|

年間契約型資訊服務

商品編碼

1504288

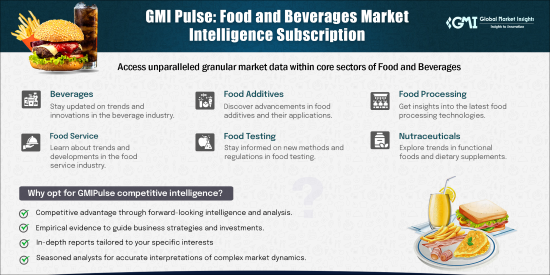

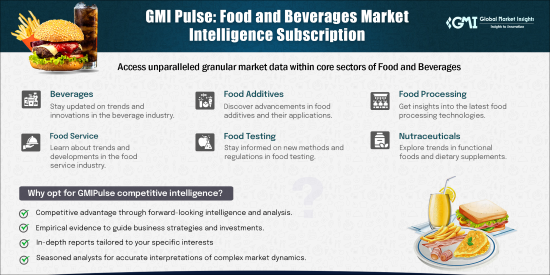

GMIPulse - 食品飲料市場情報訂閱GMIPulse - Food & Beverage Market Intelligence Subscription |

|||||||

Global Market Insights Inc. 提供 GMIPulse,這是一個支援商業智慧 (BI) 的尖端平台,旨在提供最佳的策略價值。 GMIPulse 提供適應性強的訂閱服務,可根據您的獨特需求進行客製化,提供全面而細緻的市場資料、競爭格局洞察以及對行業生態系統的深入了解。該平台是滿足所有市場研究需求的首選解決方案,確保您領先於最新趨勢和技術進步。

GMI脈衝的優點

- 1. 輕鬆取得準確的市場數據:GMIPulse 可即時取得細緻、真實的市場資料,為您提供準確、最新的策略決策資訊。

- 2. 全面的市場研究解決方案:GMIPulse作為您全方位的市場研究工具,涵蓋廣泛的行業,提供詳細的分析和預測,幫助您有效駕馭市場動態。

- 3. 深度競爭格局:平台提供全面的競爭格局和公司概況洞察,讓您全面了解競爭對手和產業標竿。

- 4.了解產業生態系統:GMIPulse讓您深入了解產業生態系統,追蹤技術進步及其對產業趨勢的影響。

- 5. 客製化客戶檔案:量身訂製的客戶檔案可協助您識別最新的成長機會並了解特定的市場需求,從而增強您的策略規劃。

- 6. 技術追蹤 隨時了解最新的技術趨勢及其對市場的影響,確保您為未來的發展做好充分準備。

- 7. 存取最新報告:訂閱者可以存取先前發布的報告和即將發布的報告,讓您隨時了解最新的市場情報。

- 8. 互動式且使用者友善的介面:此平台的互動式介面可確保無縫的使用者體驗,讓您輕鬆瀏覽資料並有效地獲得有意義的見解。

- 9. 延長分析師工作時間:受益於更好地獲得分析師的策略幫助和深入解釋,確保您做出明智的決策。

- 10. 安全登入:所有報告均受密碼保護,確保您的資料安全保密。

GMIPulse 的卓越優勢

- 1. 即時存取報告:GMIPulse 為客戶提供即時存取全面市場報告的直接存取權限,協助客戶及時做出明智的決策。

- 2. GMI Pulse 隆重推出 MyraAI 輔助功能:這項突破性功能讓每個人都能以任何語言取得資料洞察。 MyraAI 支援多語言,可無縫翻譯複雜的報告並即時解答疑問。

- 3. 互動式儀錶板:所有 GMI Pulse 使用者均可使用互動式儀錶板,徹底改變您與資料互動的方式。您可以輕鬆按地區、細分市場等篩選數據,從而專注於最重要的事項。簡潔的介面讓您即使沒有技術技能也能輕鬆調整,即時更新功能能讓您隨時隨地獲得洞察。

