|

市場調查報告書

商品編碼

1486766

全球海洋雷達市場(2024-2034)Global Ship Radar Market 2024-2034 |

||||||

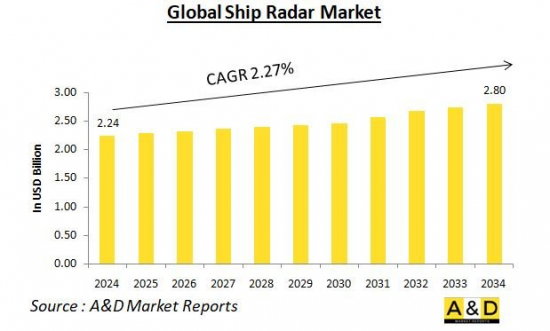

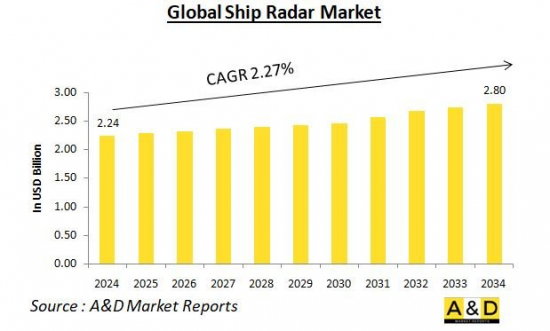

預計2024年全球海事雷達市場規模為22.4億美元,預測期內(2024-2034年)複合年增長率(CAGR)為2.27%,到2034年將達到28億美元。

船用雷達市場概況

船用雷達市場是海洋工業的一個重要分支,涵蓋用於導航、防撞、天氣監測和安全的雷達系統的開發、生產和分銷。這些系統對於從小船到大型商船和海軍艦隊的安全和高效運作至關重要。該市場上有各種類型的雷達,包括 X 波段和 S 波段雷達,每種雷達根據頻率和操作特性都有特定的應用。由於海上作業的複雜性不斷增加以及對安全和安保的重視程度不斷提高,預計海洋雷達市場將顯著成長和技術創新。

技術對海洋雷達市場的影響

由於尖端技術的進步,海洋雷達市場正在經歷重大轉變。這些進步正在創造具有增強功能和更廣泛應用的新一代雷達系統。

關鍵驅動因素之一是從磁控管技術轉變為固態雷達的因素。這種轉變帶來了多種好處,包括提高可靠性、減少維護要求和提高效能。固態雷達具有出色的分辨率和較長的使用壽命,使其成為現代海上導航的可靠選擇。

此外,數位訊號處理 (DSP) 的進步顯著提高了雷達性能。DSP 可實現更好的雜訊抑制和更清晰的雷達影像,從而提高目標偵測、追蹤和識別能力。這對於確保安全航行和避免碰撞起著重要作用。

現代船用雷達也越來越多地與自動識別系統(AIS)整合。AIS 提供附近船隻的即時訊息,大大提高船員的態勢感知能力並防止潛在的碰撞。

創新不僅限於雷達的內部結構。天線設計的進步(例如相控陣和電子掃瞄陣列)透過提供卓越的分辨率、更快的目標捕獲和更準確的追蹤來提高雷達性能。

最後,人工智慧 (AI) 和機器學習 (ML) 的整合正在進一步突破界限。這些技術用於在雷達系統內自動進行目標偵測、分類和追蹤。這不僅提高了機組人員的決策能力,還減少了操作員的認知負擔,使他能夠專注於其他重要任務。

海洋雷達市場的關鍵驅動因素

海洋雷達市場是由多種因素共同決定的。主要驅動力是始終存在的安全導航和避免碰撞的需求。雷達充當船舶的眼睛,探測其他船隻、障礙物,甚至天氣模式,從而實現安全高效的海上作業。

此外,嚴格的國際法規也扮演著重要角色。國際海事組織 (IMO) 和其他監管機構要求某些類別的船舶使用雷達系統。滿足這些監管要求需要投資先進的雷達技術。

技術進步也是重要的推手。固態雷達、改進的訊號處理以及與其他海事系統整合等領域的持續技術創新提高了雷達的性能和可靠性。這些進步使雷達對船舶營運商更具吸引力,進一步推動市場成長。

海盜、走私和非法捕魚等海上安全問題也扮演了重要角色。為了有效應對這些威脅,先進的監視雷達系統至關重要。增強的雷達功能能夠及時發現安全威脅並快速回應。

最後,航運公司和海軍的船隊現代化努力正在創造對尖端雷達系統的需求。更新至更新、功能更強大的雷達技術將確保您的船舶配備最佳的導航、安全和整體營運效率工具。

海洋雷達市場的區域趨勢

全球海洋雷達市場呈現顯著的區域差異。北美因其先進雷達技術的高採用率而脫穎而出。這是由對商業海事部門和美國海軍的大量投資推動的,美國海軍是用於導航和防禦目的的先進雷達系統的主要用戶。

歐洲正在展現一種獨特的運動。該地區是Thales、BAE Systems、Saab等主要海洋雷達製造商的所在地。嚴格的安全法規和高標準也是歐洲市場的特點,推動了對高性能商用和海軍雷達系統的需求。

由於商業航運和海軍能力的迅速擴張,亞太地區正在經歷快速成長。中國、日本和韓國等國家正大力投資雷達技術,以加強其海洋工業並加強區域安全。

中東也是一個重要的細分市場,阿聯酋和沙烏地阿拉伯等國家大力投資先進雷達系統。該地區航運和海防的戰略重要性推動了這種集中。這些國家正積極採用尖端雷達技術來增強海上安全態勢和作戰能力。

拉丁美洲和非洲是海洋雷達系統的新興市場。儘管採用水準普遍低於其他地區,但對改善海上安全和保障的興趣正在增長。國際合作和投資在將先進雷達技術引入這些地區方面發揮關鍵作用,為未來市場成長鋪平了道路。

海洋雷達市場的重點項目

- 1. CEA Technologies:總部位於坎培拉的CEA Technologies獲得了一份價值數百萬美元的國防雷達合約。總部位於坎培拉的 CEA Technologies 獲得了一份價值數百萬美元的國防合同,用於開發新型、最先進的雷達。作為綜合空戰管理系統的一部分,CEA Technologies 的任務是生產四種全新的防空雷達系統。這個新的國防項目將獲得 27 億美元的資金,這些資金將分配給各個國防承包商,其中最新的是 CEA Technologies。CEA Technologies 的雷達用於多種澳洲皇家海軍艦艇。這項投資將使這家總部位於坎培拉的公司除了海洋雷達之外還能夠開發全新的國防地面雷達。

- 2. BAE Systems:該公司已同意為巴西海軍旗艦多用途航空母艦NAM Atlantico上的ARTISAN雷達提供五年支援。這份新合約將為部署在 NAM Atlantico 上的 BAE Systems 的 ARTISAN 雷達和相關 DNA2 作戰管理系統 (CMS) 提供生命週期支持,確保旗艦產品具有一流的運作可用性。ARTISAN 雷達合約將提供矯正性和預防性維護,以及由 BAE Systems 在英國製造並儲存在巴西的備用零件。我們也提供幫助台服務,為我們從英國到巴西的團隊提供支援。NAM Atlantico 使用 ARTISAN 海軍監視雷達進行地面和空中監視以及空中交通管制。

- 3.韓國:該國即將完成可同時辨識多個目標的AESA(主動電子掃瞄陣列)雷達。目前正在測試的國產化AESA雷達預計將顯著提高韓國軍方,特別是韓國海軍的偵測能力。將於2024年交付韓國海軍的首艘未來蔚山級護衛艦(FFX Batch III)將配備AESA雷達。Hanwha Systems的新型雷達將增強防空和反艦作戰能力。在武器裝備和尺寸方面,蔚山級FFX第三批驅逐艦將與已服役的廣開托級(也稱為KDX I)驅逐艦相當。除了FFX之外,下一代驅逐艦KDDX還將配備Hanwha Systems的AESA雷達。由於整合桅桿每側都有四個相控陣,因此可以同時偵測和監控多達 4,000 個目標。

本報告分析了全球海洋雷達市場,研究了整體市場規模的趨勢、依地區和國家劃分的詳細趨勢、關鍵技術概述和市場機會。

目錄

海洋雷達市場:分析定義

船用雷達市場細分

- 依類型

- 依地區

海洋雷達市場分析:未來10年

船用雷達市場的市場技術

全球海洋雷達市場預測

海洋雷達市場:依地區劃分的趨勢和預測

- 北美

- 促進/抑制因素和課題

- PEST分析

- 市場預測與情境分析

- 大公司

- 供應商層級狀況

- 企業標竿管理

- 歐洲

- 中東

- 亞太地區

- 南美洲

海洋雷達市場:國家分析

- 美國

- 防禦計劃

- 最新趨勢

- 專利

- 該市場目前的技術成熟度水平

- 市場預測與情境分析

- 加拿大

- 義大利

- 法國

- 德國

- 荷蘭

- 比利時

- 西班牙

- 瑞典

- 希臘

- 澳大利亞

- 南非

- 印度

- 中國

- 俄羅斯

- 韓國

- 日本

- 馬來西亞

- 新加坡

- 巴西

海洋雷達市場:機會矩陣

海洋雷達市場:專家觀點

結論

關於航空和國防市場報告

The global Ship Radar market is estimated at USD 2.24 billion in 2024, projected to grow to USD 2.80 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 2.27% over the forecast period 2024-2034.

Introduction to Ship Radar Market

The ship radar market is a critical segment of the maritime industry, encompassing the development, production, and deployment of radar systems used for navigation, collision avoidance, weather monitoring, and security. These systems are essential for the safe and efficient operation of vessels, from small boats to large commercial ships and naval fleets. The market includes a range of radar types, such as X-band and S-band radars, each with specific applications based on their frequency and operational characteristics. With the increasing complexity of maritime operations and the growing emphasis on safety and security, the ship radar market is poised for significant growth and innovation.

Technology Impact in Ship Radar Market

The ship radar market is undergoing a significant transformation driven by cutting-edge technological advancements. These advancements are leading to a new generation of radar systems with enhanced capabilities and a wider range of applications.

One key driver is the shift from magnetron-based technology to solid-state radars. This transition brings several advantages, including improved reliability, reduced maintenance requirements, and enhanced performance. Solid-state radars boast superior resolution and longer operational lifespans, making them a reliable choice for modern maritime navigation.

Furthermore, advancements in Digital Signal Processing (DSP) are significantly improving radar performance. DSP allows for better noise reduction and clearer radar images, leading to improved target detection, tracking, and identification capabilities. This plays a crucial role in ensuring safe navigation and collision avoidance.

Modern ship radars are also witnessing a rise in integration with Automatic Identification Systems (AIS). AIS provides real-time information about nearby vessels, significantly enhancing situational awareness for crews and preventing potential collisions.

Innovation is not limited to the internal workings of radars. Advancements in antenna design, such as phased array and electronically scanned arrays, are improving radar performance by offering superior resolution, faster target acquisition, and more precise tracking.

Finally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is pushing the boundaries even further. These technologies are being employed to automate target detection, classification, and tracking within radar systems. This not only enhances decision-making capabilities for crews but also reduces the cognitive load on operators, allowing them to focus on other critical tasks.

Key Drivers in Ship Radar Market

The ship radar market is fueled by a confluence of factors. The primary driver remains the ever-present need for safe navigation and collision avoidance. Radars serve as the eyes of a ship, detecting other vessels, obstacles, and even weather patterns, enabling safe and efficient maritime operations.

Furthermore, stringent international regulations play a significant role. The International Maritime Organization (IMO) and other regulatory bodies mandate the use of radar systems for specific vessel classes. Meeting these regulatory requirements necessitates investment in advanced radar technology.

Technological advancements are another key driver. Continuous innovation in areas like solid-state radars, improved signal processing, and integration with other maritime systems enhances radar performance and reliability. These advancements make radars more attractive to ship operators, further propelling market growth.

