|

市場調查報告書

商品編碼

1727190

戰鬥直升機用電子光學·熱像儀的全球市場:2025年~2035年Global Combat Helicopter Electro Optics & Thermal Cameras Market 2025-2035 |

||||||

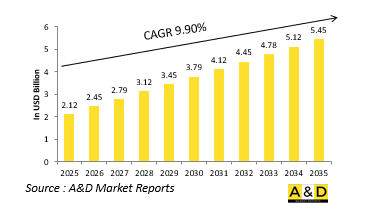

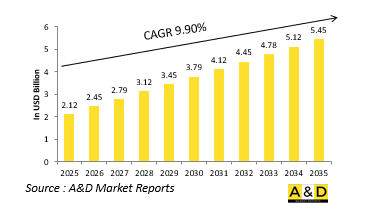

預計2025年全球作戰直升機光電和熱像儀市場規模將達到22.1億美元,到2035年將成長至54.5億美元,預測期內的複合年增長率 (CAGR) 為9.90%。

戰鬥直升機光電與熱像儀市場簡介:

光電和紅外線熱像儀系統是戰鬥直升機的關鍵部件,能夠增強晝夜瞄準、導航和態勢感知能力。這些系統支援各種任務,包括偵察、搜救、近距離空中支援和反裝甲作戰。光電感測器提供高解析度視覺影像,而熱像儀則可偵測熱訊號,使飛行員和機組人員能夠在各種天氣和光照條件下識別隱藏或偽裝的目標。這些技術的結合使直升機能夠在複雜的作戰環境中以更高的精度和安全性進行作戰。這些感測器可安裝在砲塔上或整合到瞄準系統中,幫助砲手精確瞄準武器系統,並協助飛行員導航地形、避開障礙物和監視。作戰直升機經常在低空飛行並面臨火力攻擊,因此即時可視性和快速目標捕獲對於任務成功至關重要。光電和熱成像系統無需依賴可能被幹擾或偵測到的雷達即可提供這種能力。隨著直升機被部署到各種戰場,包括城市、山區和茂密的叢林,其角色不斷擴大。這些戰場需要強大的成像解決方案來確保有效作戰和作戰優勢。

科技對作戰直升機光電和熱成像儀市場的影響:

技術進步顯著擴展了作戰直升機光電和熱成像儀的功能,使其成為用途廣泛且精確的戰場工具。最新的系統採用多光譜感測器,將可見光、紅外線和微光成像功能集於一身,以實現最佳清晰度,並可在模式之間無縫切換。這些改進增強了對隱藏威脅的偵測能力,即使透過煙霧、濃霧和植被也能有效辨識。高清顯示器和影像穩定系統即使在湍流氣流中也能確保清晰穩定的視野,而數位變焦和目標追蹤演算法則提高了遠距離交戰的精確度。將這些感測器與火控系統集成,可以使飛行員和砲手更有效率地協同作戰,從而更快地做出決策。此外,熱像儀和光電攝影機的數據現在可以在平台之間即時共享,從而增強空中和地面部隊之間的協作。基於人工智慧的影像辨識技術也開始幫助操作員區分戰鬥人員、車輛和平民。系統向更小、更堅固和軟體驅動的轉變意味著新的感測器更輕、更耐用,並且更易於韌體升級。隨著作戰任務越來越依賴數據和時間,這些光學技術在提高旋翼平台在攻擊和防禦行動中的戰術效能方面發揮關鍵作用。

作戰直升機市場光電和熱像儀的關鍵推動因素:

現代衝突環境日益複雜,是推動戰鬥直升機對先進光電和紅外線熱像儀需求的主要因素。這些技術提供夜視、目標識別和全天候偵察等關鍵任務能力,對於在不可預測的戰鬥中保持作戰效能至關重要。直升機經常用於近距離支援,因此在城市、叢林和沙漠等複雜地形中識別威脅的能力至關重要。對非對稱戰爭和反叛亂行動的日益關注也凸顯了對非雷達偵測系統的需求,這些系統不會洩漏飛機的位置。肩扛式飛彈和隱藏敵人的威脅日益增加,進一步凸顯了被動感測器在提高瞄準精度和機組人員生存能力方面的價值。現代軍事理論強調互通性和即時數據共享,這促使這些成像系統被整合到更廣泛的網路中心戰框架中。此外,世界各地的國防現代化計畫正在推動以支援自動目標探測和多角色適應性的下一代光學系統取代傳統系統。對更輕、更節能且不影響飛行性能的系統的需求也推動了這項需求。綜合起來,這些因素表明,人們越來越依賴先進的視覺系統來最大限度地提升直升機的作戰能力。