- 4. 客製化報告:存取由行業領袖根據您的需求量身定制的詳細市場趨勢、技術發展和創新報告。

- 5. 優先銷售支援:提供快速、一流的銷售支援與協助,提升客戶服務體驗。

- 6. 市場追蹤:有效率取得所有市場趨勢和動態,隨時了解最新動態,為策略規劃和決策提供參考。

- 7. 價格優勢:全面、經濟高效的報告,滿足您的預算和需求。

產業聚焦:食品與飲料

在消費者偏好變化、技術進步和監管發展的推動下,食品和飲料產業不斷發展。 GMIPulse 提供食品和飲料行業以下關鍵集群的深入見解:

飲料

在消費者對健康產品和創新口味需求不斷成長的推動下,全球飲料市場預計從 2023 年到 2030 年將以 5.3% 的複合年成長率成長。主要市場包括非酒精飲料、酒精飲料和功能飲料。例如,功能性飲料市場(包括能量飲料和強化水)因其健康益處而越來越受歡迎。

食品添加物

在加工食品需求不斷成長以及提高食品安全和延長保存期限的需求的推動下,食品添加劑市場預計從 2023 年到 2030 年將以 6.1% 的複合年成長率擴張。主要部分包括防腐劑、增味劑和著色劑。隨著消費者尋求合成添加劑的更健康替代品,甜菊糖和羅漢果等天然添加劑變得越來越受歡迎。

食品加工

在加工技術進步和簡便食品需求不斷成長的推動下,全球食品加工市場預計從 2023 年到 2030 年將以 4.8% 的複合年成長率成長。主要領域包括肉類加工、乳製品加工以及烘焙和糖果加工。食品加工中自動化和人工智慧的採用正在提高效率和產品品質。

餐飲服務

在外食趨勢上升和送餐服務日益普及的支持下,預計2023年至2030年食品服務市場將以5.5%的複合年成長率擴張。主要領域包括餐廳、咖啡館和餐飲服務。線上食品配送平台和幽靈廚房的興起正在改變食品服務業。

食品檢測

在嚴格的食品安全法規和食源性疾病發生率上升的推動下,食品檢測市場預計從 2023 年到 2030 年將以 7.2% 的複合年成長率成長。關鍵領域包括微生物檢測、化學檢測和營養標籤。快速檢測方法和可追溯性區塊鏈等檢測技術的創新正在增強食品安全和品質保證。

營養保健品

在消費者健康意識不斷提高的推動下,營養保健品市場預計從 2023 年到 2030 年將以 8.4% 的複合年成長率強勁成長。主要細分市場包括膳食補充劑、功能性食品和功能性飲料。隨著消費者尋求除基本營養之外還能提供健康益處的產品,對益生菌、omega-3 脂肪酸和植物蛋白的需求正在激增。

加工過的食物

在消費者忙碌的生活方式和對即食食品日益成長的偏好的推動下,全球加工食品市場預計從 2023 年到 2030 年將以 4.9% 的複合年成長率成長。主要市場包括冷凍食品、罐頭食品和零食。清潔標籤產品和天然成分的趨勢正在影響更健康的加工食品的發展。

蛋白質

在高蛋白飲食需求不斷成長和運動營養行業成長的支持下,蛋白質市場預計從 2023 年到 2030 年將以 6.7% 的複合年成長率擴張。主要部分包括動物性蛋白質、植物性蛋白質和昆蟲蛋白質。植物蛋白,例如豌豆蛋白和大豆蛋白,由於其環境效益和健康優勢而受到關注。

GMIPulse 透過其支援 BI 的平台提供無與倫比的策略價值。憑藉其可自訂的互動式介面、準確的資料和全面的市場洞察,GMIPulse 是您在競爭激烈的食品和飲料市場領域中保持領先地位的重要工具。立即訂閱,釋放您的市場研究和策略規劃能力的全部潛力。

Global Market Insights Inc. offers GMIPulse, a cutting-edge, Business Intelligence (BI)-enabled platform designed to deliver the finest strategic value. GMIPulse offers an adaptable subscription service, customizable to meet your unique needs, providing comprehensive and granular market data, competitive landscape insights, and an in-depth understanding of industry ecosystems. This platform is your go-to solution for all market research needs, ensuring you stay ahead with the latest trends and technological advancements.

