|

市場調查報告書

商品編碼

1709980

全球海軍光電市場:2025-2035Global Naval Optronics Market 2025-2035 |

||||||

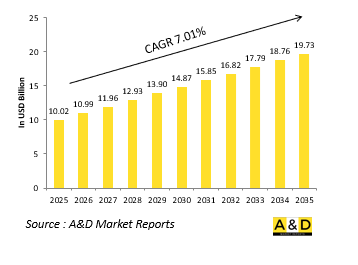

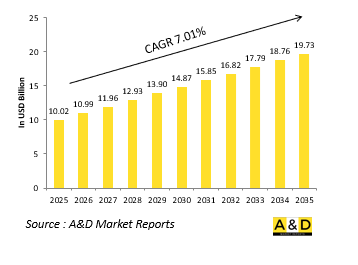

2025 年全球艦船光電市場規模估計為 100.2 億美元,預計到 2035 年將成長至 197.3 億美元,2025-2035 年預測期內的複合年增長率 (CAGR) 為 7.01%。

海軍光電市場簡介

國防海軍光電市場在現代海上作戰中發揮核心作用,為海軍平台提供先進的態勢感知、監視、目標獲取和威脅偵測能力。海軍光電系統結合了光學和電子技術,是水面艦艇、潛水艇和海岸防禦設施的關鍵部件。這些系統包括光電感測器、熱像儀、紅外線攝影機、雷射測距儀和夜視設備等多種技術。這些結合起來,可以在低能見度環境下提供即時數據和視覺清晰度,提高航行安全、搜索救援行動和戰鬥力。隨著海戰朝向更複雜的隱形作戰發展,對高解析度、遠程、多光譜感測解決方案的需求持續成長。海軍越來越依賴光電技術進行持續監視和精確瞄準,特別是在複雜的沿海和爭議水域。這些系統對於反海盜、探雷和登船行動也至關重要,使操作員能夠在交戰前直觀地評估威脅。從非法販運到領土入侵等海上安全威脅的全球性,進一步加速了對強大的海軍光電能力的投資。隨著國防戰略轉向網路化、感測器豐富的平台,海軍光電設備正成為原始環境數據和可操作海軍情報之間的關鍵橋樑。

科技對海軍光電市場的影響:

技術進步正在重塑海軍光電技術的能力和戰略作用,將海軍光電技術轉變為更大的海上指揮和控制生態系統中的重要節點。最新的感測器具有多光譜成像功能,使其能夠在可見光、紅外線和微光光譜範圍內無縫運作。這種多功能性為海軍部隊在惡劣天氣、夜間和混亂環境中作戰提供了更大的靈活性。感測器解析度和影像處理的改進顯著提高了檢測精度,使得在更遠的距離內識別較小和部分隱藏的威脅成為可能。此外,人工智慧和機器學習的整合增強了目標識別和異常檢測能力,減少了人類操作員的認知負荷,同時提高了操作速度。當今的許多光電系統都採用模組化設計,以便於與雷達、聲納和電子戰系統輕鬆整合。增強的穩定技術即使在高海況下也能確保穩定成像,而安全的高頻寬資料鏈可實現分散式海軍資產的即時傳輸和分析。小型化也是一項重大進步,使得小型高性能感測器能夠部署在無人地面和水下航行器上。這些技術變革正在改變海軍任務的計劃、執行和改進方式,不僅提高了單一系統的效能,而且促進了更大的互通性和資料整合。

海軍光電市場的關鍵推動因素:

海軍任務日益複雜以及海上威脅的動態性正在推動全球國防軍對先進光電系統的需求。主要動機是對加強監視和更早發現威脅的需求日益增長,特別是在擁擠和有爭議的水域,在那裡不對稱威脅和隱形戰術很常見。多領域作戰的轉變使得海軍必須具備水面之上和之下的即時態勢感知能力。光電技術提供了一種非輻射的雷達和聲納替代品,使船舶能夠靜默地觀察其位置而不暴露。這對於旨在避免被發現的潛艇和隱形船來說尤其有價值。此外,無人平台的興起推動了對能夠在遠端環境中獨立運作的小型、強大和自主的感測系統的更大需求。邊境安全、反海盜和反走私等任務也將受益於持續的高清成像和遠端識別能力。在海上環境監測、人道援助等活動中,光電技術常用於導航和目視確認。隨著地緣政治緊張局勢加劇和海上領域競爭加劇,海軍優先考慮能夠在一系列任務中有效運作的系統,而光電系統在和平時期行動和高強度衝突場景中都發揮著核心作用。

海軍光電市場的區域趨勢:

海軍光電市場的區域動態反映了不同的海上安全需求、產業能力和投資重點。在北美,強勁的採購計劃和正在進行的設備現代化努力繼續推動對尖端光電解決方案的需求。尤其是美國海軍,正在將先進的感測器套件整合到其航空母艦艦隊、驅逐艦和無人海上系統中,以保持在深海和沿海水域的技術優勢。作為多國海軍計劃和沿海安全活動的一部分,歐洲正在經歷綜合光電系統的開發和部署熱潮。地中海和波羅的海沿岸國家非常重視高解析度監視,以應對日益增多的海上活動和地區緊張局勢。受中國、印度、日本和澳洲等國家海軍實力增強的推動,亞太地區正在經歷顯著成長。隨著領土爭端加劇和對海洋意識的重視程度不斷提高,該地區各國海軍正大力投資加強其水面和水下光電設備。在中東,海岸防禦和海軍現代化計畫正在支持採用光電技術進行監視、攔截和船舶保護。在這些地區,透過感測器驅動的情報增強海上態勢感知是一個共同的目標,從而加強了光電技術在不斷發展的國防格局中的戰略價值。

主要海軍光電項目

Safran將為埃及海軍的十艘近海巡邏艦(OPV)提供先進的光電和導航系統。NVL Egypt 是德國造船廠 Lurssen 和埃及政府的合資企業,該公司選擇了Safran的 VIGY 4 光學瞄準鏡和 Argonyx 慣性導航系統。VIGY 4 是一種緊湊、穩定、遠端全景觀察和瞄準系統,旨在在具有課題性的海軍環境中提供卓越的態勢感知和準確性。

本報告研究了全球海軍光電市場,並提供了按細分市場、技術趨勢、機會分析、公司概況和國家數據劃分的 10 年市場預測。

目錄

全球海軍光電市場 - 目錄

全球海軍光電市場報告定義

全球海軍光電市場細分

- 按類型

- 按平台

- 按技術

- 按地區

未來10年全球艦艇光電市場分析

對全球海軍光電市場十多年的分析提供了全球海軍光電市場成長、變化趨勢、技術採用概況和整體市場吸引力的詳細概述。

全球海軍光電市場技術

本部分涵蓋了預計將影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

全球海軍光電市場預測

針對該市場未來十年的全球海軍光電市場預測已詳細涵蓋上述各個細分領域。

全球海軍光電市場趨勢及區域預測

本部分涵蓋無人機市場的區域趨勢、推動因素、阻礙因素、課題以及政治、經濟、社會和技術方面。它還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準測試。目前市場規模是根據正常業務情境估算的。

- 北美

- 推動因素、阻礙因素與課題

- PEST

市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業基準

- 歐洲

- 中東

- 亞太地區

- 南美洲

全球海軍光電市場(按國家/地區)分析

本章重點介紹該市場的主要防禦計劃,並介紹該市場的最新新聞和專利。它還提供國家級的 10 年市場預測和情境分析。

- 美國

- 國防計劃

- 最新消息

- 專利

- 該市場目前的技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳大利亞

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

全球海軍光電市場機會矩陣

全球海軍光電市場專家意見

結論

關於航空和國防市場報告

The Global Naval Optronics market is estimated at USD 10.02 billion in 2025, projected to grow to USD 19.73 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.01% over the forecast period 2025-2035.

Introduction to Naval Optronics Market:

The defense naval optronics market plays a central role in modern maritime operations, enabling advanced situational awareness, surveillance, target acquisition, and threat detection for naval platforms. Naval optronics systems-combining optical and electronic technologies-are critical components aboard surface vessels, submarines, and coastal defense installations. These systems include a range of technologies such as electro-optical sensors, thermal imagers, infrared cameras, laser rangefinders, and night vision devices. Together, they provide real-time data and visual clarity in low-visibility environments, enhancing navigation safety, search-and-rescue operations, and combat effectiveness. As naval warfare evolves toward more sophisticated and stealth-based engagements, the demand for high-resolution, long-range, and multispectral sensing solutions continues to rise. Naval forces are increasingly relying on optronics for persistent surveillance and precision targeting, especially in complex littoral zones and contested waters. These systems are also essential for counter-piracy, mine detection, and boarding operations, allowing operators to assess threats visually before engagement. The global nature of maritime security threats-from illicit trafficking to territorial incursions-has further accelerated investments in robust naval optronic capabilities. As defense strategies pivot toward networked and sensor-rich platforms, naval optronics stand as a vital bridge between raw environmental data and actionable naval intelligence.

Technology Impact in Naval Optronics Market:

Technological advancements are reshaping the capabilities and strategic role of naval optronics, turning them into integral nodes within larger maritime command-and-control ecosystems. Modern sensors are now equipped with multi-spectral imaging, allowing them to operate seamlessly across visible, infrared, and low-light spectrums. This versatility gives naval forces greater flexibility when operating in adverse weather, nighttime, or heavily cluttered environments. Improvements in sensor resolution and image processing have significantly boosted detection accuracy, enabling identification of smaller or partially concealed threats from longer distances. Additionally, the integration of artificial intelligence and machine learning enhances target recognition and anomaly detection, reducing the cognitive load on human operators while increasing operational speed. Many of today's optronic systems are also being designed for modularity, allowing for easy integration with radar, sonar, and electronic warfare systems. Enhanced stabilization technologies ensure steady imaging even in high-sea conditions, while secure, high-bandwidth data links allow for real-time transmission and analysis across distributed naval assets. Miniaturization is another major breakthrough, enabling compact, high-performance sensors to be deployed on unmanned surface and underwater vehicles. These technological shifts are not only improving individual system performance but also fostering greater interoperability and data fusion, thereby transforming how naval missions are planned, executed, and refined.

Key Drivers in Naval Optronics Market:

The growing complexity of naval missions and the dynamic nature of maritime threats are driving demand for advanced optronic systems across global defense forces. A key motivation is the increasing need for enhanced surveillance and early threat detection, particularly in congested or contested waters where asymmetric threats and stealth tactics are common. The shift toward multi-domain operations has made it essential for navies to possess real-time situational awareness, both above and below the surface. Optronics offer a non-emissive alternative to radar and sonar, allowing silent observation without giving away a ship's position. This is particularly valuable for submarines and stealth ships aiming to avoid detection. Moreover, the rise of unmanned platforms has further spurred the need for compact, ruggedized, and autonomous sensing systems capable of operating independently in remote environments. Border security, anti-piracy operations, and anti-smuggling missions also benefit from persistent, high-clarity imaging and long-range identification capabilities. Environmental monitoring and humanitarian efforts at sea often rely on optronics for navigation and visual confirmation. With geopolitical tensions rising and maritime domains becoming more contested, naval forces are prioritizing systems that can operate effectively across a range of mission profiles, giving optronics a central role in both peace-time operations and high-intensity conflict scenarios.

Regional Trends in Naval Optronics Market:

Regional dynamics in the naval optronics market reflect diverse maritime security needs, industrial capabilities, and investment priorities. In North America, robust procurement programs and ongoing fleet modernization efforts continue to drive demand for state-of-the-art optronic solutions. The U.S. Navy, in particular, is integrating advanced sensor suites across its carrier groups, destroyers, and unmanned maritime systems to maintain technological superiority in both blue-water and littoral zones. Europe has seen a surge in development and deployment of integrated optronic systems as part of multi-nation naval programs and coastal security operations. Countries bordering the Mediterranean and the Baltic Sea have emphasized high-resolution surveillance to address increased maritime activity and regional tensions. The Asia-Pacific region is witnessing significant growth, fueled by the expansion of naval capabilities in countries like China, India, Japan, and Australia. With growing territorial disputes and increased focus on maritime domain awareness, regional navies are investing heavily in both surface and subsurface optronic enhancements. In the Middle East, coastal defense and naval modernization programs are supporting the adoption of optronics for surveillance, interdiction, and ship protection roles. Across these regions, the shared objective is to bolster maritime situational awareness through sensor-driven intelligence, reinforcing the strategic value of optronics in the evolving defense landscape.