作戰直升機光電與熱像儀市場的區域趨勢:

不同地區對作戰直升機光電和熱像儀的採用情況因戰略需求、地形挑戰和採購能力而異。在北美,重點是將下一代成像系統與先進的航空電子設備結合,使旋翼平台成為網路化作戰行動中的關鍵節點。在歐洲,重點是感測器融合和模組化,使直升機能夠快速切換任務角色並搭載適應性強的有效載荷。山區和森林地形的國家正優先採用熱像儀來探測被自然掩體遮蔽的威脅。在亞太地區,地緣政治緊張局勢加劇和國防開支增加刺激了對增強型瞄準系統的投資,並努力實現本地生產,以減少對外國供應商的依賴。經常參與反恐和沙漠行動的中東國家青睞針對高溫環境和遠端監視進行最佳化的系統。在非洲和拉丁美洲,他們正在逐步擴展其邊境安全和反走私等任務的能力,通常選擇對現有機隊進行經濟高效的升級。在這些地區,與現有國防製造商的合作在技術轉移和客製化方面發揮關鍵作用。在全球範圍內,向多光譜影像和人工智慧增強分析的轉變正在重塑作戰直升機感知和應對威脅的方式,使這些技術成為面向未來的軍隊的優先事項。

主要的國防作戰直升機電光和熱像儀項目:

美國陸軍已將特種作戰需求融入其未來遠程突擊機 (FLRAA) 傾轉旋翼機的設計中,促使飛機總重量未指定增加。這些改進旨在簡化並降低將標準 FLRAA 改裝為精銳部隊第 160 特種作戰航空團 (SOAR) 特種作戰直升機的成本。目前,將標準的 UH-60M 黑鷹直升機改裝為 MH-60M 特種作戰直升機是一個高度複雜且資源密集的過程。

本報告提供全球戰鬥直升機用電子光學·熱像儀市場相關調查,彙整10年的各分類市場預測,技術趨勢,機會分析,企業簡介,各國資料等資訊。

目錄

戰鬥直升機用電子光學·熱像儀市場 - 目錄

戰鬥直升機用電子光學·熱像儀市場報告定義

戰鬥直升機用電子光學·熱像儀市場區隔

各地區

類別

用途

各作業平台類型

未來10年戰鬥直升機用光電熱像儀市場分析

本章詳細概述了戰鬥直升機用光電熱像儀市場的成長、變化趨勢、技術採用概況以及整體市場吸引力。

戰鬥直升機用光電熱像儀市場技術

本部分涵蓋了預計將影響該市場的十大技術,以及這些技術可能對整體市場產生的影響。

戰鬥直升機用光電熱像儀全球市場預測

本部分詳細介紹了上述各細分市場對戰鬥直升機用光電熱像儀市場的10年預測。

戰鬥直升機用光電熱像儀市場(按地區)的趨勢和預測

本部分涵蓋了戰鬥直升機用光電熱像儀市場(按地區)的趨勢、推動因素、阻礙因素、挑戰以及政治、經濟、社會和技術方面。此外,還詳細涵蓋了按地區進行的市場預測和情境分析。區域分析以關鍵公司概況、供應商格局和公司基準分析作為結尾。目前市場規模是基於常規情境估算。

北美

促進因素,阻礙因素,課題

PEST

市場預測與情勢分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

門禁控制市場國家分析

本章涵蓋該市場的主要國防項目,以及該市場的最新資訊和專利申請。此外,也涵蓋了各國未來10年的市場預測與情境分析。

美國

防衛計劃

最新消息

專利

這個市場上目前技術成熟度

市場預測與情勢分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

戰鬥直升機用電子光學·熱像儀市場機會矩陣

戰鬥直升機的電力光學設備和熱像儀市場報告相關專家的意見

結論

關於航空·國防市場報告

相關商品

The Global Combat Helicopter Electro Optics & Thermal Cameras market is estimated at USD 2.21 billion in 2025, projected to grow to USD 5.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 9.90% over the forecast period 2025-2035.

