|

市場調查報告書

商品編碼

1706583

航太防衛用航空電子學的全球市場:2025年~2035年Global Aerospace Defense Avionics Market 2025-2035 |

||||||

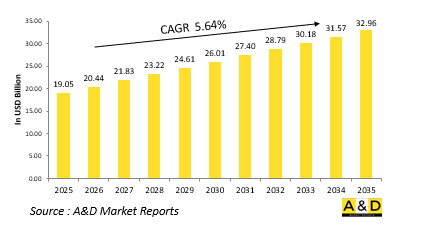

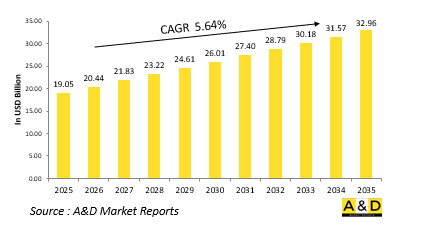

全球航空航太和國防航空電子市場規模預計在 2025 年為 15.7 億美元,預計到 2035 年將增長到 32.8 億美元,在 2025-2035 年預測期內的複合年增長率 (CAGR) 為 7.65%。

航空航太與國防航空電子市場簡介:

航空航太和國防航空電子設備是指戰鬥機、轟炸機、運輸機、無人機 (UAV) 和直升機等軍用飛機中使用的電子系統和子系統。這些系統包括導航、監視、通訊、雷達、電子戰、飛行控制、任務規劃、駕駛艙儀表等。全球航空航太國防航空電子市場在國家安全、力量投射和戰略國防規劃中發揮著至關重要的作用。隨著威脅的演變和防禦戰略轉向多領域作戰,航空電子系統對於確保態勢感知、任務有效性和作戰準備至關重要。

科技對航太和國防航空電子市場的影響:

科技正以前所未有的速度改變航空航太和國防航空電子設備。最大的變化之一是開放式架構系統的集成,允許即插即用功能和快速升級。這種模組化降低了生命週期成本,並使軍隊能夠透過整合新技術來更快地應對新出現的威脅,而無需徹底改造整個平台。人工智慧 (AI) 和機器學習 (ML) 正在嵌入航空電子系統,以實現決策、威脅偵測和資料分析的自動化。人工智慧航空電子設備可以即時分析大量感測器數據,幫助飛行員和操作員更快、更準確地識別潛在威脅、確定目標優先順序並優化任務參數。這在電子戰和 ISR(情報、監視和偵察)行動中尤其重要。下一代顯示器和擴增實境(AR)也正在重塑駕駛艙環境。頭盔顯示器 (HMD) 和全景觸控螢幕為飛行員提供了直覺的介面,增強了態勢感知能力並減少了認知工作量。使用 AR 進行任務演練和飛行導航可以為飛行員的視野增加一層新的訊息,從而實現更快、更明智的決策。網路安全已成為現代航空電子設計的核心關注點。隨著飛機系統日益網路化,它們變得更容易受到網路威脅。這就是為什麼我們採用安全資料鏈路、加密通訊和入侵偵測系統來保護航空電子網路免受惡意入侵和欺騙。感測器融合技術的進步將多個感測器輸入結合起來,形成單一、有凝聚力的影像,這將大大提高偵測準確性和威脅反應能力。現代雷達系統,例如主動電子掃描陣列 (AESA) 雷達,整合了紅外線搜索和追蹤 (IRST)、電子支援措施和被動感測器,為空對空、空對地和海上監視提供了多領域能力。

航空航太與國防航空電子市場的關鍵推動因素:

全球航空航太和國防航空電子市場受到戰略、營運和技術因素的共同驅動。其中最主要的是對飛機現代化日益增長的需求。世界各地的許多空軍都在尋求透過用新平台取代舊系統或升級其航空電子設備來保持作戰相關性。這些升級通常包括改進的通訊系統、現代雷達、電子戰套件和更有效率的任務控制系統。地緣政治緊張和地區衝突也是市場的主要推動因素。隨著全球力量平衡的變化以及來自國家和非國家行為體的新威脅的出現,各國都將空中優勢和戰場意識放在首位。這促使重點地區的國防預算增加,重點放在用於預警、快速反應和部隊保護的先進航空電子設備。

無人機和無人戰鬥機(UCAV)的普及為航空電子創新開闢了新的途徑。這些系統需要緊湊、自主的航空電子設備套件,能夠支援即時通訊、監視和武器投放,通常是在極其惡劣的條件下。該子行業對安全數據鏈路、感測器整合和人工智慧導航的需求正在迅速增長。另一個主要推動因素是人們越來越關注多域作戰 (MDO)。現代戰爭不再侷限於陸海空三軍,也延伸到網路空間、太空領域。人們對能夠在所有這些領域進行通訊和協調的航空電子系統有著很大的需求。盟軍之間的互通性需求進一步加強了對標準化和適應性航空電子架構的推動。此外,政府和私人公司之間的研發投資和國防工業合作正在推動市場向前發展。美國國防部聯合全局指揮與控制(JADC2)和歐洲未來作戰航空系統(FCAS)等專案正在推動航空電子技術的創新,重點是更快的資料共享、感測器整合和任務自主性。

