|

市場調查報告書

商品編碼

1714099

起落架測試市場:全球2025-2035年Global Landing gear testing Market 2025-2035 |

||||||

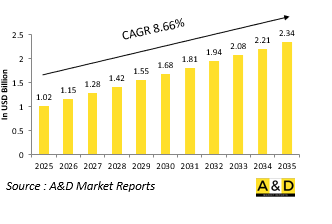

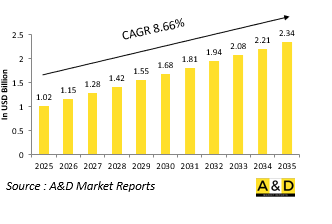

2025 年全球起落架測試市場規模估計為 10.2 億美元,預計到 2035 年將增長到 23.4 億美元,2025-2035 年預測期內的複合年增長率 (CAGR) 為 8.66%。

起落架測試市場簡介:

起落架測試對於確保世界各地空中和海軍航空軍用飛機的結構完整性、可靠性和作戰準備起著至關重要的作用。作為飛機中機械最複雜、壓力最大的部件之一,起落架必須在飛機的整個使用壽命中承受反覆的高衝擊力、不斷變化的環境條件和極端的工作週期。這在國防航空中變得更加重要,因為起落架要承受頻繁的使用模式,包括艦載作業、短距離和顛簸起飛、快速部署場景以及在未準備好的地形上的緊急降落。與民用飛機不同,戰鬥機、貨機、直升機和無人機系統等軍用平台必須在不可預測且通常惡劣的條件下運行,需要嚴格的測試標準。國防起落架測試涵蓋一系列評估,從靜態和動態負載測試到疲勞和跌落測試,不僅驗證設計的耐用性,還驗證其在關鍵任務環境中執行的能力。此外,測試過程還驗證液壓和煞車系統的性能,評估即時負載下的執行器行為,並模擬部署/縮回循環以複製戰鬥準備狀態。更靈活、更輕、更隱身的飛機的發展推動了軍事航空專案對先進起落架系統和相應先進測試方法的需求增加。

科技對起落架測試市場的影響:

技術的進步大大改變了國防部門起落架測試的面貌,提高了測試的精確度和範圍。機電試驗台和多軸執行器的整合可以即時模擬複雜的著陸場景,包括不對稱負載分佈和粗糙地面撞擊。這些測試台通常支援全尺寸起落架系統,使工程師能夠分析數千次模擬飛行循環中的真實應力、應變和磨損。現在,在設計驗證階段,通常會使用有限元素分析 (FEA) 和多體動力學模擬來預測故障點,並在物理原型開始之前優化重量強度比。這些模擬通常與數位孿生模型結合,實現虛擬行為與實體測試資料的同步。光纖應變計、無線稱重感測器和紅外線熱成像等感測器技術的創新,為材料疲勞、煞車系統內的熱量積聚和負載下的變形提供了高度細緻的洞察。此外,煞車系統測試的進步,特別是電液和碳煞車模組的進步,現在可以在各種環境和負載條件下準確分析減速性能。人工智慧分析越來越多地被用於評估測試數據、識別異常和預測組件生命週期閾值。此外,擴增實境 (AR) 等技術正在維護模擬場景中使用,以可視化組件磨損並進行程式演練,這對於在惡劣或快速反應環境中工作的軍事工程師特別有用。

起落架測試市場的關鍵推動因素:

多種戰略推動因素和營運需求正在推動國防航空航太專案更加重視起落架測試。最大的推動因素之一是對任務適應性和穩健性的需求日益增加。現代軍用飛機必須能夠在各種地面上運行,包括未鋪砌的跑道、航空母艦和臨時著陸跑道,因此起落架系統即使在惡劣條件下也必須堅固、靈活和可靠。隨著國防部隊轉向多用途和遠徵平台,裝備系統必須適應更大的重量波動和不穩定的部署週期,需要大量的疲勞和負載測試。另一個關鍵推動因素是隱身和低可觀測性設計的趨勢,這種設計通常需要可伸縮、節省空間的起落架,並優化雷達橫截面。在這種情況下,測試涉及評估受限配置中的部署機制,而不會影響結構性能。生命週期成本和可維護性也是主要考慮因素。國防採購機構越來越注重最大限度地減少長期維護需求並最大限度地延長正常運行時間,這需要預測性維護協議,並透過對齒輪進行磨損、腐蝕和液壓油完整性的全面測試來支援。包括聯合飛機開發計畫在內的國際防務合作也推動了對標準化、可重複的測試流程的需求,以滿足不同的合規要求。此外,對衝突環境中的安全性和生存能力的重視突破了操作測試的極限,包括模擬迫降、輪胎爆裂場景和壓力下的執行器故障的測試。

