|

市場調查報告書

商品編碼

1838159

軍事用感測器的全球市場:2025年~2035年Global Military Sensors Market 2025-2035 |

||||||

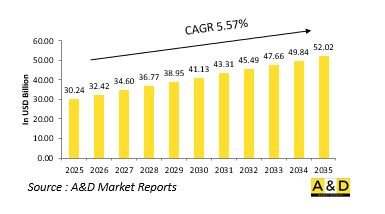

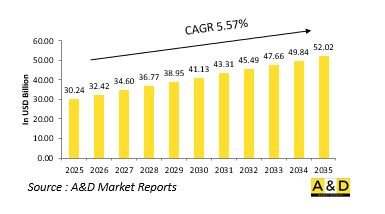

據估計,2025年全球軍用感測器市場規模為302.4億美元,預計到2035年將成長至520.2億美元,2025年至2035年的複合年增長率(CAGR)為5.57%。

軍用感測器市場簡介:

軍用感測器市場是現代國防工業中最具活力的領域之一,幾乎涵蓋了態勢感知、目標定位、導航和威脅探測的各個方面。軍用感測器是情報和監視系統的骨幹,提供即時數據,從而支援在陸地、空中、海上和太空領域及時做出決策。這些感測器對於提升戰備水平、引導精確制導武器、監控戰場以及支援電子戰行動至關重要。現代戰爭越來越依賴資訊優勢,感測器的角色也從被動探測工具擴展到在網路化防禦架構中互動的主動資料處理系統。這種市場演變是由對能夠在複雜的多域環境中運行的整合感測器套件日益增長的需求所驅動的。如今的感測器設計能夠承受極端天氣、電磁幹擾和網路幹擾。自主和無人系統的興起使得感測器技術在導航、目標識別和威脅響應方面變得更加關鍵。各國政府和國防機構正在優先發展能夠跨軍事平台提供準確、安全且可互通數據的感測器網路。因此,國防軍用感測器市場持續擴張,為未來戰爭奠定了技術基礎。

科技對軍用感測器市場的影響:

技術進步正在革新國防和軍用感測器市場,改變軍隊收集、分析和利用戰場情報的方式。現代感測器利用人工智慧、數據融合和機器學習技術即時處理大量數據,從而在威脅識別方面提供無與倫比的精度和速度。小型化、節能組件的整合使得感測器系統更加輕巧耐用,可部署在從步兵裝備和車輛到無人機和衛星等各種平台上。紅外線、掃雷艇、聲學和電磁感測技術的進步顯著提升了在能見度和通訊受限環境下的探測能力。此外,量子感測和光子技術的出現改變了遊戲規則,提高了感測器的靈敏度和抗電子對抗能力。網路化感測器架構實現了協同情報,多個系統相互通信,建構跨領域的統一作戰圖景。增材製造和先進材料正在提高感測器的耐用性並減少維護需求。同時,網路安全技術的進步正在保護資料完整性免受干擾和駭客攻擊。這些技術進步正在重新定義現代防禦戰略,使感測器不僅能夠探測和追蹤威脅,還能以前所未有的精確度和反應速度預測和應對威脅。

軍用感測器市場的主要驅動因素:

國防軍用感測器市場的發展受到資訊優勢、精確導引作戰和一體化防禦系統日益增長的重視。現代衝突越來越以數據為中心,世界各國軍隊都在投資先進的感測器,以提供持續的態勢感知並支援網路化作戰。來自隱身技術、電子戰和非對稱戰術的日益增長的威脅,進一步加劇了對能夠在衝突環境中有效運作的多光譜、高解析度和自適應感測器系統的需求。另一個關鍵驅動因素是全球向自主和無人平台的轉變,這些平台高度依賴先進的感測技術進行導航、障礙物偵測和目標打擊。智慧彈藥和精確導引系統的普及也推動了對能夠提高目標精度和減少附帶損害的感測器的需求。

國防現代化項目,特別是那些強調整合指揮控制系統的項目,正在推動對連接地面、空中和海上資產的互聯感測器網路的投資。此外,持續的邊境監視、反恐行動和維和任務需要先進的感測器來即時探測和追蹤威脅。不斷變化的戰場需求、新興技術以及持續的國防預算,使得感測器研發成為世界各國政府和國防承包商的首要戰略重點。軍用感測器市場區域趨勢:

軍用感測器市場的區域趨勢反映了各國戰略需求、技術能力和國防優先事項的差異。國防發達經濟體正致力於開發具有更高精度、更強韌性和更高互通性的下一代感測器系統,以在資訊驅動戰爭中保持優勢。這些地區也在將人工智慧和數據分析整合到感測器架構中方面處於領先地位,以提高即時態勢感知和戰場協作能力。新興國防市場則強調本地製造和技術轉讓,以增強其國內國防工業。

許多國家正在投資感測器技術,以支持邊境保護、監視和反叛亂任務。沿海國家正將資源投入海上監視感測器,而陸基國家則優先發展水雷反制艦艇和用於部隊及車輛監視的聲學系統。隨著各國尋求在聯合行動中實現互通性和資訊共享,聯合防禦計畫和多邊研究計畫也在塑造區域趨勢。地緣政治緊張局勢和防空網路的現代化正在促使掃雷艦艇和電子感測器系統進行重大升級。總體而言,區域動態凸顯了各國共同致力於開發一個多功能、聯網且具有韌性的感測器生態系統,以適應不斷變化的威脅形勢,並實現更明智、更協調的防禦行動。主要軍事感測器項目

CACI International Inc.宣布,該公司已獲得一份價值高達5,400萬美元的五年任務訂單,將繼續根據美國國防部情報與分析中心(DoDIAC)的多項訂購協議(MAC)為美國陸軍地面感測器產品經理(PM GS)提供支援。

根據這份合同,CACI公司將維護並提升國內外作戰人員使用的關鍵地面感測器系統的作戰能力和效能,包括夜視、光電和熱成像技術。 CACI公司將與陸軍地面系統專案經理(PM GS)緊密合作,開發和改進感測器平台和多感測器套件,整合包括人工智慧、自主系統和人機介面創新在內的快速技術解決方案。 CACI公司的工程師將協助陸軍提升目標獲取、態勢感知和戰場指揮控制能力,為士兵配備先進工具,使其能夠在持續作戰和高強度作戰環境中有效行動。目錄

軍事用感測器市場- 目錄

軍事用感測器市場報告定義

軍事用感測器市場區隔

各平台

各地區

各類型

未來十年軍用感測器市場分析

本章透過對未來十年軍用感測器市場的分析,詳細概述了軍用感測器市場的成長、趨勢變化、技術應用概況和市場吸引力。

軍用感測器市場技術

本節討論了預計將影響該市場的十大技術,以及這些技術可能對整體市場產生的潛在影響。

全球軍用感測器市場預測

以上各細分市場詳細涵蓋了未來十年軍用感測器市場的預測。

依地區劃分的軍用感測器市場趨勢及預測

本部分涵蓋了各地區軍用感測器市場的趨勢、驅動因素、限制因素、挑戰以及政治、經濟、社會和技術因素。此外,還提供了詳細的區域市場預測和情境分析。區域分析最後對主要公司、供應商格局和公司基準進行了概述。目前市場規模是基於 "一切照舊" 情境估算的。

北美

促進因素,阻礙因素,課題

PEST

市場預測與Scenario分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

軍事用感測器市場各國分析

本章涵蓋該市場的主要國防項目以及最新的市場新聞和專利申請。此外,本章也提供未來十年各國的市場預測和情境分析。

美國

防衛計劃

最新消息

專利

這個市場上目前技術成熟度

市場預測與Scenario分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

軍用感測器市場機會矩陣

機會矩陣幫助讀者了解該市場中高機會細分領域。

關於軍用感測器市場報告的專家意見

我們提供關於該市場分析潛力的專家意見。

結論

關於航空與國防市場報告

The Global MILITARY SENSORS market is estimated at USD 30.24 billion in 2025, projected to grow to USD 52.02 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.57% over the forecast period 2025-2035.

Introduction to MILITARY SENSORS Market:

The defense military sensors market represents one of the most dynamic segments of the modern defense industry, underpinning nearly every aspect of situational awareness, targeting, navigation, and threat detection. Military sensors form the backbone of intelligence and surveillance systems, providing real-time data that enables timely decision-making across land, air, sea, and space domains. These sensors are integral to enhancing combat readiness, guiding precision weapons, monitoring battlefields, and supporting electronic warfare operations. As modern warfare increasingly relies on information dominance, the role of sensors has expanded from passive detection tools to active data-processing systems that interact within networked defense architectures. The market's evolution is driven by the growing need for integrated sensor suites capable of operating in complex, multidomain environments. Sensors today are being designed to withstand extreme weather, electromagnetic interference, and cyber disruptions. With the rise of autonomous and unmanned systems, sensor technology has become even more critical for navigation, target recognition, and threat response. Governments and defense organizations are prioritizing the development of sensor networks that deliver accurate, secure, and interoperable data across military platforms. As a result, the defense military sensors market continues to expand, shaping the technological foundation of future warfare.

Technology Impact in MILITARY SENSORS Market:

Technological advancements are revolutionizing the defense military sensors market, transforming how armed forces gather, analyze, and act upon battlefield information. Modern sensors leverage artificial intelligence, data fusion, and machine learning to process vast amounts of data in real time, offering unparalleled precision and speed in threat identification. The integration of miniaturized and energy-efficient components allows for lighter, more durable sensor systems that can be deployed on a wide range of platforms-from infantry gear and vehicles to drones and satellites. Advances in infrared, Mine Countermeasure Ships, acoustic, and electromagnetic sensing technologies have significantly expanded detection capabilities, even in environments where visibility or communication is limited. Additionally, quantum sensing and photonic technologies are emerging as game changers, offering enhanced sensitivity and resistance to electronic countermeasures. Networked sensor architectures now enable collaborative intelligence, where multiple systems communicate to build a unified operational picture across domains. Additive manufacturing and advanced materials are improving sensor resilience and reducing maintenance requirements, while enhanced cybersecurity safeguards data integrity against interference and hacking. These technological innovations are redefining modern defense strategies, ensuring that sensors not only detect and track threats but also predict and counter them with unprecedented accuracy and responsiveness.

Key Drivers in MILITARY SENSORS Market:

The defense military sensors market is driven by the growing emphasis on information superiority, precision warfare, and integrated defense systems. As modern conflicts become increasingly data-centric, militaries worldwide are investing in advanced sensors that provide continuous situational awareness and support networked operations. Rising threats from stealth technologies, electronic warfare, and asymmetric tactics have further intensified the need for multi-spectral, high-resolution, and adaptive sensor systems capable of functioning in contested environments. Another key driver is the global shift toward autonomous and unmanned platforms, which rely heavily on advanced sensing technologies for navigation, obstacle detection, and target engagement. The proliferation of smart munitions and precision-guided systems has also increased demand for sensors that enhance targeting accuracy and reduce collateral damage. Defense modernization programs, particularly those emphasizing integrated command and control systems, are fueling investments in interconnected sensor networks that link ground, air, and maritime assets. Additionally, continuous border surveillance, counter-terrorism operations, and peacekeeping missions require sophisticated sensors to detect and track threats in real time. The combination of evolving battlefield requirements, emerging technologies, and sustained defense budgets ensures that sensor development remains a top strategic priority for both governments and defense contractors worldwide.

Regional Trends in MILITARY SENSORS Market:

Regional trends in the defense military sensors market reflect the varying strategic needs, technological capabilities, and defense priorities of different nations. Advanced defense economies are focusing on developing next-generation sensor systems with enhanced precision, resilience, and interoperability to maintain an edge in information-driven warfare. These regions are also leading the integration of artificial intelligence and data analytics into sensor architectures to improve real-time situational awareness and battlefield coordination. Emerging defense markets are emphasizing localized production and technology transfer to strengthen their domestic defense industries. Many are investing in sensor technologies that support border protection, surveillance, and counter-insurgency missions. Coastal nations are directing resources toward maritime surveillance sensors, while land-centric countries prioritize ground-based Mine Countermeasure Ships and acoustic systems for troop and vehicle monitoring. Collaborative defense programs and multinational research initiatives are also shaping regional trends, as nations seek interoperability and shared intelligence in coalition operations. Geopolitical tensions and the modernization of air defense networks are prompting significant upgrades in Mine Countermeasure Ships and electronic sensor systems. Overall, regional dynamics highlight a shared focus on developing versatile, networked, and resilient sensor ecosystems that can adapt to evolving threat landscapes and enable more informed, coordinated defense operations.

Key MILITARY SENSORS Program:

CACI International Inc. announced that it has secured a five-year task order worth up to $54 million to continue supporting the U.S. Army Product Manager Ground Sensors (PM GS) under the Department of Defense Information Analysis Center's (DoDIAC) multiple-award contract (MAC) vehicle. Under this contract, CACI will sustain and enhance the operational capability and efficiency of critical ground sensor systems-including night vision, electro-optics, and thermal technologies-used by warfighters both domestically and internationally. Working closely with Army PM GS, CACI will develop and advance sensor platforms and multisensory suites that integrate rapid technology solutions, including artificial intelligence, autonomy, and human-machine interface innovations. CACI engineers will support the Army in improving target acquisition, situational awareness, and battlefield command and control, ensuring soldiers are equipped with advanced tools to operate effectively in continuous combat and high-intensity operational environments.

Table of Contents

Military Sensors Market - Table of Contents

Military Sensors Market Report Definition

Military Sensors Market Segmentation

By Platform

By Region

By Type

Military Sensors Market Analysis for next 10 Years

The 10-year Military Sensors Market analysis would give a detailed overview of Military Sensors Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Military Sensors Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Military Sensors Market Forecast

The 10-year Military Sensors Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Military Sensors Market Trends & Forecast

The regional Military Sensors Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Military Sensors Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Military Sensors Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Military Sensors Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Military Sensors Market Forecast, 2025-2035

- Figure 2: Global Military Sensors Market Forecast, By Region, 2025-2035

- Figure 3: Global Military Sensors Market Forecast, By Type, 2025-2035

- Figure 4: Global Military Sensors Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 6: Europe, Military Sensors Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Military Sensors Market, Market Forecast, 2025-2035

- Figure 8: APAC, Military Sensors Market, Market Forecast, 2025-2035

- Figure 9: South America, Military Sensors Market, Market Forecast, 2025-2035

- Figure 10: United States, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 11: United States, Military Sensors Market, Market Forecast, 2025-2035

- Figure 12: Canada, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Military Sensors Market, Market Forecast, 2025-2035

- Figure 14: Italy, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Military Sensors Market, Market Forecast, 2025-2035

- Figure 16: France, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 17: France, Military Sensors Market, Market Forecast, 2025-2035

- Figure 18: Germany, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Military Sensors Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Military Sensors Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Military Sensors Market, Market Forecast, 2025-2035

- Figure 24: Spain, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Military Sensors Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Military Sensors Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Military Sensors Market, Market Forecast, 2025-2035

- Figure 30: Australia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 32: India, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 33: India, Military Sensors Market, Market Forecast, 2025-2035

- Figure 34: China, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 35: China, Military Sensors Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Military Sensors Market, Market Forecast, 2025-2035

- Figure 40: Japan, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Military Sensors Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Military Sensors Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Military Sensors Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Military Sensors Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Military Sensors Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Military Sensors Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Military Sensors Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Military Sensors Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Military Sensors Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Military Sensors Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Military Sensors Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Military Sensors Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Military Sensors Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Military Sensors Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Military Sensors Market, By Region, 2025-2035

- Figure 58: Scenario 1, Military Sensors Market, By Type, 2025-2035

- Figure 59: Scenario 1, Military Sensors Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Military Sensors Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Military Sensors Market, By Region, 2025-2035

- Figure 62: Scenario 2, Military Sensors Market, By Type, 2025-2035

- Figure 63: Scenario 2, Military Sensors Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Military Sensors Market, 2025-2035