|

市場調查報告書

商品編碼

1490831

全球步兵戰車市場(2023-2033)Global Infantry Fighting Vehicles Market 2023-2033 |

||||||

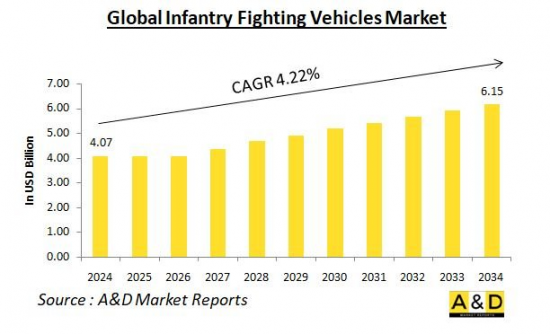

到 2024 年,全球步兵戰車市場規模預計為 40.7 億美元,在預測期內(2024-2034 年)複合年增長率 (CAGR) 為 4.22%,到 2034 年將繼續增長。年將達61.5億美元。

步兵戰車市場概覽

全球步兵戰車 (IFV) 市場是國防工業的重要組成部分,提供能夠將部隊運送到戰鬥中同時為敵軍提供火力支援的裝甲平台。步兵戰車是多功能戰場資產,集機動性、火力和防護於一體,可提高步兵部隊在現代戰爭場景中的效能。

科技對步兵戰車市場的影響

科技正在對步兵戰車市場產生重大影響,推動機動性、殺傷力和生存能力的提升。從先進裝甲材料的整合到數位化戰場管理系統的採用,技術創新正在增強步兵戰車的作戰能力,使其在戰場上更加敏捷、更具殺傷力和彈性。此外,感測器、通訊系統和目標捕獲技術的進步提高了態勢感知和戰場協調能力,使步兵戰車人員能夠在複雜和動態的環境中更有效地作戰。

步兵戰車市場的關鍵驅動因素

推動步兵戰車市場成長的關鍵因素包括軍事現代化、領土衝突和不對稱戰爭的演變。隨著全球國防預算的增加,各國政府正在優先考慮採購下一代步兵戰車,以取代老化的艦隊並保持戰鬥優勢。此外,包括叛亂、恐怖主義和混合戰術在內的混合威脅的激增,凸顯了對能夠在不同作戰環境中運行的高機動性和防護性步兵戰車的需求。

步兵戰車市場的區域趨勢

區域趨勢在塑造 IFV 市場動態方面發揮重要作用,不同區域具有不同的需求模式、採購策略和國內生產能力。在北美,美國在大量軍事開支、技術創新和多樣化的裝甲車輛專案組合的推動下主導了步兵戰車市場。美國陸軍繼續努力對其裝甲車隊進行現代化改造,包括開發下一代戰鬥車輛(NGCV)計劃,預計該計劃將推動該地區對先進步兵戰車的需求。

歐洲步兵戰車市場的特點是國內生產能力和北約盟國之間的聯合採購措施相結合。隨著地緣政治緊張局勢重新出現以及俄羅斯的軍事現代化努力,歐洲國家正在投資升級其裝甲車隊,以加強聯盟內的威懾和互通性。此外,歐洲防務基金和歐洲主戰坦克計畫等措施旨在促進下一代裝甲車(包括步兵戰車)開發的合作,以增強歐洲的國防工業能力。

由於領土爭端、軍事現代化計劃以及日益嚴重的區域衝突威脅,亞太地區的步兵戰車市場正在不斷增長。中國、印度和韓國等國正在大力投資國產步兵戰車,以減少對進口的依賴並提高國防採購的自給自足能力。此外,海盜和邊境侵犯等不對稱威脅的擴散正在推動對能夠在沿海環境中執行任務的兩棲步兵戰車的需求。

在中東和非洲,步兵戰車市場受到區域衝突、叛亂行動和非國家武裝團體擴散的影響。包括沙烏地阿拉伯、土耳其和以色列在內的該地區國家正在投資收購和現代化其裝甲車隊,以有效應對新出現的安全威脅。此外,豐富的自然資源以及與主要武器供應商的戰略聯盟進一步增加了中東地區對先進步兵戰車的需求。