起落架測試市場的區域趨勢:

在世界各地,起落架測試的性質和重點反映了當地的國防優先事項、工業能力和平台專業化。在北美,尤其是美國,領先的國防原始設備製造商和龐大的測試設施為世界上一些最全面的起落架測試項目提供了支援。這些項目專注於遠程轟炸機、海軍飛機和第五代戰鬥機的重型齒輪系統,廣泛使用先進的降落塔、高速煞車裝置和攔阻鉤模擬環境。加拿大透過為軍用旋翼機和戰術運輸機提供維護、修理和大修(MRO)和測試服務做出了重大貢獻,這通常是作為北約支援行動的一部分。在歐洲,德國、法國和英國等國家正在測試傳統飛機和下一代飛機,包括透過 FCAS(未來作戰航空系統)等聯合計畫。歐洲測試設施優先進行極寒環境測試、耐鹽水腐蝕測試以及無人機和垂直起降平台的模組化起落架配置。在亞太地區,中國正在投資一個戰鬥機起落架高通量自動化測試平台,重點是耐用性和與本土煞車系統的整合。印度正在提高其本土齒輪部件的減震、疲勞測試和驗證能力,以支援諸如 Tejas 和運輸機概念等飛機。日本和韓國目前正在測試艦載飛機和隱形無人機,重點是緊湊但高負載的起落架解決方案。在中東,沙烏地阿拉伯和阿聯酋等國家正在建立國內航空航天測試能力,以支援西方飛機的許可生產和維護。這些工作通常包括模組化起落架測試單元,重點是煞車測試和液壓系統診斷。在南美洲和非洲部分地區,起落架測試仍然嚴重依賴國際合作,但正在努力開發自己的測試生態系統,特別是針對小型運輸和偵察無人機。隨著區域防禦規劃的發展,對本地可用、適應性強且資料整合的測試設置的需求將持續成長。

主要起落架測試計畫

The Boeing Company已獲得美國空軍下一代空中優勢 (NGAD) 戰鬥機計劃的工程和製造開發 (EMD) 合約。總統唐納德·川普、國防部長皮特·赫格塞斯和空軍將軍戴維·阿爾文在橢圓形辦公室發表聲明證實,新飛機將被命名為 F-47,並將成為美國第一架第六代戰鬥機。這一里程碑標誌著波音自 1997 年與McDonnell Douglas合併以來首次部署 "全新" 戰鬥機設計。與基於傳統McDonnell Douglas平台的 F-15EX 等飛機不同,全新設計完全從零開始,專門為滿足客戶的任務要求和願景而量身定制。

本報告涵蓋全球起落架測試市場,並提供按細分市場、技術趨勢、機會分析、公司概況和國家數據劃分的 10 年市場預測。

目錄

全球防禦起落架測試 - 目錄

全球國防部門起落架測試-報告定義

全球國防起落架測試 – 細分

按地區

按類型

依用途

按最終使用者

未來10年國防部門全球起落架測試分析

對全球國防部門起落架測試長達十年的分析提供了全球國防部門起落架測試的成長詳細概述,本章提供並解釋了變化趨勢、技術採用概述和整體市場吸引力。

全球起落架測試市場在國防部門的技術

本部分涵蓋預計將影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

國防部門全球起落架測試預測

上述部分詳細介紹了未來 10 年全球國防起落架測試市場的預測。

國防起落架測試區域與全球趨勢及預測

本部分涵蓋無人機市場的區域趨勢、推動因素、阻礙因素、課題以及政治、經濟、社會和技術方面。它還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準測試。目前市場規模是根據正常業務情境估算的。

北美

促進因素、阻礙因素與課題

害蟲

市場預測與情境分析

主要公司

供應商層級結構

企業基準

歐洲

中東

亞太地區

南美洲

世界國防工業送料齒輪試驗的國家分析

本章重點介紹該市場的主要防禦計劃,並介紹該市場的最新新聞和專利。它還提供國家級的 10 年市場預測和情境分析。

美國

國防計畫

最新消息

專利

目前該市場的技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

國防部門的全球起落架測試機會矩陣

專家對全球國防領域起落架測試的看法

結論

關於航空和國防市場報告

The Global Landing gear testing market is estimated at USD 1.02 billion in 2025, projected to grow to USD 2.34 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.66% over the forecast period 2025-2035.

Introduction to Landing gear testing Market:

Landing gear testing plays a foundational role in ensuring the structural integrity, reliability, and operational readiness of military aircraft across air forces and naval aviation units worldwide. As one of the most mechanically complex and stress-prone components of an aircraft, the landing gear must withstand repeated high-impact forces, variable environmental conditions, and extreme load cycles over the life of the airframe. In defense aviation, this becomes even more critical as landing gear is subject to intense usage patterns, including carrier-based operations, short and rough-field takeoffs, rapid deployment scenarios, and emergency landings on unprepared terrain. Unlike civilian aircraft, military platforms such as fighter jets, cargo planes, helicopters, and unmanned aerial systems must perform under unpredictable and often harsh conditions, requiring rigorous testing standards. Defense landing gear testing encompasses a range of evaluations, from static and dynamic load tests to fatigue and drop tests, to validate not only the design's endurance but also its capability to function in mission-critical environments. Additionally, the testing process verifies hydraulic and brake system performance, assesses actuator behavior under real-time loads, and simulates deployment/retraction cycles to replicate combat readiness. The development of more agile, lightweight, and stealth-capable aircraft has further increased the demand for sophisticated landing gear systems and correspondingly advanced test methodologies in military aviation programs.

Technology Impact in Landing gear testing Market:

Technological advancement has profoundly reshaped landing gear testing in the defense sector, enhancing both precision and scope. The integration of electromechanical testing rigs with multi-axis actuators allows real-time simulation of complex landing scenarios, including asymmetric load distribution and uneven terrain impact. These test benches often support full-scale landing gear systems, enabling engineers to analyze realistic stress, strain, and wear over thousands of simulated flight cycles. Finite element analysis (FEA) and multibody dynamics simulation are now regularly used in the design-validation phase to predict failure points and optimize weight-to-strength ratios before physical prototyping begins. These simulations are often coupled with digital twin models, allowing synchronization between virtual behavior and physical test data. Innovations in sensor technology, including fiber-optic strain gauges, wireless load cells, and infrared thermal imaging, provide highly granular insights into material fatigue, heat buildup in braking systems, and deformation under load. Moreover, advances in braking system testing, especially for electro-hydraulic and carbon brake modules, allow for precise analysis of deceleration performance under varied environmental and load conditions. AI-driven analytics are increasingly used to evaluate test data, identify anomalies, and predict component lifecycle thresholds. Additionally, technologies like augmented reality (AR) are being used in maintenance simulation scenarios to visualize component wear and conduct procedural rehearsals, particularly useful for military technicians tasked with operating in austere or rapid-response environments.

Key Drivers in Landing gear testing Market:

Several strategic factors and operational needs are driving the heightened focus on landing gear testing within defense aerospace programs. One of the foremost drivers is the increased need for mission adaptability and ruggedization. Modern military aircraft must be capable of operating from a variety of surfaces-including unpaved runways, aircraft carriers, and makeshift landing strips-making it essential that landing gear systems are robust, agile, and reliable under adverse conditions. As defense forces move toward multi-role and expeditionary platforms, the gear systems must accommodate greater weight variability and irregular deployment cycles, demanding extensive fatigue and load testing. Another critical driver is the trend toward stealth and low observable designs, which often necessitate retractable, space-efficient landing gear with optimized radar cross-sections. Testing in these cases involves evaluating deployment mechanisms in confined geometries without compromising structural performance. Lifecycle cost and maintainability are also major considerations. Defense procurement agencies are increasingly focused on minimizing long-term maintenance demands and maximizing uptime, which requires predictive maintenance protocols supported by thorough gear testing for wear, corrosion, and hydraulic fluid integrity. International defense collaborations-involving joint aircraft development programs-also fuel demand for standardized and repeatable test processes to meet diverse compliance requirements. Additionally, the emphasis on safety and survivability in contested environments pushes the limits of operational testing, including trials that simulate crash landings, wheel burst scenarios, and actuator failure under duress.

Regional Trends in Landing gear testing Market:

Across global regions, the nature and focus of landing gear testing reflect localized defense priorities, industrial capabilities, and platform specialization. In North America, particularly in the United States, the presence of tier-one defense OEMs and expansive test facilities supports some of the most comprehensive landing gear testing programs in the world. These programs focus on heavy-duty gear systems for long-range bombers, naval aircraft, and fifth-generation fighters, with advanced drop towers, high-speed braking rigs, and arrestor hook simulation environments in widespread use. Canada contributes significantly through MRO and test services for military rotorcraft and tactical transports, often as part of NATO support operations. In Europe, countries like Germany, France, and the UK conduct testing for both legacy and next-generation aircraft, including joint programs such as the Future Combat Air System (FCAS). European test facilities prioritize environmental testing for extreme cold, saltwater corrosion resistance, and modular landing gear configurations for UAVs and VTOL platforms. In the Asia-Pacific region, China is investing in high-throughput, automated testing platforms for fighter jet landing gear, with a focus on durability and integration with indigenous braking systems. India is ramping up its capacity for shock absorption, fatigue testing, and indigenous gear component validation to support aircraft like the Tejas and transport aircraft initiatives. Japan and South Korea are advancing testing for carrier-capable aircraft and stealth UAVs, with emphasis on compact yet high-load landing gear solutions. In the Middle East, nations such as Saudi Arabia and the UAE are building domestic aerospace test capabilities to support licensed production and maintenance of Western aircraft. These initiatives often include modular landing gear testing cells focused on brake testing and hydraulic system diagnostics. In South America and parts of Africa, landing gear testing remains largely dependent on international partnerships, though efforts are underway to develop indigenous testing ecosystems, especially for light transport aircraft and surveillance drones. As regional defense programs evolve, the need for locally available, adaptable, and data-integrated testing setups will continue to grow.

Key Landing gear testing Program:

Boeing has been awarded the Engineering and Manufacturing Development (EMD) contract for the U.S. Air Force's Next-Generation Air Dominance (NGAD) fighter jet program. In an announcement made from the Oval Office, President Donald Trump, Defense Secretary Pete Hegseth, and Air Force Chief General David Allvin confirmed that the new aircraft will be designated the F-47-marking the United States' first sixth-generation fighter. This milestone marks Boeing's first "clean-sheet" fighter design to be selected since its 1997 merger with McDonnell Douglas. Unlike aircraft such as the F-15EX, which are based on legacy McDonnell Douglas platforms, a clean-sheet design begins entirely from scratch, tailored specifically to meet the mission requirements and vision of the customer.

Table of Contents

Global Landing gear testing in defense- Table of Contents

Global Landing gear testing in defense Report Definition

Global Landing gear testing in defense Segmentation

By Region

By Type

By Application

By End user

Global Landing gear testing in defense Analysis for next 10 Years

The 10-year Global Landing gear testing in defense analysis would give a detailed overview of Global Landing gear testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Landing gear testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Landing gear testing in defense Forecast

The 10-year Global Landing gear testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Landing gear testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Landing gear testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Landing gear testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Landing gear testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Landing gear testing Market Forecast, 2025-2035

- Figure 2: Global Landing gear testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Landing gear testing Market Forecast, By End User, 2025-2035

- Figure 4: Global Landing gear testing Market Forecast, By Application, 2025-2035

- Figure 5: Global Landing gear testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 17: France, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 33: India, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 35: China, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Landing gear testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Landing gear testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Landing gear testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Landing gear testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Landing gear testing Market, By End User (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Landing gear testing Market, By End User (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Landing gear testing Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Landing gear testing Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Landing gear testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Landing gear testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Landing gear testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Landing gear testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Landing gear testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Landing gear testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Landing gear testing Market, By End User, 2025-2035

- Figure 62: Scenario 1, Landing gear testing Market, By Application, 2025-2035

- Figure 63: Scenario 1, Landing gear testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Landing gear testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Landing gear testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Landing gear testing Market, By End User, 2025-2035

- Figure 67: Scenario 2, Landing gear testing Market, By Application, 2025-2035

- Figure 68: Scenario 2, Landing gear testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Landing gear testing Market, 2025-2035