|

市場調查報告書

商品編碼

1444213

油漆和塗料:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Paints and Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

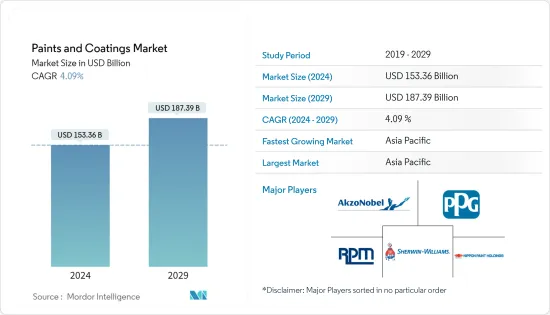

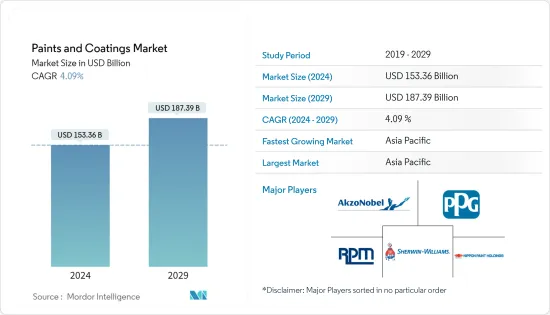

油漆和塗料市場規模預計到2024年為1533.6億美元,預計到2029年將達到1873.9億美元,在預測期內(2024-2029年)成長4.09%,年複合成長率成長。

COVID-19 大流行對油漆和塗料市場產生了負面影響。然而,目前估計市場已達到疫情前的水準。

主要亮點

- 短期內,推動所研究市場的關鍵因素是中東建設活動的快速增加、家具市場的成長以及石油和其他產業的多元化。

- 對揮發性有機化合物的日益擔憂預計將阻礙所研究市場的成長。

- 建築塗料佔據了市場的大部分佔有率,由於全球建設活動的增加,預計該細分市場在預測期內將會成長。

- 亞太地區主導全球市場,最大的消費來自中國、印度和日本等國家。

油漆和塗料市場趨勢

建築業需求增加

- 建築油漆和塗料是迄今為止油漆和塗料行業最大的部分。建築塗料旨在保護和裝飾表面特徵。用於粉刷建築物和住宅。大多數被指定用於特定用途,例如屋頂、牆麵粉刷和甲板飾面。無論應用如何,每種建築塗料都必須提供特定的裝飾、耐用和保護功能。

- 建築塗料用於商業應用,如辦公大樓、倉庫、便利商店、購物中心和住宅。此類塗料可應用於外表面和內表面,包括密封劑和特殊產品。

- 對於客廳和臥室的牆壁,大多數住宅更喜歡自己選擇的顏色。因此,丙烯酸塗料是首選,因為它們在顏色和色調方面提供了廣泛的選擇。大多數天花板都漆成純白色,以反射房間內的大部分環境光。這會讓你的房間感覺更大、更放鬆。水經常從地下室的磚石牆滲入。該部件採用合成橡膠塗料,在壓力下會膨脹以防止漏水。

- 在北美,由於美國和加拿大的大量投資,商業建築業經歷了健康成長。根據美國人口普查局的數據,美國2021年12月的建築支出經季節調整後的年率估計為16,399億美元,比11月份修正後的估計值16,365億美元高出0.2%。此外,2021年建築支出為15,890億美元,比2020年的14,692億美元增加8.2%,建築應用中油漆和塗料的消費量增加。

- 歐洲零售業也在擴張,整個非洲大陸都在興建新的購物中心。土耳其的大都會購物中心、瑞典的斯堪的斯堪地那維亞購物中心、英國的韋斯特菲爾德布拉德福德、奧地利的韋伯澤萊里德、比利時的歐洲購物中心和波蘭的盧布林購物中心是歐洲最近建設的一些購物中心。

- 中產階級人口的成長,加上可支配收入的增加,促進了中產階級住宅領域的擴大,從而鼓勵了住宅建設。由於建設產業的成長,亞太地區成為建築塗料的最大市場。

- 例如,印度政府將在未來幾年內開展相當多的計劃。政府的「全民住宅」計畫旨在到 2022 年為都市區貧困階級人口建造超過 2,000 萬套經濟適用住宅。這可能會極大地推動住宅建設。

- 由於上述所有因素,油漆和塗料市場預計在預測期內將出現顯著成長。

中國主導亞太市場

- 中國以其建築熱潮而聞名於世。廉租住宅和住宅的需求是近年來成長的原因。

- 中國正持續推動都市化,目標是2030年實現都市化70%。城市都市化導致都市區生活空間需求的增加以及城市中產階級居民對改善生活條件的渴望會影響都市化。預計將對住宅市場產生重大影響,從而增加國內住宅建設,進而對油漆和塗料市場產生正面影響。

- 中國的經濟成長主要受到發達的住宅和商業建築業的推動。在中國,香港住宅委員會推出多項措施,鼓勵興建廉租住宅。當局的目標是到 2030 年提供 301,000 套社會住宅。

- 家庭收入水準的提高,加上農村人口向都市區的遷移,預計將繼續推動國內住宅建築業的需求。公共和私營部門對經濟適用住宅的關注正在推動住宅建築業的成長。

- 非住宅基礎設施預計將顯著成長。該國的人口老化正在創造醫療設施和新醫院建設的需求。過去幾年中國經濟的結構性變化導致服務業佔GDP總量的比重不斷提高,大型商業和辦公空間的建設也隨之增加。

- 此外,2021年第一季全球電動車銷量年增超過140%,其中中國銷量約50萬輛,歐洲銷量約45萬輛。 2021年,中國成為全球電動車銷量的領先者,銷量幾乎增加了兩倍,達到340萬輛。

- 中國是世界第二大石油和天然氣消費國,但僅是第六大生產國。作為石油消費大國,中國石油消費量逐年成長,但成長速度有波動。但石油供應仍無法滿足需求,中國主要依賴進口。

- 預計這些因素將影響預測期內該地區對油漆和塗料的需求。

油漆塗料產業概述

全球油漆和塗料市場本質上是部分一體化的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設活動快速增加

- 家具市場成長

- 中東石油和其他工業的多元化

- 抑制因素

- 對揮發性有機物含量 (VOC) 增加的擔憂

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

- 監理政策分析

第5章市場區隔

- 樹脂

- 丙烯酸纖維

- 醇酸

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他

- 科技

- 水性的

- 溶劑型

- 粉末

- 紫外線固化

- 最終用戶產業

- 建築學

- 車

- 木頭

- 保護塗層

- 一般工業

- 運輸

- 包裝

- 地區

- 亞太地區

- 中國(包括台灣)

- 印度

- 日本

- 印尼

- 澳洲和紐西蘭

- 韓國

- 泰國

- 馬來西亞

- 菲律賓

- 孟加拉

- 越南

- 新加坡

- 斯里蘭卡

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 比荷盧經濟聯盟

- 俄羅斯

- 土耳其

- 瑞士

- 北歐的

- 波蘭

- 葡萄牙

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 科威特

- 埃及

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 阿爾及利亞

- 摩洛哥

- 其他非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業採取的策略

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta

- BASF SE

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India Limited

- Chugoku Marine Paints Ltd

- DAW SE

- Hempel AS

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Kelly-Moore Paints

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD

- Nippon Paint Holdings Co. Ltd

- NOROO Paint &Coatings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- Russian Paints Company

- SK KAKEN Co. Ltd

- The Sherwin-Williams Company

第7章市場機會與未來趨勢

The Paints and Coatings Market size is estimated at USD 153.36 billion in 2024, and is expected to reach USD 187.39 billion by 2029, growing at a CAGR of 4.09% during the forecast period (2024-2029).

The COVID-19 pandemic had a negative impact on the paints and coatings market. However, the market has now been estimated to have reached pre-pandemic levels.

Key Highlights

- In the short term, the major factors driving the market studied are rapidly increasing construction activities, growth in the furniture market, and diversification of oil and other industries in the Middle East.

- Rising VOC concerns are expected to hinder the growth of the market studied.

- Architectural coatings dominated the market, and the segment is expected to grow during the forecast period, owing to the increasing construction activities across the world.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries such as China, India, and Japan.

Paints & Coatings Market Trends

Increasing Demand from the Architectural Industry

- Architectural paints and coatings are by far the largest segment in the paints and coatings industry. Architectural coatings are meant to protect and decorate surface features. They are used to coat buildings and homes. Most are designated for specific uses, such as roof coatings, wall paints, or deck finishes. No matter its use, each architectural coating must provide certain decorative, durable, and protective functions.

- Architectural coatings are used in applications for commercial purposes, such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings. Such coatings can be applied on outer surfaces and inner surfaces and include sealers or specialty products.

- In the living room and bedroom walls, most homeowners prefer the color of their choices. Hence, acrylic paints are preferred, as they offer a wide variety of choices in terms of color and shade. Most ceilings are painted flat white so that they reflect the most ambient light in the room. This makes the room feel more spacious and relaxed. Basement masonry walls can often weep water. Elastomeric paints that expand on pressure are used in this area to prevent water leakage.

- North America witnessed healthy growth in the commercial construction sector due to significant investments in the United States and Canada. According to the US Census Bureau, in December 2021, construction spending in the country was estimated at a seasonally adjusted annual rate of USD 1,639.9 billion, 0.2% more than the revised November estimate of USD 1,636.5 billion. Moreover, in 2021, construction spending amounted to USD 1,589.0 billion, 8.2% above USD 1,469.2 billion in 2020, thereby increasing the consumption of paints and coatings in construction applications.

- Europe also witnesses an expansion in retail, with the new construction of malls across the continent. The Metropol Mall in Turkey, Mall of Scandinavia in Sweden, Westfield Bradford in the United Kingdom, Weberzeile Ried in Austria, Mall of Europe in Belgium, and Lublin Mall in Poland are some of the recent constructions in Europe.

- The increasing middle-class population, coupled with their increasing disposable income, has facilitated the expansion in the middle-class housing segment, thereby driving the residential construction. The Asia-Pacific region is the largest market for architectural coatings owing to the growth in the construction industry.

- For instance, the Indian government is pushing considerable projects in the next few years. The government's Housing for All initiative aims to build more than 20 million affordable homes for the urban poor by 2022. This may provide a significant boost to residential construction.

- Due to all the above-mentioned factors, the market for paints and coatings is expected to witness significant growth during the forecast period.

China to Dominate the Market in the Asia-Pacific Region

- China is globally recognized for its architectural boom. The demand for low-cost housing and commercial housing is the reason for its growth in recent years.

- China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from urbanization and the desire of middle-class urban residents to improve their living conditions may have a profound effect on the housing market and thereby increase the residential construction in the country, which in turn will have a positive impact on the paints and coatings market.

- China has been majorly driven by the ample developments in the residential and commercial construction sectors and supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units by 2030.

- The rising household income levels, combined with the population migrating from rural to urban areas, are expected to continue to drive the demand for the residential construction sector in the country. The increased focus on affordable housing by both the public and private sectors is driving the growth in the residential construction sector.

- Non-residential infrastructure is expected to grow considerably. The aging population in the country is creating a demand for the construction of healthcare facilities and new hospitals. The structural changes in the Chinese economy over the past few years, with the service sector taking a larger share in the total GDP, gave rise to the construction of huge commercial and office spaces.

- Furthermore, the worldwide electric car sales increased by over 140 percent in the first quarter of 2021 compared to the same period in previous year, owing to sales of around 500,000 vehicles in China and around 450,000 in Europe. In 2021, the China topped the world in electric vehicle sales, nearly tripling to 3.4 million units.

- China is the world's second-largest consumer of oil and gas but only the sixth largest producer of the same. As a big oil consumer, China's oil consumption is increasing year by year with fluctuating growth rates. However, as the oil supply still cannot meet the demand, China mainly relies on imports.

- These factors, in turn, are expected to affect the demand for paints and coatings in the region during the forecast period.

Paints & Coatings Industry Overview

The global paints and coatings market is partially consolidated in nature. Some of the major players in the market include The Sherwin-Williams Company, PPG Industries Inc., Akzo Nobel NV, Nippon Paint Holdings Co. Ltd, and RPM International Inc., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Increasing Construction Activities

- 4.1.2 Growth in the Furniture Market

- 4.1.3 Diversification of Oil and Other Industries in the Middle East

- 4.2 Restraints

- 4.2.1 Rising Volatile Organic contents(VOC) Concerns

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulatory Policy Analysis

5 MARKET SEGMENTATION

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coating

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China (Including Taiwan)

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Indonesia

- 5.4.1.5 Australia & New Zealand

- 5.4.1.6 South Korea

- 5.4.1.7 Thailand

- 5.4.1.8 Malaysia

- 5.4.1.9 Philippines

- 5.4.1.10 Bangladesh

- 5.4.1.11 Vietnam

- 5.4.1.12 Singapore

- 5.4.1.13 Sri Lanka

- 5.4.1.14 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Benelux

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Switzerland

- 5.4.3.9 Scandinavian Countries

- 5.4.3.10 Poland

- 5.4.3.11 Portugal

- 5.4.3.12 Spain

- 5.4.3.13 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Kuwait

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Algeria

- 5.4.6.4 Morocco

- 5.4.6.5 Rest of Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Asian Paints

- 6.4.3 Axalta

- 6.4.4 BASF SE

- 6.4.5 Beckers Group

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Berger Paints India Limited

- 6.4.8 Chugoku Marine Paints Ltd

- 6.4.9 DAW SE

- 6.4.10 Hempel AS

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd

- 6.4.14 Kelly-Moore Paints

- 6.4.15 Masco Corporation

- 6.4.16 NATIONAL PAINTS FACTORIES CO. LTD

- 6.4.17 Nippon Paint Holdings Co. Ltd

- 6.4.18 NOROO Paint & Coatings Co. Ltd

- 6.4.19 PPG Industries Inc.

- 6.4.20 RPM International Inc.

- 6.4.21 Russian Paints Company

- 6.4.22 SK KAKEN Co. Ltd

- 6.4.23 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advent of Environment-friendly Paint and Coating Resins

- 7.2 Anti-bacterial Paints and Coatings

- 7.3 Growing Construction Opportunities in Africa