Advantages of GMIPulse

- 1. Easy Access to Accurate Market Data: GMIPulse provides instant access to granular and authentic market data, empowering you with precise and up-to-date information for strategic decision-making.

- 2. Comprehensive Market Research Solution: As your all-encompassing market research tool, GMIPulse covers a wide array of industries, offering detailed analyses and forecasts to help you navigate market dynamics effectively.

- 3. In-Depth Competitive Landscape: The platform offers comprehensive insights into competitive landscapes and company profiles, enabling you to understand your competitors and industry benchmarks thoroughly.

- 4. Understanding Industry Ecosystems: GMIPulse allows you to gain a profound understanding of industry ecosystems, tracking technological advancements and their impact on industry trends.

- 5. Customized Client Profiles: Tailor-made client profiles help you identify the latest growth opportunities and understand specific market needs, enhancing your strategic planning.

- 6. Technology Tracking Stay informed about the latest technological trends and their implications on the market, ensuring you are well-prepared for future developments.

- 7. Access to Latest Reports: Subscribers receive access to previously published reports and upcoming releases, keeping you updated with the most recent market intelligence.

- 8. Interactive and User-Friendly Interface: The platform's interactive interface ensures a seamless user experience, allowing you to navigate through data effortlessly and derive meaningful insights efficiently.

- 9. Enhanced Analyst Hours: Benefit from improved access to analysts for strategic assistance and in-depth explanations, ensuring you make well-informed decisions.

- 10. Secure Login: Enjoy password-protected access to all reports, ensuring your data security and confidentiality.

Exceptional Benefits of GMIPulse

- 1. Instant Report Access GMIPulse offers clients direct access to comprehensive market reports instantly, facilitating timely and informed decision-making.

- 2. PulseAI, Introducing PulseAI Assistance within GMI Pulse: a game-changing feature that makes data insights accessible to everyone, in any language. With multilingual support, PulseAI seamlessly translates complex reports and answers your questions in real-time, breaking down language barriers for effortless, intuitive data exploration.

- 3. Interactive Dashboard We're excited to announce that the Interactive Dashboard is now available to all GMI Pulse users, changing the way you interact with your data. With easy data filtering by region, segment, and more, you can focus on what matters most. The simple interface lets you make adjustments without technical skills, and real-time updates provide live insights as you work.

- 4. Tailor-Made Reports Access customized reports detailing market trends, technological developments, and innovations by industry leaders, tailored to your specific needs.

- 5. Priority Sales Support Receive best-in-class sales support and assistance promptly, enhancing your customer service experience.

- 6. Market Tracker Stay updated with streamlined access to all market trends and happenings, aiding in strategic planning and decision-making.

- 7. Pricing Benefits Obtain reports that are not only comprehensive but also cost-effective, tailored to fit your budget and needs.

Industry Focus: Food & Beverage

The food & beverage industry is continuously evolving, driven by changing consumer preferences, technological advancements, and regulatory developments. GMIPulse provides in-depth insights into the following key clusters within the food & beverage industry:

Beverages

The global beverages market is one of the strongest and most varied consumer industries that includes both alcoholic and non-alcoholic markets which together respond to changing consumer behavior, health awareness, and lifestyle shifts. The drinks industry is undergoing dramatic change fueled by demand for premium products, health-oriented formulations, and new flavor profiles in established and fast-emerging categories.

Based on green bean equivalents, coffee consumption in 2023 was about 91,000 tons according to the Coffee Board of India. The growth was mainly driven by increased at home consumption, expanding instant coffee penetration, and increasing out-of-home cafe consumption throughout the country.

The alcoholic beverages category shows strong market visibility, with the size of the global canned alcoholic drinks market at USD 71.2 billion in 2024 and expected to increase at a rate of more than 13.2% CAGR from 2025 to 2034. This is backed by premiumization, craft drinks trends, and widening market access via digital platforms. The non-alcoholic beverages market is growing even faster with the Non-Alcoholic Beer Market size value of USD 22 billion in 2022, with an expected 5.5% CAGR during 2032.

