|

市場調查報告書

商品編碼

1433928

電池能源儲存系統-市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Battery Energy Storage System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

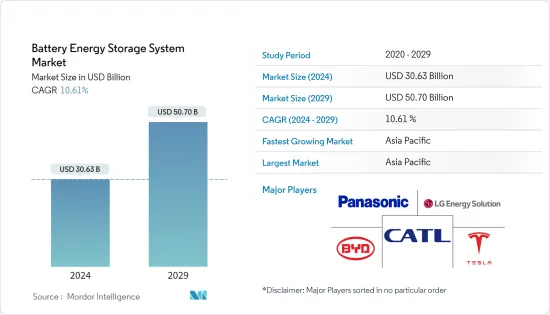

電池能源儲存系統市場規模預計到2024年為306.3億美元,預計到2029年將達到507億美元,在預測期內(2024-2029年)成長10.61%,複合年成長率成長。

2020 年,市場受到 COVID-19 的負面影響。目前市場處於大流行前的水平。

主要亮點

- 從中期來看,鋰離子電池價格下降和可再生能源普及不斷提高等因素可能會在預測期內推動電池能源儲存系統市場的發展。

- 另一方面,鈷、鋰和銅等原料的供需不匹配可能會阻礙研究期間電池能源儲存系統(BESS)市場的成長。

- 儘管如此,用於儲存能量的新型電池技術的進步可能會在預測期內為 BESS 市場創造有利的成長機會。

- 由於能源需求不斷成長,亞太地區是預測期內成長最快的市場。這一成長可歸因於該地區國家(包括印度、中國和澳大利亞)的投資增加以及支持性政府政策。

電池能源儲存系統系統市場趨勢

預計住宅成長最快的領域

- 最近,由於全部區域對可再生能源基礎設施的投資增加,能源儲存系統(ESS)經歷了顯著成長,特別是在住宅領域。

- 由於年度可支配所得的增加和全球在家工作趨勢的上升,預計在預測期內住宅建築的電力消耗量將會增加。能源儲存系統用於在尖峰時段停電期間為家庭提供持續電力。

- 全球多個政府推出了各種激勵計劃來支持住宅能源儲存市場。例如,加州的自發電獎勵計畫(SGIP)主要支持住宅儲能產業,並為新的和現有的分散式能源提供獎勵。

- 隨著能源儲存技術進步的加速,住宅能源儲存領域可能會激增,導致電池價格下降和可再生能源的普及增加。

- 在可再生能源方面,住宅領域的大部分需求來自太陽能領域,這創造了對住宅電池能源儲存系統的需求。例如,根據法國Territoire Solaire的數據,2022年第二季法國住宅太陽能發電總容量為1,758兆瓦,較2021年第二季成長13.8%。

- 包括投資公司 Harmony Energy Income Trust 在內的市場相關人員於 2022 年 11 月宣布,位於英國約克郡的 Pillswood計劃比計劃提前四個月開始運作。 Harmony 表示,98MW/196MWh 設施是歐洲最大的 BESS計劃(以兆瓦時計算)。這足以為大約 30 萬個英國家庭供電兩個小時。該計劃將使用特斯拉的 2-Hour Megapack 為英國電網提供平衡服務。 Harmony Energy 開發了計劃,特斯拉監督建造。特斯拉的演算法交易平台 Autobidder 將管理計劃。

- 2022年6月,豐田發佈住宅蓄電池產品“大內急電系統”,進軍能源儲存市場。豐田發布了額定輸出5.5kWh、額定容量8.7kWh的蓄電系統。它利用了該公司的電動車電池技術。當連接到屋頂太陽能發電系統時,該系統可以日夜為您的家供電。該公司最初的目標是在日本銷售該儲存系統。

- 因此,由於這些因素,預計住宅應用在預測期內將為電池能源儲存系統市場產生有利的需求。

預計亞太地區將主導市場

- 預計亞太地區將在未來幾年繼續引領電池能源儲存市場。該地區由兩種主要類型的電網組成,每種電網都有不同的特徵和能源儲存系統系統的機會。一方面,日本、韓國、紐西蘭、澳洲等高度發展國家和其他大城市擁有先進的電網,採用現代技術運作良好。

- 發展中地區也正在經歷快速的人口成長和都市化,增加了對電力的需求。可再生能源的成本效益越來越高,新興國家預計將大量可再生能源涵蓋電網。預計許多地區將採用更分散的電網發展方式,更多地使用本地發電和微電網系統。它正在為區域市場成長創造潛力。

- 由於政府的支持和政策,中國的住宅能源儲存市場預計將成長。表現出透過補貼和安裝目標刺激國內太陽能設備需求強勁成長的能力。

- 澳洲正在經歷能源轉型,預計這項轉型將在未來幾十年持續下去。這種轉變包括增加對可再生能源的依賴,以應對氣候變遷減緩政策。

- 2022年1月,Woodside Energy向西澳大利亞州環境保護部提交了提案。該設施佔地約 975.6 公頃,開發面積為 1,100.3 公頃。根據提案,該太陽能發電廠將包括約100萬塊太陽能板以及電池能源儲存系統和變電站等支援基礎設施。

- 可再生能源的成本效益越來越高,新興國家預計將大量可再生能源涵蓋電網。預計許多地區將採用更分散的電網發展方式,更多地使用本地發電和微電網系統。

- 因此,由於這些因素,亞太地區預計將在預測期內主導市場。

電池能源儲存系統產業概況

電池能源儲存系統系統市場較分散。市場主要企業包括(排名不分先後)比亞迪有限公司、松下公司、LG Energy Solution Ltd、特斯拉公司和寧德時代新能源科技有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模和需求預測(金額)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 鋰離子電池

- 鉛蓄電池

- 鎳氫電池

- 其他種類(鈉硫電池、液流電池)

- 目的

- 住宅

- 商業/工業

- 效用規模

- 按地區分類的市場分析(到 2028 年的市場規模和需求預測(僅按地區))

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Limited

- Panasonic Corporation

- LG Energy Solution Ltd

- Contemporary Amperex Technology Co. Limited

- Sony Corp.

