|

市場調查報告書

商品編碼

1500334

全球國防Vetronics市場(2024-2034)Global Defense Vetronics Market 2024-2034 |

||||||

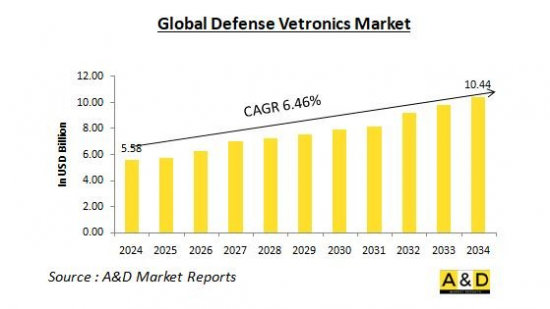

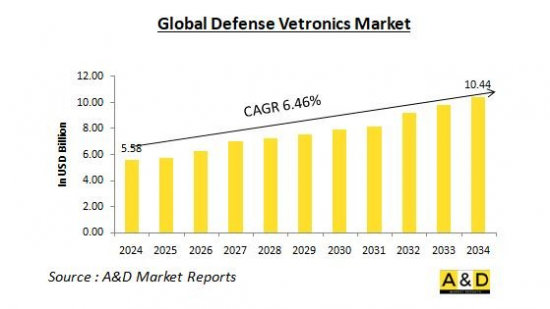

2024年全球國防車輛市場規模預計為55.8億美元,預測期內(2024-2034年)年複合成長率為6.49%,到2034年將達到104.4億美元。

全球國防電子市場概況

全球國防車輛電子市場包括整合到軍用車輛的各種電子子系統。這些子系統包括指揮、控制、通訊和電腦(C4),可實現車輛、指揮部和部隊之間的通信,以促進協調作戰。導航系統提供對戰場感知非常重要的精確定位和路徑規劃能力,武器控制系統增強武器系統的瞄準精度和火力控制。電源系統保證車內所有電子零件的可靠供電。感測器和觀察系統使用攝影機、雷達和其他感測器來偵測威脅並提供即時戰場資訊。車輛健康管理系統監控車輛性能並診斷潛在問題,以確保營運準備就緒。由於多種因素,全球國防電子市場穩步成長。在全球範圍內,國防預算不斷增加,特別是在地緣政治緊張的地區,先進軍用車輛的採購也在增加。此外,日益採用以網路為中心的戰爭策略,需要強大的通訊和資料共享能力,增加了對先進電子系統的需求。

科技對全球國防電子市場的影響

技術進步不斷重塑全球國防車輛電子市場。主要趨勢包括將人工智慧(AI)整合到 Vetronics 系統中,以實現自主導航、威脅偵測和決策支援等功能,最終減少機組人員的工作量並改善戰場決策。隨著越來越依賴互聯系統,網路安全變得非常重要,需要強大的解決方案來保護 Vetronics 免受網路攻擊。高解析度螢幕和擴增實境(AR)疊加等先進顯示器可即時提供關鍵的戰場訊息,提高機組人員的態勢感知能力。開放式架構設計有利於介面標準化,並有利於整合來自不同供應商的各種 Vetronix 子系統,提高靈活性和朝向未來。這些技術進步不僅提高了Vetronics系統的能力,也為專門從事尖端技術的公司創造了新的市場機會。

全球國防車輛電子市場的關鍵驅動因素

有幾個因素推動全球國防車輛電子市場的成長。持續的地緣政治緊張局勢導致國防支出增加,導致各國政府增加預算並增加對先進軍事裝備的投資,包括配備先進電子系統的車輛。現代化計畫也發揮關鍵作用,因為現有的軍用車輛經過更新,融入了最新的車輛電子技術,延長了使用壽命並增強了作戰能力。以網路為中心的戰爭強調即時資訊共享和協調作戰,強調了促進無縫通訊和資料交換的先進車輛電子系統的重要性。此外,偵察、監視和戰鬥應用中對無人地面車輛(UGV)的需求不斷成長,需要能夠實現自主操作和遠端控制的先進車輛電子系統。最後,隨著對乘員安全的日益重視,先進的車輛電子功能(例如改進的態勢感知和車輛健康管理系統)有助於提高戰場上的安全性。

全球國防車輛電子市場的區域趨勢

全球國防電子市場在不同地區呈現不同的趨勢。在北美,該市場是由高額國防開支和美國進行的現代化計劃推動的,美國佔據了最大的佔有率。該地區注重技術進步,強大的國內國防工業也支持成長。在歐洲,在聯合軍事計畫合作和對創新的關注的支持下,國防投資的增加推動對電子電子系統的需求增加。在中國和印度等國家國防預算增加的推動下,亞太地區經歷顯著成長。塑造這個市場的主要趨勢是本土開發努力和現有軍用飛機的現代化。中東和非洲的衝突仍在繼續,而在石油收入資助的國防支出增加的支持下,Vetronics 系統市場顯著成長。然而,儘管市場規模龐大,但政治不穩定對一些非洲國家的市場成長構成了挑戰。

主要 Vetronics 程式

比利時 Scorpion 車輛將使用Thales的電子設備。比利時陸軍計劃購買的裝甲車將配備Thales提供的車載電子設備。法國和比利時去年簽署了CaMo(Capacite Motorisee)政府間協議,以促進軍事合作。 CaMo 計畫目的是更新比利時的陸路運輸能力。根據協議,比利時將斥資約16億歐元購買382輛格里芬多用途裝甲車(VBMR)和60輛美洲虎戰鬥偵察車(EBRC)。這些車輛將採用法國標準Scorpion計畫。 442 架 Scorpions 將由三個業務合作夥伴組成的團隊交付:Arquus、Nexter 和 Thales。Thales作為汽車電子供應商啟動了該計畫。

瑞典國防部物資管理部(FMV)已授予 BAE Systems 一份合同,提供 48 輛 BvS10 裝甲全地形車和全面的初始支援套件。該交易是在 BvS10 於 1月 5 日被取消贖回權後達成的。該協議規定額外提供 127 輛車,並可能提供更徹底的支援套件包括現場援助在內。因此,整體價值將增加三倍以上。在2011年 6月啟動的競賽之後,BvS10 被選為該計劃的成員。無線電、戰場管理和保護者遠程武器站整合是合約特定的功能。此外,還將安裝煙霧彈發射器,以確保完全覆蓋車輛的整個週邊。交付的 48 輛 BvS10 包括運兵車、指揮車和救護車。

本報告分析了全球國防車輛電子市場,並研究了整體市場規模的前景、依地區和國家劃分的詳細趨勢、關鍵技術概述、市場機會等。

目錄

國防電子市場:報告定義

國防電子市場細分

- 依平台

- 依地區

- 依最終用戶

國防電子市場分析(未來 10年)

國防電子市場的市場技術

全球國防電子市場預測

國防電子市場:區域趨勢與預測

- 北美

- 促進/抑制因素和挑戰

- PEST分析

- 市場預測與情境分析

- 主要公司

- 供應商層級狀況

- 企業基準比較

- 歐洲

- 中東

- 亞太地區

- 南美洲

國防電子市場:國家分析

- 美國

- 防禦規劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度等級

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳洲

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

國防電子市場:市場機會矩陣

國防電子市場:專家對研究的看法

結論

關於航空和國防市場報告

The global Defense Vetronics market is estimated at USD 5.58 billion in 2024, projected to grow to USD 10.44 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 6.49 % over the forecast period 2024-2034.

Introduction to the Global Defense Vetronics Market

The global defense vetronics market encompasses a diverse range of electronic subsystems integrated into military vehicles. These subsystems include Command, Control, Communication, and Computers (C4), which enable communication between vehicles, command centers, and troops, facilitating coordinated operations. Navigation systems provide precise positioning and route planning capabilities crucial for battlefield awareness, while weapon control systems enhance targeting accuracy and fire control for weapon systems. Power systems ensure a reliable power supply for all electronic components within the vehicle. Sensor and observation systems employ cameras, radars, and other sensors to detect threats and provide real-time battlefield information. Vehicle health management systems monitor vehicle performance and diagnose potential issues, ensuring operational readiness. The global defense vetronics market is experiencing steady growth, fueled by several factors. Rising defense budgets globally, particularly in regions facing geopolitical tensions, are leading to increased procurement of advanced military vehicles. Additionally, the growing adoption of network-centric warfare strategies necessitates robust communication and data-sharing capabilities, driving demand for advanced vetronics systems.

.Technology Impact in the Global Defense Vetronics Market

Technological advancements are continuously reshaping the global defense vetronics market. Key trends include the integration of Artificial Intelligence (AI) into vetronics systems, enabling features like autonomous navigation, threat detection, and decision support, which ultimately reduce crew workload and improve battlefield decision-making. Cybersecurity has become paramount with the increasing reliance on interconnected systems, necessitating robust solutions to safeguard vetronics from cyberattacks. Advanced displays, including high-resolution screens and augmented reality (AR) overlays, enhance situational awareness for crews by providing critical battlefield information in real time. The adoption of open architecture design is facilitating the standardization of interfaces, making it easier to integrate diverse vetronics subsystems from different vendors, offering greater flexibility and future-proofing capabilities. These technological advancements not only improve the capabilities of vetronics systems but also create new market opportunities for companies specializing in cutting-edge technologies.

Key Drivers in the Global Defense Vetronics Market

Several key drivers are propelling the growth of the global defense vetronics market. Rising defense expenditure, fueled by persistent geopolitical tensions, is leading governments to increase their budgets, resulting in higher investments in advanced military equipment, including vehicles equipped with sophisticated vetronics systems. Modernization programs are also playing a significant role as existing military vehicles undergo upgrades to incorporate the latest vetronics technologies, thereby extending their operational lifespan and enhancing combat capabilities. The focus on network-centric warfare, which emphasizes real-time information sharing and coordinated operations, underscores the importance of advanced vetronics systems that facilitate seamless communication and data exchange. Additionally, the growing demand for unmanned ground vehicles (UGVs) for reconnaissance, surveillance, and combat roles necessitates sophisticated vetronics systems for autonomous operation and remote control. Lastly, there is a growing emphasis on crew safety, with advanced vetronics features like improved situational awareness and vehicle health management systems contributing to enhanced safety on the battlefield.

Regional Trends in the Global Defense Vetronics Market

The global defense vetronics market displays distinct trends across various regions. In North America, the market holds the largest share, driven by substantial defense spending from the US and ongoing modernization programs. The region's focus on technological advancements and a robust domestic defense industry further bolster growth. In Europe, increasing defense investments contribute to rising demand for vetronics systems, supported by collaboration on joint military projects and a strong emphasis on technological innovation. The Asia Pacific region is witnessing significant growth, fueled by escalating defense budgets in countries like China and India. Indigenous development efforts and the modernization of existing military fleets are key trends shaping this market. In the Middle East and Africa, ongoing conflicts create a substantial market for vetronics systems, supported by growing defense spending fueled by oil revenues. However, political instability poses challenges to market growth in certain African countries despite the region's potential.

Key Vetronics Programs

Electronics from Thales will be used in Belgian Scorpion vehicles. The armoured vehicles the Belgian Land Forces plan to purchase will have vehicle electronics provided by Thales. The CaMo (Capacite Motorisee) government-to-government agreement was signed by France and Belgium last year to facilitate military cooperation. The CaMo programme aims to update Belgium's capabilities for land transportation. According to this agreement, Belgium will spend an estimated €1.6 billion on the purchase of 382 Griffon multi-role armoured vehicles (VBMR) and 60 Jaguar combat and reconnaissance vehicles (EBRC). The Scorpion programme in France's standards will be present in the vehicles. The 442 Scorpion units will be provided by a team of three business partners, Arquus, Nexter, and Thales. Thales began working on the project as the supplier of the vehicle electronics.

The Swedish Defense Materiel Administration, FMV, has given BAE Systems a contract to provide 48 of its mobile BvS10 armoured all-terrain vehicles together with a comprehensive initial support package. The agreement was reached after the BvS10's down-selection on January 5. It offers possibilities for 127 more vehicles and a sustainment package that is much more thorough and may include in-theater assistance. The whole value would more than triple as a result. The BvS10 was chosen for the programme after a contest that was started in June 2011. The integration of the radio, battlefield management, and Protector remote weapon station are contract-specific capabilities. Additionally, smoke grenade launchers will be installed to provide complete coverage all around the vehicle. Deliveries for the 48 BvS10s will include troop carriers, command vehicles, and ambulances.

Table of Contents

Defense Vetronics Market Report Definition

Defense Vetronics Market Segmentation

By Platform

By Region

By End User

Defense Vetronics Market Analysis for next 10 Years

The 10-year defense vetronics market analysis would give a detailed overview of defense vetronics market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Vetronics Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Vetronics Market Forecast

The 10-year defense vetronics market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Vetronics Market Trends & Forecast

The regional defense vetronics market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Vetronics Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Vetronics Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Vetronics Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Defense Vetronics Market Forecast, 2022-2032

- Figure 2: Global Defense Vetronics Market Forecast, By Region, 2022-2032

- Figure 3: Global Defense Vetronics Market Forecast, By Type, 2022-2032

- Figure 4: North America, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 5: Europe, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 6: Middle East, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 7: APAC, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 8: South America, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 9: United States, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 10: United States, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 11: Canada, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 12: Canada, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 13: Italy, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 14: Italy, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 15: France, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 16: France, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 17: Germany, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 18: Germany, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 19: Netherlands, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 20: Netherlands, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 21: Belgium, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 22: Belgium, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 23: Spain, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 24: Spain, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 25: Sweden, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 26: Sweden, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 27: Brazil, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 28: Brazil, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 29: Australia, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 30: Australia, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 31: India, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 32: India, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 33: China, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 34: China, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 35: Saudi Arabia, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 36: Saudi Arabia, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 37: South Korea, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 38: South Korea, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 39: Japan, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 40: Japan, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 41: Malaysia, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 42: Malaysia, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 43: Singapore, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 44: Singapore, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 45: United Kingdom, Defense Vetronics Market, Technology Maturation, 2022-2032

- Figure 46: United Kingdom, Defense Vetronics Market, Market Forecast, 2022-2032

- Figure 47: Opportunity Analysis, Defense Vetronics Market, By Region (Cumulative Market), 2022-2032

- Figure 48: Opportunity Analysis, Defense Vetronics Market, By Region (CAGR), 2022-2032

- Figure 49: Opportunity Analysis, Defense Vetronics Market, By Type (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Defense Vetronics Market, By Type (CAGR), 2022-2032

- Figure 51: Scenario Analysis, Defense Vetronics Market, Cumulative Market, 2022-2032

- Figure 52: Scenario Analysis, Defense Vetronics Market, Global Market, 2022-2032

- Figure 53: Scenario 1, Defense Vetronics Market, Total Market, 2022-2032

- Figure 54: Scenario 1, Defense Vetronics Market, By Region, 2022-2032

- Figure 55: Scenario 1, Defense Vetronics Market, By Type, 2022-2032

- Figure 56: Scenario 2, Defense Vetronics Market, Total Market, 2022-2032

- Figure 57: Scenario 2, Defense Vetronics Market, By Region, 2022-2032

- Figure 58: Scenario 2, Defense Vetronics Market, By Type, 2022-2032

- Figure 59: Company Benchmark, Defense Vetronics Market, 2022-2032