Introduction to Combat Helicopter Electro Optics & Thermal Cameras Market:

Electro-optics and thermal imaging systems are vital components of combat helicopters, enabling enhanced targeting, navigation, and situational awareness in both day and night operations. These systems support a wide range of missions, including reconnaissance, search and rescue, close air support, and anti-armor engagements. Electro-optical sensors provide high-resolution visual imagery, while thermal cameras detect heat signatures, allowing pilots and crew to identify hidden or camouflaged targets in various weather and lighting conditions. The combination of these technologies allows helicopters to operate in complex combat environments with increased precision and safety. Mounted on turrets or integrated into targeting systems, these sensors assist gunners in aiming weapon systems accurately and pilots in navigating terrain, avoiding obstacles, and conducting surveillance. As combat helicopters often operate at low altitudes and under fire, real-time visibility and rapid target acquisition are crucial for mission success. Electro-optic and thermal systems deliver this capability without relying solely on radar, which can be jammed or detected. Their role continues to expand as helicopters are deployed in diverse theaters, including urban warfare, mountainous terrain, and dense forests, all of which demand robust imaging solutions for effective engagement and operational superiority.

Technology Impact in Combat Helicopter Electro Optics & Thermal Cameras Market:

Technological advancements have significantly expanded the capabilities of electro-optics and thermal imaging in combat helicopters, transforming them into highly versatile and precise battlefield tools. Modern systems now feature multispectral sensors that combine visual, infrared, and low-light imaging into a single unit, offering seamless switching between modes for optimal clarity. These improvements enhance detection of concealed threats, even through smoke, fog, or vegetation. High-definition displays and image stabilization provide sharp, steady views under turbulent flight conditions, while digital zoom and target tracking algorithms improve engagement accuracy at extended distances. The integration of these sensors with fire control systems allows for more efficient coordination between pilot and gunner, facilitating faster decision-making. Additionally, data from thermal and electro-optical cameras can now be shared across platforms in real time, enhancing coordination between air and ground forces. AI-based image recognition is also beginning to assist operators in distinguishing between combatants, vehicles, and civilians. The shift toward miniaturized, ruggedized, and software-driven systems means newer sensors are lighter, more durable, and easier to upgrade through firmware. As combat missions grow increasingly data-driven and time-sensitive, these optical technologies play a critical role in elevating the tactical effectiveness of rotary-wing platforms in both offensive and defensive operations.

Key Drivers in Combat Helicopter Electro Optics & Thermal Cameras Market:

The growing complexity of modern conflict environments is a primary factor driving the demand for advanced electro-optics and thermal imaging in combat helicopters. These technologies provide mission-critical capabilities such as night vision, target recognition, and all-weather surveillance, which are essential for maintaining effectiveness during unpredictable engagements. As helicopters are frequently used in close support roles, the ability to distinguish threats in challenging terrain-whether urban, jungle, or desert-has become indispensable. Increased focus on asymmetric warfare and counter-insurgency operations has also highlighted the need for non-radar-based detection systems that do not compromise the aircraft's position. The rising threat of shoulder-fired missiles and hidden adversaries further underscores the value of passive sensors that enhance both targeting accuracy and crew survivability. Modern military doctrines emphasize interoperability and real-time data sharing, prompting integration of these imaging systems into broader network-centric warfare frameworks. Additionally, defense modernization programs around the world are pushing for the replacement of legacy systems with next-generation optics that support automated target detection and multi-role adaptability. Demand is also being driven by the need for more lightweight and power-efficient systems that do not compromise flight performance. Collectively, these drivers underscore the increasing reliance on sophisticated vision systems to maximize helicopter combat capabilities.