- Varta AG

- Tesla Inc.

- Samsung SDI Co. Ltd

- Cellcube Energy Storage System Inc.

第7章 市場機會及未來趨勢

The Battery Energy Storage System Market size is estimated at USD 30.63 billion in 2024, and is expected to reach USD 50.70 billion by 2029, growing at a CAGR of 10.61% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and increased penetration of renewable energy are likely to drive the battery energy storage systems market in the forecast period.

- On the other hand, the demand-supply mismatch of raw materials like cobalt, lithium, copper, etc., will likely hinder the growth of the battery energy storage systems (BESS) market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy will likely create lucrative growth opportunities for the BESS market during the forecast period.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Battery Energy Storage System Market Trends

Residential Expected to be the Fastest-growing Segment

- Recently, the energy storage system (ESS) experienced significant growth, especially in the residential sector, along with the rising investments in renewable energy infrastructure across the regions.

- Electricity consumption in residential buildings is estimated to increase during the forecast period due to increasing annual disposable incomes and the rising work-from-home trend worldwide. Energy storage systems are used for continuous power supply at homes during power outages at peak hours.

- Various incentive programs initiated by several governments worldwide are in place to support the residential energy storage market. For instance, California's Self-Generation Incentive Program (SGIP) primarily supports the residential storage sector and offers incentives for new and existing distributed energy resources.

- The residential energy storage segment will likely proliferate because of increasing technological advancements in energy storage technology, leading to a decline in battery prices and the widespread deployment of renewable power sources.

- In renewable power sources, the majority of demand in the residential sector comes from the solar energy segment, which, in turn, creates demand for residential battery energy storage systems. For instance, according to France Territoire Solaire, in Q2 2022, France's total residential photovoltaic solar energy capacity accounted for 1,758 MW, an increase of 13.8 % compared to Q2 2021.

- Market players like Harmony Energy Income Trust, an investment firm, announced in November 2022 that its Pillswood project in Yorkshire, United Kingdom, had gone live four months earlier than planned. According to Harmony, the 98MW/196MWh facility is Europe's largest BESS project by MWh. It is enough to power approximately 300,000 UK homes for two hours. The project will provide balancing services to the UK electricity grid network using a Tesla two-hour Megapack. Harmony Energy developed the project, with Tesla overseeing construction. Autobidder, Tesla's algorithmic trading platform, will manage the project.

- In June 2022, Toyota entered the energy storage market by launching the O-Uchi Kyuden System, a residential battery product. Toyota launched a rated output of 5.5 kWh and a rated capacity of 8.7 kWh battery storage system. It uses the company's electric vehicle battery technology. When connected to a photovoltaic rooftop system, the system can power a home day and night. Initially, the company aimed to sell the storage system in Japan.

- Therefore, owing to these factors, the residential application is expected to create lucrative demand in the battery energy storage systems market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to keep leading the market for battery energy storage over the next few years. The region consists of two main types of power grids, each with different characteristics and opportunities for energy storage systems. On one side are highly developed countries like Japan, South Korea, New Zealand, and Australia, as well as other large cities with advanced grids that work well and use the latest technologies.

- The developing regions are also witnessing rapid population growth and urbanization, increasing the electricity demand. Renewable energy is becoming increasingly cost-effective, and developing countries are expected to include huge amounts of renewable energy into their grid. Many areas are expected to adopt a more distributed approach to grid development, using more local power generation and microgrid systems. It is creating the potential for the regional market's growth.

- China's residential energy storage market is expected to grow due to government support and policies. It showed its ability to stimulate high growth in domestic demand for solar-related equipment through subsidies and installation targets.

- Australia is undergoing an energy transformation, expected to intensify over the coming decades. The transformation includes a greater reliance on renewable energy in response to climate mitigation policies.

- In January 2022, Woodside Energy submitted a proposal for a 500 MW solar facility and 400 MWh of battery storage to the Western Australian Environmental Protection Authority. The facility would cover approximately 975.6 hectares within a development envelope of 1,100.3 hectares. According to the proposal, the solar facility will install approximately 1 million solar panels and support infrastructures such as a battery energy storage system and an electrical substation.

- Renewable energy is becoming increasingly cost-effective, and developing countries are expected to include huge amounts of renewable energy into their grid. Many areas are expected to adopt a more distributed approach to grid development, using more local power generation and microgrid systems.

- Therefore, owing to such factors, Asia-Pacific is expected to dominate the market during the forecast period.

Battery Energy Storage System Industry Overview

The battery energy storage system market is fragmented. Some of the major players in the market (in no particular order) are BYD Company Limited, Panasonic Corporation, LG Energy Solution Ltd, Tesla Inc, and Contemporary Amperex Technology Co. Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-acid Batteries

- 5.1.3 Nickel Metal Hydride

- 5.1.4 Other Types (Sodium-sulfur Batteries and Flow Batteries)

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility-scale

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Limited

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Energy Solution Ltd

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Sony Corp.

- 6.3.6 Varta AG

- 6.3.7 Tesla Inc.

- 6.3.8 Samsung SDI Co. Ltd

- 6.3.9 Cellcube Energy Storage System Inc.

![電池儲能系統市場 [應用:併網連接系統、離網連接系統、汽車等] - 2023-2031 年全球產業分析、規模、佔有率、成長、趨勢和預測](/sample/img/cover/42/1420890.png)