航空航太與國防航空電子市場的區域趨勢:

航空航太國防航空電子市場根據軍事優先事項、國防預算和獨特能力呈現不同的區域趨勢。北美,尤其是美國,在技術開發和採購方面引領全球航空電子市場。美國國防部繼續為 F-35 Lightning II、B-21 Raider 和各種無人機平台等項目投資尖端航空電子設備。該國在開發人工智慧系統、網路安全航空電子設備和電子戰解決方案方面也處於領先地位。加拿大也致力於北美防空司令部的現代化建設和採購多用途戰鬥機,為市場做出貢獻。

歐洲也是一個重要的市場,受到英國的 "暴風" 計畫、法國、德國和西班牙的 "未來作戰航空系統" (FCAS)計畫以及歐洲戰鬥機 "颱風" 機隊正在進行的升級等項目的推動。該地區非常重視北約內部的互通性,法國(泰雷茲)、德國(亨索爾特)和英國(BAE系統)等國家都擁有強大的國內航空電子設備製造能力。環境問題和出口管制法律決定了系統的設計、製造和跨境共享方式。亞太地區正在迅速擴大其在航空航太和國防航空電子領域的影響力。中國正大力投資殲-20隱形戰鬥機和不斷壯大的無人機隊等平台的國產航空電子系統。我們非常重視實現技術自給自足,特別是在出口管制方面。印度也正在推行 Tejas 和 AMCA 項目,並希望開發本土航空電子設備,以減少對海外供應商的依賴。在區域安全威脅和戰略聯盟的推動下,日本、韓國和澳洲也在提升其能力。

主要航空航太與國防航空電子專案:

GE 航空航太公司已獲得一份合同,為全球的 F/A-18、AV-8B 和 AH-1Z 飛機的航空電子系統提供基於性能的物流 (PBL) 支援。該合約包括對在世界各地操作這些平台的美國海軍艦隊的關鍵任務中使用的商店控制系統提供全面支援。根據合同,GE航空集團將管理備件供應鏈、倉儲和物流,並將提供飛機零件和子組件的站級維修服務。此外,該公司還將在海軍主要設施提供現場艦隊支持,包括技術培訓和援助。

RTX 的子公司柯林斯航空航天公司獲得了一份價值 8000 萬美元的成本加固定費用合同,為美國陸軍的 H-60M 直升機航空電子系統開發模組化開放系統架構。根據國防部最近的公告,資金和工作地點將根據任務順序決定。該合約預計將於 2029 年 3 月 7 日完成。陸軍合約司令部(位於阿拉巴馬州紅石兵工廠)負責管理採購流程,並在線上提交了一份投標書。

本報告提供全球航太防衛用航空電子學市場相關調查,彙整10年的各分類市場預測,技術趨勢,機會分析,企業簡介,各國資料等資訊。

目錄

航太防衛用航空電子學市場報告定義

航太防衛用航空電子學市場區隔

未來 10 年航太與國防航空電子市場分析

本章透過十年的航空航太國防航空電子市場分析,詳細概述了航空航太國防航空電子市場的成長、變化趨勢、技術採用概述和整體市場吸引力。

航空航太與國防航空電子市場技術

本部分涵蓋預計將影響該市場的十大技術以及這些技術可能對整個市場產生的影響。

全球航空航太與國防航空電子市場預測

上述部分詳細解釋了該市場 10 年航空航太國防電子市場預測。

區域航空航太與國防航空電子市場趨勢與預測

本部分涵蓋航空航太和國防航空電子市場的區域趨勢、推動因素、阻礙因素、課題以及政治、經濟、社會和技術方面。它還提供了詳細的區域市場預測和情境分析。區域分析包括主要公司概況、供應商格局和公司基準測試。目前市場規模是根據正常業務情境估算的。

北美

促進因素,阻礙因素,課題

PEST

市場預測與情勢分析

主要企業

供應商階層的形勢

企業基準

歐洲

中東

亞太地區

南美

航空航太與國防航空電子市場國家分析

本章重點介紹該市場的主要防禦計劃,並介紹該市場的最新新聞和專利。它還提供國家級的 10 年市場預測和情境分析。

美國

最新消息

專利

這個市場上目前技術成熟度

市場預測與情勢分析

加拿大

義大利

法國

德國

荷蘭

比利時

西班牙

瑞典

希臘

澳洲

南非

印度

中國

俄羅斯

韓國

日本

馬來西亞

新加坡

巴西

航太防衛用航空電子學市場機會矩陣

航太防衛用航空電子學市場報告相關專家的意見

結論

關於航空·國防市場報告

The Global Aerospace Defense Avionics market is estimated at USD 1.57 billion in 2025, projected to grow to USD 3.28 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.65% over the forecast period 2025-2035.

