|

市場調查報告書

商品編碼

1715439

全球PCB測試系統市場(2025-2035)Global PCB Test System Market 2025-2035 |

||||||

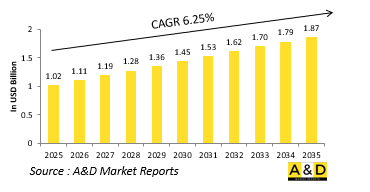

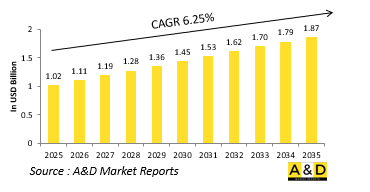

2025 年全球 PCB 測試系統市場規模價值 10.2 億美元,預計到 2035 年將達到 18.7 億美元,在 2025-2035 年預測期內的複合年增長率為 6.25%。

全球 PCB 測試系統市場簡介

世界各地的軍用PCB(印刷電路板)測試系統在確保國防應用中使用的電子元件的可靠性和性能方面發揮著至關重要的作用。這些測試系統對於評估軍事環境中通常遇到的極端環境和操作條件下 PCB 的功能性、耐用性和合規性至關重要。從通訊系統和雷達到武器導引和導航,國防平台越來越依賴先進的電子設備,大大增加了對精確和強大的 PCB 測試解決方案的需求。軍用級 PCB 必須滿足耐熱性、衝擊性、振動性和電磁幹擾性的嚴格標準,因此必須進行徹底的測試。隨著自主系統、電子戰和網路中心作戰等現代戰爭技術的普及,PCB 測試比以往任何時候都更融入軍事系統的生命週期。全球國防現代化的投資和軍事硬體中電子內容的增加進一步推動了這一領域的成長。

科技對PCB測試系統市場的影響

技術的進步大大改變了軍用 PCB 測試系統的格局,使得測試過程更快、更準確、高度自動化。人工智慧和機器學習的創新開始融入測試平台,促進預測性維護和即時故障診斷。此外,採用高速數位射頻測試功能對於驗證下一代軍事通訊和感測器系統中使用的複雜多層 PCB 至關重要。 5G、雷達系統和電子對抗設備的出現正在推動測試技術向更高的頻率範圍和更複雜的測試演算法發展。此外,組件小型化和 SoC 架構的日益普及正在推動對更精細分辨率下增加測試覆蓋率的需求。環境和壓力測試技術也得到了發展,以改善戰場條件的模擬,從而評估 PCB 的彈性。隨著軍事行動變得越來越依賴數據和電子,這些技術創新不僅提高了測試準確性,而且還降低了關鍵任務系統的生命週期成本和停機時間。

PCB測試系統市場的關鍵推動因素

有幾個因素正在推動全球國防部門對軍用 PCB 測試系統的需求和發展。其中最主要的是現代軍事裝備的複雜性和電子含量日益增加,這需要嚴格而全面的測試協議。國防現代化計劃,特別是對電子戰、無人系統和安全通訊網路等新技術的投資增加,對複雜的 PCB 驗證解決方案產生了平行的需求。此外,關鍵任務操作對系統可靠性的迫切需求正在推動嚴格測試標準的實施。電子乾擾和網路戰日益增長的威脅也促使國防機構投資先進的測試系統,以確保電磁相容性和安全性。軍事平台上電子設備體積越來越小、密度越來越高的發展趨勢推動了對精確、適應性強的測試系統的需求。向法規遵循、生命週期管理和基於條件的監控的轉變正在促進對更先進的測試解決方案的需求,使得 PCB 測試系統成為國防電子生態系統的重要組成部分。

本報告對全球 PCB 測試系統市場進行了深入分析,包括成長動力、10 年展望和區域趨勢。

目錄

全球PCB測試系統市場報告定義

全球PCB測試系統市場區隔

按地區

依科技

按類型

依用途

未來10年全球PCB測試系統市場分析

全球PCB測試系統市場市場技術

全球PCB測試系統市場預測

全球 PCB 測試系統市場趨勢及各區域預測

北美

促進因素、阻礙因素與課題

害蟲

市場預測與情境分析

主要公司

供應商層級狀況

企業基準

歐洲

中東

亞太地區

南美洲

全球 PCB 測試系統市場(按國家/地區)分析

美國

國防計畫

最新消息

專利

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

全球 PCB 測試系統市場機會矩陣

全球PCB測試系統市場報告專家意見

結論

關於航空和國防市場報告

The global PCB Test System market is estimated at USD 1.02 billion in 2025, projected to grow to USD 1.87 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 6.25% over the forecast period 2025-2035.

Introduction to Global PCB Test System market:

The global military PCB (Printed Circuit Board) test system plays a critical role in ensuring the reliability and performance of electronic components used in defense applications. These test systems are essential for evaluating the functionality, durability, and compliance of PCBs under extreme environmental and operational conditions typically encountered in military settings. As defense platforms become increasingly reliant on advanced electronics-ranging from communication systems and radar to weapons guidance and navigation-the demand for precise and robust PCB testing solutions has grown significantly. Military-grade PCBs must meet stringent standards for thermal resistance, shock, vibration, and electromagnetic interference, making thorough testing indispensable. With the proliferation of modern warfare technologies such as autonomous systems, electronic warfare, and network-centric operations, PCB testing is now more integrated into the lifecycle of military systems than ever before. Global investment in defense modernization and increasing electronic content in military hardware are further fueling the growth of this segment.

Technology Impact in PCB Test System Market:

Advancements in technology have significantly reshaped the landscape of military PCB test systems, enabling faster, more accurate, and highly automated testing processes. Innovations in artificial intelligence and machine learning are beginning to be integrated into test platforms, facilitating predictive maintenance and real-time fault diagnostics. Additionally, the adoption of high-speed digital and RF test capabilities is essential for validating the complex, multilayered PCBs used in next-generation military communication and sensor systems. The emergence of 5G, radar systems, and electronic countermeasure equipment has pushed testing technologies toward higher frequency ranges and more sophisticated test algorithms. Furthermore, the miniaturization of components and the increasing use of system-on-chip architectures have demanded greater test coverage at finer resolutions. Environmental and stress testing technologies have also evolved, offering improved simulation of battlefield conditions to assess PCB resilience. As military operations become more data-driven and electronic-dependent, these technological innovations are not only enhancing test accuracy but also reducing lifecycle costs and downtime for mission-critical systems.

Key Drivers in PCB Test System Market:

Several factors are driving the demand and evolution of military PCB test systems across global defense sectors. Foremost among these is the increasing complexity and electronic content of modern military equipment, which necessitates rigorous and comprehensive testing protocols. Rising investments in defense modernization programs, especially in emerging technologies like electronic warfare, unmanned systems, and secure communication networks, have created a parallel demand for sophisticated PCB validation solutions. Additionally, the critical need for system reliability in mission-critical operations drives the implementation of stringent testing standards. Growing threats from electronic interference and cyber warfare have also pushed defense agencies to invest in advanced testing systems to ensure electromagnetic compatibility and security. The trend toward miniaturized, high-density electronics in military platforms increases the necessity for precise and adaptable test systems. Regulatory compliance, lifecycle management, and the shift toward condition-based maintenance further contribute to the need for advanced testing solutions, making PCB test systems an integral part of the defense electronics ecosystem.

Regional Trends in PCB Test System Market:

Regional dynamics play a significant role in shaping the military PCB test system market, with each region reflecting its unique defense priorities and technological capabilities. North America, led by the United States, remains a dominant player due to its robust defense budget and continuous focus on electronic warfare and modernization of military assets. The presence of key defense contractors and advanced research institutions in the region further accelerates the development and deployment of high-end PCB test systems. In Europe, countries like the UK, Germany, and France are investing in upgrading their defense electronics infrastructure, driving demand for advanced testing solutions tailored to NATO standards. The Asia-Pacific region is witnessing rapid growth, particularly in China, India, South Korea, and Japan, driven by increased defense spending, geopolitical tensions, and a growing domestic electronics manufacturing base. The Middle East, while still emerging in this domain, is focusing on localized defense production and maintenance capabilities, creating opportunities for regional test system providers. Africa and Latin America are at a nascent stage but show potential for growth as part of broader defense capability development initiatives.

Key PCB Test System Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global PCB Tests Systems Market - Table of Contents

Global PCB Tests Systems Market Report Definition

Global PCB Tests Systems Market Segmentation

By Region

By Technology

By Type

By Application

Global PCB Tests Systems Market Analysis for next 10 Years

The 10-year Global PCB Tests Systems market analysis would give a detailed overview of Global PCB Tests Systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global PCB Tests Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global PCB Tests Systems Market Forecast

The 10-year Global PCB Tests Systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global PCB Tests Systems Market Trends & Forecast

The regional Global PCB Tests Systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global PCB Tests Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global PCB Tests Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global PCB Tests Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global PCB Test System Market Forecast, 2025-2035

- Figure 2: Global PCB Test System Market Forecast, By Region, 2025-2035

- Figure 3: Global PCB Test System Market Forecast, By Technology, 2025-2035

- Figure 4: Global PCB Test System Market Forecast, By Application, 2025-2035

- Figure 5: Global PCB Test System Market Forecast, By Type, 2025-2035

- Figure 6: North America, PCB Test System Market, Market Forecast, 2025-2035

- Figure 7: Europe, PCB Test System Market, Market Forecast, 2025-2035

- Figure 8: Middle East, PCB Test System Market, Market Forecast, 2025-2035

- Figure 9: APAC, PCB Test System Market, Market Forecast, 2025-2035

- Figure 10: South America, PCB Test System Market, Market Forecast, 2025-2035

- Figure 11: United States, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 12: United States, PCB Test System Market, Market Forecast, 2025-2035

- Figure 13: Canada, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 14: Canada, PCB Test System Market, Market Forecast, 2025-2035

- Figure 15: Italy, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 16: Italy, PCB Test System Market, Market Forecast, 2025-2035

- Figure 17: France, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 18: France, PCB Test System Market, Market Forecast, 2025-2035

- Figure 19: Germany, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 20: Germany, PCB Test System Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, PCB Test System Market, Market Forecast, 2025-2035

- Figure 23: Belgium, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, PCB Test System Market, Market Forecast, 2025-2035

- Figure 25: Spain, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 26: Spain, PCB Test System Market, Market Forecast, 2025-2035

- Figure 27: Sweden, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, PCB Test System Market, Market Forecast, 2025-2035

- Figure 29: Brazil, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, PCB Test System Market, Market Forecast, 2025-2035

- Figure 31: Australia, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 32: Australia, PCB Test System Market, Market Forecast, 2025-2035

- Figure 33: India, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 34: India, PCB Test System Market, Market Forecast, 2025-2035

- Figure 35: China, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 36: China, PCB Test System Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, PCB Test System Market, Market Forecast, 2025-2035

- Figure 39: South Korea, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, PCB Test System Market, Market Forecast, 2025-2035

- Figure 41: Japan, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 42: Japan, PCB Test System Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, PCB Test System Market, Market Forecast, 2025-2035

- Figure 45: Singapore, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, PCB Test System Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, PCB Test System Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, PCB Test System Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, PCB Test System Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, PCB Test System Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, PCB Test System Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, PCB Test System Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, PCB Test System Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, PCB Test System Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, PCB Test System Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, PCB Test System Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, PCB Test System Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, PCB Test System Market, Global Market, 2025-2035

- Figure 59: Scenario 1, PCB Test System Market, Total Market, 2025-2035

- Figure 60: Scenario 1, PCB Test System Market, By Region, 2025-2035

- Figure 61: Scenario 1, PCB Test System Market, By Technology, 2025-2035

- Figure 62: Scenario 1, PCB Test System Market, By Application, 2025-2035

- Figure 63: Scenario 1, PCB Test System Market, By Type, 2025-2035

- Figure 64: Scenario 2, PCB Test System Market, Total Market, 2025-2035

- Figure 65: Scenario 2, PCB Test System Market, By Region, 2025-2035

- Figure 66: Scenario 2, PCB Test System Market, By Technology, 2025-2035

- Figure 67: Scenario 2, PCB Test System Market, By Application, 2025-2035

- Figure 68: Scenario 2, PCB Test System Market, By Type, 2025-2035

- Figure 69: Company Benchmark, PCB Test System Market, 2025-2035