|

市場調查報告書

商品編碼

1850320

軟體定義資料中心:市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)Software Defined Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

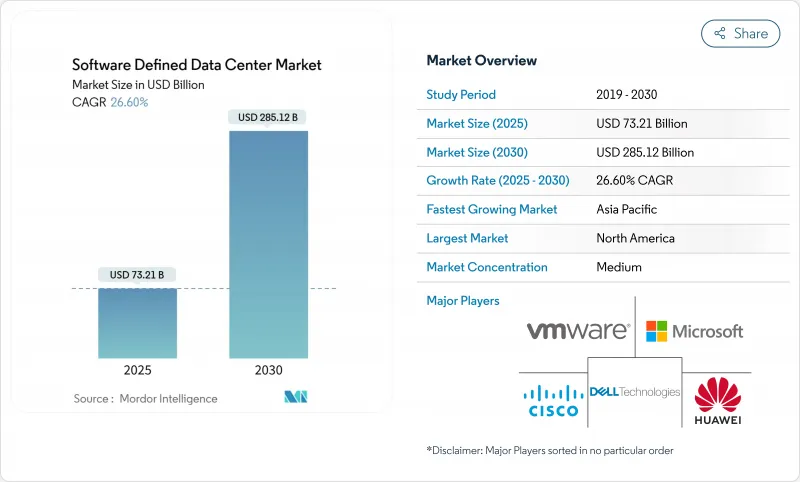

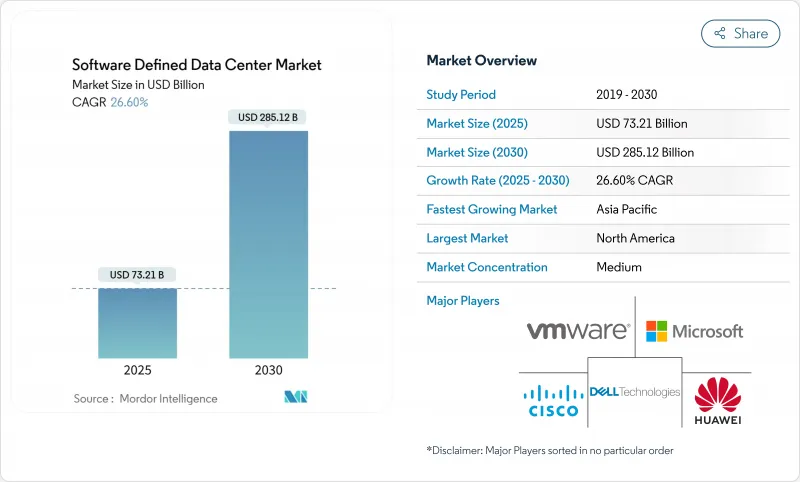

軟體定義資料中心市場預計到 2025 年將達到 732.1 億美元,到 2030 年將達到 2851.2 億美元。

強勁的發展勢頭源於企業對敏捷基礎設施、雲端優先策略以及虛擬化和自動化平台穩步發展的需求。超大規模資料中心的崛起,加上演算法工作負載的快速成長,正推動創紀錄的資本支出,並波及到託管和邊緣運算服務提供者。對人工智慧驅動的資料中心基礎設施管理的持續投資、日益嚴格的碳排放目標以及用於現場發電的核能微型反應器的出現,進一步重塑了競爭動態。能夠將運算、儲存和網路統一到策略主導的軟體層下的供應商將從傳統硬體供應商手中奪取市場佔有率,而服務合作夥伴則將透過複雜的遷移和託管營運外包收益。

全球軟體定義資料中心市場趨勢與洞察

降低硬體和資源使用成本

硬體和軟體的廣泛解耦降低了資本支出並縮短了更新周期。運行全端軟體定義資料中心 (SDDC) 平台的公司報告稱,部署 VMware Cloud Foundation 後,基礎設施成本降低了 34%,三年投資回報率高達 564%。自動化配置提高了資源利用率,使公司能夠在不降低效能的前提下,將資料中心佔用空間減少 50%。電力和冷卻成本的降低也提高了整個全部區域的計劃報酬率。

雲端運算和虛擬化在企業中蓬勃發展

虛擬化的運算、儲存和網路池支援混合策略,既能滿足對延遲敏感的工作負載需求,又能兼顧公共雲端的彈性。一家金融機構採用軟體定義資料中心市場平台,在將其中間件堆疊現代化升級到直覺的 .cloud 平台後,訊息處理速度提升了 40%,停機時間減少了 30%。與虛擬機器並行運行的 Kubernetes 主機簡化了 DevOps 流程,並加速了部署。

