|

市場調查報告書

商品編碼

1851645

巨量資料安全:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Big Data Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

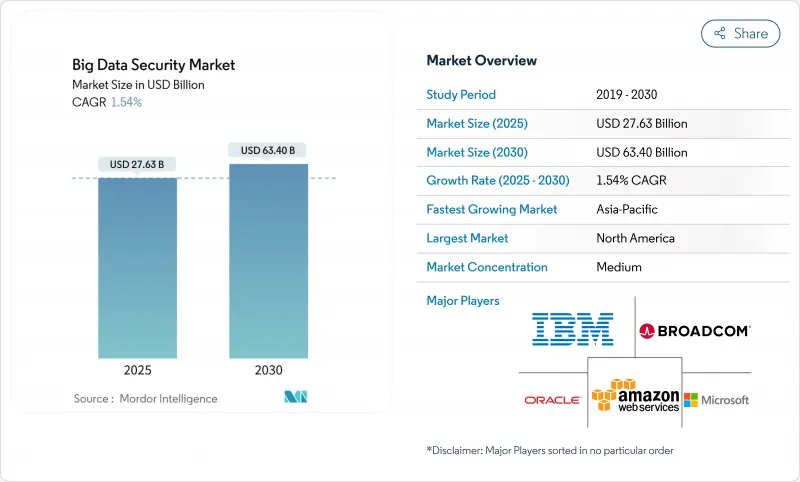

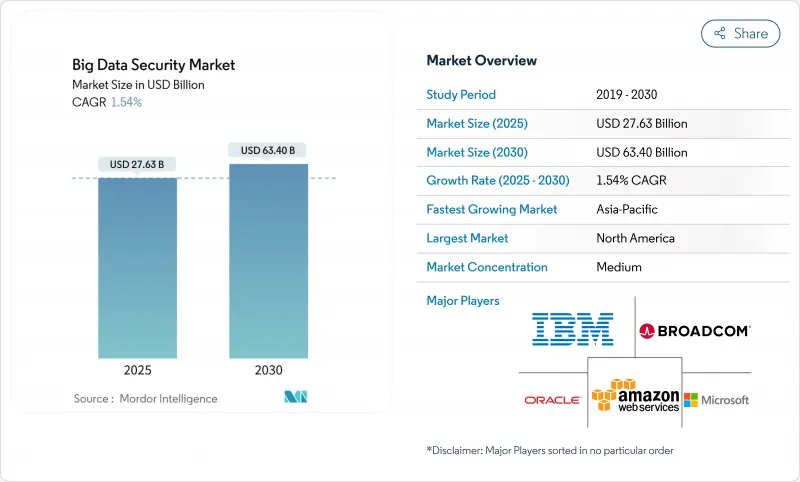

巨量資料安全市場預計到 2025 年價值 276.3 億美元,預計到 2030 年將達到 634 億美元,預測期(2025-2030 年)複合年成長率為 1.54%。

由於網路攻擊日益頻繁、資料保護法律日益嚴格,以及Petabyte級工作負載遷移到公有公共雲端),零信任技術的普及速度正在加快。隨著人工智慧驅動的資料外洩、勒索軟體攻擊和供應鏈入侵加劇營運和財務風險,企業正將以資料為中心的安全提升至董事會層面的優先事項。醫療保健、製造業和金融服務業面臨的資料外洩成本最高,促使它們增加對加密、令牌化和人工智慧分析的投資。同時,平台供應商正在整合各種工具以降低複雜性並填補網路安全人才短缺的空白,而亞太地區的資料主權法規也引發了資料中心投資的空前成長。

全球巨量資料安全市場趨勢與洞察

人工智慧引發的安全漏洞促使企業重新分配安全預算

勒索軟體集團如今正利用生成式人工智慧發動快速憑證竊取和社交工程宣傳活動,繞過傳統防禦措施。在製造業,重大安全事件造成的停機損失可能超過每分鐘 22,000 美元,促使董事會大幅增加安全預算,遠超過以往撥款。預計到 2024 年,工業領域資料外洩的成本將達到 556 萬美元,超過整體 IT 支出成長速度,並刺激了對即時分析以檢測橫向移動的需求。金融機構承認,目前只有 13% 的 IT 投資用於安全防禦,專家敦促將這一比例提高到 20%,以應對攻擊者的自動化攻擊。在關鍵基礎設施領域,人工智慧驅動的安全營運中心報告稱,當機器學習關聯分析取代人工分診時,事件解決速度提高了 30%。因此,企業正在重新調整資金籌措優先級,推動巨量資料安全市場持續成長。