Regional Trends in Combat Helicopter Electro Optics & Thermal Cameras Market:

Regional adoption of electro-optics and thermal cameras in combat helicopters varies based on strategic needs, terrain challenges, and procurement capabilities. In North America, there is a strong focus on integrating next-generation imaging systems with advanced avionics, enabling rotary-wing platforms to function as key nodes in networked combat operations. Europe emphasizes sensor fusion and modularity, allowing helicopters to switch mission roles quickly using adaptable payloads. Countries with mountainous or forested regions are prioritizing thermal imaging to detect threats obscured by natural cover. In the Asia-Pacific, rising geopolitical tensions and increased defense spending are fueling investments in enhanced targeting systems, with local production efforts aimed at reducing reliance on foreign suppliers. Middle Eastern nations, often engaged in counter-terrorism and desert operations, favor systems optimized for high-heat environments and long-range surveillance. Africa and Latin America are gradually expanding their capabilities, driven by border security and anti-smuggling missions, often opting for cost-effective upgrades to existing fleets. In these regions, partnerships with established defense manufacturers play a key role in technology transfer and customization. Across the globe, the shift toward multi-spectral imaging and AI-enhanced analytics is reshaping how combat helicopters perceive and react to threats, making these technologies a priority for forward-looking military forces.

Key Defense Combat Helicopter Electro Optics & Thermal Cameras Program:

The U.S. Army has integrated special operations-specific requirements into the design of its Future Long-Range Assault Aircraft (FLRAA) tiltrotor, resulting in an unspecified increase in the aircraft's gross weight. These modifications aim to simplify and reduce the cost of converting standard FLRAAs into special operations variants for the elite 160th Special Operations Aviation Regiment (SOAR). Currently, converting standard UH-60M Black Hawks into MH-60M special operations helicopters is a highly complex and resource-intensive process.

Table of Contents

Combat Helicopter Electro Optics & Thermal Cameras Market - Table of Contents

Combat Helicopter Electro Optics & Thermal Cameras market Report Definition

Combat Helicopter Electro Optics & Thermal Cameras market Segmentation

By Region

By Type

By Application

By Platform Type

Combat Helicopter Electro Optics & Thermal Cameras market Analysis for next 10 Years

The 10-year Combat Helicopter Electro Optics & Thermal Cameras market analysis would give a detailed overview of Combat Helicopter Electro Optics & Thermal Cameras market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Combat Helicopter Electro Optics & Thermal Cameras market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Combat Helicopter Electro Optics & Thermal Cameras market Forecast

The 10-year Combat Helicopter Electro Optics & Thermal Cameras market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Combat Helicopter Electro Optics & Thermal Cameras market Trends & Forecast

The regional Combat Helicopter Electro Optics & Thermal Cameras market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Combat Helicopter Electro Optics & Thermal Cameras market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Combat Helicopter Electro Optics & Thermal Cameras market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

Related product

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Platform Type, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Application, 2025-2035

List of Figures

- Figure 1: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, 2025-2035

- Figure 2: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Region, 2025-2035

- Figure 3: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Type, 2025-2035

- Figure 4: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Platform Type, 2025-2035

- Figure 5: Global Combat Helicopter Electro Optics and Thermal Cameras Market Forecast, By Application, 2025-2035

- Figure 6: North America, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 7: Europe, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 9: APAC, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 10: South America, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 11: United States, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 12: United States, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 13: Canada, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 15: Italy, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 17: France, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 18: France, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 19: Germany, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 25: Spain, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 31: Australia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 33: India, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 34: India, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 35: China, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 36: China, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 41: Japan, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Combat Helicopter Electro Optics and Thermal Cameras Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Combat Helicopter Electro Optics and Thermal Cameras Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Combat Helicopter Electro Optics and Thermal Cameras Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region, 2025-2035

- Figure 61: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type, 2025-2035

- Figure 62: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type, 2025-2035

- Figure 63: Scenario 1, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application, 2025-2035

- Figure 64: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Region, 2025-2035

- Figure 66: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Type, 2025-2035

- Figure 67: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Platform Type, 2025-2035

- Figure 68: Scenario 2, Combat Helicopter Electro Optics and Thermal Cameras Market, By Application, 2025-2035

- Figure 69: Company Benchmark, Combat Helicopter Electro Optics and Thermal Cameras Market, 2025-2035