There are major market drivers for beverage alcohol or near-beverage alcohol when looking at the central market including, growing awareness of health issues, disposable income, rapidly changing demographics, and high interest from younger consumers in "sober curious" coding.Along with product innovation around functional beverage product development, sustainability in packaging, and personalized nutrition, all navigating the new landscape of product development. The convergence of plant-based ingredients, wellness trends, and low alcohol options are periodically re-energizing alcoholic and non-alcoholic manufacturers and consumers.

Food Additives Market Category Description

The food additives market is undergoing radical growth underpinned by consumers' evolving preference for clean-label solutions and sustainable ingredients. Based on the ingredient, 49-67 percent of consumers expressed willingness to try food and beverages with novel ingredients, with consumers willing to try novel ingredients in snacks and at lunch most. Labels that use language familiar to consumers and that provide easily understandable claims about health effects most effectively encourage trial of food products with novel ingredients.

The global market for food additives represents a huge industry with continued growth - across many different product categories. The total size of the food additives market was over USD 124.2 billion in 2024 and is expected to grow at 10.1% CAGR from 2025-2034 partly due to a growing consumer preoccupation with clean labelled products. Clean-labeling trends in consumers are reshaping market drivers. The clean labelled food additives market was worth USD 45.3 billion in 2024 and expected to grow at a CAGR of 5.8% from 2025 to 2034 as more consumers become aware of consuming food that is natural, open, and healthy.

Specialty additive segments highlight focused growth opportunities fueled by health awareness and compliance. Flavor enhancers are a key segment, with the market size of food flavors & enhancers reaching over USD 8.73 billion in 2023 and anticipated to register a 6.2% CAGR from 2024 to 2032 due to rising need for natural flavors and enhancers. Food colorings are aided by natural substitutes, with the annatto food colors market value reaching more than USD 210.4 million in 2023 and anticipated to record a 5.9% CAGR during the period between 2024 and 2032, as a result of increasing awareness regarding health hazards posed by artificial additives. The intersection of consumer desire for transparency and biotechnology innovation is leading to new opportunities in antioxidants, preservatives, sweeteners, and texturizers and thickeners and tunities while conventional chemical-based additives are increasingly coming under scrutiny and pressure from natural substitutes.

Food Processing

The food processing market is a pillar of the global food economy, witnessing unparalleled growth due to urbanization, shifting lifestyles among consumers, and technological advancements transforming the production capacity and efficiency of operations. As cited by the USDA, Brazil's food processing industry recorded USD 233 billion in revenue in 2024, which was a 9.9% increase from 2023. This sector contributed 10.8% to the national GDP. It is clear from the growth of the industry that it is most important position to serve the increasing worldwide food requirements, while meeting safety, efficiency, and sustainability expectations.

Industrial food processor market size stood at USD 64.1 billion in 2023 and is expected to record more than 4.5% CAGR from 2024 to 2032, driven by growing investments in the food and beverage industry and embracing cutting-edge processing technology. The industry incorporates a variety of processing sectors, with the processed fruits and vegetables sector worth USD 377.3 billion in 2024 and forecasted to reach USD 698.6 billion by 2034 at a CAGR of over 6.3%, and the fermented processed foods sector exceeded USD 109.58 billion in 2023, forecasted to show a +6.6% CAGR during the 2022-'32 period.

Automation and digitalization are changing how many of the industry's processes are applied, and the food robotics segment had a market size of USD 3.2 billion in 2022, hypothesized to realize at least 12% CAGR over the 2022-'32 period, due to labour shortages, and the food technology segment had a market size of USD 210.9 billion in 2024, forecasted to experience 8.2% CAGR during 2025-2034, due to plant-based alternatives and clean-label ingredients as well as IoT-enabled processing technologies. Leading market drivers include stringent food safety regulations, sustainability corroborated by the raising disposable incomes, increasing consumer demand for convenience foods, and technological advances in automation, artificial intelligence, and intelligent manufacturing systems applied to enhance productivity while limiting the environmental impacts.

