|

市場調查報告書

商品編碼

1709978

空氣動力學測試與模擬市場:2025-2035Global Aerodynamics Testing and Simulation Market 2025-2035 |

||||||

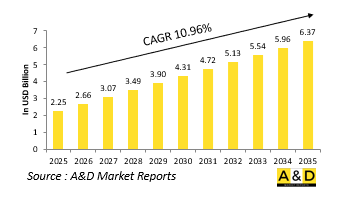

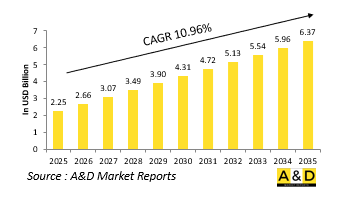

預計2025年全球空氣動力學測試和模擬市場規模將達22.5億美元,2035年將成長至63.7億美元,複合年增長率為10.96%。

空氣動力學測試與模擬市場介紹:

國防空氣動力學測試和模擬市場在改善軍用飛機、飛彈和無人機系統的設計、市場和運作方面發揮著至關重要的作用。隨著國防平台變得越來越先進,其空氣動力學性能直接影響機動性、生存力、燃油效率和任務效能。透過測試和模擬,可以在受控的極端條件下安全且經濟高效地評估這些性能參數。風洞、運算流體動力學工具和虛擬飛行環境構成了這個市場的基礎,為工程師和策略家提供了模擬整個複雜機身的氣流、熱量分佈和壓力動態的能力。這些能力對於驗證新設計、改進舊系統以及確保在各種環境和戰鬥條件下實現最佳性能至關重要。空氣動力學模擬還支援隱身優化、武器整合和高速飛行規劃——現代戰爭的關鍵面向。此外,這些技術可以透過準確模擬現實場景中的車輛行為來幫助策略規劃。隨著空戰越來越依賴敏捷性、速度和低可觀測性,空氣動力學測試和模擬的重要性日益增加。這個市場不僅支持研究和生產,還支持當今不斷變化的威脅環境所需的持續適應。

技術對空氣動力學測試和模擬市場的影響:

新興技術正在改變國防空氣動力學測試和模擬的格局,使物理和虛擬環境中的準確性、可擴展性和真實性更高。高效能運算徹底改變了運算流體動力學,使分析師能夠以前所未有的精度和速度模擬極其複雜的流動條件。這些數位模型現在可以考慮多變量場景,包括湍流、熱負荷以及控制面和嵌入式武器系統之間的相互作用。機器學習的整合透過基於海量資料集識別性能模式並優化設計迭代,進一步完善了模擬輸出。同時,下一代風洞正在不斷發展,以模擬極端高度和速度條件,支援高超音速平台和機動滑翔機的開發。虛擬實境和沈浸式介面也開始影響工程師和飛行員與空氣動力學模型互動的方式,提供對氣流動力學和車輛行為的直觀洞察。此外,基於雲端的類比工具支援國防公司、研究機構和軍事承包商之間的全球協作和安全資料共享。這種技術融合不僅縮短了開發週期,而且增強了系統驗證,有助於建立更靈活、適應性更強的防禦平台,使其能夠在複雜且有爭議的空中環境中作戰。

空氣動力學測試和模擬市場的關鍵推動因素:

有幾個關鍵因素推動國防空氣動力學測試和模擬市場的成長。其中一個最重要的因素是空戰系統日益複雜,需要先進的空氣動力學特性來滿足不斷變化的任務需求。軍用飛機和飛彈必須在各種速度、高度和大氣條件下可靠運行,需要嚴格的測試和高保真模擬。隨著隱身成為現代機身的基本期望,必須優化氣動形狀以支援雷達規避,同時保持性能和穩定性。高超音速技術的興起開闢了氣流行為的新領域,要求能夠處理極端熱和壓力條件的模擬工具。此外,鼓勵使用虛擬測試環境,以最大限度地減少對昂貴的實體測試的依賴,降低生命週期成本並推動高效的平台開發。訓練和任務演練系統也受惠於空氣動力學模擬,幫助機組人員瞭解新平台或改裝平台的操控特性。同時,人們對多用途無人機和巡飛彈藥的興趣日益濃厚,要求改善續航能力、有效載荷和機動性的空氣動力學特性。這些重點凸顯了空氣動力學測試不僅在開發中而且在確保任務準備和作戰優勢方面的作用日益擴大。

空氣動力學測試和模擬市場的區域趨勢:

全球國防空氣動力學測試和模擬市場呈現獨特的區域特徵,受國家優先事項、工業能力和先進航空航天系統投資的影響。在北美,尤其是美國,市場得到了強大的國防研發系統以及風洞、模擬實驗室和飛行試驗場等廣泛的基礎設施的支持。這些設施在支援下一代飛機計劃、高超音速武器開發和綜合防空平台方面發揮核心作用。歐洲高度重視合作研究計劃和多國防禦計劃,從而對先進的類比能力和數位設計中心進行共同投資。法國、德國和英國等國家都擁有專門的測試設施,以支援國家和聯合航空航天發展工作。在亞太地區,本土國防航空計畫的快速發展正在推動對國內模擬和測試能力的需求。印度、中國和韓國等國家正在擴大其技術基礎設施,以減少對外國驗證的依賴並加速其自身的航空航太發展時間表。在中東,對國防工業化的興趣促使了與國際航空航太公司的合作,以發展當地的空氣動力學建模和驗證能力。每個地區的發展軌跡都反映了其戰略目標和在全球防禦格局中不斷演變的角色。

主要的空氣動力學測試和模擬程序:

未來作戰空中系統(FCAS)是歐洲維護國防和安全主權努力的基石。FCAS 的核心是下一代武器系統 (NGWS),它構成了先進 "系統之系統" 的基礎。這個綜合網路將以有人駕駛的新一代戰鬥機和無人遙控運輸機協同作戰為特色,所有這些都透過 "作戰雲" 無縫連接——這是一個連接空中、陸地、海洋、太空和網路空間資產的安全數據網路。這些相互連接的平台可作為感測器、效應器和指揮控制節點,支援快速且靈活的決策。FCAS 的基礎架構是開放的、模組化的和服務導向的,能夠實現未來平台和新技術的整合。國家和盟軍將透過貢獻各自的能力來補充下一代武器系統,透過可互通的網路化系統的集體力量,實現跨多個領域的真正聯合作戰環境。

本報告研究了全球空氣動力學測試和模擬市場,並按細分市場、技術趨勢、機會分析、公司概況和國家數據提供了 10 年市場預測。

目錄

全球空氣動力學測試和模擬市場 - 目錄

全球空氣動力學測試和模擬市場報告定義

全球空氣動力學測試和模擬市場細分

- 按測試方法

- 按技術

- 按最終用途

- 按地區

未來10年全球空氣動力學測試與模擬市場分析

對全球空氣動力學測試和模擬市場十多年的分析提供了全球空氣動力學測試和模擬市場成長、變化趨勢、技術採用概況和整體市場吸引力的詳細概述。

全球空氣動力學測試與模擬市場技術

本部分涵蓋了預計將影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

全球空氣動力學測試與模擬市場預測

上述各部分詳細介紹了該市場十年全球空氣動力學測試和模擬市場的預測。

全球空氣動力學測試及模擬市場趨勢及區域預測

本部分涵蓋無人機市場的區域趨勢、推動因素、阻礙因素、課題以及政治、經濟、社會和技術方面。它還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準測試。目前市場規模是根據正常業務情境估算的。

- 北美

- 推動因素、阻礙因素與課題

- PEST

市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業基準

- 歐洲

- 中東

- 亞太地區

- 南美洲

全球空氣動力學測試和模擬市場(按國家/地區)分析

本章重點介紹該市場的主要防禦計劃,並介紹該市場的最新新聞和專利。它還提供國家級的 10 年市場預測和情境分析。

- 美國

- 國防計劃

- 最新消息

- 專利

- 該市場目前的技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳大利亞

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

全球空氣動力學測試與模擬市場機會矩陣

全球空氣動力學測試與模擬市場專家意見

結論

關於航空和國防市場報告

The Global Aerodynamics Testing and Simulation market is estimated at USD 2.25 billion in 2025, projected to grow to USD 6.37 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 10.96% over the forecast period 2025-2035.

Introduction to Aerodynamics Testing and Simulation Market:

The defense aerodynamics testing and simulation market plays a pivotal role in the design, development, and operational refinement of military aircraft, missiles, and unmanned aerial systems. As defense platforms become more advanced, their aerodynamic performance directly impacts maneuverability, survivability, fuel efficiency, and mission effectiveness. Testing and simulation allow for the safe and cost-effective evaluation of these performance parameters under controlled and extreme conditions. Wind tunnels, computational fluid dynamics tools, and virtual flight environments form the foundation of this market, offering engineers and strategists the ability to model airflow, heat distribution, and pressure dynamics across complex airframes. These capabilities are essential for validating new designs, improving legacy systems, and ensuring optimal performance under variable environmental and combat conditions. Aerodynamic simulation also supports stealth optimization, weapon integration, and high-speed flight planning-key elements in modern warfare. Furthermore, these technologies contribute to strategic planning by enabling accurate modeling of vehicle behavior in real-world scenarios. As aerial warfare becomes more dependent on agility, speed, and low observability, the significance of aerodynamic testing and simulation continues to grow. This market supports not only research and production but also the continuous adaptation required in today's evolving threat environments.

Technology Impact in Aerodynamics Testing and Simulation Market:

Emerging technologies are transforming the landscape of defense aerodynamics testing and simulation, enabling greater precision, scalability, and realism in both physical and virtual environments. High-performance computing has revolutionized computational fluid dynamics, allowing analysts to simulate highly complex flow conditions with unprecedented accuracy and speed. These digital models can now account for multi-variable scenarios, including turbulence, thermal loads, and interactions between control surfaces and embedded weapons systems. The integration of machine learning further refines simulation outputs by identifying performance patterns and optimizing design iterations based on vast datasets. In parallel, next-generation wind tunnels have evolved to simulate extreme altitude and velocity conditions, supporting the development of hypersonic platforms and maneuverable glide vehicles. Virtual reality and immersive interfaces are also beginning to influence how engineers and pilots interact with aerodynamic models, providing intuitive insights into airflow dynamics and vehicle behavior. Moreover, cloud-based simulation tools are enabling global collaboration and secure data sharing among defense contractors, research institutions, and military clients. This technological convergence is not only reducing development cycles but also enhancing system validation, contributing to more agile and adaptable defense platforms capable of operating in contested and complex aerial environments.

Key Drivers in Aerodynamics Testing and Simulation Market:

Several key factors are propelling growth in the defense aerodynamics testing and simulation market. One of the most significant is the increasing complexity of aerial combat systems, which require advanced aerodynamic profiles to meet evolving mission demands. Military aircraft and missiles must perform reliably across a broad spectrum of speeds, altitudes, and atmospheric conditions, which necessitates rigorous testing and high-fidelity simulation. As stealth becomes a baseline expectation in modern airframes, aerodynamic shaping must be optimized to support radar evasion while maintaining performance and stability. The rise of hypersonic technologies has introduced a new frontier in airflow behavior, demanding simulation tools that can handle extreme thermal and pressure conditions. Additionally, the push for reduced lifecycle costs and more efficient platform development encourages the use of virtual testing environments that minimize reliance on costly physical trials. Training and mission rehearsal systems also benefit from aerodynamic simulations, helping aircrews understand the handling characteristics of new or modified platforms. Meanwhile, growing interest in multi-role UAVs and loitering munitions requires aerodynamic refinement for endurance, payload, and maneuverability. These drivers highlight the expanding role of aerodynamic testing not just in development, but also in ensuring mission readiness and operational superiority.

Regional Trends in Aerodynamics Testing and Simulation Market:

The global defense aerodynamics testing and simulation market exhibits distinct regional profiles shaped by national priorities, industrial capabilities, and investment in advanced aerospace systems. In North America, particularly the United States, the market is supported by a robust defense R&D ecosystem and an extensive infrastructure of wind tunnels, simulation labs, and flight test ranges. These facilities play a central role in supporting next-generation aircraft programs, hypersonic weapons development, and integrated air defense platforms. Europe places strong emphasis on collaborative research initiatives and multinational defense programs, which has led to shared investment in advanced simulation capabilities and digital design hubs. Countries like France, Germany, and the United Kingdom maintain dedicated testing facilities that support both national and joint aerospace development efforts. In Asia-Pacific, rapid advancements in indigenous defense aviation programs are driving demand for domestic simulation and testing capabilities. Nations such as India, China, and South Korea are expanding their technical infrastructure to reduce dependency on foreign validation and accelerate their own aerospace timelines. In the Middle East, interest in defense industrialization is leading to partnerships with international aerospace firms to develop local capabilities in aerodynamic modeling and verification. Each region's trajectory reflects its strategic objectives and evolving role in the global defense landscape.

Key Aerodynamics Testing and Simulation Program:

The Future Combat Air System (FCAS) is a cornerstone of Europe's efforts to maintain sovereignty in defense and security. At the heart of FCAS lies the Next Generation Weapon System (NGWS), forming the foundation of a sophisticated "system of systems." This integrated network will feature manned New Generation Fighters operating in tandem with Unmanned Remote Carriers, all seamlessly connected through the "Combat Cloud"-a secure data network linking assets across air, land, sea, space, and cyberspace. These interconnected platforms will function as sensors, effectors, and command-and-control nodes, supporting rapid and flexible decision-making. The architecture behind FCAS is open, modular, and service-oriented, allowing for the integration of future platforms and emerging technologies. National and allied assets will complement the NGWS by contributing their distinct capabilities, enabling a truly collaborative combat environment across multiple domains through the combined strength of interoperable, networked systems.

Table of Contents

Global aerodynamics testing and simulation market- Table of Contents

Global aerodynamics testing and simulation market Report Definition

Global aerodynamics testing and simulation market Segmentation

By Test method

By Technology

By End Use

By Region

Global aerodynamics testing and simulation market Analysis for next 10 Years

The 10-year Global aerodynamics testing and simulation market analysis would give a detailed overview of Global aerodynamics testing and simulation market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global aerodynamics testing and simulation market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global aerodynamics testing and simulation market Forecast

The 10-year Global aerodynamics testing and simulation market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global aerodynamics testing and simulation market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global aerodynamics testing and simulation market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global aerodynamics testing and simulation market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global aerodynamics testing and simulation market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Test Methods, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Test Methods, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By End User, 2022-2032

List of Figures

- Figure 1: Global Aerodynamics Testing and Simulation Forecast, 2022-2032

- Figure 2: Global Aerodynamics Testing and Simulation Forecast, By Region, 2022-2032

- Figure 3: Global Aerodynamics Testing and Simulation Forecast, By Test Methods, 2022-2032

- Figure 4: Global Aerodynamics Testing and Simulation Forecast, By Technology, 2022-2032

- Figure 5: Global Aerodynamics Testing and Simulation Forecast, By End User, 2022-2032

- Figure 6: North America, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 7: Europe, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 8: Middle East, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 9: APAC, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 10: South America, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 11: United States, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 12: United States, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 13: Canada, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 14: Canada, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 15: Italy, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 16: Italy, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 17: France, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 18: France, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 19: Germany, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 20: Germany, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 21: Netherlands, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 23: Belgium, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 24: Belgium, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 25: Spain, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 26: Spain, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 27: Sweden, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 28: Sweden, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 29: Brazil, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 30: Brazil, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 31: Australia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 32: Australia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 33: India, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 34: India, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 35: China, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 36: China, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 39: South Korea, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 40: South Korea, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 41: Japan, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 42: Japan, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 43: Malaysia, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 45: Singapore, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 46: Singapore, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Aerodynamics Testing and Simulation, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Aerodynamics Testing and Simulation, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Aerodynamics Testing and Simulation, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Aerodynamics Testing and Simulation, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Aerodynamics Testing and Simulation, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Aerodynamics Testing and Simulation, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Aerodynamics Testing and Simulation, By Test Methods (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Aerodynamics Testing and Simulation, By Test Methods (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Aerodynamics Testing and Simulation, By End User (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Aerodynamics Testing and Simulation, By End User (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Aerodynamics Testing and Simulation, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Aerodynamics Testing and Simulation, Global Market, 2022-2032

- Figure 59: Scenario 1, Aerodynamics Testing and Simulation, Total Market, 2022-2032

- Figure 60: Scenario 1, Aerodynamics Testing and Simulation, By Region, 2022-2032

- Figure 61: Scenario 1, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 62: Scenario 1, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 63: Scenario 1, Aerodynamics Testing and Simulation, By End User, 2022-2032

- Figure 64: Scenario 2, Aerodynamics Testing and Simulation, Total Market, 2022-2032

- Figure 65: Scenario 2, Aerodynamics Testing and Simulation, By Region, 2022-2032

- Figure 66: Scenario 2, Aerodynamics Testing and Simulation, By Test Methods, 2022-2032

- Figure 67: Scenario 2, Aerodynamics Testing and Simulation, By Technology, 2022-2032

- Figure 68: Scenario 2, Aerodynamics Testing and Simulation, By End User, 2022-2032

- Figure 69: Company Benchmark, Aerodynamics Testing and Simulation, 2022-2032