資料安全與合規的複雜性

歐盟《數位運作彈性法案》等法規要求自2025年1月起加強管控,迫使金融機構檢驗跨虛擬層的網路彈性。抽象的資源池使得邊界防禦變得困難,從而推動了對整合金鑰管理中心(例如與VMware Sovereign Cloud整合的Fortanix資料安全管理器)的需求。合規性審核延長了計劃週期,並增加了諮詢成本。

細分市場分析

軟體定義資料中心(SD-DC)的軟體元件市場規模預計到2025年將達到549億美元,佔總營收的75.4%。編配引擎和基於策略的控制器正以28.4%的複合年成長率成長,這印證了企業對自動化配置的迫切需求。早期採用者在不到12個月的時間內即可實現工作流程自動化和漂移校正的投資回報。隨著生態系統的日趨成熟,安全插件、AI觀察模組和開發者工具鏈正在不斷擴大其潛在用戶群。

剩餘佔有率主要由服務驅動,包括諮詢、客製化和全天候運維。服務提供者正在將遷移指南、參考架構和按需收費打包,以簡化進入高度監管的垂直市場的流程。硬體創新正朝著可組合設計的方向發展,但仍受軟體策略的約束,這進一步鞏固了程式碼主導基礎設施的主導地位。

到2024年,私有實例將佔軟體定義資料中心市場的41.2%,受到需要保護敏感資料的企業的青睞。 VMware Cloud Foundation就是承包解決方案,它模擬了公共雲端的經濟效益,同時又維持了在地管治。然而,混合雲環境預計將以26.9%的複合年成長率(CAGR)成為成長最快的解決方案,因為企業希望在不放棄沉沒資產的情況下,靈活應對激增的工作負載。

Rackspace SDDC Flex 將託管私有雲端和超大規模擴充功能整合到一個消費模式中,展現了服務供應商如何模糊部署類別之間的界線。對於雲端原生企業而言,僅限公有雲的部署仍然至關重要,但即使是這些部署也需要跨區域一致的策略引擎,以避免工具氾濫。

軟體定義資料中心市場按元件(解決方案和服務)、部署模式(本地部署、私有雲端、公共雲端、混合雲端)、資料中心類型(託管、超大規模/雲端、企業級和邊緣運算)、最終用戶產業(IT和電信、銀行、金融服務和保險、醫療保健、零售及其他)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區將佔2024年總收入的47.6%,這主要得益於虛擬化技術的早期應用、深厚的雲端生態系以及超大規模雲端服務供應商的擴張。德克薩斯州宣佈興建一座核能反應器,標誌著電力合理化方案的創造性轉變。資料主權區域監管政策的明朗化促進了美國兩國跨境災害復原合作,而墨西哥的金融科技產業正在擴大其在開放銀行計畫中的混合應用規模。

亞太地區軟體定義資料中心市場預計到2030年將以28.23%的複合年成長率成長,主要驅動力包括主權雲端津貼、電子商務的蓬勃發展以及數位銀行的牌照發放。超大規模資料中心營運商正在批量租賃容量,但需要依賴第三方開發人員來獲取土地、電力和授權。新加坡憑藉著營運商密集的園區,並採用新型液冷技術來滿足電力需求,持續維持其中心地位。印度、日本和中國正在建造千兆瓦級園區,而澳洲則支援邊緣部署,以適應遠端挖礦作業。

歐洲正積極擁抱軟體定義資料中心(SDDC),以回應主權和碳排放目標。 DORA設定的2025年1月最後期限促使金融機構加強網路韌性,並增加加密租戶層級網路覆蓋的預算。北方市場在採用SDDC方面處於領先地位,而南方國家則透過公共雲端著陸區和綠色氫能試點計畫加速推進。在中東和非洲,阿拉伯聯合大公國和沙烏地阿拉伯的活動正在興起,這些國家將公用事業規模的太陽能發電廠與模組化資料中心結合,用於清潔能源託管。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 降低硬體和資源使用成本

- 企業中雲端運算與虛擬化的蓬勃發展

- 超融合和組合式基礎架構的興起

- AI驅動的資料中心基礎設施管理(DCIM)數位雙胞胎最佳化(鮮為人知)

- 核微型反應器(在不為人知的情況下)實現了機架級高密度運行

- 5G 站點邊緣原生微型 SDDC編配(悄悄進行)

- 市場限制

- 資料安全與合規的複雜性

- 傳統系統整合與遷移成本

- 電網電力短缺和併網延遲(不明顯)

- 供應商整合/整體擁有成本風險增加(並不明顯)

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 對宏觀經濟趨勢的市場評估

第5章 市場規模與成長預測

- 按組件

- 解決方案(SDN、SDS、SDC、自動化和編配安全)

- 服務(諮詢與整合、管理、訓練與支援)

- 按部署模式

- 本地部署

- 私有雲端

- 公共雲端

- 混合雲端

- 依資料中心類型

- 搭配

- 超大規模資料中心業者雲

- 企業和邊緣運算

- 最終用戶

- 資訊科技和通訊

- BFSI

- 衛生保健

- 零售與電子商務

- 製造業

- 政府和國防部

- 媒體與娛樂

- 能源和公共產業

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 新加坡

- 澳洲

- 馬來西亞

- 其他亞太地區

- 南美洲

- 巴西

- 智利

- 阿根廷

- 其他南美

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- VMware Inc.

- Microsoft Corp.

- Dell Technologies

- Cisco Systems

- Hewlett Packard Enterprise

- IBM Corp.

- Huawei Technologies

- Oracle Corp.

- Citrix Systems

- NEC Corp.

- Nutanix Inc.

- Amazon Web Services

- Google Cloud Platform

- Broadcom(VMware division)

- Juniper Networks

- Arista Networks

- Red Hat(IBM)

- Equinix Inc.

- Lenovo Group

- Rackspace Technology

第7章 市場機會與未來展望

The software-defined data center market size is expected to be valued at USD 73.21 billion in 2025 and is forecast to reach USD 285.12 billion by 2030, reflecting a vigorous 26.6% CAGR over the period.

Strong momentum comes from enterprise demand for agile infrastructure, cloud-first strategies, and steady advances in virtualization and automation platforms. Hyperscaler build-outs, coupled with rapid algorithmic workloads, are prompting record capital spending that spills over to colocation and edge operators. Sustained investment in AI-enabled data center infrastructure management, stricter carbon targets, and the arrival of nuclear micro-reactors for on-site generation further reshape competitive dynamics. Vendors able to unify compute, storage, and networking under policy-driven software layers are capturing wallet share from legacy hardware suppliers, while service partners monetize complex migration and managed operations mandates.

Global Software Defined Data Center Market Trends and Insights

Cost reduction in hardware and resource use

Widespread decoupling of hardware and software lowers capital outlays and shrinks refresh cycles. Enterprises running full-stack SDDC platforms report infrastructure cost savings of 34% and a 564% three-year ROI on VMware Cloud Foundation deployments. Automated provisioning tightens utilization, letting firms cut data center footprints by 50% without performance degradation. Lower power and cooling bills compound the benefit, reinforcing project paybacks across regions.

Cloud and virtualization boom among enterprises

Virtualized compute, storage, and network pools underpin hybrid strategies that reconcile latency-sensitive workloads with public-cloud elasticity. Financial institutions using software defined data center market platforms achieved 40% faster message processing and 30% less downtime after modernizing middleware stacks intuitive.cloud. Kubernetes-ready hosts run side by side with virtual machines, simplifying DevOps pipelines and hastening rollouts.

Data-security and compliance complexities

Regulations such as the EU Digital Operational Resilience Act mandate tighter controls from January 2025, pushing financial institutions to verify cyber resilience across virtual layers. Abstracted resource pools challenge perimeter defenses, driving demand for unified key-management hubs like Fortanix Data Security Manager that integrate with VMware Sovereign Cloud. Compliance audits prolong project timelines and raise consulting spend.

Other drivers and restraints analyzed in the detailed report include:

- Hyper-converged and composable infrastructure uptake

- AI-driven DCIM and digital-twin optimisation

- Legacy integration and migration costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software-defined data center market size for software components reached USD 54.9 billion in 2025, equating to 75.4% of overall revenue. Orchestration engines and policy-based controllers are expanding at a 28.4% CAGR, underlining enterprise appetite for hands-free provisioning. Early adopters record sub-12-month paybacks on workflow automation and drift remediation. Security plug-ins, AI observability modules, and developer tool chains widen the addressable base as ecosystems mature.

Services contribute the remaining share, encompassing advisory, customization, and 24X7 managed operations. Providers bundle migration playbooks, reference architectures, and consumption-based billing to ease entry for heavily regulated verticals. Hardware innovations shift toward composable designs but stay governed by software policies, reinforcing the primacy of code-driven infrastructure.

Private instances captured 41.2% of the software-defined data center market in 2024, favored by organizations securing sensitive data. VMware Cloud Foundation exemplifies turnkey stacks that mimic public-cloud economies while retaining on-premises governance. Hybrid estates, however, are projected to post the highest 26.9% CAGR as firms seek elasticity for spiky workloads without abandoning sunk assets.

Rackspace SDDC Flex merges hosted private clouds with hyperscale extensions under a consumption model, illustrating how service providers blur deployment categories. Public-only footprints remain relevant for cloud-native firms, yet even they demand consistent policy engines across zones to avoid tool sprawl.

Software Defined Data Center Market is Segmented by Component (Solutions and Services), Deployment Model (On-Premises, Private Cloud, Public Cloud, and Hybrid Cloud), Data Center Type ( Colocation, Hyperscalers/ Cloud, and Enterprise and Edge), End-User Vertical (IT and Telecom, BFSI, Healthcare, Retail, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 47.6% of 2024 revenue, a consequence of early virtualization adoption, deep cloud ecosystems, and hyperscaler expansion corridors. Nuclear micro-reactor announcements in Texas signal creative approaches to power adequacy. Regulatory clarity around data-sovereignty zones fuels cross-border disaster-recovery pairings between the United States and Canada, while Mexico's fintech sector ramps up hybrid footprints for open-banking initiatives.

The Asia-Pacific software-defined data center market will rise at a 28.23% CAGR to 2030, aided by sovereign cloud grants, e-commerce surges, and digital-bank licensing rounds. Hyperscalers lease bulk capacity yet still rely on third-party developers to secure land, power, and permits. Singapore maintains hub status through carrier-dense campuses employing novel liquid cooling to meet power caps. India, Japan, and China inaugurate gigawatt-scale campuses, while Australia backs edge rollouts to serve remote mining operations.

Europe adopts SDDC in response to sovereignty and carbon targets. DORA's January 2025 deadline is spurring financial institutions to harden cyber-resilience, expanding budgets for encrypted per-tenant overlays. Northern markets lead in adoption, and southern states accelerate via public-cloud landing zones and green-hydrogen pilots. The Middle East and Africa see rising activity in the UAE and Saudi Arabia, where utility-scale solar farms couple with modular data halls for clean-energy hosting.

- VMware Inc.

- Microsoft Corp.

- Dell Technologies

- Cisco Systems

- Hewlett Packard Enterprise

- IBM Corp.

- Huawei Technologies

- Oracle Corp.

- Citrix Systems

- NEC Corp.

- Nutanix Inc.

- Amazon Web Services

- Google Cloud Platform

- Broadcom (VMware division)

- Juniper Networks

- Arista Networks

- Red Hat (IBM)

- Equinix Inc.

- Lenovo Group

- Rackspace Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost reduction in hardware and resource use

- 4.2.2 Cloud and virtualization boom among enterprises

- 4.2.3 Hyper-converged and composable infrastructure uptake

- 4.2.4 AI-driven DCIM and digital-twin optimisation (under-radar)

- 4.2.5 Nuclear micro-reactors unlocking rack-level densities (under-radar)

- 4.2.6 Edge-native micro-SDDC orchestration at 5G sites (under-radar)

- 4.3 Market Restraints

- 4.3.1 Data-security and compliance complexities

- 4.3.2 Legacy integration and migration costs

- 4.3.3 Grid-power scarcity and interconnect delays (under-radar)

- 4.3.4 Increased vendor consolidation/TCO risk (under-radar)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions (SDN, SDS, SDC, Automation and Orchestration Security)

- 5.1.2 Services (Consulting and Integration, Managed, Training and Support)

- 5.2 By Deployment Model

- 5.2.1 On-Premises

- 5.2.2 Private Cloud

- 5.2.3 Public Cloud

- 5.2.4 Hybrid Cloud

- 5.3 By Data Center Type

- 5.3.1 Colocation

- 5.3.2 Hyperscalers/Cloud

- 5.3.3 Enterprise and Edge

- 5.4 By End-user Vertical

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Retail and E-Commerce

- 5.4.5 Manufacturing

- 5.4.6 Government and Defense

- 5.4.7 Media and Entertainment

- 5.4.8 Energy and Utilities

- 5.4.9 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware Inc.

- 6.4.2 Microsoft Corp.

- 6.4.3 Dell Technologies

- 6.4.4 Cisco Systems

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 IBM Corp.

- 6.4.7 Huawei Technologies

- 6.4.8 Oracle Corp.

- 6.4.9 Citrix Systems

- 6.4.10 NEC Corp.

- 6.4.11 Nutanix Inc.

- 6.4.12 Amazon Web Services

- 6.4.13 Google Cloud Platform

- 6.4.14 Broadcom (VMware division)

- 6.4.15 Juniper Networks

- 6.4.16 Arista Networks

- 6.4.17 Red Hat (IBM)

- 6.4.18 Equinix Inc.

- 6.4.19 Lenovo Group

- 6.4.20 Rackspace Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment