|

市場調查報告書

商品編碼

1727191

主戰坦克用熱像儀的全球市場:2025年~2035年Global Main Battle Tank Thermal Camera Market 2025-2035 |

||||||

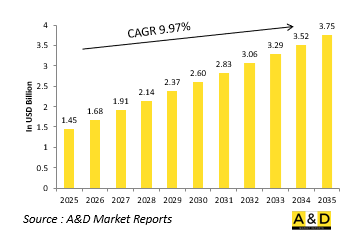

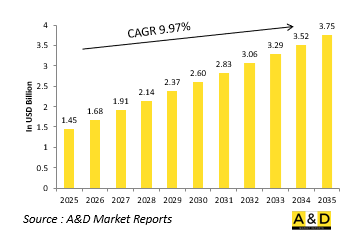

預計2025年全球主戰戰車熱像儀市場規模將達14.5億美元,2035年將成長至37.5億美元,預測期內的複合年增長率 (CAGR) 為9.97%。

主戰坦克熱像儀市場簡介:

熱像儀是現代主戰坦克感測器的重要組成部分,在各種作戰條件下提供無與倫比的目標探測、導航和威脅打擊能力。這些熱像儀的工作原理是捕捉物體發出的紅外光,使坦克乘員能夠在完全黑暗的環境中,透過煙霧、濃霧和偽裝物觀察戰場。與傳統光學元件不同,熱像儀能夠顯示溫差,使其能夠在視覺遮蔽的情況下識別車輛、人員和其他熱源。對於坦克指揮官、砲手和駕駛者來說,熱像儀可以提高戰場態勢感知能力,使他們能夠精確協調火力和機動。熱像儀通常安裝在砲長瞄準鏡、車長全景觀察鏡和駕駛員輔助系統中,在激烈的裝甲作戰中發揮著至關重要的作用。熱像儀的引入顯著提高了主戰坦克的作戰效能,縮短了反應時間,並提高了在不利條件下的命中率。將熱像儀整合到火控系統中,可以更快、更可靠地捕捉目標。隨著裝甲部隊在日益難以預測和複雜的作戰環境中作戰,熱像儀已成為保持地面作戰優勢的重要工具。全球各國防軍紛紛採用熱像儀系統,體現了對機械化戰爭中更高精準度、生存力和戰備狀態的追求。

科技對主戰戰車熱像儀市場的影響:

技術創新已將熱像儀從基本的成像設備轉變為安裝在主戰坦克上的先進的聯網戰場感測器。現今的系統比以往型號擁有更高的解析度、更遠的探測距離和更高的可靠性,能夠提供清晰的影像,從而能夠精確識別遠距離目標。更高的熱靈敏度能夠更精細地區分相似的熱源,從而更容易區分敵我。影像穩定和基於軟體的增強功能確保即使在坦克高速行駛或在崎嶇地形中行駛時也能獲得清晰的視野。現代熱成像系統也越來越多地與數位火控和態勢感知平台集成,從而實現自動目標追蹤和改進的彈道解決方案。一些坦克現在配備了多通道光學系統,將熱成像和日間攝影機整合到一個用戶介面中,從而簡化了車組人員的操作。與其他車輛和指揮中心即時共享熱成像數據,可以在動態戰鬥情況下協調行動並快速回應。熱成像系統也變得更小巧、更堅固,使感測器更耐用,也更易於在戰場上維護。隨著人工智慧的應用日益廣泛,熱圖像可以與能夠對物體進行分類並確定威脅優先順序的演算法相結合。這些進步顯著提升了坦克的殺傷力、防護能力和戰術價值,強化了熱成像作為裝甲作戰關鍵要素的作用。

主戰戰車熱像儀市場的關鍵推動因素:

