十年的預測以及區域趨勢。

目錄

國防裝甲材料市場報告定義

國防裝甲材料市場區隔

按地區

按類型

按應用

未來十年國防裝甲材料市場分析

國防裝甲材料市場技術

全球國防裝甲材料市場預測

區域國防裝甲材料市場趨勢及預測

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測及情境分析

主要公司

供應商層級市場概況

公司標竿分析

歐洲

中東

亞太地區

南美洲

國防裝甲材料市場國家分析

美國

國防項目

最新消息

專利

當前市場技術成熟度

市場預測及情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

國防裝甲材料市場機會矩陣

專家對國防裝甲材料市場報告的意見

結論

關於航空和國防市場報告

The Global Defense Armor Materials market is estimated at USD 19.50 billion in 2026, projected to grow to USD 26.44 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.09% over the forecast period 2026-2036.

Introduction to Defense Armor Materials Market

The Global Defense Armor Materials Market encompasses specialized materials engineered to protect personnel, vehicles, vessels, and aircraft from ballistic, blast, fragmentary, and directed energy threats. Modern armor represents a sophisticated materials science challenge, balancing protection level, weight, thickness, cost, and multi-threat capability across diverse operational scenarios. Materials employed include high-hardness steels, aluminum alloys, ceramics, composites, transparent armors, and reactive systems that actively defeat threats. Applications range from personal body armor and vehicle applique kits to integrated hull structures for main battle tanks and protective systems for ships and aircraft. As threat mechanisms evolve-incorporating shaped charges, explosively formed penetrators, and kinetic energy penetrators-armor materials must correspondingly advance through novel material combinations, geometrical arrangements, and active protection integration. The perpetual competition between threat and protection drives continuous innovation in this fundamentally important defense sector.

Technology Impact in Defense Armor Materials Market:

Technological evolution in armor materials focuses on multi-functional capability, weight reduction, and adaptive protection. Nano-engineered materials-including carbon nanotubes, graphene, and metallic glasses-offer exceptional strength-to-weight ratios for next-generation armor systems. Transparent ceramics and laminated polymer composites provide improved ballistic protection for vision blocks and canopy applications with reduced weight. Additive manufacturing enables complex geometry armor components with graded material properties optimized for specific threat directions. Active protection systems detect and intercept incoming threats before impact, complementing passive armor materials. Multi-hit capability designs ensure continued protection after initial impacts through carefully engineered failure modes. Integrated health monitoring sensors detect armor damage without visual inspection. These advancements address the fundamental armor design challenge of providing maximum protection within minimum weight and volume allocations while maintaining affordability for widespread deployment.

Key Drivers in Defense Armor Materials Market:

The proliferation of increasingly potent anti-armor weapons-from advanced rocket-propelled grenades to top-attack missile systems-creates continuous demand for improved protective solutions. Asymmetric warfare environments expose platforms and personnel to diverse threats including improvised explosive devices, requiring armor solutions effective across multiple threat mechanisms. Vehicle weight constraints-dictated by transportability, mobility, and fuel efficiency-mandate lightweight armor materials that maximize protection per unit mass. Personnel protection enhancement drives development of more comfortable, flexible body armor that provides greater coverage without restricting mobility. Platform survivability requirements favor integrated armor architectures that protect critical components and crew compartments while minimizing overall weight penalty. Additionally, cost considerations drive innovation in manufacturing processes and material alternatives that deliver required protection levels at sustainable acquisition and lifecycle costs for large-scale deployment.

Regional Trends in Defense Armor Materials Market:

Regional armor material capabilities reflect differing threat environments, vehicle inventories, and industrial expertise. North American development emphasizes integrated vehicle protection suites combining passive, reactive, and active elements for next-generation combat vehicles. European innovation focuses on lightweight composite solutions for wheeled armored vehicles and personal protection systems. The Asia-Pacific region shows rapid advancement in ceramic armor materials and vehicle upgrade packages for existing platforms. Israeli industry excels in innovative armor solutions derived from continuous operational experience and rapid prototyping capabilities. Middle Eastern nations invest in comprehensive vehicle protection upgrades tailored to specific regional threats and environmental conditions. Developing nations increasingly seek technology transfer for local armor production as part of vehicle procurement agreements. Global material availability and export controls influence regional capabilities, with some strategic materials subject to restrictions that drive local substitution or development efforts in strategically important regions.

Key Defense Armor Materials Program:

BEML Limited's June 2025 licensing pacts with DRDO's VRDE for Arjun MBT variants include composite armor modules for Unit Maintenance Vehicle (UMV) and Repair Vehicle (URV). Valued at ₹1,000+ crore over 5 years, contracts cover 100+ units with Kanchan-Dyneema hybrid panels offering 1.5x steel protection at 40% weight. Production at BEML's Bangalore plant ramps to 20/year by 2027, enhancing 124 Arjun Mk1A fleet sustainment. Field trials validated blast resistance, addressing mobility issues in deserts. This supports Army's 2030 armored recapitalization, reducing import reliance from Israel/Russia.

Table of Contents

Defense Armor Materials Market Report Definition

Defense Armor Materials Market Segmentation

By Region

By Type

By Application

Defense Armor Materials Market Analysis for next 10 Years

The 10-year Defense Armor Materials Market analysis would give a detailed overview of Defense Armor Materials Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Armor Materials Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Armor Materials Market Forecast

The 10-year Defense Armor Materials Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Armor Materials Market Trends & Forecast

The regional Defense Armor Materials Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Armor Materials Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Armor Materials Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Armor Materials Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Armor Materials Market Forecast, 2025-2035

- Figure 2: Global Defense Armor Materials Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Armor Materials Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Armor Materials Market Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Armor Materials Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Armor Materials Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Armor Materials Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Armor Materials Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Armor Materials Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Armor Materials Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Armor Materials Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Armor Materials Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Armor Materials Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Armor Materials Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Armor Materials Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Armor Materials Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Armor Materials Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Armor Materials Market, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Armor Materials Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Armor Materials Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Armor Materials Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Armor Materials Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Armor Materials Market, 2025-2035