Food Service

The global food service market is among the most diverse and widespread categories of the food market, covering various channels of service ranging from full-service restaurants to food service in institutions, quick-service restaurants, and rising delivery platforms. Based on the National Restaurant Association, the foodservice industry is expected to reach $1.5 trillion in sales by 2025. In addition, a large majority of consumers indicate that they would like to eat out more frequently if the price were right. Robust growth arises from the ongoing urbanization of population, operating technologies, and consumers with increasing demands for convenience dining options from numerous demographic groups and locations.

Technology integration will continue to affect operational efficiency, and the food service packaging market will also play an important supportive role. The food service packaging market was valued at over USD 131.48 billion in 2023 and is projected to register 4.9% CAGR growth from 2024 to 2032 due to increasing convenience food demand.

The industry also has specialized segments, such as the airport quick service restaurant industry, with a size of USD 36.8 billion in 2024, which is projected to grow at a rate of over 4.5% during 2025-2034, fueled by increasing passenger traffic at airports.

Key market drivers are changing consumer lifestyles, digitalization through mobile ordering and delivery platforms, hospitality sectors' post-pandemic recovery, and growing demand for bespoke dining experiences. Sustainability initiatives, contactless service initiatives, and ghost kitchen concepts continue to transform industry operations and consumer engagement strategies across all food service channels.

Food Testing

The global food testing market plays an important role in public health and food safety, continuing to grow rapidly due to increases in foodborne illness outbreaks, continued regulatory burdens, and increased knowledge of food quality and contamination risks, leading to an increase in consumer demand. According to the Journal of Food: Microbiology, Safety & Hygiene, the food testing market worldwide will grow at a CAGR of 7.7% and amount to $24.6 billion by 2026. An increase in foodborne outbreaks and increasing consumer pressure for safe and healthy food items are driving the growth of the market.

The food testing industry includes in-depth analysis of various contamination sources, with specialized segments registering incredible growth. The size of the food pathogen testing market was more than USD 5 billion in 2022 and is expected to grow at over 7.5% CAGR during the forecast period of 2023-2032, owing to growing foodborne disease outbreaks globally. The sector is also aided by underlying technologies, with the microbiology testing market being worth USD 4.9 billion in 2022 and expected to grow to more than USD 11.9 billion by 2032 as a result of the rising incidence of infectious diseases and pandemic outbreaks.

Drivers of the market are strict regulatory guidelines imposed by the FDA, FAO, and EU regulators, growing worldwide processed meat and dairy consumption, and growing vegetable consumption necessitating contamination monitoring. Technological innovation in quick testing technologies, AI-driven detection devices, and automatic laboratory instruments is transforming the efficiency and accuracy of testing. The industry is hampered by infrastructure constraints in developing countries, but is sustained by government policies aimed at regulating food quality and increasing media coverage of contamination-borne diseases, driving demand for full-range food tests across all food segments.

Nutraceuticals Market Category Description

The nutraceuticals market is a dynamic convergence of nutrition and pharmaceuticals, fueled by the globalization of preventive healthcare and wellness-oriented lifestyles. As per ScienceDirect, the market for nutraceuticals is a high-value, multi-billion-dollar one that is bound for robust and fast growth in the next decade driven by the growing incidence of metabolic disorders. The vast and expansive marketplace has key areas which include amino acids, herbal supplements, omega-3 fatty acids, protein supplements and vitamins that satisfy niche consumer health needs and demographic imperatives.

Protein supplements are market leaders because awareness of fitness and sports nutrition for Gen Z and millennial consumers increased. The amino acids category is also continuing to grow rapidly, as demand rises from fitness fans and athletes seeking better performance and recovery strategies.

Herbal supplements are making tremendous headway as consumers increasingly prefer natural, plant-based solutions to synthetic ones, backed by growing evidence in support of traditional medical practices. The vitamins category continues to be core with steady demand for immune and specific nutrient deficiency treatments.

Rising niche markets also reflect the industry's fast growth. The seaweed extracts industry grew to USD 1.7 billion in 2024 with its increasing application in dietary supplements, functional foods, and gut health products. At the same time, the postnatal probiotic supplements industry was worth USD 5.3 billion in 2024 and is projected to grow to USD 11.5 billion by 2034 with a CAGR of 8.1%, led by rising awareness of infant and maternal health.

Market driving factors generally include: aging population, rising health care costs, trends toward personalized nutrition, and consumers' awareness of the role of nutrition for disease prevention. Product access and consumer experience will continue to change across all nutraceutical subsegments through direct-to-consumer and digital health integration.

Processed Food

The processed food industry is one of the largest segments in the food industry on a global scale, with stable growth characterized by urbanization, shift in lifestyles among consumers, and food manufacturing technology advancements. The Agricultural and Processed Food Products Export Development Authority (APEDA) stated that the exports of processed foods from India in the 2023-24 fiscal year amounted to USD 7,701.66 million. This large market includes varied subcategories, ranging from baking foods, convenience foods, fresh fruits and vegetables, to processing equipment, each segmenting unique consumer demands and operational needs along the food value chain.

The bakery products segment has a steady presence in the market, with technology advancing efficiency and product development. The market for bakery processing equipment sized USD 11.1 billion in 2023 and is expected to grow at a CAGR of 8.5% during 2032, representing growing automation and energy-efficient processing technology. Convenience foods continue to witness a remarkable growth rate as active lifestyles fuel demand for ready-to-consume and simple preparation foods supported by advances in packaging and preservation technologies.

The processing equipment category is the industry's technological foundation. The world food processing equipment market size was USD 48.1 billion in 2024 and is projected to expand at a CAGR of 4.8% during 2034. Fresh vegetable processing is an important emerging area, supported by health awareness and need for minimally processed, nutritionally retained products. Key drivers of the market include an increase in labor cost, sustainability initiatives, automation adoption, and shifting consumer preferences toward less unhealthy processed foods. Digitalization, manufacturing intelligence technologies, and green package solutions are transforming operational effectiveness and sustainability in every subcategory of processed foods.

Proteins

The global proteins market is a basic pillar of food security and nutrition, undergoing dynamic change fueled by changing consumer trends, concerns about sustainability, and technological advances in conventional and new protein sources. The global market for alternative meats, eggs, dairy, and seafood is projected to reach at least USD 290 billion by 2035, driven by surging global consumer demand for plant-based, microorganism-based and cell-based protein alternatives. This large market represents various protein groups, such as alternative proteins, animal proteins, and plant proteins, each serving different nutritional requirements, environmental aspects, and lifestyle preferences of consumers.

The segment of alternative proteins is witnessing phenomenal growth with the market worth USD 79.7 billion in 2023 growing at a rate of 11% CAGR during 2024-2032 on account of environmental, health, and ethics. This expansion is a result of growing consumer knowledge on the environmental effects of traditional livestock production and preference for more environmentally friendly protein sources. Animal proteins continue to be an important market, backed by the economic size of the animal feed protein market at USD 309 billion in 2023, projected to grow at 4.9% CAGR from 2024 to 2032, due to increasing demand for high-quality meat, dairy, and egg, as consumers are looking for protein-rich diets.

Plant proteins are capturing tremendous momentum as consumers become more and more vegetarian, vegan, and flexitarian in their diets, driven by advances in processing technologies and enhanced taste profiles. Major drivers of the market are growing health awareness, environmental sustainability, innovation in protein extraction and processing, and regulatory promotion of alternative protein development. The overlap between precision fermentation, cellular agriculture, and new protein sources continues to reshape the marketplace in all food protein subcategories.

GMIPulse offers unparalleled strategic value through its BI-enabled platform. With its customizable and interactive interface, accurate data, and comprehensive market insights, GMIPulse is your essential tool for staying ahead in the competitive food & beverage market landscape. Subscribe today to unlock the full potential of your market research and strategic planning capabilities.