陸戰日益複雜,威脅不斷演變,推動了熱像儀在主戰坦克中的應用。這些感測器使部隊能夠在視覺系統受損的條件下有效作戰,例如夜間作戰、惡劣天氣條件以及煙霧瀰漫、碎片密布的環境。向高機動性和高響應速度的地面部隊轉變,帶來了一種戰術需求,即能夠在不依賴環境光的情況下精確探測和打擊目標。由於敵人使用隱蔽戰術和地形進行隱藏,這進一步增加了對能夠識別傳統光學系統可能遺漏的隱藏威脅的熱像儀的需求。由於現代坦克預計將承擔從城市戰到露天戰等各種任務,熱像儀提供了在這些情況下保持作戰效能所需的適應性。舊式坦克的升級也推動了需求,因為熱成像系統通常是更廣泛的現代化升級方案的一部分,可以擴大車輛在戰場上的實用性。此外,自主和半自主瞄準平台的進步也提升了感測器系統的重要性,而熱成像在向自動決策支援工具提供數據方面發揮關鍵作用。這些因素使得熱成像能力成為現代裝甲作戰理論的標準,而非奢侈品。

主戰戰車熱像儀市場的區域趨勢:

主戰坦克熱像儀的採用和普及率在不同地區存在顯著差異,這反映了國防重點、作戰環境和技術能力的差異。西方國家,尤其是北美和歐洲部分地區,正在將熱像儀深度整合到主戰坦克平台中,作為其高度數位化和網路化戰爭戰略的一部分。這些國家非常重視支援遠端作戰和多車組協同作戰的高性能感測器。東歐國家正在加速為老舊坦克升級熱成像系統,以應對日益嚴峻的安全挑戰,提高可能部署在前線坦克的生存力和瞄準精度。在亞太地區,緊張局勢加劇和裝甲部隊擴張促使對國產感測器研發和整合的投資增加。韓國和印度等國家正致力於自主研發解決方案,以增強其戰略自主性。在中東地區,熱成像技術對於在能見度經常受灰塵和高溫影響的開闊乾旱環境中有效作戰至關重要。這些系統在應對農村和城市地區的非常規威脅方面也發揮著重要作用。同時,拉丁美洲和非洲正在透過國際援助和旨在加強邊境安全和國內穩定任務的選擇性採購項目,進行有限的部署。

先進主戰戰車紅外線熱像儀專案:

韓國知名國防製造商現代羅特姆公司已在韓國知識產權局正式註冊其下一代坦克計畫。該專利申請於2024年8月26日提交,並於2025年4月17日獲得批准,最終決定於2025年4月21日公佈。這款新坦克被一些分析師非正式地稱為“K3”,很可能是K2“黑豹”的繼任者,與之前的概念渲染圖相比,其設計顯著流線型。其砲塔模組看起來很堅固,暗示這是一個採用先進防護材料(例如鋼、陶瓷和複合裝甲)的重型裝甲平台。

本報告提供全球主戰坦克用熱像儀市場相關調查,彙整10年的各分類市場預測,技術趨勢,機會分析,企業簡介,各國資料等資訊。

目錄

主戰坦克用熱像儀市場主戰場- 目錄

主戰坦克用熱像儀市場報告定義

主戰坦克用熱像儀市場區隔

類別

各技術

各地區

未來10年主戰戰車熱像儀市場分析

本章詳細概述了主戰坦克熱像儀市場的成長、變化趨勢、技術採用概況和市場吸引力,並對未來10年主戰坦克熱像儀市場進行了分析。

主戰坦克熱像儀市場技術

本部分涵蓋了預計將影響該市場的十大技術,以及這些技術對整體市場的潛在影響。

全球主戰熱像儀市場預測

以上各部分詳細介紹了該市場未來10年的主戰熱像儀市場預測。

主戰熱像儀市場(依地區)趨勢及預測

本部分涵蓋了無人機市場(按地區)的趨勢、推動因素、阻礙因素、挑戰以及政治、經濟、社會和技術層面。此外,還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準分析。目前市場規模是基於正常業務情境估算的。

北美

促進因素,阻礙因素,課題

PEST

市場預測與情勢分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

主力戰鬥用熱像儀市場各國分析

本章涵蓋該市場的主要國防項目,以及該市場的最新資訊和專利申請。此外,也涵蓋了各國未來10年的市場預測與情境分析。

美國

防衛計劃

最新消息

專利

這個市場上目前技術成熟度

市場預測與情勢分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

主力戰鬥用熱像儀市場機會矩陣

主力戰鬥用熱像儀市場報告相關專家的意見

結論

關於航空·國防市場報告

The Global Main Battle Tank Thermal Camera Market is estimated at USD 1.45 billion in 2025, projected to grow to USD 3.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.97% over the forecast period 2025-2035.