Introduction to Aerospace Defense Avionics Market:

Aerospace defense avionics refers to the electronic systems and subsystems used in military aircraft, including fighters, bombers, transport planes, unmanned aerial vehicles (UAVs), and helicopters. These systems include navigation, surveillance, communication, radar, electronic warfare, flight control, mission planning, and cockpit instrumentation. The global aerospace defense avionics market plays a crucial role in national security, force projection, and strategic defense planning. As threats evolve and defense strategies shift toward multi-domain operations, avionics systems have become essential for ensuring situational awareness, mission effectiveness, and operational readiness.

Technology Impact in Aerospace Defense Avionics Market:

Technology is transforming aerospace defense avionics at an unprecedented pace. One of the most significant changes is the integration of open architecture systems, allowing for plug-and-play capabilities and faster upgrades. This modularity reduces lifecycle costs and enables armed forces to adapt quickly to emerging threats by integrating newer technologies without needing to overhaul entire platforms. Artificial intelligence (AI) and machine learning (ML) are being embedded into avionics systems to automate decision-making, threat detection, and data analysis. AI-driven avionics can analyze vast amounts of sensor data in real-time, helping pilots and operators identify potential threats, prioritize targets, and optimize mission parameters with greater speed and accuracy. This is particularly crucial in electronic warfare and ISR (Intelligence, Surveillance, and Reconnaissance) operations. Next-generation displays and augmented reality (AR) are also reshaping cockpit environments. Helmet-mounted displays (HMDs) and panoramic touchscreens provide intuitive interfaces for pilots, enhancing situational awareness and reducing cognitive workload. The use of AR in mission rehearsal and in-flight navigation adds an additional layer of information to the pilot's field of vision, enabling faster and more informed decision-making. Cybersecurity has become a core concern in modern avionics design. As aircraft systems become more networked, they are increasingly vulnerable to cyber threats. This has led to the incorporation of secure data links, encrypted communications, and intrusion detection systems to protect avionics networks from hostile intrusions and spoofing. Advancements in sensor fusion, where multiple sensor inputs are combined to create a single cohesive picture, significantly improve detection accuracy and threat response. Modern radar systems such as AESA (Active Electronically Scanned Array) radars, integrated with IRST (Infrared Search and Track), electronic support measures, and passive sensors, provide multi-domain capabilities for air-to-air, air-to-ground, and maritime surveillance.

Key Drivers in Aerospace Defense Avionics Market:

The global aerospace defense avionics market is driven by a combination of strategic, operational, and technological factors. Foremost among them is the rising demand for fleet modernization. Many air forces across the globe are replacing legacy systems with newer platforms or upgrading their avionics to remain operationally relevant. These upgrades often include enhanced communication systems, modern radars, electronic warfare suites, and more efficient mission control systems. Geopolitical tensions and regional conflicts have also become significant market drivers. As global power dynamics shift and new threats emerge-from both state and non-state actors-nations are prioritizing air superiority and battlefield awareness. This has led to increased defense budgets in key regions and an emphasis on advanced avionics for early warning, rapid response, and force protection.

The proliferation of UAVs and unmanned combat aerial vehicles (UCAVs) has opened new avenues for avionics innovation. These systems require compact, autonomous avionics suites that can support real-time communication, surveillance, and weapons delivery, often under highly contested conditions. The demand for secure data links, sensor integration, and AI-enabled navigation is growing rapidly in this sub-sector. Another major driver is the increasing focus on multi-domain operations (MDO). Modern warfare is no longer confined to air, land, or sea-it spans cyber and space domains as well. Avionics systems that can communicate and coordinate across all these spheres are in high demand. The need for interoperability among allied forces further reinforces the push for standardized and adaptable avionics architectures. Additionally, R&D investments and defense-industrial collaborations between governments and private firms are propelling the market forward. Programs like the U.S. Department of Defense's Joint All-Domain Command and Control (JADC2) and the European Future Combat Air System (FCAS) are fostering innovation in avionics technologies that focus on faster data sharing, sensor integration, and mission autonomy.

Regional Trends in Aerospace Defense Avionics Market:

The aerospace defense avionics market exhibits distinct regional trends based on military priorities, defense budgets, and indigenous capabilities. North America, particularly the United States, leads the global avionics market both in terms of technological development and procurement. The U.S. Department of Defense consistently invests in cutting-edge avionics for programs like the F-35 Lightning II, B-21 Raider, and various UAV platforms. The country is also a leader in developing AI-driven systems, cyber-secure avionics, and electronic warfare solutions. Canada also contributes to the market with its focus on NORAD modernization and multi-role fighter acquisitions.

Europe is another significant market, driven by programs such as the UK's Tempest, France-Germany-Spain's FCAS, and continued upgrades to Eurofighter Typhoon fleets. The region emphasizes interoperability within NATO and has strong domestic avionics manufacturing capabilities in countries like France (Thales), Germany (Hensoldt), and the UK (BAE Systems). Environmental concerns and export control laws shape how systems are designed, manufactured, and shared across borders. Asia-Pacific is rapidly expanding its presence in aerospace defense avionics. China is heavily investing in indigenous avionics systems for platforms like the J-20 stealth fighter and its expanding UAV fleet. Emphasis is placed on achieving technological self-sufficiency, especially in the face of export restrictions. India is following suit with its Tejas and AMCA programs, aiming to develop homegrown avionics to reduce dependence on foreign suppliers. Japan, South Korea, and Australia are also advancing their capabilities, driven by regional security threats and strategic alliances.

Key Aerospace Defense Avionics Program:

GE Aerospace has secured a contract to deliver performance-based logistics (PBL) support for the avionics systems of the F/A-18, AV-8B, and AH-1Z aircraft worldwide. This agreement includes comprehensive support for the stores management systems used in critical missions by the U.S. Navy fleets operating these platforms globally. Under the contract, GE Aerospace will manage the supply chain, warehousing, and logistics of spare parts, while also providing depot-level repair services for aircraft components and subassemblies. Additionally, the company will offer on-site fleet support at key naval installations, including technical training and assistance.

Collins Aerospace, a subsidiary of RTX, has been awarded an $80 million cost-plus-fixed-fee contract to develop a modular open systems architecture for the U.S. Army's H-60M helicopter avionics system. According to a recent Department of Defense announcement, funding and work locations will be determined on a per-task-order basis. The contract is scheduled for completion by March 7, 2029. The Army Contracting Command at Redstone Arsenal, Alabama, managed the procurement process, which resulted in a single bid submitted online.

Table of Contents

Aerospace Defense Avionics Market Report Definition

Aerospace Defense Avionics Market Segmentation

By Region

By End User

By Fitment

Aerospace Defense Avionics Market Analysis for next 10 Years

The 10-year aerospace defense avionics market analysis would give a detailed overview of aerospace defense avionics market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Aerospace Defense Avionics Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Aerospace Defense Avionics Market Forecast

The 10-year aerospace defense avionics market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Aerospace Defense Avionics Market Trends & Forecast

The regional aerospace defense avionics market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Aerospace Defense Avionics Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Aerospace Defense Avionics Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Aerospace Defense Avionics Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Fit, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Platform, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Fit, 2025-2035

List of Figures

- Figure 1: Global Aerospace Defense Avionics Market Forecast, 2025-2035

- Figure 2: Global Aerospace Defense Avionics Market Forecast, By Region, 2025-2035

- Figure 3: Global Aerospace Defense Avionics Market Forecast, By Platform, 2025-2035

- Figure 4: Global Aerospace Defense Avionics Market Forecast, By Fit, 2025-2035

- Figure 5: North America, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 6: Europe, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 8: APAC, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 9: South America, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 10: United States, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 11: United States, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 12: Canada, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 14: Italy, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 16: France, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 17: France, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 18: Germany, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 24: Spain, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 30: Australia, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 32: India, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 33: India, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 34: China, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 35: China, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 40: Japan, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Aerospace Defense Avionics Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Aerospace Defense Avionics Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Aerospace Defense Avionics Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Aerospace Defense Avionics Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Aerospace Defense Avionics Market, By Platform (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Aerospace Defense Avionics Market, By Platform (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Aerospace Defense Avionics Market, By Fit (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Aerospace Defense Avionics Market, By Fit (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Aerospace Defense Avionics Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Aerospace Defense Avionics Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Aerospace Defense Avionics Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Aerospace Defense Avionics Market, By Region, 2025-2035

- Figure 58: Scenario 1, Aerospace Defense Avionics Market, By Platform, 2025-2035

- Figure 59: Scenario 1, Aerospace Defense Avionics Market, By Fit, 2025-2035

- Figure 60: Scenario 2, Aerospace Defense Avionics Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Aerospace Defense Avionics Market, By Region, 2025-2035

- Figure 62: Scenario 2, Aerospace Defense Avionics Market, By Platform, 2025-2035

- Figure 63: Scenario 2, Aerospace Defense Avionics Market, By Fit, 2025-2035

- Figure 64: Company Benchmark, Aerospace Defense Avionics Market, 2025-2035