主要步兵戰車項目

阿爾巴尼亞政府已與韓華防務澳洲公司簽署合同,為澳洲陸軍供應和維護 129 輛國產紅背步兵戰車。項目總成本估計約為 70 億美元,是迄今為止對陸軍能力的最大單項投資。採購和初步支持協議的總價值約為45億美元。

印度國防部已與 Nigam 裝甲車輛有限公司 (AVNL) 簽署採購協議,將 693 輛步兵戰車從 BMP2 升級為 BMP2M。更新內容包括夜間啟用、砲手主瞄準具、車長全景瞄準具、具有自動目標追蹤功能的火控系統(FCS),並且是 "購買" 的(分類在印度設計、開發和製造)。 AVNL 開發了一種本土解決方案,透過將FCS 與印度國防研究與發展組織(DRDO) 和金奈巴拉特電子有限公司(BEL) 開發的瞄準具集成,為現有BMP 2/2K 車輛配備夜間作戰能力和FCS。

陸軍可選載人戰車計畫(更名為 XM30 機械化步兵戰車)已宣佈將原型機合約授予兩家供應商:通用動力陸地系統公司和美國萊茵金屬車輛有限責任公司。兩家供應商將開發一款原型車來取代 M2 布拉德利步兵戰車。 M2 Bradley 是一款履帶式車輛,設計用於偵察、班組保護、運輸和小型武器。兩份合約的總價值估計約為 16 億美元。

本報告分析了全球步兵戰車市場,研究了總體市場規模的趨勢、依地區和國家劃分的詳細趨勢、關鍵技術概述和市場機會。

目錄

步兵戰車市場:報告定義

步兵戰車市場區隔

- 依配置

- 依地區

- 依類型

步兵戰車市場分析(未來10年)

步兵戰車市場的市場技術

全球步兵戰車市場預測

步兵戰車市場:依地區劃分的趨勢和預測

- 北美

- 促進/抑制因素和課題

- PEST分析

- 市場預測與情境分析

- 主要公司

- 供應商層級狀況

- 企業基準比較

- 歐洲

- 中東

- 亞太地區

- 南美洲

步兵戰車市場:國家分析

- 美國

- 防禦規劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度水平

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳大利亞

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

步兵戰車市場:市場機會矩陣

步兵戰車市場:專家對研究的看法

結論

關於航空和國防市場報告

The global Infantry Fighting Vehicles market is estimated at USD 4.07 billion in 2024, projected to grow to USD 6.15 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 4.22% over the forecast period 2024-2034.

Introduction to Infantry Fighting Vehicles Market

The global infantry fighting vehicles (IFVs) market is a crucial segment within the defense industry, providing armored platforms capable of transporting troops into combat while offering fire support against enemy forces. IFVs serve as versatile battlefield assets, combining mobility, firepower, and protection to enhance the effectiveness of infantry units in modern warfare scenarios.

Technology Impact in Infantry Fighting Vehicles Market

Technology has significantly impacted the IFVs market, driving advancements in mobility, lethality, and survivability. From the integration of advanced armor materials to the adoption of digital battlefield management systems, technological innovations have enhanced the operational capabilities of IFVs, making them more agile, lethal, and resilient on the battlefield. Moreover, advancements in sensors, communication systems, and target acquisition technologies have improved situational awareness and battlefield coordination, enabling IFV crews to operate more effectively in complex and dynamic environments.

Key drivers in Infantry Fighting Vehicles Market

Key drivers fueling the growth of the IFVs market include the modernization of armed forces, territorial disputes, and the evolving nature of asymmetric warfare. As defense budgets increase globally, governments are prioritizing the acquisition of next-generation IFVs to replace aging fleets and maintain combat superiority. Additionally, the proliferation of hybrid threats, including insurgencies, terrorism, and hybrid warfare tactics, has underscored the need for highly mobile and well-protected IFVs capable of operating in diverse operational environments.

Regional Trends in Infantry Fighting vehicles Market

Regional trends play a significant role in shaping the dynamics of the IFVs market, with different regions exhibiting varying patterns of demand, procurement strategies, and indigenous production capabilities. In North America, the United States dominates the IFVs market, driven by its extensive military expenditures, technological innovation, and a diverse portfolio of armored vehicle programs. The U.S. Army's ongoing efforts to modernize its armored fleet, including the development of the Next Generation Combat Vehicle (NGCV) program, are expected to drive demand for advanced IFVs in the region.

In Europe, the IFVs market is characterized by a mix of domestic production capabilities and collaborative procurement initiatives among NATO allies. With the resurgence of geopolitical tensions and the Russian military's modernization efforts, European countries are investing in upgrading their armored vehicle fleets to enhance deterrence capabilities and interoperability within the alliance. Moreover, initiatives such as the European Defense Fund and the European Main Battle Tank project aim to foster cooperation in developing next-generation armored vehicles, including IFVs, to strengthen European defense industrial capabilities.

Asia-Pacific represents a growing market for IFVs, driven by territorial disputes, military modernization programs, and the rising threat of regional conflicts. Countries such as China, India, and South Korea are investing heavily in indigenous IFV development to reduce dependency on imports and bolster self-sufficiency in defense procurement. Additionally, the proliferation of asymmetric threats, including maritime piracy and border incursions, has spurred demand for amphibious IFVs capable of conducting operations in littoral environments.

In the Middle East and Africa, the IFVs market is influenced by regional conflicts, counterinsurgency operations, and the proliferation of non-state armed groups. Countries in the region, including Saudi Arabia, Turkey, and Israel, are investing in acquiring and modernizing their armored vehicle fleets to address emerging security threats effectively. Moreover, the presence of natural resource wealth and strategic alliances with major arms suppliers further fuels demand for advanced IFVs in the Middle East.

Key Infantry Fighting Vehicles Program

The Albanese Government has entered agreements with Hanwha Defense Australia to supply and maintain 129 domestically manufactured Redback infantry fighting vehicles for the Australian Army. The overall project is estimated to be worth around $7 billion, marking the largest individual investment in Army capability thus far. The collective worth of both the procurement and initial support agreements stands at roughly $4.5 billion.

the Ministry of Defence signed a contract with Armoured Vehicles Nigam Limited (AVNL) for the acquisition of 693 Armament Upgrades of Infantry Combat Vehicle BMP2 to BMP2M. This upgrade encompasses Night Enablement, Gunner Main Sight, Commander Panoramic Sight, and Fire Control System (FCS) with Automatic Target Tracker, falling under the Buy {Indian-Indigenously Designed Developed and Manufactured} Category.

AVNL has devised an indigenous solution to equip existing BMP 2/2K vehicles with Night Fighting Capabilities and FCS through the integration of sights and FCS developed by Defence Research and Development Organisation (DRDO) and Bharat Electronics Limited (BEL), Chennai.

The Army's Optionally Manned Fighting Vehicle program, now renamed as the XM30 Mechanized Infantry Combat Vehicle, has declared that contracts for prototypes will be granted to two vendors: General Dynamics Land Systems Inc. and American Rheinmetall Vehicles LLC.

These two vendors will develop prototypes of a vehicle intended to replace the M2 Bradley Infantry Fighting Vehicle. The M2 Bradley is a tracked vehicle designed for reconnaissance and offers protection, transportation, and small-arms firepower for squad elements. The combined value of both contracts is estimated to be around $1.6 billion.