GDPR 與各國資料法要求建立Petabyte級合規基礎設施

歐洲的GDPR、加州的CCPA以及亞太地區的類似法規強制要求對日益龐大的資料集進行加密、遮罩和審核追蹤。中國2025年的執法計畫將對金融和保險公司增加即時合規審核,並加強對監管不力行為的處罰。根據NIS2指令,歐洲企業正在將其資訊安全預算提高到IT總投資的9%,預計到2025年,每個地區的平均資料外洩成本將達到440萬歐元。在美國,衛生與公眾服務部在其2026年計畫中提案1億美元用於全部門的網路安全協調。隨著合規性從政策層面轉向技術實施,可擴展加密、令牌化和不可篡改日誌記錄(巨量資料安全市場的主要收入促進因素)的需求將會成長。

網路安全人才短缺限制了市場成長

32%的歐盟組織無法勝任關鍵的網路安全角色,因此更依賴託管安全服務供應商。日本企業正與Cloudflare合作,提供承包零信任服務,填補中小企業的人才缺口。微軟的「安全未來舉措」展示瞭如何利用34,000名工程師進行人工智慧主導的自動化,從而將事件回應速度提升30%,並填補超大規模企業的專業知識缺口。雖然自動化可以減輕工作量,但長期存在的人手不足阻礙了自動化的普及,並限制了巨量資料安全市場的短期擴張。

細分市場分析

到2024年,解決方案將佔總收入的63.0%,這主要得益於對加密、令牌化和安全資訊與事件管理(SIEM)套件的強勁需求。同時,隨著企業將全天候監控和合規性整合外包,服務業務的複合年成長率將達到19.08%。人才短缺和平台複雜性的增加正促使企業轉向託管式檢測與回應、諮詢和整合服務。供應商正在將這些服務打包到雲端訂閱中,從而實現可預測的營運支出和快速引進週期。因此,在整個預測期內,巨量資料安全市場將繼續體現以服務主導的價值創造。

託管安全服務獲得了最大程度的成長,而隨著企業在雲端平台上重新建構資料湖,諮詢和整合專案也激增。受監管要求的推動,資料加密和令牌化軟體仍然是解決方案需求的主要驅動力。 SIEM 平台透過人工智慧推理不斷發展,以減少警報疲勞,而 IAM 升級則支援零信任部署。平台功能的整合預示著巨量資料安全市場正在整合,各參與者都在尋求端到端的控制點。

大型企業將佔據主導地位,預計2024年將佔銷售額的69.5%。然而,中小企業的複合年成長率預計將達到20.04%,凸顯了降低准入門檻的雲端訂閱模式的必要性。超大規模雲端服務供應商目前正將企業級加密、金鑰管理和行為分析等功能整合到其基礎套餐中,使資源受限的企業也能使用以往只有財富500強企業才能享有的功能。這種轉變正在擴大基本客群,並推動巨量資料安全市場保持兩位數的成長。

大型機構正將投資重點放在由高階分析、同構加密試點計畫和人工智慧驅動的安全營運中心(SOC)上,以挖掘Petabyte級日誌。有些機構擁有超過1000名安全專家的團隊,凸顯了其內部專業知識的深度。相比之下,中小企業則優先考慮能夠降低複雜性的承包託管服務。隨著巨量資料安全產業的日趨成熟,能夠提供針對該細分市場量身定做的定價和自動化解決方案的供應商將獲得顯著的市場佔有率。

巨量資料安全市場報告按組件(解決方案和服務)、組織規模(中小企業和大型企業)、最終用戶垂直行業(銀行、金融服務和保險 [BFSI]、IT 和通訊、製造業、醫療保健和生命科學、航太和國防等)、部署類型(本地部署和雲端部署)以及地區進行細分。

區域分析

北美地區將佔2024年收入的41.3%,這得益於零信任架構的早期應用、密集的供應商生態系統以及成熟的違規通知法律。隨著大型企業完成初步的雲端遷移,成長速度將放緩,但持續的人工智慧安全測試將維持支出動能。在GDPR實施和NIS2指令的推動下,歐洲的資訊安全支出已達到整體IT預算的9%。儘管經濟逆風對可自由支配的IT計劃造成壓力,但監管的確定性仍在推動需求成長。

