|

市場調查報告書

商品編碼

1709976

航空航太與工具市場:2025-2035Global Aerospace and tooling Market 2025-2035 |

||||||

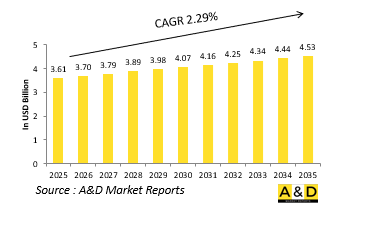

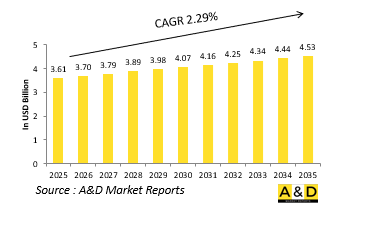

2025 年全球航空航太和工具市場規模估計為 36.1 億美元,預計到 2035 年將成長至 45.3 億美元,2025-2035 年預測期內的複合年增長率 (CAGR) 為 2.29%。

航空航太和工具市場介紹:

全球國防航空航太和工具市場是生產、組裝和維護複雜軍用飛機及相關系統的關鍵基礎設施。這裡所說的工具包括機身、引擎或安裝系統整個生命週期中所使用的各種精密儀器、夾具、固定裝置、模具和客製化設備。隨著國防航空航太領域在隱身技術、高性能材料和數位整合系統的進步,工具加工流程的複雜性也隨之增加。這些工具確保了製造過程中的尺寸精度、結構完整性和可重複性——所有這些都是滿足嚴格的軍事標準所必需的。無論是組裝第五代戰鬥機、大型運輸機或無人機系統,客製化的工具解決方案都是不可或缺的。此外,工具在改裝和大修中起著關鍵作用,使平台能夠快速改裝新的航空電子設備和任務系統。國防航空計畫通常跨越數十年,因此對耐用、適應性強和可擴展的工具的需求成為長期戰略重點。該市場不僅在主要機身製造商層面運作,還透過複雜的供應商和維修提供者網路運作,使其成為更廣泛的國防工業基礎中一個重要且相互關聯的部分。

科技對航空航太和工具市場的影響:

技術正在透過提高生產和維護操作的精度、靈活性和效率來改變航空航太和工具市場。電腦輔助設計和電腦輔助製造等先進的數位製造工具正在簡化複雜形狀的開發並優化零件公差。積層製造(3D列印)現在也被用於生產輕質、客製化模具和一些結構部件,從而減少了交貨時間和材料浪費。機器人和自動引導系統越來越多地被整合到模具工作流程中,以提高一致性和工人安全性,特別是在鑽孔、緊固和表面處理等重複性任務中。配備感測器的工具和即時回饋系統可以實現更智慧的品質控制,在流程早期檢測偏差並最大限度地減少返工。虛擬和擴增實境應用程式開始影響工具對準和技術人員培訓,提高組裝和檢查程序的準確性。工具資料庫正在數位化並連接到更廣泛的航空航天平台,使全球營運的可追溯性和配置管理更加有效。此類技術發展符合更廣泛的國防目標,即縮短交付時間、提高平台準備度並以最少的錯誤和最大的一致性支援日益複雜的飛機系統。

航空航太和工具市場的關鍵推動因素:

一些強勁的趨勢正在刺激國防航空航太和工具市場的持續成長。主要推動因素之一是全球對先進軍用飛機和無人系統的需求不斷增長,這些系統從最初的開發到維護都需要先進的工具。隨著各國追求空中優勢和多領域作戰,模具對於確保飛機系統滿足嚴格的性能和耐久性要求至關重要。生命週期維持和中期升級也推動了對工具的投資,特別是在使用數位航空電子設備和新結構部件對舊平台進行現代化改造時。此外,對快速原型設計和短開發週期的日益重視需要能夠適應不斷變化的設計要求的靈活、可重構的工具。全球供應鏈策略也在影響採購決策,國防製造商尋求更本地化和有彈性的工具支持,以減少對脆弱貿易路線的依賴。永續性已成為一個新的考慮因素,環保材料和節能製造方法越來越受到支持。最重要的是,國家安全需求要求模具系統在壓力下提供最大的可靠性和可重複性,無論是在生產線上還是在現場維修。這項背景凸顯了工具在支援國防航空航太能力的規模和速度的戰略重要性。

航空航太和工具市場的區域趨勢:

全球國防航空航太和工具市場表現出獨特的區域動態,受國防優先事項、工業能力和先進製造業投資的影響。北美,尤其是美國,憑藉其龐大的飛機生產項目和成熟的國防製造生態系統而佔據領先地位。該地區的特點是軍事承包商、工具專家和研究機構之間的深度整合,促進了持續的技術創新。在歐洲,聯合防禦計畫正在鼓勵盟友之間實現模具系統的標準化,特別是為了支援聯合飛機開發和維護計畫。德國、法國和英國等國家正在投資精密工具基礎設施,以支援其國內平台和跨大西洋計畫。亞太地區正快速崛起,印度、韓國和日本等國都重視其航空航太能力。這些國家不僅生產自己的戰鬥機,而且還建立模具製造設施,以減少對外國供應鏈的依賴。在中東,工業化努力與國防補償結合,鼓勵國內生產和在地化模具能力。拉丁美洲和非洲部分地區在該領域發展程度較低,但對聯合製造中心表現出了興趣。每個地區都體現了模具開發中創新、能力建構和策略自主的獨特平衡。

關鍵航空航太和工具計畫:

根據與 DARPA 簽訂的研發契約,Boeing和Lockheed Martin分別開發了 X-planes,以幫助降低下一代空中優勢 (NGAD) 平台的風險。這些實驗飛機分別於2019年和2022年完成首飛,迄今已累計飛行數百小時。

本報告研究了全球航空航太和工具市場,並提供了 10 年細分市場預測、技術趨勢、機會分析、公司簡介和國家數據。

目錄

全球航空航太和工具市場 - 目錄

全球航空航太和工具市場報告定義

全球航空航太和工具市場細分

- 按材質

- 按製造工藝

- 按用途

- 按地區

未來10年全球航空航太與工具市場分析

對全球航空航太和工具市場十多年的分析提供了全球航空航太和工具市場的成長、變化趨勢、技術採用概況和整體市場吸引力的詳細概述。

全球航空航太和工具市場技術

本部分涵蓋了預計將影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

全球航空航太和工具市場預測

針對該市場未來十年的全球航空航太和工具市場預測已詳細涵蓋上述各個領域。

全球航空航太和工具市場的區域趨勢和預測

本部分涵蓋無人機市場的區域趨勢、推動因素、阻礙因素、課題以及政治、經濟、社會和技術方面。它還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準測試。目前市場規模是根據正常業務情境估算的。

- 北美

- 推動因素、阻礙因素與課題

- PEST

市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業基準

- 歐洲

- 中東

- 亞太地區

- 南美洲

全球航空航太和工具市場(按國家/地區)分析

本章重點介紹該市場的主要防禦計劃,並介紹該市場的最新新聞和專利。它還提供國家級的 10 年市場預測和情境分析。

- 美國

- 國防計劃

- 最新消息

- 專利

- 該市場目前的技術成熟度

市場預測與情境分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳大利亞

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

全球航空航太和工具市場機會矩陣

全球航空航太和工具市場報告專家意見

結論

關於航空和國防市場報告

The Global Aerospace and Tooling Market is estimated at USD 3.61 billion in 2025, projected to grow to USD 4.53 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.29% over the forecast period 2025-2035.

Introduction to Aerospace and Tooling Market:

The global defense aerospace and tooling market represents a critical foundation for producing, assembling, and maintaining sophisticated military aircraft and related systems. Tooling in this context encompasses an extensive array of precision equipment, jigs, fixtures, molds, and custom-built instruments used throughout the lifecycle of airframes, engines, and onboard systems. As the defense aerospace sector advances, driven by stealth technology, high-performance materials, and digitally integrated systems, the complexity of tooling processes has expanded accordingly. These tools ensure dimensional accuracy, structural integrity, and repeatability in manufacturing, all of which are essential to meet strict military standards. Whether it's the assembly of fifth-generation fighter jets, heavy-lift transport aircraft, or unmanned aerial systems, customized tooling solutions are indispensable. Additionally, tooling plays a key role in modifications and overhauls, enabling rapid retrofitting of platforms with new avionics or mission systems. With defense aviation programs often spanning decades, the need for durable, adaptive, and scalable tooling has become a long-term strategic priority. This market operates not only at the level of major airframe manufacturers but also within a complex web of suppliers and maintenance providers, making it a vital and interconnected segment of the broader defense industrial base.

Technology Impact in Aerospace and Tooling Market:

Technology is transforming the defense aerospace and tooling market by enabling higher precision, flexibility, and efficiency in both production and maintenance operations. Advanced digital manufacturing tools, such as computer-aided design and computer-aided manufacturing, have streamlined the development of complex geometries and optimized part tolerances. Additive manufacturing, or 3D printing, is now being used to produce lightweight, custom tooling and even some structural components, reducing lead times and material waste. Robotics and automated guided systems are increasingly being integrated into tooling workflows, especially in repetitive tasks like drilling, fastening, and surface treatment, improving consistency and worker safety. Sensor-equipped tools and real-time feedback systems allow for smarter quality control, detecting deviations early in the process and minimizing rework. Virtual reality and augmented reality applications are beginning to influence tool alignment and technician training, enhancing accuracy during assembly and inspection procedures. Tooling databases are being digitized and connected to broader aerospace platforms, making traceability and configuration management more effective across global operations. These technological developments are aligning with broader goals in defense: faster delivery schedules, enhanced platform readiness, and the ability to support increasingly complex aircraft systems with minimal error and maximum consistency.

Key Drivers in Aerospace and Tooling Market:

Several powerful trends are fueling sustained growth in the defense aerospace and tooling market. One major factor is the increased global demand for modern military aircraft and unmanned systems, which require sophisticated tooling from the outset of development through to sustainment. As nations pursue air dominance and multi-domain operations, tooling becomes essential to ensure that aircraft systems meet stringent performance and durability requirements. Lifecycle sustainment and mid-life upgrades also drive tooling investments, especially when older platforms are being modernized with digital avionics or new structural components. Additionally, the growing emphasis on rapid prototyping and short-turnaround development cycles demands agile and reconfigurable tooling that can keep up with shifting design requirements. Global supply chain strategies are also influencing procurement decisions, as defense manufacturers seek more localized and resilient tooling support to reduce dependency on vulnerable trade routes. Sustainability is emerging as a new consideration, with eco-friendly materials and energy-efficient manufacturing practices gaining traction. Above all, national security imperatives require that tooling systems deliver maximum reliability and repeatability under pressure, whether on the production line or during in-field repairs. These drivers collectively underscore tooling's strategic importance in supporting defense aerospace capabilities at scale and speed.

Regional Trends in Aerospace and Tooling Market:

The global defense aerospace and tooling market exhibits distinct regional dynamics shaped by national defense priorities, industrial capacity, and investment in advanced manufacturing. North America, particularly the United States, maintains a strong lead due to its expansive aircraft production programs and mature defense manufacturing ecosystem. The region is marked by deep integration between military contractors, tooling specialists, and research institutions, fostering continuous innovation. In Europe, collaborative defense initiatives are prompting standardization of tooling systems across allied nations, especially in support of joint aircraft development and maintenance programs. Countries like Germany, France, and the UK are investing in high-precision tooling infrastructure to support both indigenous platforms and transatlantic projects. Asia-Pacific is emerging rapidly, with countries such as India, South Korea, and Japan focusing on indigenous aerospace capabilities. These nations are not only producing their own combat aircraft but are also establishing tooling facilities to reduce reliance on foreign supply chains. In the Middle East, industrialization efforts are being tied to defense offsets, encouraging domestic production and localized tooling capabilities. Latin America and parts of Africa are slower to develop in this sector but are showing interest in collaborative manufacturing hubs. Each region reflects a unique balance of innovation, capability-building, and strategic autonomy in tooling development.

Key Aerospace and Tooling Program:

Under research and development contracts with DARPA, Boeing and Lockheed Martin each developed an X-plane to support risk reduction efforts for the Next Generation Air Dominance (NGAD) platform. These experimental aircraft completed their first flights in 2019 and 2022, respectively, and have since accumulated several hundred flight hours each.

Table of Contents

Global Aerospace and tooling market - Table of Contents

Global Aerospace and tooling market Report Definition

Global Aerospace and tooling market Segmentation

By Material

By Manufacturing Process

By Application

By Region

Global Aerospace and tooling market Analysis for next 10 Years

The 10-year Global Aerospace and tooling market analysis would give a detailed overview of Global Aerospace and tooling market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and tooling market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace and tooling market Forecast

The 10-year Global Aerospace and tooling market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and tooling market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and tooling market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and tooling market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and tooling market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Material, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Manufacturing Process, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Material, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Manufacturing Process, 2022-2032

List of Figures

- Figure 1: Global Aerospace and Tooling Forecast, 2022-2032

- Figure 2: Global Aerospace and Tooling Forecast, By Region, 2022-2032

- Figure 3: Global Aerospace and Tooling Forecast, By Material, 2022-2032

- Figure 4: Global Aerospace and Tooling Forecast, By Application, 2022-2032

- Figure 5: Global Aerospace and Tooling Forecast, By Manufacturing Process, 2022-2032

- Figure 6: North America, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 7: Europe, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 8: Middle East, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 9: APAC, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 10: South America, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 11: United States, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 12: United States, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 13: Canada, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 14: Canada, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 15: Italy, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 16: Italy, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 17: France, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 18: France, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 19: Germany, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 20: Germany, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 21: Netherlands, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 23: Belgium, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 24: Belgium, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 25: Spain, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 26: Spain, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 27: Sweden, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 28: Sweden, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 29: Brazil, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 30: Brazil, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 31: Australia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 32: Australia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 33: India, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 34: India, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 35: China, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 36: China, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 39: South Korea, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 40: South Korea, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 41: Japan, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 42: Japan, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 43: Malaysia, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 45: Singapore, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 46: Singapore, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Aerospace and Tooling, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Aerospace and Tooling, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Aerospace and Tooling, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Aerospace and Tooling, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Aerospace and Tooling, By Material (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Aerospace and Tooling, By Material (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Aerospace and Tooling, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Aerospace and Tooling, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Aerospace and Tooling, By Manufacturing Process (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Aerospace and Tooling, By Manufacturing Process (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Aerospace and Tooling, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Aerospace and Tooling, Global Market, 2022-2032

- Figure 59: Scenario 1, Aerospace and Tooling, Total Market, 2022-2032

- Figure 60: Scenario 1, Aerospace and Tooling, By Region, 2022-2032

- Figure 61: Scenario 1, Aerospace and Tooling, By Material, 2022-2032

- Figure 62: Scenario 1, Aerospace and Tooling, By Application, 2022-2032

- Figure 63: Scenario 1, Aerospace and Tooling, By Manufacturing Process, 2022-2032

- Figure 64: Scenario 2, Aerospace and Tooling, Total Market, 2022-2032

- Figure 65: Scenario 2, Aerospace and Tooling, By Region, 2022-2032

- Figure 66: Scenario 2, Aerospace and Tooling, By Material, 2022-2032

- Figure 67: Scenario 2, Aerospace and Tooling, By Application, 2022-2032

- Figure 68: Scenario 2, Aerospace and Tooling, By Manufacturing Process, 2022-2032

- Figure 69: Company Benchmark, Aerospace and Tooling, 2022-2032