|

市場調查報告書

商品編碼

1811816

監視雷達的全球市場:2025年~2035年Global Surveillance Radar Market 2025 - 2035 |

||||||

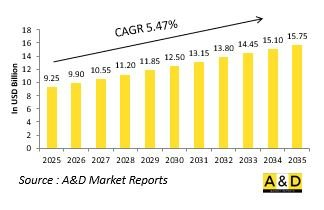

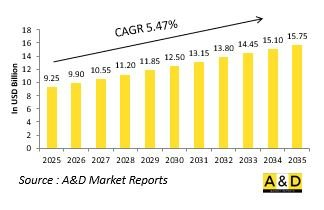

預計2025年全球監視雷達市場規模將達到92.5億美元,到2035年預計將成長至157.5億美元,2025年至2035年的複合年增長率 (CAGR) 為5.47%。

監視雷達市場簡介

國防監視雷達市場是現代安全基礎設施的重要組成部分,支援對空中、海上和地面威脅的探測、追蹤和監控。這些系統旨在提供預警和態勢感知,使軍隊能夠在防禦和進攻行動中做出明智的決策。與主要關注天氣和空中交通管制的民用雷達不同,國防監視雷達的設計注重韌性、精度以及在惡劣條件下的作戰能力。隨著軍隊面臨日益複雜的威脅,從隱形飛機和無人機到高超音速武器和低空巡航飛彈,這些雷達正變得越來越重要。它們的作用不僅限於戰鬥;它們對於邊境安全、沿海監視和維和行動也至關重要。市場已經發展到包括各種各樣的系統,從大型固定裝置到可快速部署到衝突地區的機動裝置。這種多樣性反映了現代國防戰略對靈活性的需求。隨著對綜合防空反導防禦的日益重視,監視雷達仍然是探測網路的重要組成部分,它提供衝突環境中活動的全面視圖,並確保各國能夠保護其領空和領海。

科技對監視雷達市場的影響

技術進步正在重塑國防監視雷達的能力,提高其探測距離、精度和抗干擾能力。最具突破性的發展之一是主動電子掃描陣列系統的廣泛應用,使雷達能夠同時追蹤多個目標,同時保持較低的攔截機率。這項技術提高了在爭奪空域的反應能力和生存能力,在這種空域中,對手會部署電子戰來幹擾常規雷達訊號。數位訊號處理和人工智慧的進步進一步提升了效能。現代雷達可以過濾背景雜波,區分真實威脅和誘餌,並提供即時、可操作的洞察。這些系統還與指揮和控製網路整合,實現空中、陸地和海上的無縫資料共享。這種連結性對於聯合作戰和合成作戰至關重要,因為快速協調決定了任務的成敗。市場發展和小型化技術也在塑造市場,推動了更輕、更機動的系統的發展,這些系統可以安裝在車輛、船舶甚至無人平台上。同時,對量子雷達和被動雷達概念的研究凸顯了未來對抗隱形技術的方向。這些技術進步將繼續使監視雷達成為現代下一代國防戰略的重要組成部分。

監視雷達市場的關鍵驅動因素

國防監視雷達市場的成長是由不斷變化的安全需求和日益複雜的威脅所驅動的。各國認識到,早期探測對於保護其領空、海岸線和關鍵基礎設施至關重要。無人機系統、隱形技術和先進飛彈系統的普及,正在催生對能夠識別更小、更快、更難偵測威脅的雷達的需求。另一個主要驅動因素是對綜合防禦系統的重視。現代軍隊要求雷達不僅能偵測目標,還能與攔截飛彈、飛機和指揮中心無縫連接。這種互通性能夠協同應對多域威脅,並強化分層防禦架構。彈道飛彈防禦日益重要,進一步增強了對能夠遠距離追蹤高速射彈的遠程雷達的依賴。國防現代化的預算撥款也扮演關鍵角色。各國政府優先投資雷達技術,以因應常規戰爭和非對稱戰爭。此外,國防力量越來越多地參與災害監視和邊境監控等非戰鬥任務,也確保了穩定的需求。總而言之,這些因素凸顯了監視雷達在製定具有彈性和麵向未來的國防戰略方面發揮的核心作用。

監視雷達市場的區域趨勢

國防監視雷達市場的區域趨勢反映了地理需求、安全課題和技術重點的融合。海洋國家優先發展沿海和海軍雷達系統,以監視廣闊的海上航線並遏制潛在的入侵;而內陸地區則優先發展邊境監視和防空雷達,以防止空中入侵。因此,地區因素對雷達採購策略有顯著影響。國防先進國家正在引領尖端技術的採用,例如電子掃描陣列和遠端預警雷達。他們專注於建造能夠對抗隱形飛機和高超音速威脅的一體化防空反導系統。相較之下,新興經濟體通常優先考慮靈活、經濟高效的解決方案,這些解決方案能夠支援從戰場監控到災難應變等多種用途。地區緊張局勢和聯盟關係也會影響需求。經歷領土爭端和衝突加劇的地區在雷達網路方面投入巨資,以確保持續的警覺和威懾。同時,參與多邊行動的國家優先考慮互通性,並確保其系統與盟友系統的完整性。一些國家正在尋求國內雷達生產以減少對進口的依賴,而其他國家則依靠聯合開發來獲取先進的設計。這些趨勢凸顯了全球國防監視雷達市場的多樣性和活力。

主要監視雷達計畫

經德國議會批准,Indra公司已與德國空軍國家採購辦公室(BAAINBw)簽署合同,為德國裝備一套用於探測低地球軌道物體的下一代雷達系統。該雷達有助於保護現役衛星免受高速軌道碎片的潛在碰撞,並降低其他衛星試圖接近、幹擾或收集衛星情報的風險。 Indra公司透過德國子公司參與了競標,並憑藉其成熟的太空雷達系統、卓越的性能以及可擴展升級的模組化靈活設計贏得了合約。

目錄

監視雷達市場報告定義

監視雷達市場區隔

各用途

各平台

各地區

這份為期10年的監視雷達市場分析報告詳細概述了監視雷達市場的成長、變化趨勢、技術採用概況以及整體市場吸引力。

監視雷達市場的市場技術

本部分涵蓋了預計將影響該市場的十大技術及其對整體市場的潛在影響。

全球監視雷達市場預測

本部分對未來十年的監視雷達市場進行了詳細的預測,涵蓋了上述各個細分市場。

區域監視雷達市場趨勢與預測

本部分涵蓋區域監視雷達市場趨勢、驅動因素、限制因素和課題,以及政治、經濟、社會和技術層面。此外,本部分也提供詳細的區域市場預測和情境分析。區域分析包括對主要公司的分析、供應商格局和公司基準分析。目前市場規模是基於常規情境進行估算。

北美

驅動因素、限制因素與課題

PEST

市場預測與情境分析

主要公司

供應商層級結構

公司基準測試

歐洲

中東

亞太地區

南美洲

監視雷達市場國家分析

本章涵蓋該市場的主要國防項目以及該市場的最新新聞和專利申請。本章也提供國家層級的10年市場預測和情境分析。

美國

國防計畫

最新消息

專利

該市場目前的技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

德國

澳洲

南非

印度

中國

俄羅斯

南非韓國

日本

馬來西亞

新加坡

巴西

監視雷達市場機會矩陣

機會矩陣幫助讀者了解該市場中機會較高的市場區隔。

專家對監視雷達市場報告的意見

我們提供對該市場潛力分析的專家意見。

結論

關於調查公司

The Global Surveillance Radar market is estimated at USD 9.25 billion in 2025, projected to grow to USD 15.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 5.47% over the forecast period 2025-2035.

Introduction to Surveillance Radar Market:

The defense surveillance radar market is an integral part of modern security infrastructure, supporting the detection, tracking, and monitoring of aerial, maritime, and ground-based threats. These systems are designed to provide early warning and situational awareness, enabling armed forces to make informed decisions in both defensive and offensive operations. Unlike civilian radars that primarily focus on weather or air traffic control, defense surveillance radars are engineered for resilience, precision, and the ability to operate under hostile conditions. The importance of these radars has grown as militaries face increasingly complex threats ranging from stealth aircraft and drones to hypersonic weapons and low-altitude cruise missiles. Their role extends beyond combat, as they are also vital for border security, coastal monitoring, and peacekeeping operations. The market has evolved to include a wide variety of systems, from large fixed installations to mobile units capable of rapid deployment in conflict zones. This diversity reflects the need for flexibility in modern defense strategies. With the rising emphasis on integrated air and missile defense, surveillance radars remain the cornerstone of detection networks, ensuring that nations maintain a comprehensive picture of activities in contested environments and safeguard their airspace and territorial waters.

Technology Impact in Surveillance Radar Market:

Technological advances are reshaping the capabilities of defense surveillance radars, driving improvements in detection range, accuracy, and resilience against countermeasures. One of the most transformative developments has been the widespread adoption of active electronically scanned array systems, which allow radars to track multiple targets simultaneously while maintaining a low probability of interception. This technology enhances responsiveness and survivability in contested airspace, where adversaries deploy electronic warfare to disrupt traditional radar signals. Advances in digital signal processing and artificial intelligence are further enhancing performance. Modern radars can filter through background clutter, distinguish between genuine threats and decoys, and deliver actionable insights in real time. These systems also integrate with command-and-control networks, allowing seamless sharing of data across air, land, and sea domains. Such connectivity is crucial for joint and coalition operations where rapid coordination determines mission success. Materials and miniaturization technologies are also shaping the market, enabling the development of lighter, mobile systems that can be mounted on vehicles, ships, or even unmanned platforms. Meanwhile, research into quantum radar and passive radar concepts highlights future directions aimed at countering stealth technologies. Collectively, these innovations ensure that surveillance radars remain indispensable in modern and next-generation defense strategies.

Key Drivers in Surveillance Radar Market:

The growth of the defense surveillance radar market is fueled by evolving security requirements and the increasing sophistication of threats. Nations recognize that early detection is fundamental to safeguarding airspace, coastlines, and critical infrastructure. The proliferation of unmanned aerial systems, stealth technologies, and advanced missile systems has created demand for radars capable of identifying threats that are smaller, faster, and harder to detect than ever before. Another major driver is the emphasis on integrated defense systems. Modern militaries seek radars that not only detect but also seamlessly connect with interceptors, aircraft, and command centers. This interoperability allows for coordinated responses to multi-domain threats and strengthens layered defense architectures. The rising importance of ballistic missile defense has further increased reliance on long-range radars capable of tracking high-speed projectiles across vast distances. Budgetary allocations for defense modernization also play a key role. Governments are prioritizing investments in radar technology to ensure preparedness for both conventional and asymmetric warfare scenarios. In addition, the increasing involvement of defense forces in non-combat roles, such as disaster monitoring and border surveillance, ensures consistent demand. Collectively, these drivers underline the central role of surveillance radars in shaping resilient and future-ready defense strategies.

Regional Trends in Surveillance Radar Market:

Regional trends in the defense surveillance radar market reflect a blend of geographic needs, security challenges, and technological priorities. Maritime nations emphasize coastal and naval radar systems to monitor expansive sea lanes and deter potential intrusions, while landlocked regions focus on border surveillance and air defense radars to protect against aerial incursions. Geography, therefore, heavily influences radar procurement strategies. Advanced defense powers are leading the adoption of cutting-edge technologies such as electronically scanned arrays and long-range early warning radars. Their focus lies in building integrated air and missile defense systems that can counter stealth aircraft and hypersonic threats. In contrast, emerging economies often prioritize mobile, cost-effective solutions that can serve multiple purposes, from battlefield surveillance to disaster response. Regional tensions and alliances also shape demand. Areas experiencing territorial disputes or heightened rivalries invest heavily in radar networks to ensure constant vigilance and deterrence. Meanwhile, nations engaged in multinational operations emphasize interoperability, ensuring that their systems align with those of allies. Industrial capability further defines regional dynamics, as some countries push for indigenous radar development to reduce dependency on imports, while others rely on collaborations to access advanced designs. These trends together highlight the diversity and vitality of the global defense surveillance radar market.

Key Surveillance Radar Program:

After receiving approval from the German Parliament, Indra has signed a contract with the National Procurement Office (BAAINBw) of the Bundeswehr to equip the Luftwaffe with a next-generation radar system designed to detect objects in low Earth orbit. The radar will safeguard active satellites from potential collisions with high-speed orbital debris and help counter risks posed by other satellites attempting to approach, interfere with, or gather intelligence on them. Indra, through its German subsidiary, was invited to participate in the tender and secured the contract based on the proven maturity, superior performance, and modular, flexible design of its space radar, which allows for scalable capability upgrades.

Table of Contents

Surveillance Radar Market Report Definition

Surveillance Radar Market Segmentation

By Application

By Platform

By Region

Surveillance Radar Market Analysis for next 10 Years

The 10-year surveillance radar market analysis would give a detailed overview of surveillance radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Surveillance Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Surveillance Radar Market Forecast

The 10-year Surveillance Radar Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Surveillance Radar Market Trends & Forecast

The regional surveillance radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Surveillance Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Surveillance Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Surveillance Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Surveillance Radar Market Forecast, 2025-2035

- Figure 2: Global Surveillance Radar Market Forecast, By Region, 2025-2035

- Figure 3: Global Surveillance Radar Market Forecast, By Platform, 2025-2035

- Figure 4: Global Surveillance Radar Market Forecast, By Application, 2025-2035

- Figure 5: North America, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 6: Europe, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 8: APAC, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 9: South America, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 10: United States, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 11: United States, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 12: Canada, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 14: Italy, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 16: France, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 17: France, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 18: Germany, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 24: Spain, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 30: Australia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 32: India, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 33: India, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 34: China, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 35: China, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 40: Japan, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Surveillance Radar Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Surveillance Radar Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Surveillance Radar Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Surveillance Radar Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Surveillance Radar Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Surveillance Radar Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Surveillance Radar Market, By Application (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Surveillance Radar Market, By Application (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Surveillance Radar Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Surveillance Radar Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Surveillance Radar Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Surveillance Radar Market, By Region, 2025-2035

- Figure 58: Scenario 1, Surveillance Radar Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Surveillance Radar Market, By Application, 2025-2035

- Figure 60: Scenario 2, Surveillance Radar Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Surveillance Radar Market, By Region, 2025-2035

- Figure 62: Scenario 2, Surveillance Radar Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Surveillance Radar Market, By Application, 2025-2035

- Figure 64: Company Benchmark, Surveillance Radar Market, 2025-2035