Key Naval Optronics Program:

Safran has been chosen to provide its advanced optronic and navigation systems for integration aboard the Egyptian Navy's fleet of ten offshore patrol vessels (OPVs), in a move aimed at strengthening Egypt's maritime defense capabilities. NVL Egypt-a joint venture between German shipbuilder Lurssen and the Egyptian government-selected Safran's VIGY 4 optronic sights and Argonyx inertial navigation systems for the vessels. The VIGY 4 is a compact, stabilized, long-range panoramic observation and targeting system, designed to deliver superior situational awareness and precision in demanding naval environments.

Table of Contents

Global Naval optronics market- Table of Contents

Global Naval optronics market Report Definition

Global Naval optronics market Segmentation

By Type

By Platform

By Technology

By Region

Global Naval optronics market Analysis for next 10 Years

The 10-year Global Naval optronics market analysis would give a detailed overview of Global Naval optronics market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Naval optronics market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval optronics market Forecast

The 10-year Global Naval optronics market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Naval optronics market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Naval optronics market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Naval optronics market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Naval optronics market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Naval Optronics Market Forecast, 2022-2032

- Figure 2: Global Naval Optronics Market Forecast, By Region, 2022-2032

- Figure 3: Global Naval Optronics Market Forecast, By Platform, 2022-2032

- Figure 4: Global Naval Optronics Market Forecast, By Technology, 2022-2032

- Figure 5: Global Naval Optronics Market Forecast, By Type, 2022-2032

- Figure 6: North America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 7: Europe, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 8: Middle East, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 9: APAC, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 10: South America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 11: United States, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 12: United States, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 13: Canada, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 14: Canada, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 15: Italy, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 16: Italy, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 17: France, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 18: France, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 19: Germany, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 20: Germany, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 21: Netherlands, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 23: Belgium, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 24: Belgium, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 25: Spain, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 26: Spain, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 27: Sweden, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 28: Sweden, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 29: Brazil, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 30: Brazil, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 31: Australia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 32: Australia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 33: India, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 34: India, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 35: China, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 36: China, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 39: South Korea, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 40: South Korea, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 41: Japan, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 42: Japan, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 43: Malaysia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 45: Singapore, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 46: Singapore, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Naval Optronics Market, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Naval Optronics Market, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Naval Optronics Market, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Naval Optronics Market, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Naval Optronics Market, By Platform (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Naval Optronics Market, By Platform (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Naval Optronics Market, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Naval Optronics Market, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Naval Optronics Market, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Naval Optronics Market, Global Market, 2022-2032

- Figure 59: Scenario 1, Naval Optronics Market, Total Market, 2022-2032

- Figure 60: Scenario 1, Naval Optronics Market, By Region, 2022-2032

- Figure 61: Scenario 1, Naval Optronics Market, By Platform, 2022-2032

- Figure 62: Scenario 1, Naval Optronics Market, By Technology, 2022-2032

- Figure 63: Scenario 1, Naval Optronics Market, By Type, 2022-2032

- Figure 64: Scenario 2, Naval Optronics Market, Total Market, 2022-2032

- Figure 65: Scenario 2, Naval Optronics Market, By Region, 2022-2032

- Figure 66: Scenario 2, Naval Optronics Market, By Platform, 2022-2032

- Figure 67: Scenario 2, Naval Optronics Market, By Technology, 2022-2032

- Figure 68: Scenario 2, Naval Optronics Market, By Type, 2022-2032

- Figure 69: Company Benchmark, Naval Optronics Market, 2022-2032