|

市場調查報告書

商品編碼

1714095

發動機和發動機部件測試台市場:全球(2025-2035)Global Rigs for engine and engine component testing Market 2025-2035 |

||||||

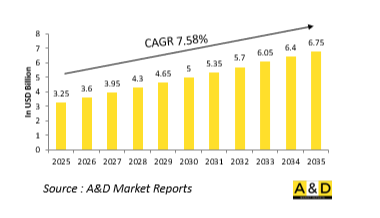

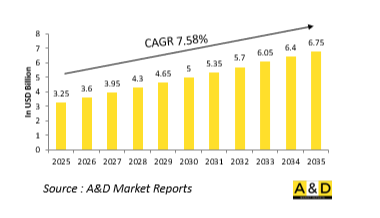

全球引擎和引擎零件測試台市場規模預計將從 2025 年的 32.5 億美元增長到 2035 年的 67.5 億美元,預測期內的複合年增長率為 7.58%。

引擎與引擎零件測試台市場:簡介

在全球國防部門,對發動機和發動機部件進行嚴格的測試對於確保軍用車輛、飛機、船舶和無人系統的可靠性、性能和安全性至關重要。測試台是專為模擬真實運行條件而設計的系統,是現場部署之前驗證引擎耐久性、耐熱性、功率輸出、燃油經濟性、整合相容性等的重要工具。這些系統複製了惡劣的操作環境,包括極端溫度變化、海拔變化、振動模式和可變負載。從戰鬥機的渦輪噴射發動機到裝甲地面車輛的柴油動力系統,國防專用發動機試驗台的設計都符合軍事規範所要求的獨特標準和公差。與商業航空和汽車應用不同,國防引擎測試通常涉及更高的靈敏度要求、多角色操作和更大的壓力條件,這要求測試設備具有高度的靈活性、巨大的資料處理能力和承受長時間測試的能力。特別是,混合電力推進和超音速性能等新型推進系統日益複雜,推動了全球對擴大和現代化測試台基礎設施以支援下一代國防計畫的興趣。

引擎與引擎零件測試台市場:技術的影響

先進的技術正在徹底改變國防部門對引擎和零件的測試方式。一個特別重要的變化是將先進的測量和控制系統整合到測試台中,以實現即時診斷、高解析度資料擷取和預測分析。數位孿生技術使工程師能夠創建引擎系統的虛擬副本,並將其與實際台架測試結果相匹配,以模擬性能退化、性能偏差和維護場景。此外,自動化和自適應回饋迴路的引入使測試台能夠根據即時性能指標自動調整應力水平、燃料成分、氣流和熱條件,從而提高測試準確性並減少人為幹預。光纖應變計、壓電壓力感測器和雷射多普勒速度計等先進感測器的引入也增強了檢測負載下微小機械變化和動態響應的能力。此外,使用閉環流體系統和燃燒模擬器可以高保真度模擬各種海拔和天氣條件下的運行環境。超音速燃燒沖壓發動機和電輔助渦輪等新型推進技術的出現,推動了集空氣動力學、電氣和熱力學測試能力於一體的新型測試台的設計。這些創新正在加速從靜態、手動驅動的測試環境向智慧、互聯測試環境的轉變,從而優化引擎認證過程的速度和可靠性。

引擎與引擎零件測試台市場:關鍵推動因素

多種策略和規劃因素正在推動全球引擎和引擎零件測試台市場的成長和創新。其中一個主要推動因素是為下一代軍用飛機(如第六代戰鬥機和遠程攻擊無人機)開發的先進推進系統的激增。這些新系統需要比過去更為複雜的測試環境。此外,高超音速武器和可重複使用太空系統的發展也帶來了對能夠承受強烈熱流、高振動和超高速氣流的試驗台的需求。此外,整合平台設計的趨勢是將推進系統與航空電子設備、結構材料和任務系統整合在一起,這就要求使用多功能設備來全面測試整個系統而不是單一元素。此外,對鑽機的投資也受到透過基於模擬的驗證來加速開發週期、降低實體原型成本和提高測試可靠性的需求的推動。國防機構還投資了可以評估組件升級和修改的測試台,以滿足現代操作需求,從而延長遺留系統的使用壽命。近年來,隨著國防部門越來越重視永續性,引擎正在重新設計,以提高燃料效率並減少排放,從而產生了評估混合燃燒模型和與生物燃料相容性的新測試要求。同時,國防採購正在推動對可驗證數據和模組化的需求,促使原始設備製造商和測試中心為鑽機配備即插即用功能和標準化測量協議。

本報告研究了全球引擎和引擎零件測試台市場,並概述了當前的市場狀況、技術趨勢、市場影響因素分析、市場規模趨勢和預測、按地區進行的詳細分析、競爭格局以及主要公司的概況。

目錄

國防引擎與引擎零件測試台:目錄

國防發動機和發動機部件試驗台:報告定義

國防發動機和發動機部件測試台

按類型

按平台

依用途

按地區

國防引擎與引擎零件試驗台 10 年分析

國防引擎與引擎零件測試台:市場技術

國防引擎與引擎零件測試台:市場預測

國防發動機及發動機零件測試台市場趨勢及各地區預測

北美

促進因素、阻礙因素與課題

抑制因子

市場預測與情境分析

主要公司

供應商層級格局

企業基準測試

歐洲

中東

亞太地區

南美洲

國防發動機與發動機部件試驗台:國家分析

美國

國防計畫

最新消息

專利

目前技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

國防引擎與引擎零件測試台:機會矩陣

國防發動機和發動機部件試驗台:專家意見

概述

關於航空和國防市場報告

The Global Rigs for engine and engine component testing market is estimated at USD 3.25 billion in 2025, projected to grow to USD 6.75 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.58% over the forecast period 2025-2035.

Introduction to Rigs for engine and engine component testing Market:

In the global defense sector, the rigorous testing of engines and engine components is foundational to ensuring the reliability, performance, and safety of military vehicles, aircraft, ships, and unmanned systems. Test rigs-specialized systems designed to simulate real-world operational conditions-serve as critical tools for validating engine durability, thermal resilience, power output, fuel efficiency, and integration compatibility before deployment. These systems replicate harsh operational environments, including extreme temperatures, altitude changes, vibration profiles, and varying loads. Whether testing turbojet engines for fighter aircraft or diesel powertrains for armored ground vehicles, defense-specific engine test rigs are built to accommodate the unique standards and tolerances required by military specifications. Unlike commercial aviation or automotive sectors, defense engine testing often involves classified requirements, multi-role usage, and greater stress profiles, making it essential for rigs to be highly configurable, data-intensive, and capable of extended-duration testing. The growing complexity of propulsion systems-particularly with hybrid-electric concepts and supersonic performance demands-has led to a surge in global interest in expanding and modernizing test rig infrastructure to support next-generation defense programs.

Technology Impact in Rigs for engine and engine component testing Market:

Technological advancements are transforming how engine and component testing is conducted in defense applications. One of the most significant shifts is the integration of advanced instrumentation and control systems into test rigs, enabling real-time diagnostics, high-resolution data capture, and predictive analytics. Digital twin technology allows engineers to create virtual replicas of engine systems, which are then tested against real-world rig results to simulate degradation, performance deviation, and maintenance scenarios. Furthermore, automation and adaptive feedback loops allow test rigs to adjust stress levels, fuel composition, airflow, and thermal conditions based on live performance metrics, reducing human intervention and increasing test accuracy. Advanced sensors, such as fiber-optic strain gauges, piezoelectric pressure transducers, and laser Doppler velocimetry tools, have also enhanced the ability to capture minute mechanical changes and dynamic responses under load. In addition, closed-loop fluid systems and combustion simulators are enabling high-fidelity replication of operational conditions across different altitudes and climates. Emerging propulsion technologies, including scramjets and electric-assisted turbines, are also prompting the design of novel rigs that combine aerodynamic, electrical, and thermodynamic testing capabilities in one integrated platform. These innovations have accelerated the shift from static, manually operated test setups to intelligent, interconnected environments that optimize both speed and reliability in engine qualification.

Key Drivers in Rigs for engine and engine component testing market:

Several strategic and programmatic forces are driving growth and innovation in the global market for defense engine and component test rigs. A key driver is the proliferation of advanced propulsion systems being developed for next-generation military aircraft, such as sixth-generation fighters and long-range strike drones, which demand more sophisticated test environments than ever before. The push for hypersonic weapons and reusable space-based systems has created a demand for test rigs capable of withstanding intense heat flux, high vibration, and ultra-high-speed airflow. Additionally, the trend toward integrated platform design-where propulsion is no longer isolated from avionics, structural materials, and mission systems-has required a more holistic testing methodology that can be executed through versatile rig systems. Another important driver is the need to accelerate development cycles through simulation-backed validation, thereby reducing physical prototyping costs while increasing test confidence. Defense organizations are also investing in test rigs to extend the lifecycle of legacy systems by evaluating component upgrades and retrofits under modern operational demands. As sustainability gains traction even in the defense space, engines are being redesigned for greater efficiency and reduced emissions, creating new testing requirements for hybrid combustion models and biofuel compatibility. Meanwhile, defense procurement frameworks increasingly demand verifiable data and modularity, pushing OEMs and testing centers to equip their rigs with plug-and-play features and standardized measurement protocols.

Regional Trends in Rigs for engine and engine component testing Market:

Regional developments in defense engine testing reflect varied national defense priorities, industrial capabilities, and strategic goals. In North America, the United States continues to dominate in engine test rig development, with major defense contractors and research institutions operating sophisticated facilities for evaluating turbine engines, rotary propulsion units, and electric thrust systems. These include both military and dual-use platforms, with test cells equipped for high-altitude simulation, acoustic analysis, and combustion diagnostics. Canada, while smaller in scale, contributes to regional testing expertise with a focus on cold-weather engine validation and NATO-aligned requirements. In Europe, the UK, Germany, and France are leading investments in test rigs through programs like FCAS (Future Combat Air System) and Tempest, which include propulsion testbeds tailored for stealth-compatible and high-performance engines. European facilities often emphasize modularity and cross-national cooperation, reflecting the continent's integrated defense manufacturing environment. In the Asia-Pacific region, China is rapidly building independent capabilities in propulsion testing as part of its broader push for self-reliant military technology. China's investment in jet engine development has resulted in expansive test infrastructure built around high-thrust engines and long-range UAVs. India, through HAL and DRDO, is expanding indigenous testing capacity for engines like the Kaveri and for strategic projects such as AMCA. Japan and South Korea are developing advanced engine testing infrastructure for both air and naval platforms, with a strong emphasis on stealth propulsion and export compliance. In the Middle East, nations like Saudi Arabia and the UAE are investing in establishing in-country test and evaluation hubs, often through partnerships with Western OEMs, as part of their localization strategies under Vision 2030 and similar initiatives. Globally, this regional diversity is fostering both cooperation and competition in the defense test rig ecosystem, ensuring steady innovation and growth in capabilities.

Key Defense Rigs for engine and engine component testing Program:

Boeing has been awarded the Engineering and Manufacturing Development (EMD) contract for the U.S. Air Force's Next-Generation Air Dominance (NGAD) fighter jet program. In a formal announcement from the Oval Office, President Donald Trump, Defense Secretary Pete Hegseth, and Air Force Chief General David Allvin revealed that the aircraft will be designated the F-47-marking the United States' first sixth-generation fighter jet. This contract marks a significant milestone for Boeing, representing its first "clean-sheet" fighter jet design selected since its 1997 merger with McDonnell Douglas. Unlike the F-15EX and other Boeing aircraft based on legacy McDonnell Douglas platforms, a clean-sheet design is developed entirely from scratch, tailored specifically to meet the customer's requirements.

Table of Contents

Global Rigs for engine and engine component testing in defense- Table of Contents

Global Rigs for engine and engine component testing in defense Report Definition

Global Rigs for engine and engine component testing in defense Segmentation

By Type

By Platform

By Application

By Region

Global Rigs for engine and engine component testing in defense Analysis for next 10 Years

The 10-year Global Rigs for engine and engine component testing in defense analysis would give a detailed overview of Global Rigs for engine and engine component testing in defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Rigs for engine and engine component testing in defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Rigs for engine and engine component testing in defense Forecast

The 10-year Global Rigs for engine and engine component testing in defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Rigs for engine and engine component testing in defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Rigs for engine and engine component testing in defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Rigs for engine and engine component testing in defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Rigs for engine and engine component testing in defense

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Engine Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Engine Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Rigs for Engine and Engine Component Testing Market Forecast, 2025-2035

- Figure 2: Global Rigs for Engine and Engine Component Testing Market Forecast, By Region, 2025-2035

- Figure 3: Global Rigs for Engine and Engine Component Testing Market Forecast, By Engine Type, 2025-2035

- Figure 4: Global Rigs for Engine and Engine Component Testing Market Forecast, By Application, 2025-2035

- Figure 5: Global Rigs for Engine and Engine Component Testing Market Forecast, By Type, 2025-2035

- Figure 6: North America, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 7: Europe, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 9: APAC, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 10: South America, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 11: United States, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 12: United States, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 13: Canada, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 15: Italy, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 17: France, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 18: France, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 19: Germany, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 25: Spain, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 31: Australia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 33: India, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 34: India, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 35: China, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 36: China, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 41: Japan, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Rigs for Engine and Engine Component Testing Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Rigs for Engine and Engine Component Testing Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Engine Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Engine Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Rigs for Engine and Engine Component Testing Market, By Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Rigs for Engine and Engine Component Testing Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Rigs for Engine and Engine Component Testing Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Rigs for Engine and Engine Component Testing Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Region, 2025-2035

- Figure 61: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Engine Type, 2025-2035

- Figure 62: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Application, 2025-2035

- Figure 63: Scenario 1, Rigs for Engine and Engine Component Testing Market, By Type, 2025-2035

- Figure 64: Scenario 2, Rigs for Engine and Engine Component Testing Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Region, 2025-2035

- Figure 66: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Engine Type, 2025-2035

- Figure 67: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Application, 2025-2035

- Figure 68: Scenario 2, Rigs for Engine and Engine Component Testing Market, By Type, 2025-2035

- Figure 69: Company Benchmark, Rigs for Engine and Engine Component Testing Market, 2025-2035