Table of Contents

Infantry Fighting Vehicles Market Report Definition

Infantry Fighting Vehicles Market Segmentation

By Configuration

By Region

By Type

Infantry Fighting Vehicles Market Analysis for next 10 Years

The 10-year infantry fighting vehicles market analysis would give a detailed overview of infantry fighting vehicles market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Infantry Fighting Vehicles Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Infantry Fighting Vehicles Market Forecast

The 10-year infantry fighting vehicles market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Infantry Fighting Vehicles Market Trends & Forecast

The regional infantry fighting vehicles market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Infantry Fighting Vehicles Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Infantry Fighting Vehicles Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Infantry Fighting Vehicles Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2024-2034

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2024-2034

- Table 18: Scenario Analysis, Scenario 1, By Configuration, 2024-2034

- Table 19: Scenario Analysis, Scenario 1, By Type, 2024-2034

- Table 20: Scenario Analysis, Scenario 2, By Region, 2024-2034

- Table 21: Scenario Analysis, Scenario 2, By Configuration, 2024-2034

- Table 22: Scenario Analysis, Scenario 2, By Type, 2024-2034

List of Figures

- Figure 1: Global Infantry Fighting Vehicles Market Forecast, 2024-2034

- Figure 2: Global Infantry Fighting Vehicles Market Forecast, By Region, 2024-2034

- Figure 3: Global Infantry Fighting Vehicles Market Forecast, By Configuration, 2024-2034

- Figure 4: Global Infantry Fighting Vehicles Market Forecast, By Type, 2024-2034

- Figure 5: North America, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 6: Europe, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 7: Middle East, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 8: APAC, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 9: South America, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 10: United States, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 11: United States, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 12: Canada, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 13: Canada, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 14: Italy, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 15: Italy, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 16: France, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 17: France, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 18: Germany, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 19: Germany, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 20: Netherlands, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 21: Netherlands, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 22: Belgium, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 23: Belgium, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 24: Spain, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 25: Spain, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 26: Sweden, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 27: Sweden, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 28: Brazil, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 29: Brazil, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 30: Australia, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 31: Australia, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 32: India, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 33: India, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 34: China, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 35: China, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 36: Saudi Arabia, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 37: Saudi Arabia, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 38: South Korea, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 39: South Korea, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 40: Japan, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 41: Japan, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 42: Malaysia, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 43: Malaysia, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 44: Singapore, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 45: Singapore, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 46: United Kingdom, Infantry Fighting Vehicles Market, Technology Maturation, 2024-2034

- Figure 47: United Kingdom, Infantry Fighting Vehicles Market, Market Forecast, 2024-2034

- Figure 48: Opportunity Analysis, Infantry Fighting Vehicles Market, By Region (Cumulative Market), 2024-2034

- Figure 49: Opportunity Analysis, Infantry Fighting Vehicles Market, By Region (CAGR), 2024-2034

- Figure 50: Opportunity Analysis, Infantry Fighting Vehicles Market, By Configuration (Cumulative Market), 2024-2034

- Figure 51: Opportunity Analysis, Infantry Fighting Vehicles Market, By Configuration (CAGR), 2024-2034

- Figure 52: Opportunity Analysis, Infantry Fighting Vehicles Market, By Type (Cumulative Market), 2024-2034

- Figure 53: Opportunity Analysis, Infantry Fighting Vehicles Market, By Type (CAGR), 2024-2034

- Figure 54: Scenario Analysis, Infantry Fighting Vehicles Market, Cumulative Market, 2024-2034

- Figure 55: Scenario Analysis, Infantry Fighting Vehicles Market, Global Market, 2024-2034

- Figure 56: Scenario 1, Infantry Fighting Vehicles Market, Total Market, 2024-2034

- Figure 57: Scenario 1, Infantry Fighting Vehicles Market, By Region, 2024-2034

- Figure 58: Scenario 1, Infantry Fighting Vehicles Market, By Configuration, 2024-2034

- Figure 59: Scenario 1, Infantry Fighting Vehicles Market, By Type, 2024-2034

- Figure 60: Scenario 2, Infantry Fighting Vehicles Market, Total Market, 2024-2034

- Figure 61: Scenario 2, Infantry Fighting Vehicles Market, By Region, 2024-2034

- Figure 62: Scenario 2, Infantry Fighting Vehicles Market, By Configuration, 2024-2034

- Figure 63: Scenario 2, Infantry Fighting Vehicles Market, By Type, 2024-2034

- Figure 64: Company Benchmark, Infantry Fighting Vehicles Market, 2024-2034