|

市場調查報告書

商品編碼

1850344

智慧照明:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Smart Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

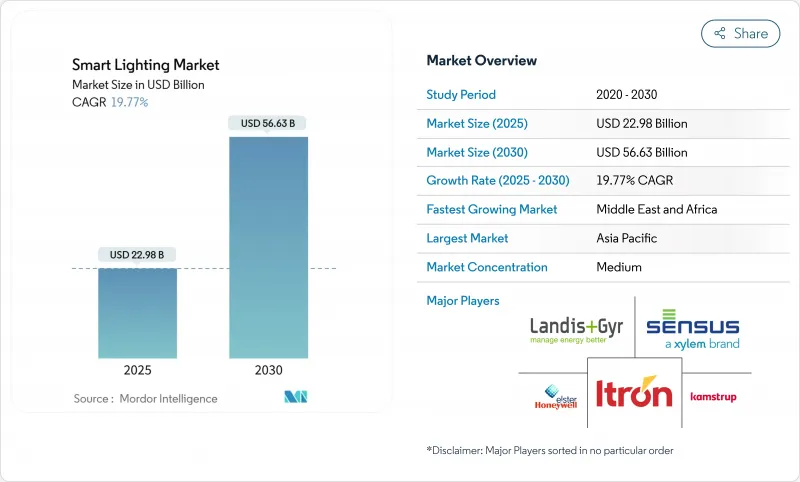

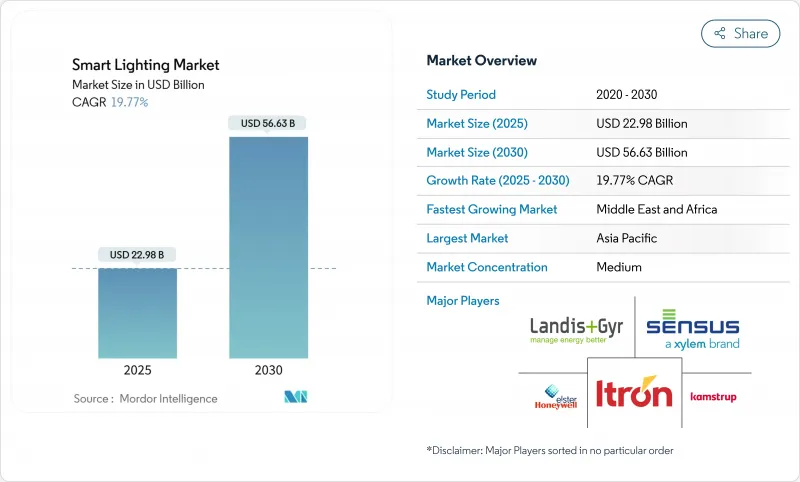

預計到 2025 年,智慧照明市場規模將達到 229.8 億美元,到 2030 年將達到 566.3 億美元。

推動這一發展趨勢的是住宅、商業和工業建築中智慧照明安裝量的加速成長,這得益於監管機構日益嚴格的能源效率標準以及LED組件成本的下降。如今,建築業主將智慧照明視為降低能源成本、支援數據主導的設施管理以及提升居住體驗的策略平台。供應商正在整合邊緣人工智慧和雲端分析技術以實現產品差異化,而各國政府也不斷擴大淨零排放標準,要求從計劃開始就採用先進的控制系統。亞太地區的成長機會尤其顯著,當地的都市化和獎勵為製造商提供了規模經濟優勢。

全球智慧照明市場趨勢與洞察

擴展智慧家庭生態系統整合

智慧照明系統如今已成為整個家庭自動化平台的基礎。 Matter 標準打破了專有技術壁壘,使不同品牌的設備能夠透過統一的應用程式通訊。飛利浦 Hue 和三星 SmartThings 的整合,在一個控制面板中同步了照明、娛樂和安防系統。 Thread 1.4 使不同廠商的邊界路由器能夠共用網路,這項里程碑式的改進增強了消費者對其未來投資的信心。

