|

市場調查報告書

商品編碼

1896748

全球國防訓練與模擬市場(2026-2036)Global Defense Training and Simulation Market 2026-2036 |

||||||

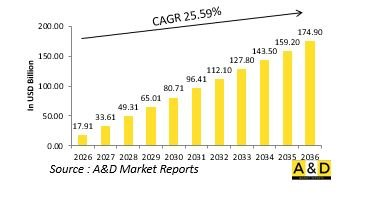

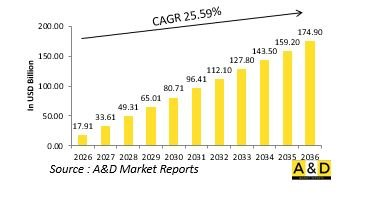

據估計,2026年全球國防訓練與模擬市場規模為179.1億美元,預計到2036年將達到1749億美元,2026年至2036年的複合年增長率(CAGR)為25.59%。

國防訓練與模擬市場簡介

國防訓練與模擬市場涵蓋先進的技術和系統,這些技術和系統能夠重現逼真的軍事場景,從而提高人員的作戰準備、戰略規劃和作戰執行能力。 這些解決方案結合了虛擬、結構和現實世界環境,旨在提升作戰準備和決策能力,同時避免實戰演習帶來的成本和風險。訓練和模擬系統涵蓋廣泛的國防領域,包括空中、陸地、海上和網路作戰。它們使士兵和指揮官能夠在受控條件下演練複雜作戰行動、提升協調能力並評估結果。隨著戰爭日益數位化和先進武器系統的出現,世界各地的國防機構都在大力投資於能夠重現高威脅、多域戰場環境的模擬系統。互通性、精確作戰和作戰適應性的日益重要,使得基於模擬的訓練成為國防戰備和現代化戰略的關鍵組成部分。

科技對國防訓練與模擬市場的影響

技術正在透過創造高度沉浸式、資料驅動和自適應的訓練環境,徹底改變國防訓練和模擬市場。虛擬實境(VR)和擴增實境(AR)技術能夠實現逼真的360度作戰模擬,展現複雜的地形和動態的戰場環境。 人工智慧正被用於產生模擬敵意、分析受訓人員表現以及即時個人化訓練模組。雲端運算和網路化模擬系統的整合使得不同地點的多支部隊能夠在共享的虛擬空間中進行協同訓練。數位孿生和先進的建模工具能夠模擬整個武器平台和作戰系統,使軍隊能夠在不危及實體資產的情況下進行部隊訓練和測試。此外,動作捕捉、觸覺回饋和高清圖形技術的進步,使得模擬效果比以往任何時候都更加逼真。這些技術進步正在將訓練從靜態演習轉變為一個智慧、可擴展的生態系統,從而提升所有國防領域的戰備水平和作戰精度。

國防訓練與模擬市場的主要驅動因素

國防訓練與模擬市場的主要驅動因素是現代戰爭日益複雜,這促使人們需要以更貼近現實、更具成本效益的方式訓練人員。先進國防平台的高昂營運和維護成本,促使軍隊越來越依賴虛擬環境來演練飛行員、車輛和作戰行動。 日益重視多域作戰(即空中、陸地、海上、太空和網路部隊無縫協作)也推動了對綜合訓練系統的需求。預算效率、安全考量和永續發展目標進一步推動了基於模擬的訓練方式的普及,使其成為資源密集型實地演習的替代方案。世界各地的國防現代化計畫都將模擬視為實現戰備和盟軍互通性的關鍵推動因素。此外,無人和自主系統的興起需要專門的訓練框架,而這只能透過先進的模擬技術來實現。這些因素凸顯了模擬在幫助國防人員應對不斷演變的全球威脅方面所發揮的重要作用。

國防訓練與模擬市場的區域趨勢

國防訓練和模擬市場的區域趨勢呈現出受國防優先事項和現代化計畫影響的多樣化模式。北美地區在支援空中和聯合作戰方面投入巨資建設高保真模擬中心和人工智慧驅動的訓練解決方案,處於領先地位。 歐洲正優先發展符合多國防務框架的聯合訓練體系,並促進盟軍間的互通性。亞太地區正迅速擴展其訓練基礎設施,以應對日益緊張的地緣政治局勢和大規模的國防現代化,從而提升戰備水準。中東地區則專注於利用模擬技術進行防空和反恐訓練,以優化在複雜環境下的作戰效能。拉丁美洲和非洲正透過合作和技術轉讓,擴大模擬技術的應用範圍,以提升訓練標準。所有地區都在加速採用虛擬實境/擴增實境平台、網路化模擬系統和數據分析技術。這一全球轉變體現了各國致力於透過新一代基於模擬的訓練來提升作戰準備、協作和決策能力的共同目標。 本報告分析了全球國防訓練和模擬市場,深入剖析了影響該市場的技術、未來十年的市場預測以及區域市場趨勢。

目錄

國防訓練與模擬市場報告定義

國防訓練與模擬市場區隔

按地區

按元件

按應用

未來十年國防訓練與模擬市場分析

國防訓練與模擬市場技術

全球國防訓練與模擬市場預測

區域國防訓練與模擬市場趨勢及預測

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測及情境分析

主要公司

供應商層級現況

公司基準分析

歐洲

中東

亞太地區

南美洲

國防訓練與模擬:國防市場國家分析

美國

國防項目

最新資訊

專利

當前市場技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

國防訓練與模擬市場機會矩陣

專家對國防訓練與模擬市場的看法報告

結論

關於航空和國防市場報告

The Global Defense Training and Simulation market is estimated at USD 17.91 billion in 2026, projected to grow to USD 174.90 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 25.59% over the forecast period 2026-2036.

Introduction to Defense Training and Simulation Market

The defense training and simulation market encompasses advanced technologies and systems that replicate real-world military scenarios to prepare personnel for combat, strategic planning, and mission execution. These solutions combine virtual, constructive, and live simulation environments to enhance operational readiness and decision-making skills without the cost or risk associated with live exercises. Training and simulation systems cover a wide spectrum of defense domains, including air, land, naval, and cyber operations. They enable soldiers and commanders to rehearse complex missions, improve coordination, and assess outcomes in controlled conditions. With the increasing digitization of warfare and the emergence of sophisticated weapon systems, defense forces worldwide are investing heavily in simulated environments that can replicate high-threat, multi-domain battlefields. The growing importance of interoperability, precision warfare, and mission adaptability has made simulation-based training a vital component of defense preparedness and modernization strategies.

Technology Impact in Defense Training and Simulation Market:

Technology is profoundly reshaping the defense training and simulation market by creating highly immersive, data-driven, and adaptive training environments. Virtual and augmented reality technologies are enabling realistic, 360-degree combat simulations that replicate complex terrains and dynamic battlefield conditions. Artificial intelligence is being used to generate adaptive adversaries, analyze trainee performance, and personalize training modules in real time. The integration of cloud computing and networked simulation systems allows multiple units across different locations to train collaboratively in shared virtual spaces. Digital twins and advanced modeling tools are also enabling the simulation of entire weapon platforms or operational systems, allowing forces to train and test without risking physical assets. Moreover, advances in motion capture, haptic feedback, and high-fidelity graphics are making simulations more lifelike than ever before. These technological developments are transforming training from static exercises into intelligent, scalable ecosystems that enhance readiness and operational precision across all defense domains.

Key Drivers in Defense Training and Simulation Market:

The defense training and simulation market is primarily driven by the increasing complexity of modern warfare, which demands realistic and cost-effective methods to train personnel. The high operational and maintenance costs of advanced defense platforms have encouraged militaries to rely more on virtual environments for pilot, vehicle, and mission rehearsals. The rising emphasis on multi-domain operations-where air, land, sea, space, and cyber forces must work seamlessly-has also increased the need for integrated training systems. Budget efficiency, safety concerns, and sustainability goals further propel the adoption of simulation-based training as an alternative to resource-intensive field exercises. Defense modernization initiatives across the world highlight simulation as a key enabler for readiness and joint-force interoperability. Additionally, the emergence of unmanned and autonomous systems requires specialized training frameworks that can only be achieved through advanced simulation. Together, these factors underline simulation's role as an essential element in preparing defense personnel for evolving global threats.

Regional Trends in Defense Training and Simulation Market:

Regional trends in the defense training and simulation market reveal diverse patterns shaped by defense priorities and modernization agendas. North America leads through significant investments in high-fidelity simulation centers and AI-driven training solutions supporting air and joint-force operations. Europe emphasizes collaborative training systems that align with multinational defense frameworks, promoting interoperability among allied forces. The Asia-Pacific region is rapidly expanding its training infrastructure to enhance readiness amid rising geopolitical tensions and large-scale defense modernization. The Middle East focuses on simulation for air defense and counterterrorism training, optimizing operational efficiency in demanding environments. Latin America and Africa are increasingly incorporating simulation technologies to improve training standards through partnerships and technology transfers. Across all regions, the adoption of virtual and augmented reality platforms, networked simulation systems, and data analytics is accelerating. This global shift reflects a unified focus on enhancing combat preparedness, coordination, and decision-making through next-generation simulation-based training.

Key Defense Training and Simulation Program:

CAE announced that it has secured defence contracts worth over C$80 million in the fourth quarter of fiscal year 2016 to deliver simulation products and training services to military customers worldwide. Key awards include a contract from the NATO Support and Procurement Agency (NSPA) to carry out a major upgrade of the German Navy's Sea King MK41 helicopter simulator; a contract via Public Works and Government Services Canada (PWGSC) to provide the Canadian Coast Guard with a Bell 412/429 helicopter simulator; and a contract to upgrade the U.S. Air Force KC-135 tanker aircrew training devices. The KC-135 contract had been previously announced to trade media on February 11, though its value was not disclosed.

Table of Contents

Defense Training and Simulation Market - Table of Contents

Defense Training and Simulation Market Report Definition

Defense Training and Simulation Market Segmentation

By Region

By Component

By Application

Defense Training and Simulation Market Analysis for next 10 Years

The 10-year Defense Training and Simulation Market analysis would give a detailed overview of Defense Training and Simulation Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Training and Simulation Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Training and Simulation Market Forecast

The 10-year Defense Training and Simulation Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Training and Simulation Market Trends & Forecast

The regional Defense Training and Simulation Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Training and Simulation Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Training and Simulation Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Training and Simulation Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Defense Training and Simulation Forecast, 2025-2035

- Figure 2: Global Defense Training and Simulation Forecast, By Region, 2025-2035

- Figure 3: Global Defense Training and Simulation Forecast, By Component, 2025-2035

- Figure 4: Global Defense Training and Simulation Forecast, By Application, 2025-2035

- Figure 5: North America, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 9: South America, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 10: United States, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 16: France, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 17: France, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 20: Netherlands, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 32: India, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 33: India, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 34: China, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 35: China, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Training and Simulation, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Training and Simulation, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Training and Simulation, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Training and Simulation, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Training and Simulation, By Component (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Training and Simulation, By Component (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Training and Simulation, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Training and Simulation, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Training and Simulation, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Training and Simulation, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Training and Simulation, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Training and Simulation, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Training and Simulation, By Component, 2025-2035

- Figure 59: Scenario 1, Defense Training and Simulation, By Application, 2025-2035

- Figure 60: Scenario 2, Defense Training and Simulation, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Training and Simulation, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Training and Simulation, By Component, 2025-2035

- Figure 63: Scenario 2, Defense Training and Simulation, By Application, 2025-2035

- Figure 64: Company Benchmark, Defense Training and Simulation, 2025-2035