|

市場調查報告書

商品編碼

1904996

全球國防複合材料市場:2026-2036Global Defense Composites Market 2026-2036 |

||||||

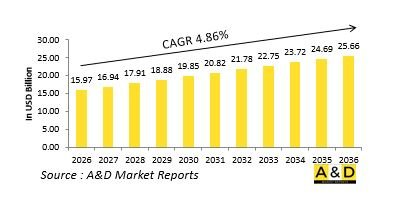

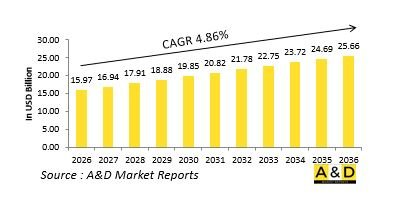

據估計,2026年全球國防複合材料市場規模為159.7億美元,預計到2036年將達到256.6億美元,2026年至2036年的複合年增長率(CAGR)為4.86%。

國防複合材料市場簡介

全球國防複合材料市場涵蓋將兩種或多種物理或化學性質差異顯著的組成材料結合在一起的工程材料,從而生產出一種性能不同於其各個組成材料的材料。國防應用通常涉及將碳纖維、玻璃纖維或芳綸等增強纖維嵌入聚合物、金屬或陶瓷基體中。與鋁和鋼等傳統材料相比,複合材料具有更高的強度重量比、耐腐蝕性、雷達透明度和設計靈活性。其應用涵蓋所有軍事領域,包括飛機結構、無人系統、車輛裝甲、海軍艦艇、飛彈零件和個人防護裝備。透過調整纖維取向、堆疊順序和樹脂配方來定製材料性能,可以針對特定需求進行優化,例如隱身、彈道防護和極端環境下的耐久性。隨著國防平台在嚴格的重量限制下追求更高的性能,複合材料正從專業應用領域轉向影響平台整體設計和性能的基礎材料。

國防複合材料市場的技術影響因素:

國防複合材料的技術進步主要集中在製造效率、性能提升和多功能性方面。自動化纖維鋪放和膠帶鋪放設備能夠精確、可重複地製造大型複雜結構,進而降低人力成本。非熱壓罐固化製程在保持材料性能的同時,降低了生產成本。奈米技術的應用,包括碳奈米管和石墨烯添加劑,提高了材料的機械性能、導電性和損傷容限。多功能複合材料整合了用於結構健康監測的嵌入式感測器、用於電磁屏蔽的導電線路以及用於熱管理的相變材料。可回收和生物基樹脂體系解決了環境問題,並實現了生命週期的可持續性。數位孿生技術優化了複合材料的設計,並預測了其整個使用壽命期間的性能。這些進步正在拓展複合材料的應用範圍,同時提高了其在嚴苛的國防環境中的經濟性和可靠性。

國防複合材料市場的主要驅動因素:

所有移動防禦平台對減重的不懈追求,推動了複合材料的持續應用和發展,以提高有效載荷、航程和燃油效率。低可偵測性平台的隱身要求也使複合材料憑藉其雷達吸波和形狀控制能力成為理想之選。裝甲應用重視複合材料在提供彈道防護的同時,還能比金屬材料減輕重量。優異的耐腐蝕性有助於降低維修成本,並提高海軍和近海系統的可用性。設計靈活性允許將多個組件整合到單一複合材料部件中,從而降低組裝複雜性。無人系統的激增催生了對兼顧性能和成本效益的複合材料解決方案的需求,以滿足可能消耗型平台的需求。此外,供應鏈安全問題也推動了戰略要地國內複合材料原料來源和加工能力的發展。

國防複合材料市場區域趨勢:

各區域的複合材料技術能力反映了產業優先事項、平台規劃和材料科學專業知識的差異。北美產業在先進航空航天應用領域處於領先地位,尤其是在戰鬥機和隱形平台方面。歐洲的發展除了先進的航空航天技術外,還強調將源自汽車的技術應用於裝甲車輛。亞太地區正在快速發展,日本和韓國在碳纖維生產方面展現出強大的實力,而中國正在建立一個全面的複合材料生態系統,以支持其平台項目。以色列工業在裝甲車輛升級和無人系統等專業應用領域展現出創新能力。中東國家正在加大對複合材料維修和維護設施的投資,以支援其先進的飛機機隊。材料出口管制和技術轉移限制為擁有國內材料生產能力的地區提供了競爭優勢,同時也鼓勵了那些尋求戰略性產業自主的地區的本土發展。

主要國防複合材料項目:

巴拉特鍛造公司(Bharat Forge)的ATAGS 155毫米牽引式榴彈砲合約(已獲國防採購委員會批准,將於2025年底交付)採用先進的碳纖維複合材料製造砲管護套和後座力系統。已批准307門火砲(價值700億盧比)。這些火砲比鋼製版本輕20%,提高了48公里射程內的火力支援機動性。由海德拉巴複合材料研發中心 (CFMRI) 開發的國產材料確保了 60% 的國產化率。這些材料已在惡劣氣候條件下證明了其耐久性。交付將於 2026 年第二季開始,從而解決自博福斯時代以來火砲裝備短缺的問題。擴大的私部門產能將與埃爾比特系統公司等全球競爭對手競爭,並支持對亞美尼亞的出口計畫。複合材料還能減輕在拉達克等高海拔地區部署時的後勤負擔。

目錄

國防複合材料市場報告定義

國防複合材料市場區隔

按類型

按地區

按應用

未來十年國防複合材料市場分析

本章透過對未來十年國防複合材料市場的分析,詳細概述了國防複合材料市場的成長、趨勢變化、技術應用概況以及市場吸引力。

國防複合材料市場技術

本部分討論了預計將影響該市場的十大技術,以及這些技術可能對整體市場產生的潛在影響。

全球國防複合材料市場預測

以上各細分市場詳細涵蓋了未來十年的國防複合材料市場預測。

區域國防複合材料市場趨勢與預測

本部分涵蓋了區域國防複合材料市場的趨勢、驅動因素、限制因素、挑戰以及政治、經濟、社會和技術因素。此外,還提供了詳細的區域市場預測和情境分析。最終的區域分析包括主要公司的概況、供應商狀況和公司基準分析。目前市場規模是基於 "一切照舊" 情境估算的。

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測與情境分析

主要公司

供應商層級結構

公司標竿分析

歐洲

中東

亞太地區

南美洲

國防複合材料市場國家分析

本章涵蓋該市場的主要國防項目以及最新的市場動態和專利申請資訊。此外,本章也提供未來十年各國的市場預測和情境分析。

美國

國防項目

最新消息

專利

當前市場技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

德國

澳洲

南非

印度

中國

俄羅斯

南非

韓國

日本

馬來西亞

新加坡

巴西

國防複合材料市場機會矩陣

機會矩陣幫助讀者了解該市場中高機會細分領域。

專家對國防複合材料市場報告的意見

本報告總結了我們專家對此市場潛力分析的意見。

結論

關於航空航太與國防市場報告

The Global Defense Composites market is estimated at USD 15.97 billion in 2026, projected to grow to USD 25.66 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 4.86% over the forecast period 2026-2036.

Introduction to Defense Composites Market

The Global Defense Composites Market encompasses engineered materials created by combining two or more constituent materials with significantly different physical or chemical properties to produce a material with characteristics different from the individual components. In defense applications, these typically involve reinforcing fibers-such as carbon, glass, or aramid-embedded in polymer, metal, or ceramic matrices. Composites deliver exceptional strength-to-weight ratios, corrosion resistance, radar transparency, and design flexibility compared to traditional materials like aluminum and steel. Applications span all military domains: aircraft structures, unmanned systems, vehicle armor, naval vessels, missile components, and personal protective equipment. The ability to tailor material properties through fiber orientation, layer sequencing, and resin formulation enables optimization for specific requirements-whether for stealth characteristics, ballistic protection, or extreme environment durability. As defense platforms pursue greater performance within strict weight constraints, composites have transitioned from specialized applications to fundamental materials influencing overall platform design and capability.

Technology Impact in Defense Composites Market:

Technological evolution in defense composites focuses on manufacturing efficiency, performance enhancement, and multifunctionality. Automated fiber placement and tape laying machines enable precise, repeatable fabrication of large complex structures with reduced labor content. Out-of-autoclave curing processes lower production costs while maintaining material properties. Nanotechnology enhancements-including carbon nanotubes and graphene additives-improve mechanical properties, electrical conductivity, and damage tolerance. Multifunctional composites incorporate embedded sensors for structural health monitoring, conductive traces for electromagnetic shielding, or phase-change materials for thermal management. Recyclable and bio-based resin systems address environmental concerns and lifecycle sustainability. Digital twin technology optimizes composite design and predicts performance throughout the service life. These advancements expand composite applications while improving affordability and reliability in demanding defense environments.

Key Drivers in Defense Composites Market:

The relentless pursuit of weight reduction across all mobile defense platforms to increase payload, range, and fuel efficiency drives continuous composite adoption and advancement. Stealth requirements for low observable platforms favor composites for their radar-absorbing and shaping capabilities. Armor applications benefit from composites' ability to provide ballistic protection at reduced weight compared to metallic alternatives. Corrosion resistance advantages reduce maintenance costs and increase availability for naval and coastal-deployed systems. Design flexibility enables integrated structures that combine multiple components into single composite parts, reducing assembly complexity. Unmanned system proliferation creates demand for cost-optimized composite solutions that balance performance and affordability for potentially expendable platforms. Additionally, supply chain security concerns encourage development of domestic composite material sources and processing capabilities in strategically important regions.

Regional Trends in Defense Composites Market:

Regional composite capabilities reflect differing industrial priorities, platform programs, and material science expertise. North American industry leads in advanced aerospace applications, particularly for combat aircraft and stealth platforms. European development emphasizes automotive-derived technologies for armored vehicle applications alongside sophisticated aerospace capabilities. The Asia-Pacific region shows rapid advancement, with Japan and South Korea excelling in carbon fiber production while China develops comprehensive composite ecosystems supporting indigenous platform programs. Israeli industry demonstrates innovation in specialized applications like armored vehicle upgrades and unmanned systems. Middle Eastern nations increasingly invest in composite repair and maintenance facilities to support their advanced aircraft inventories. Material export controls and technology transfer restrictions create competitive advantages for regions with indigenous material production capabilities while driving local development in regions seeking strategic industrial autonomy.

Key Defense Composites Program:

Bharat Forge's ATAGS 155mm towed howitzer contract, DAC-approved end-2025, incorporates advanced carbon-fiber composites for barrel jackets and recoil systems, approved for 307 units at ₹7,000 crore. Lighter by 20% than steel equivalents, composites enhance mobility for 48km range fire support. Indigenous materials from CFMRI Hyderabad ensure 60% local content, with trials validating extreme-weather durability. Supply starts Q2 2026, addressing artillery shortages post-Bofors era. This scales production via private sector, rivaling global peers like Elbit, and supports export bids to Armenia. Composites reduce logistics strain in high-altitude deployments like Ladakh.

Table of Contents

Defense Composites Market Report Definition

Defense Composites Market Segmentation

By Type

By Region

By Application

Defense Composites Market Analysis for next 10 Years

The 10-year Defense Composites Market analysis would give a detailed overview of Defense Composites Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Composites Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Composites Market Forecast

The 10-year Defense Composites Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Composites Market Trends & Forecast

The regional Defense Composites Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Composites Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Composites Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Composites Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Composites Market Forecast, 2025-2035

- Figure 2: Global Defense Composites Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Composites Market Forecast, By Type, 2025-2035

- Figure 4: Global Defense Composites Market Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Composites Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Composites Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Composites Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Composites Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Composites Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Composites Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Composites Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Composites Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Composites Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Composites Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Composites Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Composites Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Composites Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Composites Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Composites Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Composites Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Composites Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Composites Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Composites Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Composites Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Composites Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Composites Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Composites Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Composites Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Composites Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Composites Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Composites Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Composites Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Composites Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Composites Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Composites Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Composites Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Composites Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Composites Market, By Type, 2025-2035

- Figure 59: Scenario 1, Defense Composites Market, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Composites Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Composites Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Composites Market, By Type, 2025-2035

- Figure 63: Scenario 2, Defense Composites Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Composites Market, 2025-2035