LED成本的快速降低提高了投資報酬率

先進的封裝技術,例如覆晶構裝,在維持10萬小時使用壽命的同時,效率提升了20%,從而降低了高架廠房的維護成本。板載晶片)提高了安裝靈活性,並重塑了2025年的產品系列。結合公用事業公司的補貼,這些成本節約使得許多商業維修的投資回收期縮短至18個月甚至更短,例如AirPark North計劃,該項目每年可節省4990美元。

無線通訊協定中的網路安全漏洞

調查團隊已證實,Zigbee LightLink 設備可能被使用預設金鑰劫持,從而導致對企業網路的側翼攻擊。此外,Check Point 的研究表明,被入侵的飛利浦 Hue 燈泡可以成為入侵更廣泛 IT 系統的橋頭堡。在安全至關重要的環境中,由於修復成本和法律風險,Zigbee LightLink 設備的快速普及受到阻礙。

細分市場分析

預計到2024年,智慧照明市場控制系統將以22.1%的複合年成長率成長,而智慧燈具將維持64.9%的市場佔有率。控制平台結合了感測器、分析和雲端儀錶板,與通用燈具相比,能夠帶來持續的軟體收入和利潤優勢。 Acuity Brands以12.15億美元收購QSC,擴大了其智慧空間集團的規模,預計到2025年第一季,該業務板塊的營收將成長14.5%。

這些系統利用邊緣人工智慧預測運作模式,通常可實現超過 50% 的節能。工業場所正在利用資料流最佳化工作流程,凸顯了從硬體到資料洞察的策略轉變。相較之下,智慧燈具和配件作為物理層發揮作用,但隨著 LED 成本下降和銷售成長,它們正面臨價格壓力。

到 2024 年,改裝計劃將佔智慧照明市場規模的 52.1%。公共的激勵措施和較短的投資回收期使該行業極具吸引力,澳洲稅務局發現,透過改裝,照明成本降低了 94%。

隨著建築師從設計初就將智慧照明融入建築設計,新建築中智慧照明的採用率正以21.3%的複合年成長率成長。加州2022年的標準將強制要求所有新建建築配備先進的控制系統。從零開始安裝智慧照明系統還能實現一些後期難以維修的功能,例如Li-Fi和高密度感測器網路,從而提升了這一領域的長期價值。

智慧照明系統市場按產品類型(控制系統、智慧燈具)、安裝類型(新建、維修)、連接技術(Wi-Fi、藍牙及其他)、最終用戶(住宅、商業及其他)和地區進行細分。市場預測以美元計價。

區域分析

由於嚴格的能源效率法規和日益成熟的自動化需求,歐洲在2024年將維持26.4%的銷售額。德國的改裝,例如VIVARES的Zigbee升級項目,符合KfW276補貼資格,體現了政策主導的良好勢頭。政府補貼和碳排放目標正在推動技術的持續應用,尤其是在公共建築和高階辦公空間。

亞太地區成長最快,複合年成長率達19.8%。中國將於2024年推出八項新的照明標準,提高能源效率閾值並推廣智慧互聯控制,將促使國內製造商拓展其智慧產品線。印度的「明路計畫」旨在186個城市以智慧燈泡取代傳統白熾燈泡,引導大規模採購轉向連網LED照明系統。香港秋季照明展等區域展覽會吸引了3000家參展,專注於智慧城市照明,印證了供應鏈的強勁成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧家庭生態系統的進一步整合

- LED成本快速下降,投資報酬率提高

- 公共產業資助的需求面管理獎勵

- 國家淨零建築標準(將於2025年至2030年間實施)

- 倉庫中採用LiFi技術的照明試點項目

- 邊緣AI驅動的自我調整調光演算法

- 市場限制

- 無線通訊協定中的網路安全漏洞

- 互通性標準碎片化

- 稀土元素磷光體供應鏈的不穩定性

- 智慧家庭隱私法規的不確定性

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 評估市場中的宏觀經濟因素

第5章 市場規模與成長預測

- 依產品類型

- 控制系統

- 智慧燈具和照明設備

- 按安裝類型

- 新建工程

- 修改

- 透過連接技術

- Wi-Fi

- Bluetooth

- ZigBee

- 其他

- 最終用戶

- 住宅

- 商業的

- 產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Signify NV

- Acuity Brands Inc.

- Hubbell Inc.

- Eaton Corp.

- Lutron Electronics Co. Inc.

- Legrand SA

- Cree Lighting(IDEAL Ind.)

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- Snap One LLC(Control4)

- Savant Systems Inc.(GE Lighting)

- Nanoleaf Canada Ltd.

- Sengled Optoelectronics Co.

- Wyze Labs Inc.

- Feit Electric(LIFX)

- Panasonic Corp.

- Opple Lighting

- EGLO Leuchten GmbH

- Zumtobel Group

- Helvar

第7章 市場機會與未來展望

The smart lighting market size is estimated at USD 22.98 billion in 2025 and is forecast to reach USD 56.63 billion by 2030, reflecting a vigorous 19.77% CAGR.

This trajectory is underpinned by accelerating installations across residential, commercial, and industrial sites as regulators tighten energy-efficiency mandates and LED component costs decline. Building owners now view connected lighting as a strategic platform that lowers electricity bills, supports data-driven facility management, and enhances occupant experience. Vendors are integrating edge AI and cloud analytics to differentiate offerings, while governments expand net-zero codes that require advanced controls from project inception. Growth opportunities are especially pronounced in Asia-Pacific, where urbanization and policy incentives create scale advantages for manufacturers.

Global Smart Lighting Market Trends and Insights

Expanding Smart-Home Ecosystem Integration

Smart lighting systems now anchor whole-home automation platforms. The Matter standard removes proprietary barriers, letting devices from different brands communicate through unified apps. Philips Hue's tie-in with Samsung SmartThings synchronizes lighting, entertainment, and security under a single dashboard. Thread 1.4 will let border routers from varied vendors share a network, a milestone that strengthens consumer confidence in future-proof investments.

Rapid LED Cost Reductions Improve ROI

Advances such as flip-chip packages deliver 20% higher efficacy while preserving 100,000-hour lifespans, lowering maintenance costs for high-bay sites. Chip-on-board strips add installation flexibility that is reshaping 2025 product portfolios. Combined with utility rebates, these cost declines are compressing payback periods to well under 18 months in many commercial retrofits, as shown by the AirPark North project saving USD 4,990 annually.

Cyber-Security Vulnerabilities in Wireless Protocols

Researchers showed that Zigbee Light Link devices can be hijacked through default keys, enabling lateral attacks on corporate networks. Check Point further demonstrated that compromised Philips Hue bulbs provide a beachhead into wider IT systems. Resulting remediation costs and liability risks deter rapid adoption in security-critical environments.

Other drivers and restraints analyzed in the detailed report include:

- Utility-Funded Demand-Side-Management Incentives

- National Net-Zero Building Codes (2025-30 Roll-Outs)

- Fragmented Inter-Operability Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Control Systems are forecast to grow at 22.1% CAGR, while Smart Lamps and Fixtures retained a 64.9% share of the smart lighting market in 2024. Control platforms blend sensors, analytics, and cloud dashboards, delivering recurring software revenue and margins that beat commodity lamps. Acuity Brands' USD 1.215 billion QSC acquisition expanded its Intelligent Spaces Group and lifted segment revenue 14.5% in Q1 2025.

These systems use edge AI to predict occupancy patterns, driving energy savings that often exceed 50%. Industrial sites leverage the data stream to optimize workflow, highlighting a strategic pivot from hardware to insights. In contrast, Smart Lamps and Fixtures serve as the physical layer yet face price pressure as LED costs fall and volumes scale.

Retrofit projects commanded 52.1% of the smart lighting market size in 2024 due to a vast base of legacy luminaires. Utility incentives and short payback periods keep this segment attractive, as seen when the Australian Taxation Office cut lighting costs 94% via a retrofit.

New construction adoption is rising at a 21.3% CAGR because architects are embedding intelligent lighting from the blueprint stage. California's 2022 code requires advanced controls in all new builds. Ground-up installations also unlock functions such as Li-Fi and dense sensor grids that are cumbersome to retrofit later, tilting long-term value toward this segment.

Smart Lighting System Market is Segmented by Product Type (Control Systems, Smart Lamps and Fixture), Installation Type (New Construction, Retrofit), Connectivity Technology (Wi-Fi, Bluetooth, and More), End User (Residential, Commercial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe preserved 26.4% of revenue in 2024 due to strict efficiency codes and mature automation demand. German retrofits such as the VIVARES Zigbee upgrade qualified for KfW276 subsidies, evidencing policy-driven momentum. Government grants and carbon targets sustain continued adoption, particularly in public buildings and premium office space.

Asia-Pacific is the fastest mover with a 19.8% CAGR. China implemented eight new lighting standards in 2024 that raise efficacy thresholds and push connected controls, spurring domestic manufacturers to scale smart product lines. India's Bright Road program aims to replace traditional bulbs in 186 cities, steering large-scale procurement toward networked LED systems. Regional trade fairs such as Hong Kong's Autumn Lighting Fair showcased 3,000 exhibitors focusing on smart-city lighting, underscoring robust supply-chain expansion

- Signify N.V.

- Acuity Brands Inc.

- Hubbell Inc.

- Eaton Corp.

- Lutron Electronics Co. Inc.

- Legrand SA

- Cree Lighting (IDEAL Ind.)

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- Snap One LLC (Control4)

- Savant Systems Inc. (GE Lighting)

- Nanoleaf Canada Ltd.

- Sengled Optoelectronics Co.

- Wyze Labs Inc.

- Feit Electric (LIFX)

- Panasonic Corp.

- Opple Lighting

- EGLO Leuchten GmbH

- Zumtobel Group

- Helvar

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Smart-Home Ecosystem Integration

- 4.2.2 Rapid LED Cost Reductions Improve ROI

- 4.2.3 Utility-Funded Demand-Side-Management Incentives

- 4.2.4 National Net-Zero Building Codes (2025-30 roll-outs)

- 4.2.5 Li-Fi-enabled Lighting Pilots in Warehouses

- 4.2.6 Edge-AI-powered Adaptive Dimming Algorithms

- 4.3 Market Restraints

- 4.3.1 Cyber-security Vulnerabilities in Wireless Protocols

- 4.3.2 Fragmented Inter-operability Standards

- 4.3.3 Supply Chain Volatility in Rare-earth Phosphors

- 4.3.4 Smart-home Privacy Regulation Uncertainty

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS(VALUE)

- 5.1 By Product Type

- 5.1.1 Control Systems

- 5.1.2 Smart Lamps and Fixtures

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit

- 5.3 By Connectivity Technology

- 5.3.1 Wi-Fi

- 5.3.2 Bluetooth

- 5.3.3 Zigbee

- 5.3.4 Others

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify N.V.

- 6.4.2 Acuity Brands Inc.

- 6.4.3 Hubbell Inc.

- 6.4.4 Eaton Corp.

- 6.4.5 Lutron Electronics Co. Inc.

- 6.4.6 Legrand SA

- 6.4.7 Cree Lighting (IDEAL Ind.)

- 6.4.8 Samsung Electronics Co. Ltd.

- 6.4.9 Xiaomi Corp.

- 6.4.10 Snap One LLC (Control4)

- 6.4.11 Savant Systems Inc. (GE Lighting)

- 6.4.12 Nanoleaf Canada Ltd.

- 6.4.13 Sengled Optoelectronics Co.

- 6.4.14 Wyze Labs Inc.

- 6.4.15 Feit Electric (LIFX)

- 6.4.16 Panasonic Corp.

- 6.4.17 Opple Lighting

- 6.4.18 EGLO Leuchten GmbH

- 6.4.19 Zumtobel Group

- 6.4.20 Helvar

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment