|

市場調查報告書

商品編碼

1714094

振動測試設備市場:全球2025-2035年Global Vibration Test Equipment Market 2025-2035 |

||||||

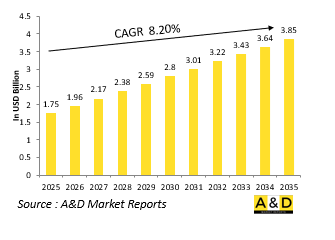

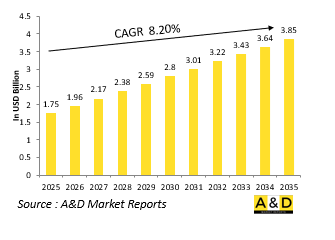

全球振動測試設備市場規模預計將從 2025 年的 17.5 億美元增長到 2035 年的 38.5 億美元,預測期內的複合年增長率為 8.20%。

震動測試設備市場:簡介

震動測試設備在國防工業中發揮著至關重要的作用。這是為了確保關鍵任務系統即使在緊張的操作條件下也能保持其機械穩健性、結構完整性和性能可靠性。從飛機航空電子設備和飛彈部件到強化通訊系統和移動地面車輛,國防平台在部署期間都暴露在惡劣的振動環境中。國防振動測試設備市場處於機械工程和任務保證的交叉點,提供複製現實世界中遇到的衝擊、碰撞和持續振動的模擬能力。隨著國防系統變得越來越複雜和小型化,並具有精確的公差和多領域能力,對先進測試基礎設施的需求也隨之增加。振動測試設備用於產品生命週期的各個階段,從原型驗證到最終產品認證和線上升級。國防承包商、政府實驗室和航空航天測試中心依靠這些儀器來驗證是否符合 MIL-STD-810 和 NATO STANAG 等國際軍事標準。市場涵蓋多種技術,包括電動振動台、液壓振動台和多軸系統,這些技術越來越多地與數位數據採集系統集成,以實現高精度分析。隨著國防部門轉向快速系統部署和延長生命週期戰略,振動測試設備對於降低開發風險和確保戰備狀態變得至關重要。

震動測試設備市場:科技的影響

技術的進步正在重新定義國防部門使用的振動測試設備的功能和性能指標。現代系統現在整合了高解析度感測器、即時控制軟體和基於機器學習的分析,以提供更準確、更適應性更強的測試環境。最具變革性的轉變之一是數位孿生技術的引入。該技術透過組件和系統的虛擬複製品模擬振動場景,以在不造成物理破壞的情況下識別結構弱點。這些數位模擬透過高頻加速度計和應變計捕獲的實體測試資料進行驗證,從而形成反饋迴路,改善設計並增強預測性維護模型。此外,轉向多軸振動平台可以同時在不同的向量(X、Y 和 Z)上進行激勵,以更真實地模擬真實世界的戰場動態,無論是在空中、海上或陸地。高負載電磁振動器的使用也越來越多,它可以透過冷卻系統和動態負載控制的創新來複製極端的發射、飛行和運輸條件。此外,支援人工智慧的軟體現在可以根據感測器回饋自動即時調整測試參數,從而減少測試時間並提高準確性。隨著國防研發朝著更靈活和更快的開發週期發展,技術增強的振動測試系統對於在日益動態的軍事環境中實現可靠性保證、結構認證和系統彈性至關重要。

震動測試設備市場的關鍵推動因素:

多種戰略和營運因素正在推動全球國防部門對先進振動測試設備的需求。其中最突出的是現代防禦系統日益增加的複雜性和性能要求。其中許多包含緊湊的電子組件、高精度導引裝置和模組化結構元件,所有這些都必須承受不可預測的環境和機械應力。隨著軍方追求更輕、更靈活和電子整合的系統,確保這些組件在振動下保持其功能完整性不是一種選擇,而是一種必要。隨著各國逐步淘汰傳統平台並轉向需要新測試協議的下一代車輛、飛彈和飛機,這種情況尤其如此。此外,對高超音速武器、可重複使用太空系統和無人作戰飛機(UCAV)的投資增加,引入了新的振動測試參數,包括高速通過、大氣再入和極端溫度變化——這些條件對敏感子系統施加了獨特的機械應力。此外,政府國防合約越來越要求遵守環境測試標準,從而需要使用高性能、可認證的振動測試解決方案。最後,國防工業越來越重視透過結構健康監測和預測性維護來延長資產生命週期,這在很大程度上依賴於能夠在災難性故障發生之前模擬操作磨損和評估材料疲勞的測試設備。這些因素結合在一起,將振動測試從常規驗證過程轉變為國防系統工程和生命週期管理中的戰略功能。

本報告調查了全球振動測試設備市場,並總結了當前的市場狀況、技術趨勢、市場影響因素分析、市場規模趨勢和預測、按地區進行的詳細分析、競爭格局以及主要公司的概況。

目錄

全球震動測試設備市場:目錄

全球震動測試設備市場:報告定義

全球震動測試設備市場:細分

按地區

按類型

依裝置類型

依用途

未來10年全球震動測試設備市場分析

全球震動測試設備市場:市場技術

全球震動測試設備市場:預測

全球震動測試設備市場趨勢及各區域預測

北美

促進因素、阻礙因素與課題

抑制因子

市場預測與情境分析

主要公司

供應商層級格局

企業基準測試

歐洲

中東

亞太地區

南美洲

全球震動測試設備市場:國家分析

美國

國防計畫

最新消息

專利

目前技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

全球振動測試設備市場:機會矩陣

全球振動測試設備市場:專家對報告的看法

概述

關於航空和國防市場報告

The Global Vibration Test Equipment market is estimated at USD 1.75 billion in 2025, projected to grow to USD 3.85 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 8.20% over the forecast period 2025-2035.

Introduction to Vibration Test Equipment Market:

Vibration test equipment plays a critical role in the defense industry by ensuring the mechanical robustness, structural integrity, and performance reliability of mission-critical systems under operational stress conditions. From aircraft avionics and missile components to ruggedized communication systems and mobile ground vehicles, defense platforms are subject to harsh vibration environments during deployment. The global defense vibration test equipment market exists at the intersection of mechanical engineering and mission assurance, providing simulation capabilities that replicate shock, impact, and sustained vibration encountered in real-world scenarios. As defense systems become increasingly complex and miniaturized, with tighter tolerances and multi-domain functionality, the need for advanced testing infrastructure has intensified. Vibration test equipment is used across multiple phases of the product lifecycle-from prototype validation to final product certification and ongoing system upgrades. Defense contractors, government laboratories, and aerospace test centers rely on these tools to verify compliance with international military standards such as MIL-STD-810 and NATO STANAG protocols. The market includes a range of technologies, including electrodynamic shakers, hydraulic vibration tables, and multi-axis systems, which are increasingly integrated with digital data acquisition systems for high-fidelity analysis. As the defense sector pivots toward rapid system deployment and lifecycle extension strategies, vibration test equipment is becoming indispensable in reducing development risk and enhancing combat-readiness assurance.

Technology Impact in Vibration Test Equipment Market:

Technological advancements are redefining the capabilities and performance metrics of vibration test equipment used in the defense sector. Modern systems now integrate high-resolution sensors, real-time control software, and machine learning-based analytics to deliver more precise and adaptable testing environments. One of the most transformative shifts has been the incorporation of digital twin technology, where virtual replicas of components or systems are subjected to simulated vibration scenarios to identify structural vulnerabilities without physical destruction. These digital simulations are then validated with physical test data captured through high-frequency accelerometers and strain gauges, enabling a feedback loop that refines design and enhances predictive maintenance models. Additionally, the transition to multi-axis vibration platforms has allowed for simultaneous excitation along different vectors-X, Y, and Z axes-thereby providing more realistic simulations of actual battlefield motion, whether it be in airborne, seaborne, or land-based conditions. Innovations in cooling systems and dynamic load control have also expanded the use of high-force electrodynamic shakers capable of replicating extreme launch, flight, or transport conditions. Furthermore, AI-driven software can now automatically adjust test parameters in real-time based on sensor feedback, reducing test time and improving accuracy. As defense R&D moves toward more agile and accelerated development cycles, technology-enhanced vibration test systems are emerging as essential enablers of reliability assurance, structural certification, and system resilience in increasingly dynamic military environments.

Key Drivers in Vibration Test Equipment Market:

Several strategic and operational factors are propelling the demand for advanced vibration test equipment within global defense sectors. Chief among them is the growing complexity and performance demands of modern defense systems, many of which include compact electronic assemblies, high-precision guidance units, and modular structural elements-all of which must endure unpredictable environmental and mechanical stressors. As militaries pursue lighter, more agile, and electronically integrated systems, ensuring these components maintain functional integrity under vibration is not optional-it is mandatory. Another significant driver is the ongoing global push for defense system modernization and platform interoperability, particularly as countries phase out legacy platforms in favor of next-generation vehicles, missiles, and aircraft that require new testing protocols. In addition, increasing investments in hypersonic weapons, reusable space systems, and unmanned combat aerial vehicles (UCAVs) have introduced new vibration test parameters involving high-speed transit, atmospheric re-entry, and extreme thermal variation-conditions that place unparalleled mechanical stress on sensitive subsystems. Government defense contracts also increasingly specify stricter compliance with environmental test standards, which necessitates the use of highly capable and certifiable vibration test solutions. Finally, the defense industry's growing emphasis on extending asset lifecycles-through structural health monitoring and predictive maintenance-relies heavily on test equipment that can simulate operational wear and assess material fatigue before critical failure occurs. Collectively, these drivers are transforming vibration testing from a routine verification process to a strategic function within defense systems engineering and lifecycle management.

Regional Trends in Vibration Test Equipment Market:

The adoption and development of vibration test equipment in the defense sector varies across global regions, reflecting distinct national priorities, defense procurement strategies, and industrial capabilities. In North America, particularly the United States, defense agencies and prime contractors maintain some of the world's most sophisticated test facilities, supporting development of aircraft like the F-35, missile systems under the Missile Defense Agency, and space programs led by the U.S. Space Force. These facilities invest in cutting-edge vibration simulation infrastructure, often paired with climate chambers and EMI/EMC labs, to deliver comprehensive qualification processes. Canada also maintains an active role, especially in testing for NATO-interoperable systems and cold-weather stress applications. In Europe, countries like Germany, France, and the UK are investing heavily in vibration testing capabilities for joint defense programs like the Future Combat Air System (FCAS) and Tempest, while also supporting dual-use technologies for both military and civil aviation. European defense firms often collaborate with academic institutions and testing consortia, creating innovation clusters that advance vibration simulation methods and standards compliance. In the Asia-Pacific region, China and India are rapidly expanding their defense manufacturing bases and associated testing infrastructure. China, in particular, is building large-scale vibration and shock testing complexes to support the development of indigenous fighter aircraft, long-range missile systems, and space assets. India, through DRDO and ISRO, is enhancing its vibration test capabilities as it pushes toward strategic autonomy in defense production. Japan and South Korea, while smaller in defense output, lead in high-precision vibration systems used for naval and aerospace component qualification. In the Middle East, especially in countries like the UAE and Saudi Arabia, there is growing investment in establishing in-country test facilities as part of defense localization efforts. These regional trends suggest that while North America and Europe maintain leadership in vibration testing technology, Asia-Pacific and the Middle East are rapidly scaling up their capabilities to meet domestic manufacturing and strategic independence goals.

Key Vibration Test Equipment Program:

The impending deployment of the U.S. Army's Long-Range Hypersonic Weapon (LRHW), officially named "Dark Eagle," signals a significant shift in the dynamics of modern warfare. Expected to enter service by the end of fiscal year 2025, Dark Eagle marks the United States' official entry into the hypersonic missile arena-an area currently led by China and Russia. This development holds far-reaching implications for both U.S. military capabilities and the broader global strategic balance and deterrence posture.

Table of Contents

Global vibration test equipment Market - Table of Contents

Global vibration test equipment Market Report Definition

Global vibration test equipment Market Segmentation

By Region

By Type

By Equipment Type

By Application

Global vibration test equipment Market Analysis for next 10 Years

The 10-year Global vibration test equipment market analysis would give a detailed overview of Global vibration test equipment market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global vibration test equipment Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global vibration test equipment Market Forecast

The 10-year Global vibration test equipment market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global vibration test equipment Market Trends & Forecast

The regional Global vibration test equipment market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global vibration test equipment Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global vibration test equipment Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global vibration test equipment Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Equipment Type, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Equipment Type, 2025-2035

List of Figures

- Figure 1: Global Vibration Test Equipment Market Forecast, 2025-2035

- Figure 2: Global Vibration Test Equipment Market Forecast, By Region, 2025-2035

- Figure 3: Global Vibration Test Equipment Market Forecast, By Type, 2025-2035

- Figure 4: Global Vibration Test Equipment Market Forecast, By Application, 2025-2035

- Figure 5: Global Vibration Test Equipment Market Forecast, By Equipment Type, 2025-2035

- Figure 6: North America, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 7: Europe, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 9: APAC, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 10: South America, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 11: United States, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 12: United States, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 13: Canada, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 15: Italy, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 17: France, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 18: France, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 19: Germany, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 25: Spain, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 31: Australia, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 33: India, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 34: India, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 35: China, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 36: China, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 41: Japan, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Vibration Test Equipment Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Vibration Test Equipment Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Vibration Test Equipment Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Vibration Test Equipment Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Vibration Test Equipment Market, By Type (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Vibration Test Equipment Market, By Type (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Vibration Test Equipment Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Vibration Test Equipment Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Vibration Test Equipment Market, By Equipment Type (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Vibration Test Equipment Market, By Equipment Type (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Vibration Test Equipment Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Vibration Test Equipment Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Vibration Test Equipment Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Vibration Test Equipment Market, By Region, 2025-2035

- Figure 61: Scenario 1, Vibration Test Equipment Market, By Type, 2025-2035

- Figure 62: Scenario 1, Vibration Test Equipment Market, By Application, 2025-2035

- Figure 63: Scenario 1, Vibration Test Equipment Market, By Equipment Type, 2025-2035

- Figure 64: Scenario 2, Vibration Test Equipment Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Vibration Test Equipment Market, By Region, 2025-2035

- Figure 66: Scenario 2, Vibration Test Equipment Market, By Type, 2025-2035

- Figure 67: Scenario 2, Vibration Test Equipment Market, By Application, 2025-2035

- Figure 68: Scenario 2, Vibration Test Equipment Market, By Equipment Type, 2025-2035

- Figure 69: Company Benchmark, Vibration Test Equipment Market, 2025-2035