Concerns over maritime security, including piracy, smuggling, and illegal fishing, also contribute significantly. To effectively counter these threats, advanced radar systems are crucial for surveillance and monitoring purposes. Enhanced radar capabilities allow for the timely detection of security threats, enabling a swift response.

Finally, fleet modernization efforts by shipping companies and naval forces create a demand for cutting-edge radar systems. Upgrading to newer, more capable radar technologies ensures that vessels are equipped with the best tools for navigation, safety, and overall operational efficiency.

Regional Trends in Ship Radar Market

The global ship radar market exhibits significant regional variations. North America stands out for its high adoption rate of advanced radar technologies. This is fueled by substantial investments in both the commercial maritime sector and the U.S. Navy, a major user of sophisticated radar systems for navigation and defense purposes.

Europe presents a unique dynamic. The region boasts some of the leading ship radar manufacturers, including Thales, BAE Systems, and Saab. Stringent safety regulations and high standards also characterize the European market, driving demand for high-performance radar systems across commercial and naval applications.

The Asia-Pacific region is experiencing a growth surge, fueled by the rapid expansion of both commercial shipping and naval capabilities. Countries like China, Japan, and South Korea are making significant investments in radar technologies to bolster their maritime industries and enhance regional security.

The Middle East is another important market segment, with countries like the UAE and Saudi Arabia investing heavily in advanced radar systems. This focus is driven by the strategic importance of shipping and naval defense in the region. These countries are actively adopting cutting-edge radar technologies to elevate their maritime security posture and operational capabilities.

Latin America and Africa represent emerging markets for ship radar systems. While adoption levels are generally lower compared to other regions, there is a growing interest in improving maritime safety and security. International partnerships and investments are playing a crucial role in introducing advanced radar technologies to these regions, paving the way for future market growth.

Key Ship Radar Market Programs

1.CEA Technologies: CEA Technologies, based in Canberra, has been awarded a multi-million dollar defence radar contract. CEA Technologies, situated in Canberra, has been given a multi-million dollar defence contract to develop fresh new cutting-edge radars. As part of the Joint Air Battle Management System, CEA Technologies has been tasked to manufacture four brand new air defence radar systems. This new defence project involves $2.7 billion in funding, which will be distributed among a number of different defence contractors, the most current of which being CEA Technologies. CEA Technologies radars are used on various Australian navy ships. This investment will enable the Canberra-based company to create completely new ground-based radars for defence in addition to its ship-based radars.

2.BAE Systems: BAE Systems has agreed to support its ARTISAN Radar on the Brazilian Navy's flagship, the multipurpose aircraft carrier NAM Atlantico, for five years. The new contract will provide life-cycle support for the BAE Systems ARTISAN Radar and related DNA2 Combat Management System (CMS) deployed on the NAM Atlantico, ensuring the flagship has class-leading operational availability. The ARTISAN Radar component of the deal will provide corrective and preventative maintenance, as well as spare components made by BAE Systems in the UK and stored in Brazil. It will also provide a help-desk service that will be run remotely from the United Kingdom to assist the team in Brazil. NAM Atlantico will use the ARTISAN naval surveillance radar for surface and air surveillance, as well as air traffic control.

3. South Korea: South Korea is nearing completion of the AESA (Active Electronically Scanned Array) radar, which can identify several targets at the same time. The localised AESA radar, which is now being tested, is projected to significantly increase the detection capabilities of Korean armed forces, particularly the ROK Navy. The future Ulsan-class frigates (FFX Batch III), the first of which will be delivered to the ROK Navy in 2024, will be equipped with the AESA radar. Hanwha Systems' new radar will enhance anti-air and anti-ship operating capabilities. In terms of weaponry and size, the Ulsan-class FFX Batch III destroyers will be equal to the Gwanggaeto the Great-class (also known as KDX I) destroyers already in service. In addition to the FFX, the next-generation Korean destroyers, designated as KDDX, will be equipped with Hanwha Systems' AESA radar. Thanks to the four phased arrays on each side of their integrated mast, they will be able to detect and monitor up to 4,000 targets at the same time.

Table of Contents

Ship Radar Market Report Definition

Ship Radar Market Segmentation

By Type

By Region

Ship Radar Market Analysis for next 10 Years

The 10-year ship radar market analysis would give a detailed overview of ship radar market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Ship Radar Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Ship Radar Market Forecast

The 10-year ship radar market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Ship Radar Market Trends & Forecast

The regional ship radar market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Ship Radar Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Ship Radar Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Ship Radar Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 19: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Ship Radar Market Forecast, 2022-2032

- Figure 2: Global Ship Radar Market Forecast, By Region, 2022-2032

- Figure 3: Global Ship Radar Market Forecast, By Type, 2022-2032

- Figure 4: North America, Ship Radar Market, Market Forecast, 2022-2032

- Figure 5: Europe, Ship Radar Market, Market Forecast, 2022-2032

- Figure 6: Middle East, Ship Radar Market, Market Forecast, 2022-2032

- Figure 7: APAC, Ship Radar Market, Market Forecast, 2022-2032

- Figure 8: South America, Ship Radar Market, Market Forecast, 2022-2032

- Figure 9: United States, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 10: United States, Ship Radar Market, Market Forecast, 2022-2032

- Figure 11: Canada, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 12: Canada, Ship Radar Market, Market Forecast, 2022-2032

- Figure 13: Italy, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 14: Italy, Ship Radar Market, Market Forecast, 2022-2032

- Figure 15: France, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 16: France, Ship Radar Market, Market Forecast, 2022-2032

- Figure 17: Germany, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 18: Germany, Ship Radar Market, Market Forecast, 2022-2032

- Figure 19: Netherlands, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 20: Netherlands, Ship Radar Market, Market Forecast, 2022-2032

- Figure 21: Belgium, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 22: Belgium, Ship Radar Market, Market Forecast, 2022-2032

- Figure 23: Spain, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 24: Spain, Ship Radar Market, Market Forecast, 2022-2032

- Figure 25: Sweden, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 26: Sweden, Ship Radar Market, Market Forecast, 2022-2032

- Figure 27: Brazil, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 28: Brazil, Ship Radar Market, Market Forecast, 2022-2032

- Figure 29: Australia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 30: Australia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 31: India, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 32: India, Ship Radar Market, Market Forecast, 2022-2032

- Figure 33: China, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 34: China, Ship Radar Market, Market Forecast, 2022-2032

- Figure 35: Saudi Arabia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 36: Saudi Arabia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 37: South Korea, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 38: South Korea, Ship Radar Market, Market Forecast, 2022-2032

- Figure 39: Japan, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 40: Japan, Ship Radar Market, Market Forecast, 2022-2032

- Figure 41: Malaysia, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 42: Malaysia, Ship Radar Market, Market Forecast, 2022-2032

- Figure 43: Singapore, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 44: Singapore, Ship Radar Market, Market Forecast, 2022-2032

- Figure 45: United Kingdom, Ship Radar Market, Technology Maturation, 2022-2032

- Figure 46: United Kingdom, Ship Radar Market, Market Forecast, 2022-2032

- Figure 47: Opportunity Analysis, Ship Radar Market, By Region (Cumulative Market), 2022-2032

- Figure 48: Opportunity Analysis, Ship Radar Market, By Region (CAGR), 2022-2032

- Figure 49: Opportunity Analysis, Ship Radar Market, By Type (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Ship Radar Market, By Type (CAGR), 2022-2032

- Figure 51: Scenario Analysis, Ship Radar Market, Cumulative Market, 2022-2032

- Figure 52: Scenario Analysis, Ship Radar Market, Global Market, 2022-2032

- Figure 53: Scenario 1, Ship Radar Market, Total Market, 2022-2032

- Figure 54: Scenario 1, Ship Radar Market, By Region, 2022-2032

- Figure 55: Scenario 1, Ship Radar Market, By Type, 2022-2032

- Figure 56: Scenario 2, Ship Radar Market, Total Market, 2022-2032

- Figure 57: Scenario 2, Ship Radar Market, By Region, 2022-2032

- Figure 58: Scenario 2, Ship Radar Market, By Type, 2022-2032

- Figure 59: Company Benchmark, Ship Radar Market, 2022-2032