預計到2030年,亞太地區將以20.61%的複合年成長率成長,這反映了對主權雲的投資和國內技術政策的推動。 AWS承諾到2027年將在日本投資2.26兆日圓(約153億美元)以擴大業務,象徵其對超大規模資料中心的堅定承諾。Oracle也計劃投資80億美元興建國內資料中心,以符合經濟安全準則。到2027年,中國的資訊安全市場規模可能達到37兆元。該地區各國政府正在鼓勵本地數據處理並推動安全產品的應用,從而擴大新興國家巨量資料安全市場的規模。

儘管中東、非洲和拉丁美洲的市場規模較小,但隨著雲端運算的普及和金融業現代化政策的推進,這些地區的市場接受度正在不斷提高。波灣合作理事會成員國已宣布與其「2030願景」議程相關的新網路安全法規,巴西的「光導板」也鼓勵鄰國制定相關法律。雖然基礎設施的不足阻礙了市場成長,但數位銀行的日益普及創造了巨大的潛在需求,巨量資料安全市場可以藉助不斷改善的網路連接來挖掘這些需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網、行動和雲端日誌的激增使傳統控制方式不堪重負,推動了下一代以資料為中心的安全性的發展。

- 人工智慧驅動的資料外洩、雙重勒索軟體和供應鏈攻擊推動了巨量資料安全分析預算的成長。

- GDPR、CCPA、PDPA 和數十項新的國家法律要求進行Petabyte級加密、遮罩和審核追蹤。

- 資料湖向公共雲端遷移加速了對雲端原生安全、零信任和責任共用工具的需求

- 各公司正爭先恐後地保護用於訓練 LLM 的龐大專有資料集,以避免模型外洩和智慧財產權損失。

- 零售媒體、醫療保健和廣告科技公司需要加密技術來共用訊息,同時避免洩露原始資料。

- 市場限制

- 資料安全工程師和資料科學家的短缺正在推高MSSP的計劃工期和成本。

- 在混合環境中編配加密、SIEM、IAM 和資料管治工具會對資本支出/營運支出預算造成壓力。

- 居住法的差異阻礙了統一的全球安全架構的建構。

- 聯邦學習和同態加密減少了對集中式資料儲存的需求,並降低了在傳統巨量資料安全堆疊上的支出。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠疫情與地緣政治事件的影響

第5章 市場規模與成長預測

- 按組件

- 解決方案

- 資料加密和令牌化

- 安全情報/SIEM

- IAM 和 PAM

- 入侵偵測/防禦

- 數據遮罩和混淆

- 服務

- 諮詢與整合

- 託管安全服務

- 培訓和支持

- 解決方案

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶行業分類

- 銀行、金融服務和保險(BFSI)

- 資訊科技/通訊

- 製造業

- 醫療保健和生命科學

- 航太/國防

- 政府和公共部門

- 零售與電子商務

- 透過部署模式

- 本地部署

- 雲

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 墨西哥

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services

- Broadcom(Symantec)

- Check Point Software Technologies

- Cisco Systems

- Cloudera

- CrowdStrike

- Dell Technologies

- Elastic NV

- Fortinet

- Google Cloud(Alphabet)

- Hewlett Packard Enterprise

- IBM Corporation

- Imperva

- McAfee

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- RSA Security

- Snowflake Inc.

- Splunk Inc.

- Talend SA

- Thales Group

第7章 市場機會與未來展望

The Big Data Security Market size is estimated at USD 27.63 billion in 2025, and is expected to reach USD 63.40 billion by 2030, at a CAGR of 1.54% during the forecast period (2025-2030).

Accelerated adoption stems from rising cyber-attack frequency, stricter data-protection laws, and the shift of petabyte-scale workloads to public clouds that demand zero-trust controls. Enterprises now treat data-centric security as a board-level priority as AI-enabled breaches, ransomware, and supply-chain intrusions elevate operational and financial risk. Healthcare, manufacturing, and financial services face the highest breach costs, which pushes capital toward encryption, tokenization, and AI-powered analytics. Meanwhile, platform vendors consolidate point tools to reduce complexity and offset the cybersecurity talent shortfall, while data-sovereignty rules in Asia Pacific spark record data-center investment.

