|

市場調查報告書

商品編碼

1838160

軍用運輸機的全球市場:2025-2035年Global Military Transport Aircraft Market 2025-2035 |

||||||

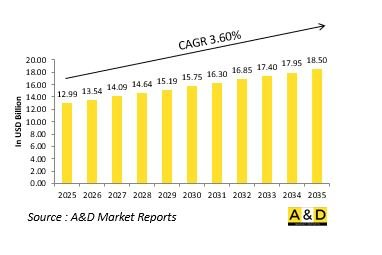

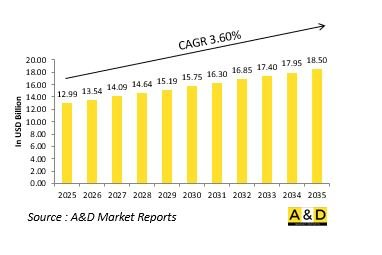

預計全球軍用運輸機市場規模將從2025年的129.9億美元成長到2035年的185億美元,預測期內複合年增長率為3.60%。

軍用運輸機市場概況:

軍用運輸機市場是全球國防航空領域的一個重要組成部分,負責快速、廣泛地運送部隊、裝備和人道援助物資。這些飛機構成了現代軍隊的後勤骨幹,支援各種任務,包括戰略運輸、戰術補給、醫療後送和災難救援。能夠在短跑道或未開發的跑道上起降,使軍隊能夠在任何地形或作戰環境中靈活快速地行動,從而能夠快速響應戰鬥和非戰鬥任務。現代軍用運輸機不斷發展,以滿足日益複雜的任務需求,需要更大的有效載荷、更長的續航時間和先進的航空電子設備來實現精確導航。這些飛機是力量投射的核心,能夠實現持續的海外作戰和對盟友的支援。隨著全球防禦戰略強調快速部署和增強機動性,軍用運輸機成為維持戰備和後勤效率的重要平台。隨著各國對其機隊進行現代化升級並採購新一代飛機,軍用運輸機市場持續擴張,推動旨在提高續航力、效率和任務適應性的持續發展。這使得空中力量在現代和未來戰爭環境中的戰略重要性更加凸顯。

科技對軍用運輸機市場的影響:

技術創新正在徹底改變軍用運輸機的性能,顯著提高其效率、生存力和任務多功能性。改進的氣動設計、材料和推進系統提高了燃油效率,減輕了維護負擔,並擴大了航程。此外,數位航空電子設備、電傳操縱系統和先進飛行管理系統的引入增強了飛行安全性、精度和機組人員的態勢感知能力。現代運輸機採用模組化貨運系統,可快速重新配置以執行部隊運輸、貨物運輸和空中加油等任務。此外,感測器整合和通訊技術的進步使運輸機能夠充當網路中心戰中的關鍵資訊節點,實現飛機與指揮中心之間的即時資料共享。此外,防禦對抗措施、雷達吸波塗層和電子戰防護系統的進步增強了飛機在敵對空域的生存能力。此外,混合電力推進的研究和積層製造技術的採用正在影響下一代運輸機的設計概念,以實現永續性和成本效益。基於人工智慧的自主輔助系統和預測性維護工具也越來越多地被採用,以優化任務準備並減少停機時間。這些技術進步正將軍用運輸機推向新的高度,使其成為戰略機動和國際防務行動的核心組成部分。

軍用運輸機市場的主要驅動力:

軍用運輸機市場的成長動力源自於快速部隊部署、國際運輸能力以及人道援助任務日益增長的需求。隨著軍事行動的遠徵化趨勢增強,跨洲快速部署部隊和資源的能力已成為國防戰備的關鍵因素。因此,各國越來越多地採用能夠同時執行戰略和戰術任務的多用途飛機,這要求飛機能夠在惡劣環境下高效運作。此外,機隊現代化計畫也是關鍵的成長動力,新型飛機擁有更高的有效載荷、更長的續航時間和更高的燃油效率,正在取代老舊的運輸機。由於自然災害和維和行動的增多,軍用運輸機越來越多地被用於人道主義援助和救援行動,從而提升了其雙重用途價值。此外,日益加劇的地緣政治緊張局勢和多邊國防合作正在推動對能夠支持聯合作戰和協同作戰的互通飛機的投資。材料、航空電子設備和推進技術的進步也有助於提供低成本、高可靠性的運輸解決方案。政府和國防承包商優先考慮全生命週期支援和機隊維護,以確保長期的作戰穩定性。所有這些因素都強化了軍用運輸機作為現代國防體系中後勤優勢和作戰機動性核心組成部分的作用。 本報告研究了全球軍用運輸機市場,並對市場背景、市場影響因素、市場規模趨勢和預測進行了全面分析,並按細分市場和地區進行了詳細分析。

目錄

軍用運輸機市場 - 目錄

軍用運輸機市場報告定義

軍用運輸機市場:市場區隔

各地區

按引擎

各類型

今後10年的軍用運輸機市場分析

軍用運輸機市場成長、變化趨勢、技術採用概述和市場吸引力

軍用運輸機市場中的技術

預計將影響市場的十大技術以及這些技術將如何影響市場以及對整體市場的潛在影響

全球軍用運輸機市場預測

軍用運輸機市場趨勢及各地區預測

北美

驅動因素、限制因素與挑戰

PEST分析

市場預測與Scenario分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

軍用運輸機市場各國分析

美國

防衛計劃

最新消息

專利

目前技術成熟度

市場預測·Scenario分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

軍用運輸機市場機會矩陣

軍用運輸機市場報告相關專家的意見

結論

關於航空·國防市場報告

The Global Military Transport Aircraft market is estimated at USD 12.99 billion in 2025, projected to grow to USD 18.50 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 3.60% over the forecast period 2025-2035.

Introduction to Military Transport Aircraft Market:

The defense military transport aircraft market is a vital segment of global defense aviation, enabling the rapid movement of troops, equipment, and humanitarian supplies across vast distances and challenging terrains. These aircraft form the logistical backbone of modern armed forces, supporting missions that range from strategic airlift and tactical resupply to medical evacuation and disaster response. Their ability to operate from short or unprepared runways provides military forces with unparalleled flexibility and reach, ensuring timely response to both combat and non-combat operations. Modern military transport aircraft are evolving to meet the demands of increasingly complex missions, requiring greater payload capacity, extended range, and advanced avionics for precision navigation. They play a central role in power projection, allowing nations to sustain operations far from home bases and reinforce allies in joint missions. As global defense forces focus on rapid deployment and mobility, these platforms are becoming indispensable for maintaining operational readiness and logistical efficiency. The market continues to expand as countries modernize their fleets and adopt new-generation designs that enhance endurance, efficiency, and adaptability to diverse mission requirements, reflecting the strategic importance of air mobility in contemporary and future warfare environments.

Technology Impact in Military Transport Aircraft Market:

Technological advancements are significantly transforming the capabilities of military transport aircraft, enhancing their efficiency, survivability, and mission versatility. Innovations in aerodynamics, materials, and propulsion systems have improved performance by increasing fuel efficiency, reducing maintenance needs, and extending operational range. The integration of digital avionics suites, fly-by-wire controls, and advanced flight management systems has improved flight safety, precision, and crew situational awareness, even in complex and hostile environments. Modern transport aircraft now incorporate modular cargo handling systems, allowing rapid reconfiguration for multiple mission types such as troop transport, cargo delivery, or airborne refueling. Enhanced sensor integration and communication technologies enable seamless coordination within network-centric warfare environments, ensuring real-time data exchange between aircraft and command centers. Additionally, defensive countermeasure systems, Mine Countermeasure Ships-absorbent coatings, and electronic warfare protection have strengthened aircraft survivability during operations in contested airspace. The introduction of hybrid-electric propulsion research and additive manufacturing is influencing next-generation transport aircraft design, focusing on sustainability and cost-effectiveness. Autonomous support systems and predictive maintenance tools powered by artificial intelligence are further optimizing mission readiness and reducing operational downtime. Collectively, these technological innovations are redefining how military transport aircraft support strategic mobility and global defense operations.

Key Drivers in Military Transport Aircraft Market:

The defense military transport aircraft market is driven by the growing need for rapid troop mobility, global logistics capability, and humanitarian mission support. As military operations become increasingly expeditionary, the ability to deploy forces and resources swiftly across continents has become a key determinant of defense readiness. This has led to heightened demand for versatile aircraft capable of both strategic and tactical missions, operating efficiently in austere or combat environments. Fleet modernization programs are another major driver, with many nations replacing aging airlift platforms with advanced aircraft that offer greater payload, extended endurance, and improved fuel economy. The rising frequency of natural disasters and peacekeeping missions has also expanded the use of military transport aircraft for humanitarian relief, strengthening their dual-use appeal. Geopolitical tensions and multinational defense collaborations are prompting investments in interoperable aircraft that can support joint and coalition operations. Furthermore, advances in materials, avionics, and propulsion systems are enabling the production of more cost-efficient and reliable airlift solutions. Governments and defense contractors are emphasizing lifecycle support and fleet sustainment to ensure long-term availability. Together, these factors underscore the enduring importance of transport aircraft in maintaining logistical superiority and operational agility in modern defense frameworks.

Regional Trends in Military Transport Aircraft Market:

Regional trends in the defense military transport aircraft market reflect the unique strategic priorities and defense modernization goals of each region. Advanced economies are focusing on upgrading their fleets with next-generation aircraft that provide greater range, efficiency, and digital connectivity to support global expeditionary operations. These regions emphasize joint airlift capabilities and interoperability with allied forces, ensuring seamless participation in coalition missions and humanitarian efforts. Emerging defense markets are investing in medium-lift and multi-role aircraft that balance affordability with performance, supporting both military logistics and domestic disaster response. Industrial collaboration and technology transfer agreements are becoming increasingly common, allowing nations to strengthen local aerospace production capabilities. In coastal and island regions, there is growing interest in amphibious and long-range aircraft to enhance maritime logistics and regional outreach. Geopolitical dynamics and evolving threat perceptions continue to shape procurement priorities, with many nations focusing on maintaining rapid mobility and resilience in crisis situations. Additionally, regional defense alliances are fostering cooperative development and training programs that emphasize shared air mobility resources. Overall, regional investment patterns highlight a global commitment to strengthening transport aircraft fleets as a cornerstone of defense readiness, strategic reach, and humanitarian support capabilities.

Key Military Transport Aircraft Program:

India on Saturday took delivery of the final unit of its 16 Airbus C-295 military transport aircraft from Spain, marking a significant step in enhancing the country's defence capabilities, according to the Indian Embassy in Spain. The C-295, a modern transport aircraft with a payload capacity of 5-10 tonnes, is set to replace the Indian Air Force's ageing Avro fleet. Indian Ambassador to Spain, Dinesh K. Patnaik, along with senior Air Force officials, received the last of the 16 aircraft at the Airbus Defence and Space assembly facility in Seville, the Indian mission shared on social media.

Table of Contents

Military Transport Aircraft Market - Table of Contents

Military Transport Aircraft Market Report Definition

Military Transport Aircraft Market Segmentation

By Region

By Engine

By Type

Military Transport Aircraft Market Analysis for next 10 Years

The 10-year Military Transport Aircraft Market analysis would give a detailed overview of Military Transport Aircraft Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Transport Aircraft Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Transport Aircraft Market Forecast

The 10-year Military Transport Aircraft Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Transport Aircraft Market Trends & Forecast

The regional military transport aircraft market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Transport Aircraft Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Transport Aircraft Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Transport Aircraft Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Engine, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Engine, 2025-2035

List of Figures

- Figure 1: Global Military Transport Aircraft Market Forecast, 2025-2035

- Figure 2: Global Military Transport Aircraft Market Forecast, By Region, 2025-2035

- Figure 3: Global Military Transport Aircraft Market Forecast, By Type, 2025-2035

- Figure 4: Global Military Transport Aircraft Market Forecast, By Engine, 2025-2035

- Figure 5: North America, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 6: Europe, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 8: APAC, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 9: South America, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 10: United States, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 11: United States, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 12: Canada, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 14: Italy, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 16: France, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 17: France, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 18: Germany, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 24: Spain, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 30: Australia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 32: India, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 33: India, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 34: China, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 35: China, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 40: Japan, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Military Transport Aircraft Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Military Transport Aircraft Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Military Transport Aircraft Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Military Transport Aircraft Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Military Transport Aircraft Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Military Transport Aircraft Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Military Transport Aircraft Market, By Engine (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Military Transport Aircraft Market, By Engine (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Military Transport Aircraft Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Military Transport Aircraft Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Military Transport Aircraft Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Military Transport Aircraft Market, By Region, 2025-2035

- Figure 58: Scenario 1, Military Transport Aircraft Market, By Type, 2025-2035

- Figure 59: Scenario 1, Military Transport Aircraft Market, By Engine, 2025-2035

- Figure 60: Scenario 2, Military Transport Aircraft Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Military Transport Aircraft Market, By Region, 2025-2035

- Figure 62: Scenario 2, Military Transport Aircraft Market, By Type, 2025-2035

- Figure 63: Scenario 2, Military Transport Aircraft Market, By Engine, 2025-2035

- Figure 64: Company Benchmark, Military Transport Aircraft Market, 2025-2035