Introduction to Main Battle Tank Thermal Camera Market:

Thermal cameras are a critical part of the sensor suite onboard modern main battle tanks, offering unmatched capabilities for target detection, navigation, and threat engagement across diverse combat conditions. These cameras function by capturing infrared radiation emitted by objects, enabling tank crews to visualize the battlefield even in total darkness, through smoke, fog, or camouflage. Unlike conventional optics, thermal imaging reveals temperature differences, helping distinguish vehicles, personnel, and other heat sources regardless of visual concealment. For tank commanders, gunners, and drivers, thermal cameras provide enhanced battlefield awareness, enabling accurate firing solutions and movement coordination. Mounted typically in the gunner's sight, commander's panoramic viewers, and driver assistance systems, these devices play a pivotal role in high-intensity armored warfare. The introduction of thermal imaging has significantly elevated the effectiveness of MBTs, reducing reaction times and improving hit probability under adverse conditions. Their integration into fire control systems ensures faster and more reliable target acquisition. As armored units operate in increasingly unpredictable and complex operational environments, thermal imaging has become an essential tool for maintaining dominance in ground combat. Across global defense forces, the adoption of thermal systems reflects a broader push for greater precision, survivability, and operational readiness in mechanized warfare.

Technology Impact in Main Battle Tank Thermal Camera Market:

Technological innovation has transformed thermal cameras from basic imaging devices into advanced, networked battlefield sensors onboard main battle tanks. Today's systems offer far greater resolution, range, and reliability than earlier models, delivering crisp imagery that enables precise identification of targets at extended distances. Enhanced thermal sensitivity now allows for finer distinction between similar heat sources, aiding in friend-or-foe discrimination. Image stabilization and software-based enhancements ensure clear visibility even when the tank is moving rapidly or operating in rough terrain. Modern thermal systems are also increasingly integrated with digital fire control and situational awareness platforms, enabling automatic target tracking and improved ballistic solutions. Some tanks now feature multi-channel optics, combining thermal and day cameras into a single user interface, streamlining operations for the crew. Real-time sharing of thermal data with other vehicles or command units enables coordinated action and quicker responses in fluid combat situations. Miniaturization and ruggedization have also improved, making sensors more durable and easier to maintain in the field. With the growing use of AI, thermal imaging is being paired with algorithms capable of object classification and threat prioritization. These advancements significantly boost a tank's lethality, protection, and tactical value, reinforcing the role of thermal imaging as a cornerstone of armored warfare.

Key Drivers in Main Battle Tank Thermal Camera Market:

The growing complexity of land warfare and the evolving nature of threats are primary forces driving the adoption of thermal cameras in main battle tanks. These sensors enable forces to operate effectively in conditions that would otherwise compromise visual systems, such as night operations, adverse weather, or environments filled with smoke and debris. With the shift toward high-mobility, rapid-reaction ground forces, the ability to detect and engage targets accurately without relying on ambient light has become a tactical necessity. Enemy use of concealment tactics and terrain for cover further underscores the need for thermal imaging, which can identify hidden threats that traditional optics might miss. As modern tanks are expected to perform in a variety of roles-ranging from urban engagements to open-field warfare-thermal cameras provide the adaptability required to maintain combat effectiveness across these scenarios. Upgrades to older tank fleets also drive demand, as thermal systems are often part of broader modernization packages that extend vehicle relevance on the battlefield. In addition, advances in autonomous and semi-autonomous targeting platforms are increasing the importance of sensor systems, with thermal imaging playing a key role in feeding data to automated decision-support tools. These factors make thermal capability a standard, not a luxury, in modern armored doctrine.

Regional Trends in Main Battle Tank Thermal Camera Market:

Adoption and advancement of thermal cameras for main battle tanks vary widely across regions, reflecting differences in defense priorities, operational environments, and technological capabilities. In Western countries, particularly in North America and parts of Europe, thermal imaging is deeply integrated into MBT platforms as part of advanced digitization and networked warfare strategies. These nations focus on high-performance sensors that support long-range engagement and multi-crew coordination. Eastern European countries, responding to increasing security challenges, are accelerating the upgrade of legacy tanks with thermal systems to enhance survivability and targeting accuracy in potential frontline deployments. In the Asia-Pacific region, growing tensions and expanding armored forces have led to increased investment in domestic sensor development and integration. Nations such as South Korea and India are placing emphasis on indigenous solutions to support their strategic autonomy. In the Middle East, thermal technology is essential for effective combat in open, arid environments where visibility is often impaired by dust and heat. These systems also play a major role in countering unconventional threats in both rural and urban areas. Meanwhile, Latin America and Africa exhibit more limited adoption, often driven by international aid or selective procurement projects aimed at bolstering border security or internal stability missions.

Key Main Battle Tank Thermal Camera Program:

Hyundai Rotem, a prominent South Korean defense manufacturer, has formally registered a next-generation tank project with the South Korean patent office. The patent application, submitted on August 26, 2024, was approved on April 17, 2025, with the decision publicly disclosed on April 21, 2025. Informally referred to by some analysts as the "K3" - a likely successor to the K2 Black Panther - the new tank features a notably streamlined design compared to earlier concept renderings. Its turret modules appear robust, suggesting a heavily armored platform that incorporates advanced protection materials, including steel, ceramics, and composite armor.

Table of Contents

Main Battle Thermal Camera Market - Table of Contents

Main Battle Thermal Camera Market Report Definition

Main Battle Thermal Camera Market Segmentation

By Type

By Technology

By Region

Main Battle Thermal Camera Market Analysis for next 10 Years

The 10-year Main Battle thermal camera market analysis would give a detailed overview of Main Battle thermal camera market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Main Battle Thermal Camera Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Main Battle Thermal Camera Market Forecast

The 10-year Main Battle thermal camera market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Main Battle Thermal Camera Market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Main Battle Thermal Camera Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Main Battle Thermal Camera Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Main Battle Thermal Camera Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Component, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Main Battle Tank Thermal Camera Market Forecast, 2025-2035

- Figure 2: Global Main Battle Tank Thermal Camera Market Forecast, By Region, 2025-2035

- Figure 3: Global Main Battle Tank Thermal Camera Market Forecast, By Component, 2025-2035

- Figure 4: Global Main Battle Tank Thermal Camera Market Forecast, By Technology, 2025-2035

- Figure 5: Global Main Battle Tank Thermal Camera Market Forecast, By Application, 2025-2035

- Figure 6: North America, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 7: Europe, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 9: APAC, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 10: South America, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 11: United States, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 12: United States, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 13: Canada, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 15: Italy, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 17: France, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 18: France, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 19: Germany, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 25: Spain, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 31: Australia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 33: India, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 34: India, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 35: China, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 36: China, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 41: Japan, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Main Battle Tank Thermal Camera Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Main Battle Tank Thermal Camera Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Component (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Component (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Technology (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Technology (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Main Battle Tank Thermal Camera Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Main Battle Tank Thermal Camera Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Main Battle Tank Thermal Camera Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Main Battle Tank Thermal Camera Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Main Battle Tank Thermal Camera Market, By Region, 2025-2035

- Figure 61: Scenario 1, Main Battle Tank Thermal Camera Market, By Component, 2025-2035

- Figure 62: Scenario 1, Main Battle Tank Thermal Camera Market, By Technology, 2025-2035

- Figure 63: Scenario 1, Main Battle Tank Thermal Camera Market, By Application, 2025-2035

- Figure 64: Scenario 2, Main Battle Tank Thermal Camera Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Main Battle Tank Thermal Camera Market, By Region, 2025-2035

- Figure 66: Scenario 2, Main Battle Tank Thermal Camera Market, By Component, 2025-2035

- Figure 67: Scenario 2, Main Battle Tank Thermal Camera Market, By Technology, 2025-2035

- Figure 68: Scenario 2, Main Battle Tank Thermal Camera Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Main Battle Tank Thermal Camera Market, 2025-2035