Global Big Data Security Market Trends and Insights

AI-enabled breaches drive enterprise security budget reallocations

Ransomware groups now weaponize generative AI for rapid credential theft and social-engineering campaigns that bypass legacy defenses. Manufacturing downtime has surpassed USD 22,000 per minute during major incidents, prompting boards to lift security budgets well above prior allocations. Data-breach costs in industrial domains climbed to USD 5.56 million in 2024, eclipsing general IT-spending growth and fueling demand for real-time analytics that detect lateral movement. Financial institutions concede that current allocations of only 13% of IT spend underfund defenses, with experts urging a shift toward 20% to keep pace with attacker automation. Across critical infrastructure, AI-powered security operations centers report 30% faster incident resolution once machine-learning correlation replaces manual triage. The result is sustained top-line expansion for the big data security market as enterprises reprioritize funding.

GDPR and national data laws mandate petabyte-scale compliance infrastructure

Europe's GDPR, California's CCPA, and similar statutes in Asia Pacific now obligate encryption, masking, and audit trails across ever-larger datasets. China's 2025 enhancements add real-time compliance audits for finance and insurance firms, tightening penalties for lax controls. European organizations have raised information-security budgets to 9% of total IT outlays under the NIS2 Directive, while average regional breach costs reached EUR 4.4 million in 2025. In the United States, the Department of Health and Human Services proposed USD 100 million for sector-wide cybersecurity coordination in its FY 2026 plan. As compliance moves from policy to technical enforcement, demand increases for scalable encryption, tokenization, and immutable logging key revenue streams within the big data security market.

Cybersecurity talent shortage constrains market growth

Thirty-two percent of EU organizations cannot fill essential cybersecurity roles, driving reliance on managed security service providers. Japan's operators collaborate with Cloudflare to supply turnkey zero-trust services that offset staffing gaps for SMEs. Microsoft's Secure Future Initiative applies 34,000 engineers to AI-driven automation, improving incident response by 30% and showcasing how hyperscalers compensate for scarce expertise. Although automation eases workloads, chronic shortages slow deployment and limit the near-term scale-up of the big data security market.

Other drivers and restraints analyzed in the detailed report include:

- Cloud data lakes accelerate zero-trust architecture adoption

- LLM training in data protection becomes a strategic imperative

- Tool-orchestration complexity strains enterprise budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions held 63.0% of 2024 revenue, driven by robust demand for encryption, tokenization, and SIEM suites. At the same time, Services is set to grow at 19.08% CAGR as organizations outsource 24/7 monitoring and compliance integration. Talent scarcity and platform complexity push enterprises toward managed detection and response, consulting, and integration contracts. Vendors bundle these offerings with cloud subscriptions, enabling predictable OpEx and faster implementation cycles. As a result, the big data security market phrase continues to reflect service-led value creation throughout the forecast horizon.

Managed Security Services show the highest traction, while Advisory and Integration engagements surge as firms re-architect data lakes on cloud foundations. Data encryption and tokenization software remains the volume driver within Solutions, propelled by regulatory mandates. SIEM platforms evolve with AI inference that reduces alert fatigue, and IAM upgrades underpin zero-trust rollouts. The convergence of platform features signals ongoing consolidation in the big data security market as players chase end-to-end control points.

Large Enterprises dominated in 2024 with 69.5% revenue, reflecting multi-region operations and stringent compliance obligations. Yet SMEs are forecast to post a 20.04% CAGR, highlighting cloud subscription models that lower entry barriers. Hyperscalers now embed enterprise-grade encryption, key management, and behavior analytics into baseline plans, letting resource-constrained firms access capabilities once exclusive to Fortune 500 peers. This shift broadens the customer base, sustaining double-digit expansion in the big data security market.

For large organizations, investments focus on advanced analytics, homomorphic encryption pilots, and AI-powered SOCs that mine petabyte-scale logs. Some institutions maintain teams exceeding 1,000 security specialists, underscoring the depth of in-house expertise. SMEs, by contrast, emphasize turnkey managed services that offload complexity. Vendors tailoring price points and automation to this segment stand to capture an outsized share as the big data security industry matures.

The Big Data Security Market Report is Segmented by Component (Solutions and Services), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Banking, Financial Services, and Insurance [BFSI], IT and Telecommunication, Manufacturing, Healthcare and Life Sciences, Aerospace and Defense, and More), Deployment Mode (On-Premise and Cloud), and Geography.

Geography Analysis

North America held 41.3% of 2024 revenue, benefiting from early zero-trust adoption, a dense vendor ecosystem, and mature breach-notification laws. Growth moderates as large enterprises complete initial cloud migrations, yet ongoing AI-security pilots maintain spending momentum. Europe follows, propelled by GDPR enforcement and the NIS2 Directive, with information-security allocations now 9% of total IT budgets. Regulatory certainty fuels demand even as economic headwinds weigh on discretionary IT projects.

Asia Pacific is forecast for a 20.61% CAGR through 2030, reflecting sovereign-cloud investments and domestic-technology mandates. AWS's pledge of 2.26 trillion yen (USD 15.3 billion) to expand Japanese regions by 2027 exemplifies its hyperscale commitment. Oracle separately plans USD 8 billion in local data centers to meet economic-security guidelines. China's information-security market could hit 37 trillion yuan by 2027 as state bodies prioritize indigenous tooling. Governments across the region encourage local data processing to spur security product adoption, enlarging the big data security market size in emerging economies.

The Middle East, Africa, and Latin America represent smaller bases but show rising adoption as cloud coverage widens and financial-sector modernization policies advance. Gulf Cooperation Council states issue new cyber regulations tied to Vision 2030 agendas, while Brazil's LGPD inspires neighbouring countries to legislate. Although infrastructure gaps temper growth, rising digital-banking penetration creates latent demand that the big data security market can tap as connectivity improves.

- Amazon Web Services

- Broadcom (Symantec)

- Check Point Software Technologies

- Cisco Systems

- Cloudera

- CrowdStrike

- Dell Technologies

- Elastic NV

- Fortinet

- Google Cloud (Alphabet)

- Hewlett Packard Enterprise

- IBM Corporation

- Imperva

- McAfee

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- RSA Security

- Snowflake Inc.

- Splunk Inc.

- Talend SA

- Thales Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging IoT, mobile and cloud logs overwhelm legacy controls, driving next-gen data-centric security adoption

- 4.2.2 AI-enabled breaches, double-extortion ransomware and supply-chain attacks force bigger budgets for big-data security analytics

- 4.2.3 GDPR, CCPA, PDPA and dozens of new national laws mandate encryption, masking and audit trails at petabyte scale

- 4.2.4 Shift of data lakes to public cloud accelerates demand for cloud-native security, zero-trust and shared-responsibility tooling

- 4.2.5 Enterprises scramble to secure massive proprietary datasets used for LLM training to avoid model leakage and IP loss

- 4.2.6 Retail-media, healthcare and ad-tech firms require encryption-in-use to share insights without exposing raw data

- 4.3 Market Restraints

- 4.3.1 Scarcity of data-security engineers and data scientists inflates project timelines and MSSP costs

- 4.3.2 Orchestrating encryption, SIEM, IAM and data-governance tools across hybrid estates strains CapEx/OpEx budgets

- 4.3.3 Divergent residency laws block unified global security architectures

- 4.3.4 Federated learning and homomorphic encryption reduce need for centralized data stores, tempering spend on classic big-data security stacks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 and Geopolitical Events

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Data Encryption and Tokenization

- 5.1.1.2 Security Intelligence/SIEM

- 5.1.1.3 IAM and PAM

- 5.1.1.4 Intrusion Detection/Prevention

- 5.1.1.5 Data Masking and Obfuscation

- 5.1.2 Services

- 5.1.2.1 Consulting and Integration

- 5.1.2.2 Managed Security Services

- 5.1.2.3 Training and Support

- 5.1.1 Solutions

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 Banking, Financial Services and Insurance (BFSI)

- 5.3.2 IT and Telecommunication

- 5.3.3 Manufacturing

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Aerospace and Defense

- 5.3.6 Government and Public Sector

- 5.3.7 Retail and E-commerce

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Mexico

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Broadcom (Symantec)

- 6.4.3 Check Point Software Technologies

- 6.4.4 Cisco Systems

- 6.4.5 Cloudera

- 6.4.6 CrowdStrike

- 6.4.7 Dell Technologies

- 6.4.8 Elastic NV

- 6.4.9 Fortinet

- 6.4.10 Google Cloud (Alphabet)

- 6.4.11 Hewlett Packard Enterprise

- 6.4.12 IBM Corporation

- 6.4.13 Imperva

- 6.4.14 McAfee

- 6.4.15 Microsoft Corporation

- 6.4.16 Oracle Corporation

- 6.4.17 Palo Alto Networks

- 6.4.18 RSA Security

- 6.4.19 Snowflake Inc.

- 6.4.20 Splunk Inc.

- 6.4.21 Talend SA

- 6.4.22 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment